Need help here

Need help here

anyone?

anyone?

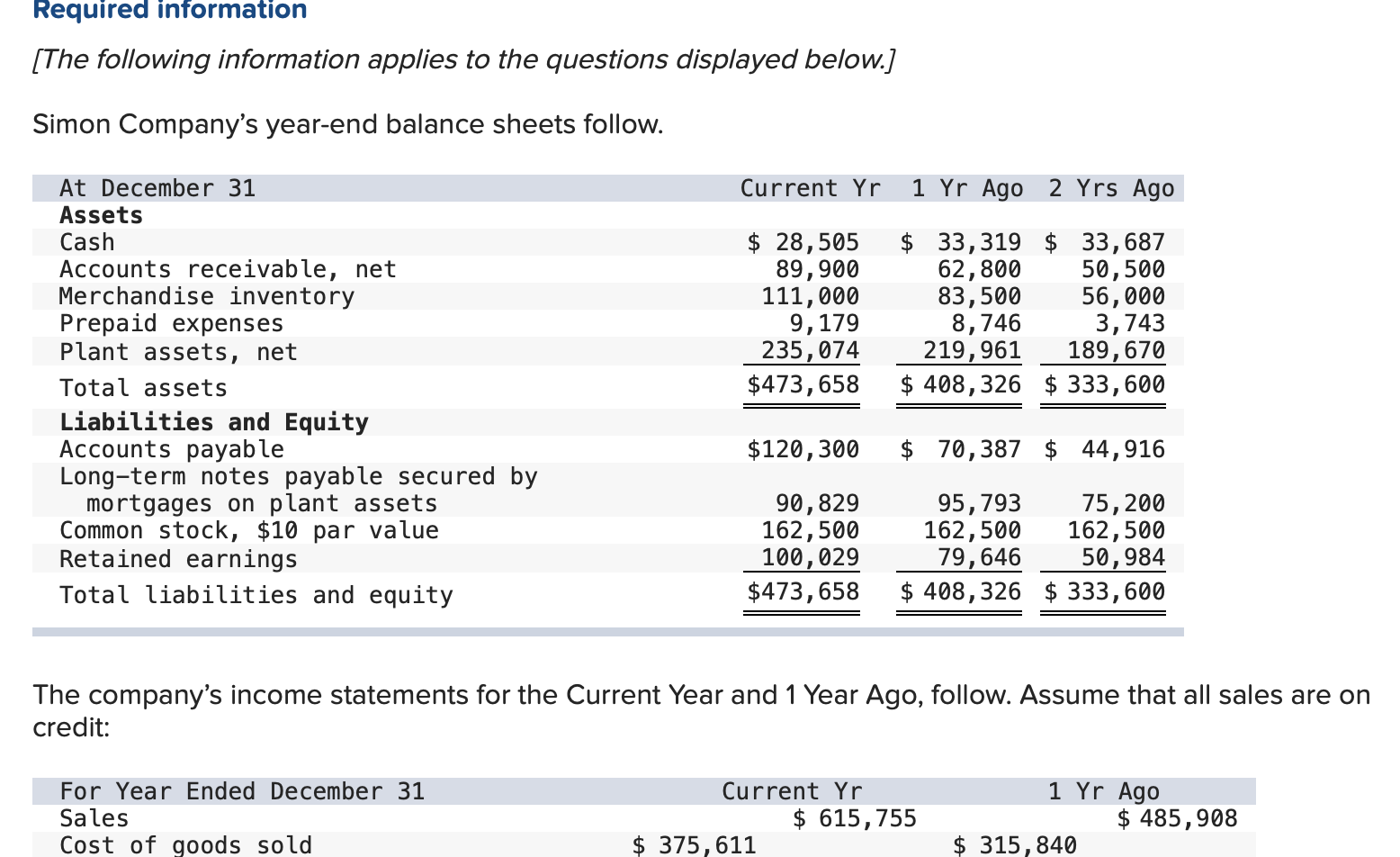

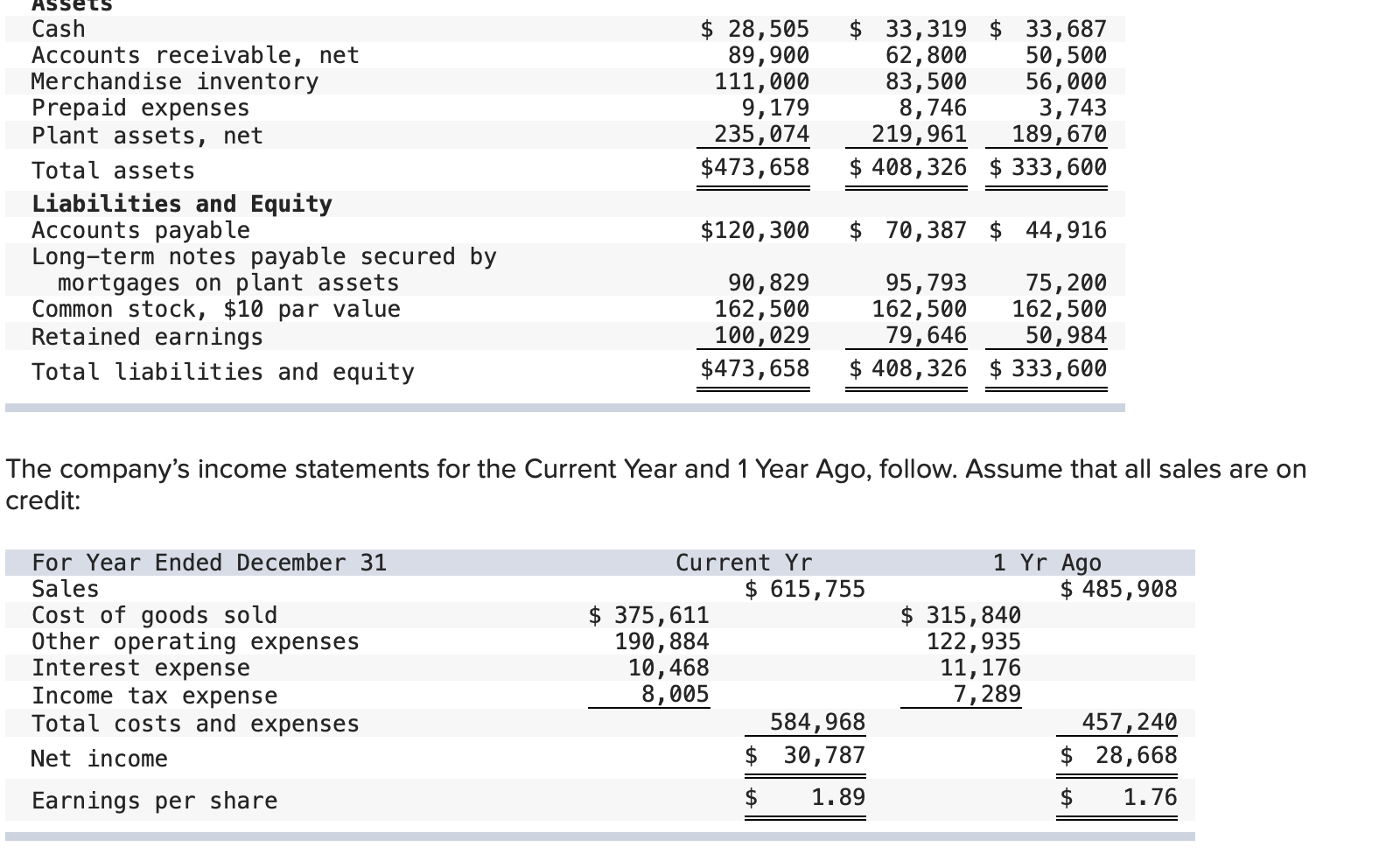

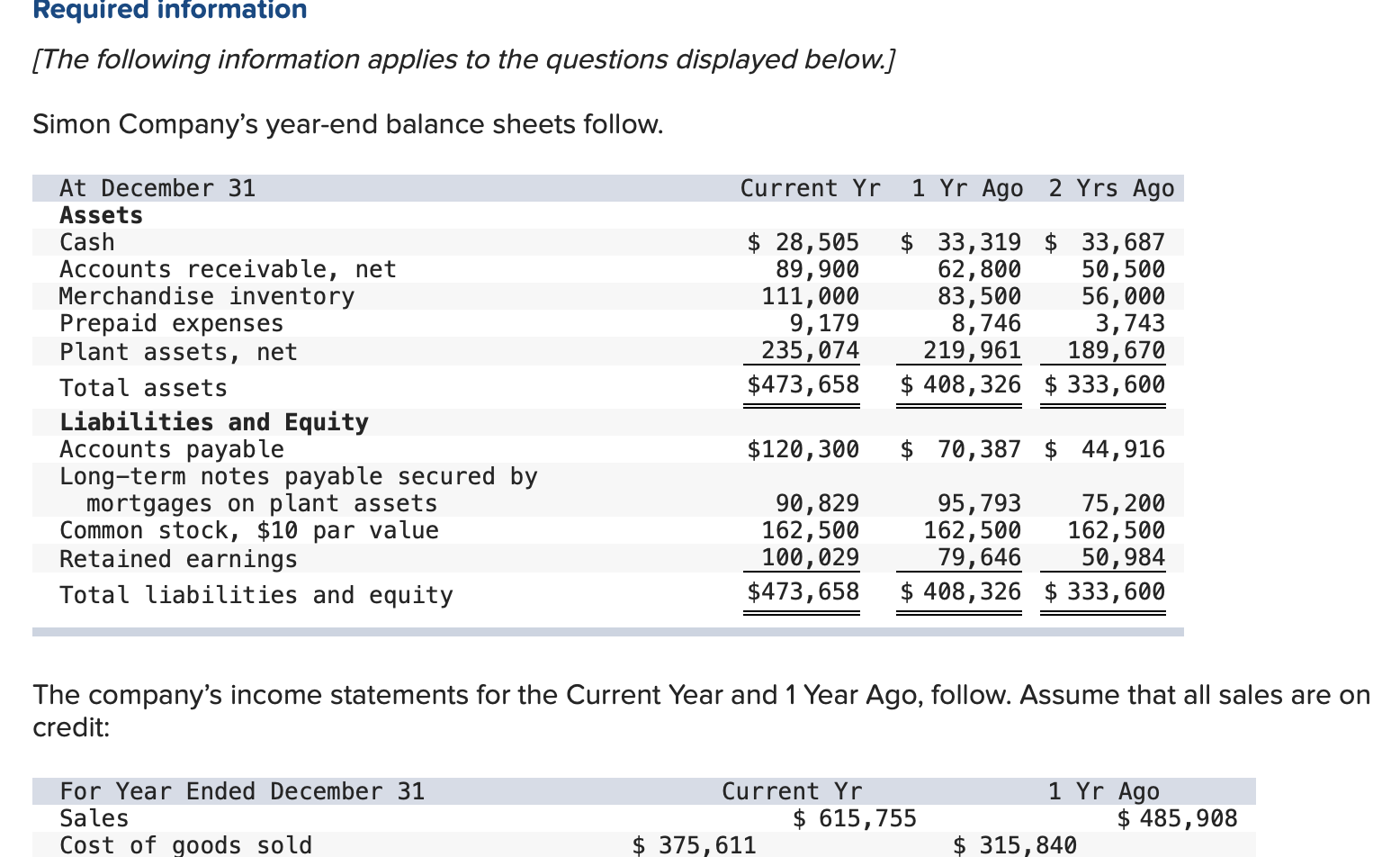

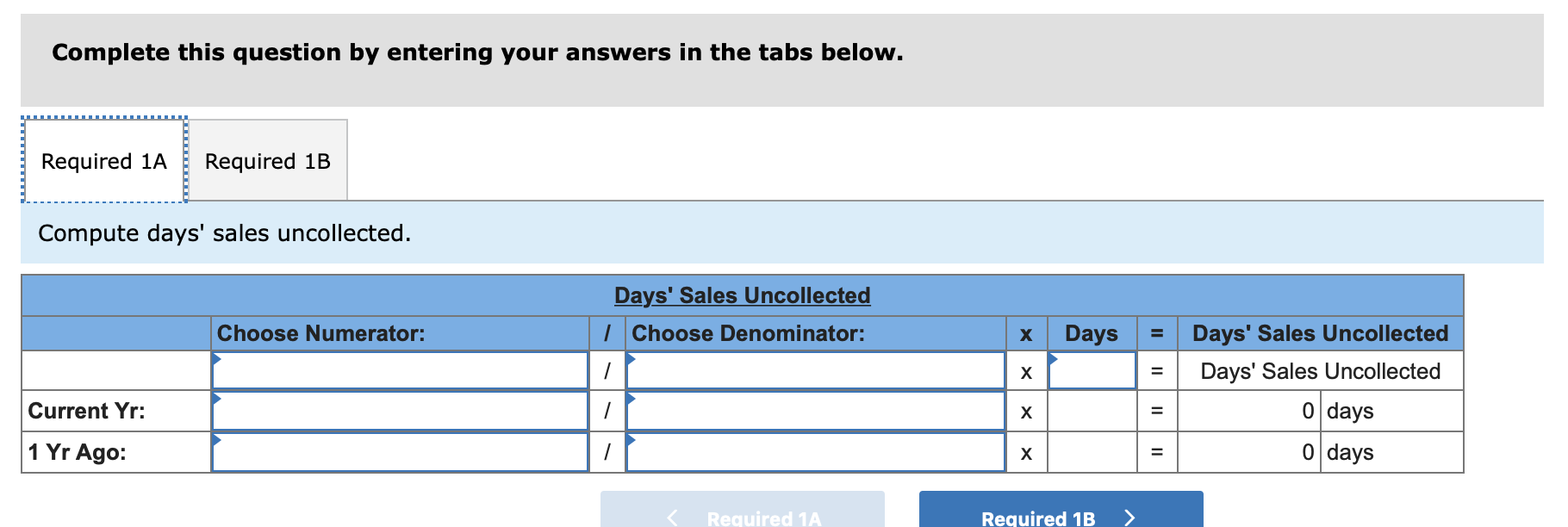

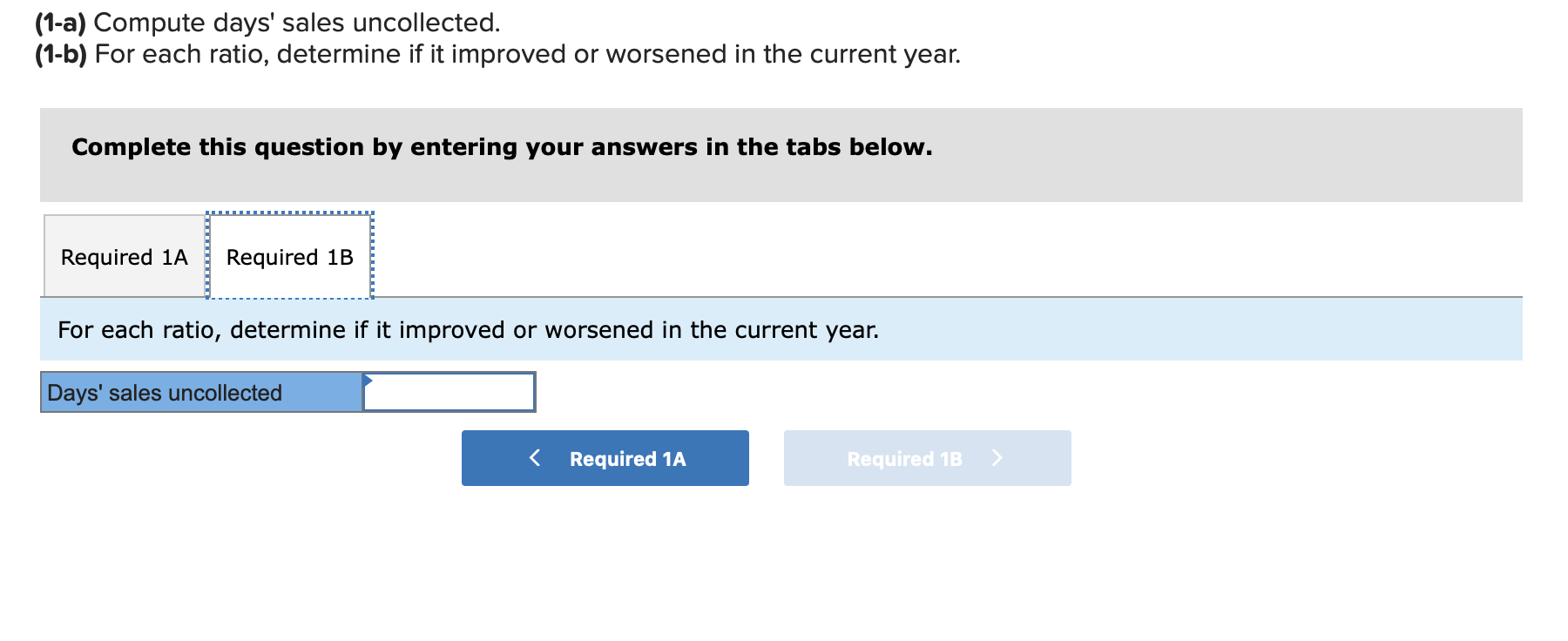

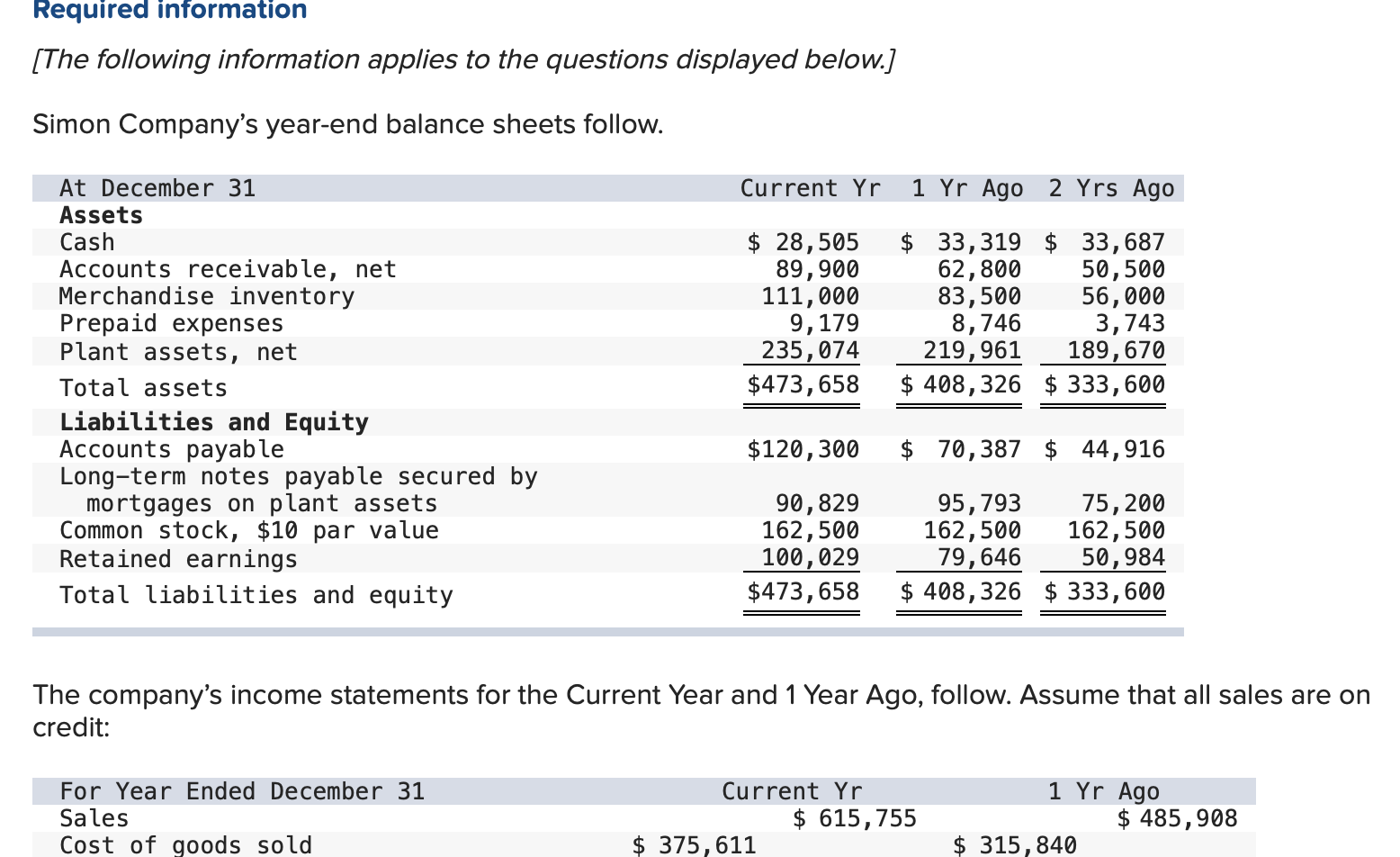

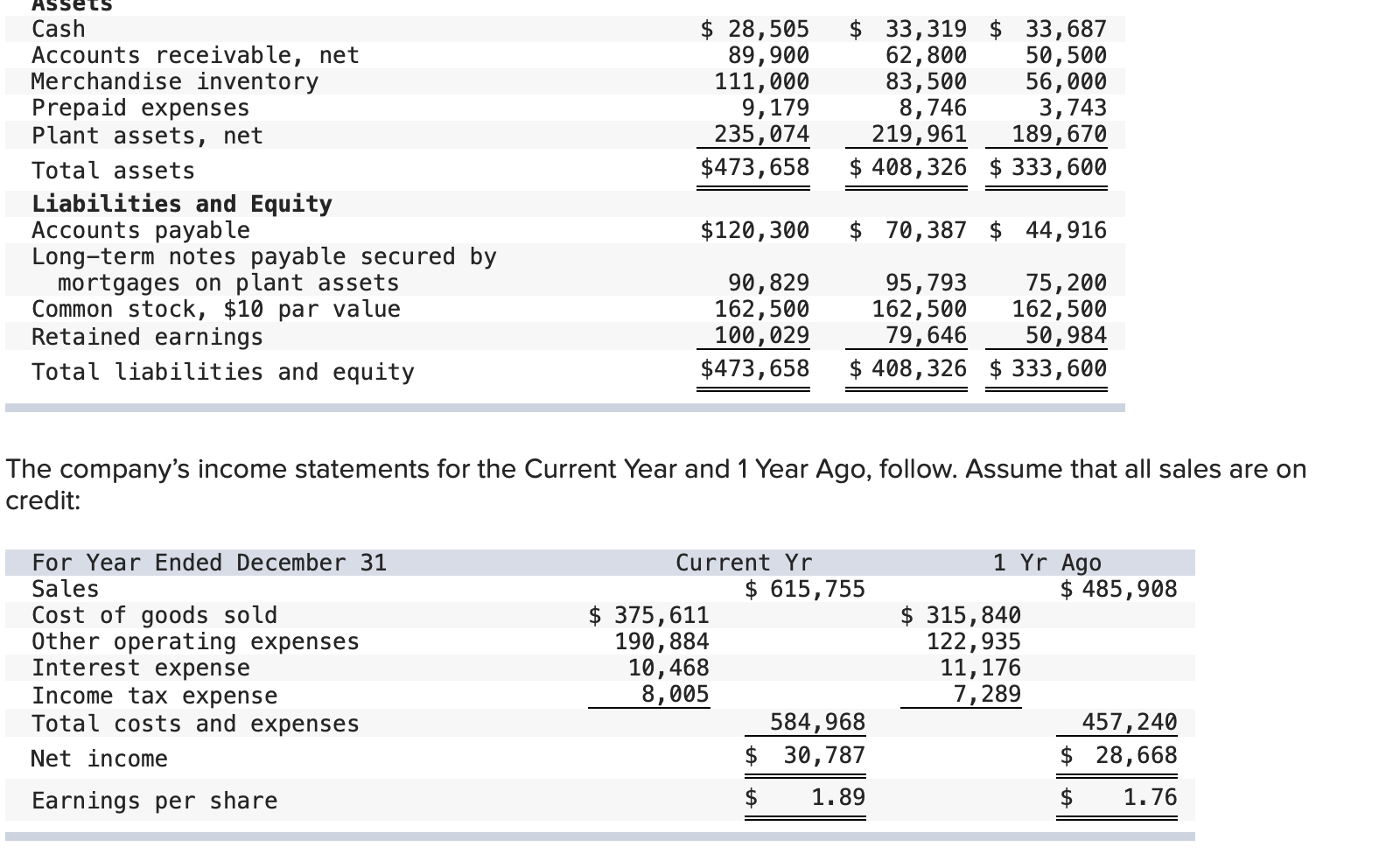

