Need help getting this onto excel sheet Thank you!

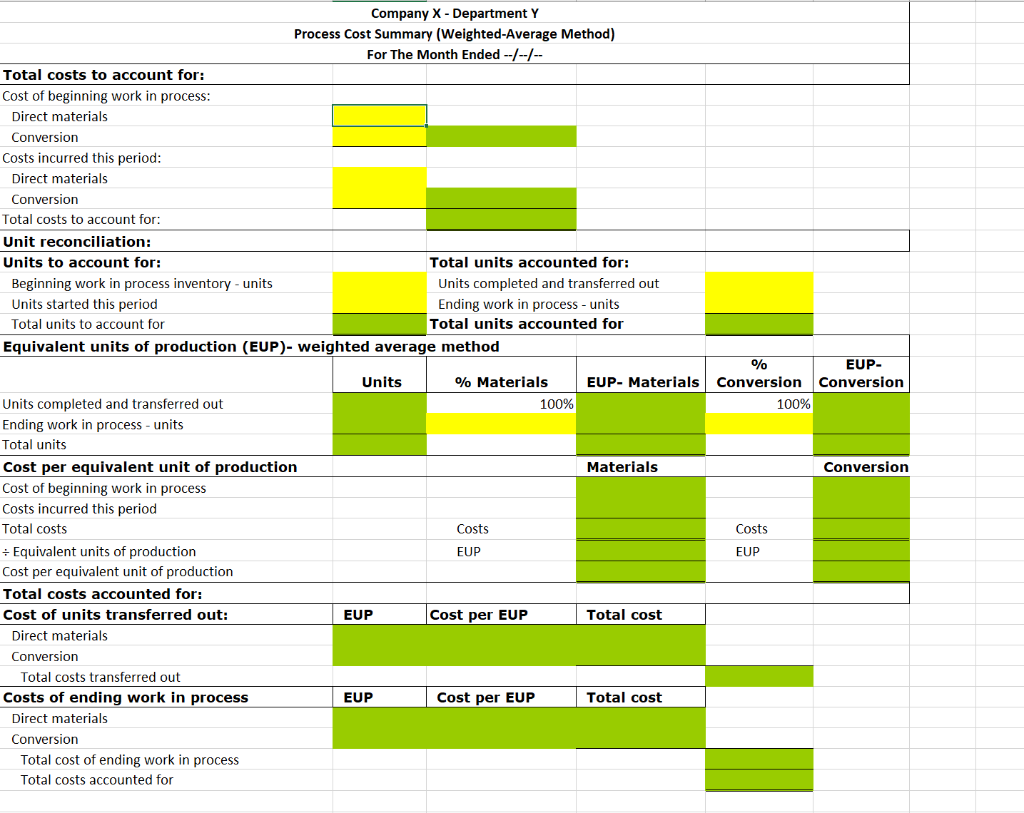

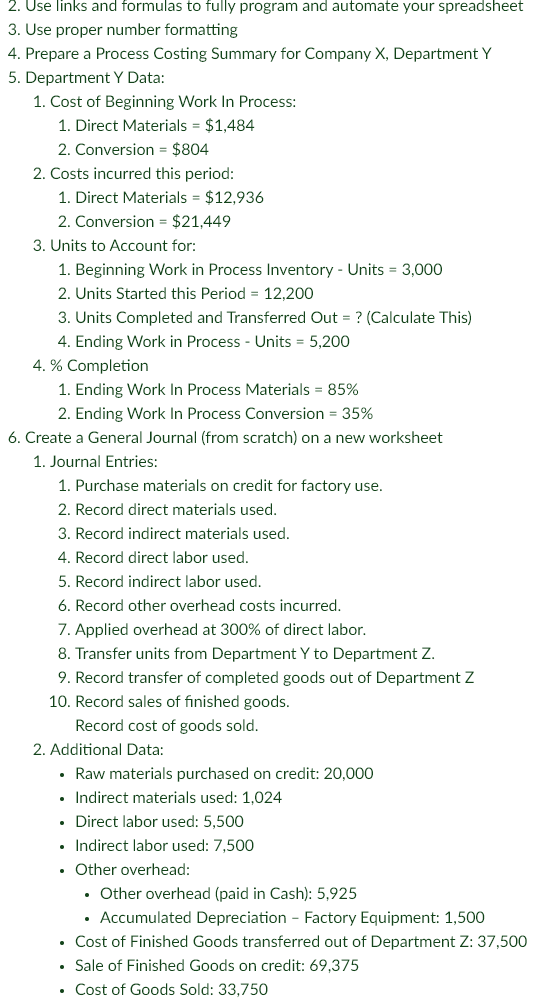

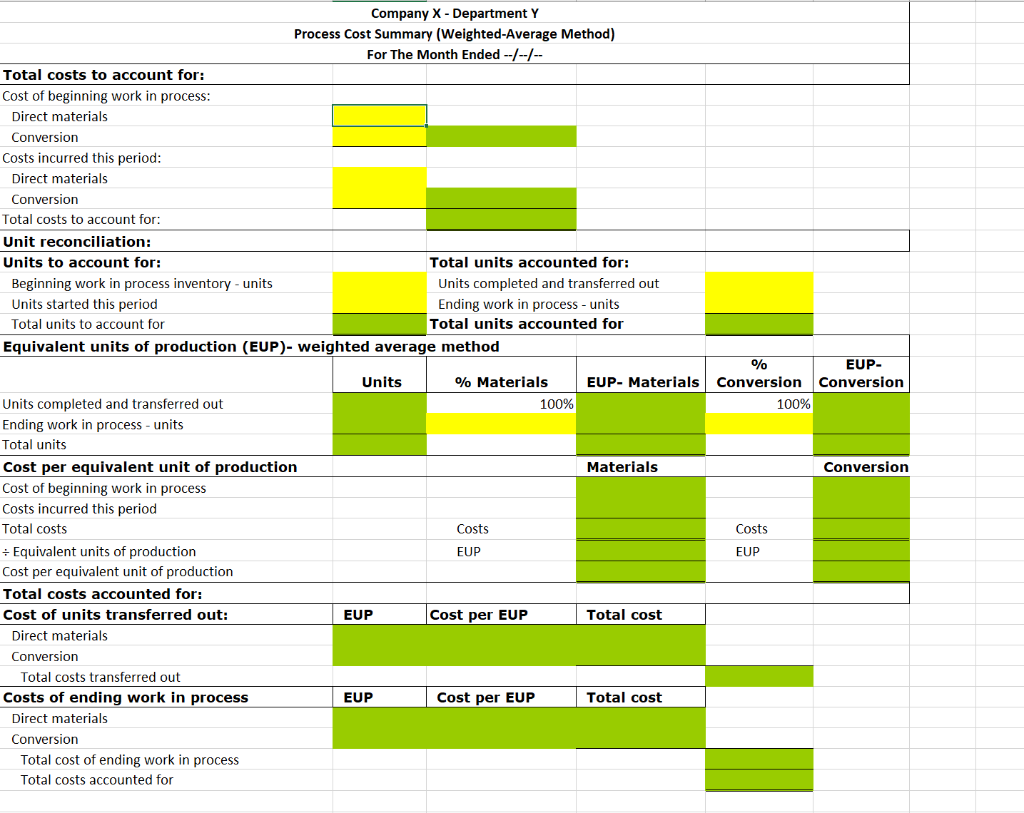

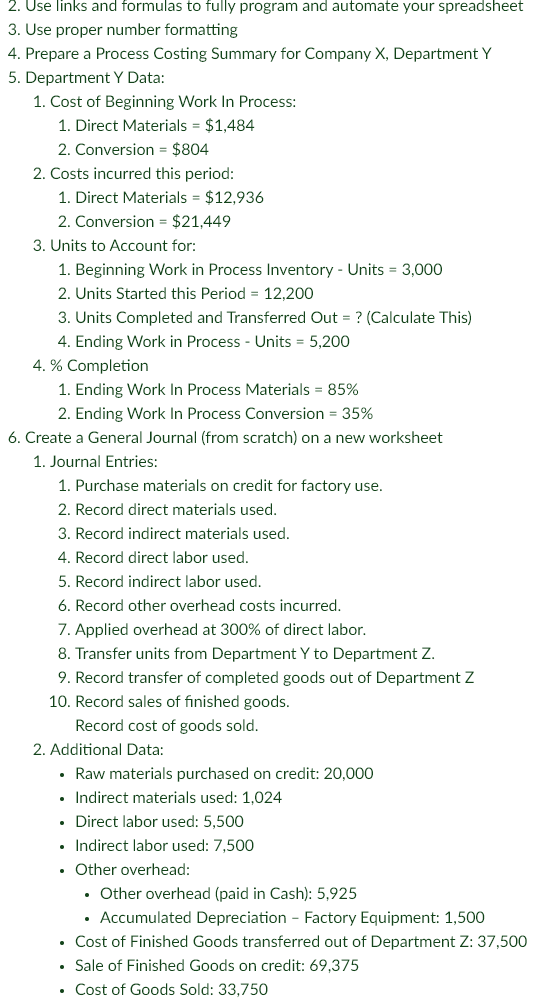

Company X-Department Y Process Cost Summary (Weighted-Average Method) For The Month Ended --/--/- Total costs to account for: Cost of beginning work in process: Direct materials Conversion Costs incurred this period: Direct materials Conversion Total costs to account for: Unit reconciliation: Units to account for: Total units accounted for: Beginning work in process inventory - units Units completed and transferred out Units started this period Ending work in process - units Total units to account for Total units accounted for Equivalent units of production (EUP)- weighted average method Cost of beginning work in process Costs incurred this period Total costs Equivalent units of production Cost per equivalent unit of production Total costs accounted for: \begin{tabular}{c} Cost of uni \\ \hline Direct mate \\ Conversion \end{tabular} Total costs transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for 2. Use links and formulas to fully program and automate your spreadsheet 3. Use proper number formatting 4. Prepare a Process Costing Summary for Company X, Department Y 5. Department Y Data: 1. Cost of Beginning Work In Process: 1. Direct Materials =$1,484 2. Conversion =$804 2. Costs incurred this period: 1. Direct Materials =$12,936 2. Conversion =$21,449 3. Units to Account for: 1. Beginning Work in Process Inventory - Units =3,000 2. Units Started this Period =12,200 3. Units Completed and Transferred Out = ? (Calculate This) 4. Ending Work in Process - Units =5,200 4. \% Completion 1. Ending Work In Process Materials =85% 2. Ending Work In Process Conversion =35% 6. Create a General Journal (from scratch) on a new worksheet 1. Journal Entries: 1. Purchase materials on credit for factory use. 2. Record direct materials used. 3. Record indirect materials used. 4. Record direct labor used. 5. Record indirect labor used. 6. Record other overhead costs incurred. 7. Applied overhead at 300% of direct labor. 8. Transfer units from Department Y to Department Z. 9. Record transfer of completed goods out of Department Z 10. Record sales of finished goods. Record cost of goods sold. 2. Additional Data: - Raw materials purchased on credit: 20,000 - Indirect materials used: 1,024 - Direct labor used: 5,500 - Indirect labor used: 7,500 - Other overhead: - Other overhead (paid in Cash): 5,925 - Accumulated Depreciation - Factory Equipment: 1,500 - Cost of Finished Goods transferred out of Department Z: 37,500 - Sale of Finished Goods on credit: 69,375 - Cost of Goods Sold: 33,750