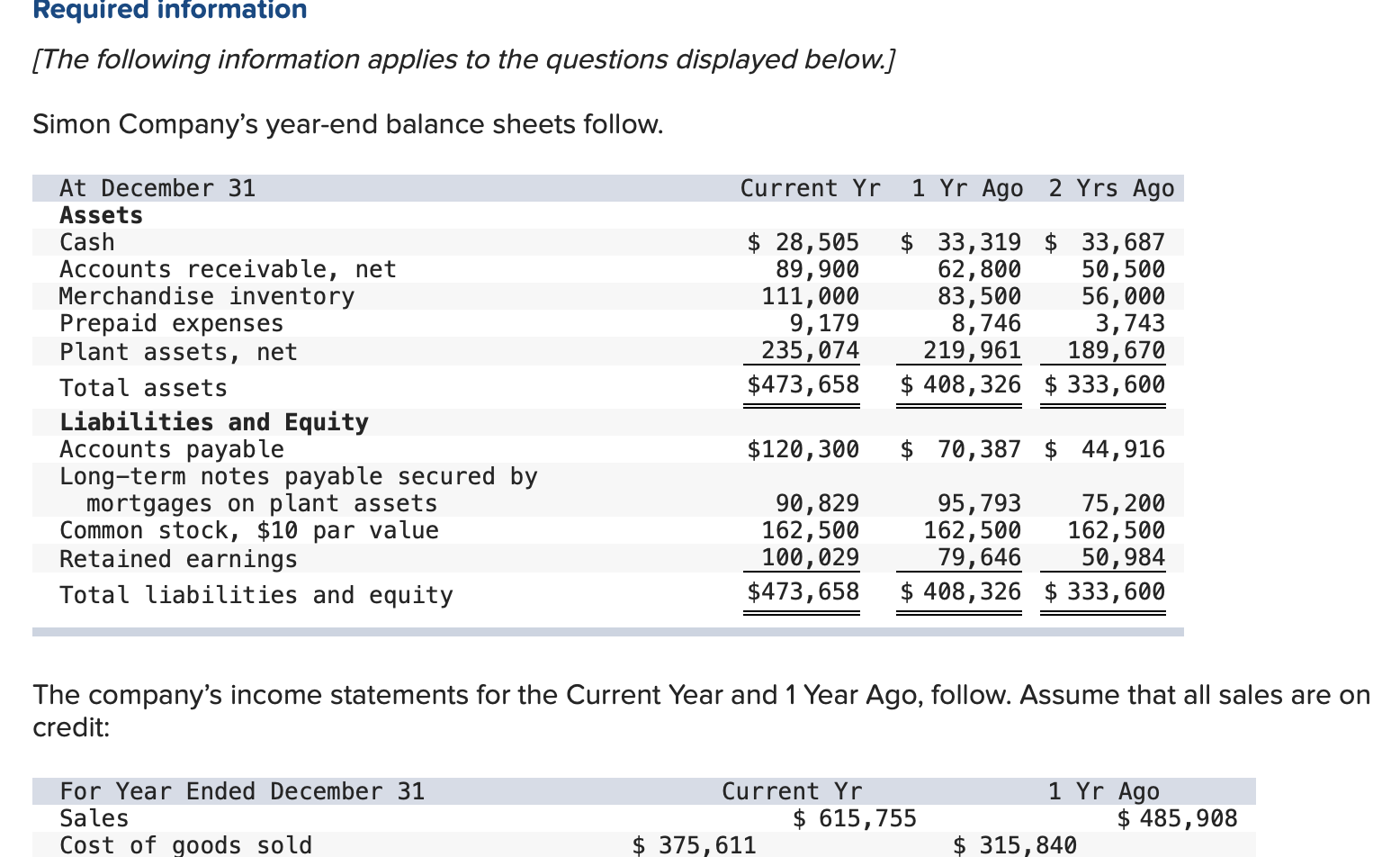

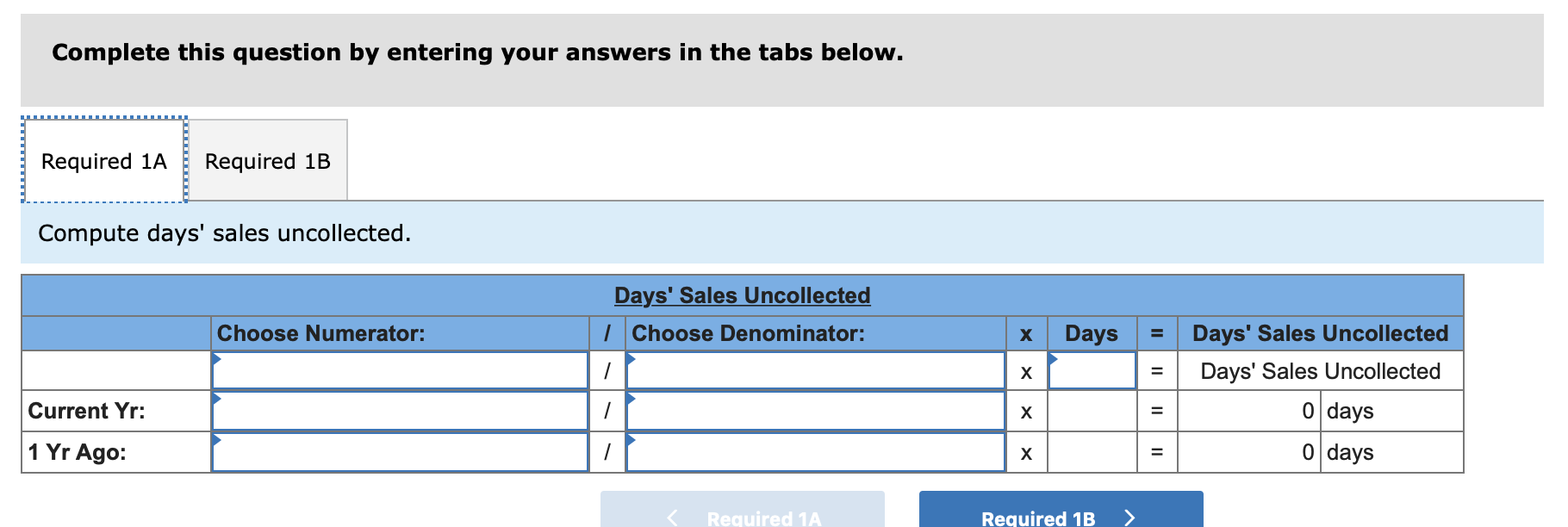

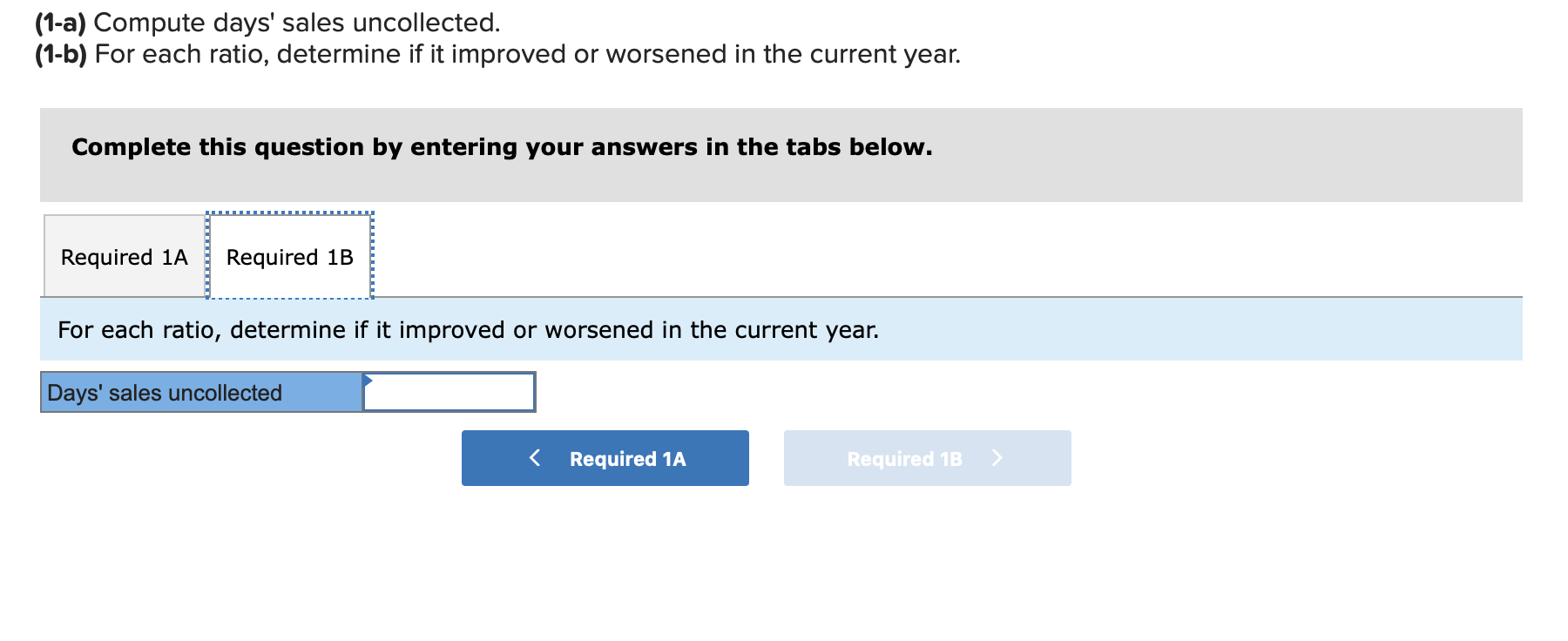

Required information (The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 28,505 89,900 111,000 9,179 235,074 $473,658 $ 33,319 $ 33,687 62,800 50,500 83,500 56,000 8,746 3,743 219,961 189,670 $ 408,326 $ 333,600 $120,300 $ 70,387 $ 44,916 90,829 162,500 100,029 $473,658 95,793 75,200 162,500 162,500 79,646 50,984 $ 408,326 $ 333,600 The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit: For Year Ended December 31 Sales Cost of goods sold Current Yr $ 615,755 $ 375, 611 1 Yr Ago $ 485,908 $ 315, 840 $ 28,505 89,900 111,000 9, 179 235,074 $473,658 $ 33,319 $ 33,687 62,800 50,500 83,500 56,000 8,746 3,743 219,961 189,670 $ 408,326 $ 333,600 Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $120,300 $ 70,387 $ 44,916 90,829 162,500 100,029 $473,658 95,793 75,200 162,500 162,500 79,646 50,984 $ 408,326 $ 333,600 The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit: For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $ 615,755 $ 375,611 190,884 10,468 8,005 584,968 $ 30,787 1 Yr Ago $ 485,908 $ 315,840 122,935 11,176 7, 289 457, 240 $ 28,668 Earnings per share $ 1.89 $ 1.76 Required information (The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 28,505 89,900 111,000 9,179 235,074 $473,658 $ 33,319 $ 33,687 62,800 50,500 83,500 56,000 8,746 3,743 219,961 189,670 $ 408,326 $ 333,600 $120,300 $ 70,387 $ 44,916 90,829 162,500 100,029 $473,658 95,793 75,200 162,500 162,500 79,646 50,984 $ 408,326 $ 333,600 The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit: For Year Ended December 31 Sales Cost of goods sold Current Yr $ 615,755 $ 375, 611 1 Yr Ago $ 485,908 $ 315, 840 Complete this question by entering your answers in the tabs below. Required 1A Required 1B Compute days' sales uncollected. Days' Sales Uncollected | Choose Denominator: Choose Numerator: Days Days' Sales Uncollected Days' Sales Uncollected / Current Yr: 1 11 0 days 0 days 1 Yr Ago: X II Required 1A Required 1B (1-a) Compute days' sales uncollected. (1-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Required 1A Required 1B For each ratio, determine if it improved or worsened in the current year. Days' sales uncollected

Need help here

Need help here

anyone?

anyone?