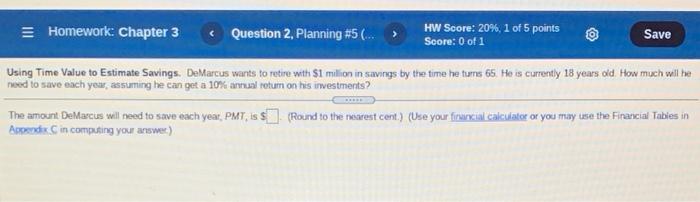

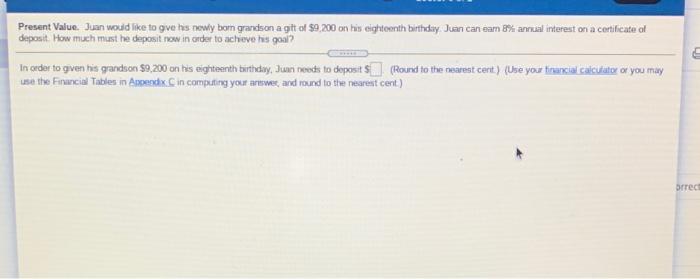

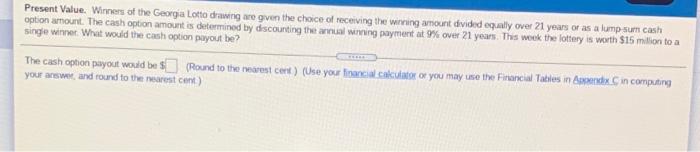

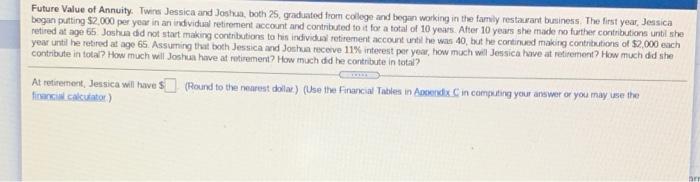

Homework: Chapter 3 Question 2 Planning #5 ... HW Score: 20%, 1 of 5 points Score: 0 of 1 Save Using Time Value to Estimate Savings. DeMarcus wants to retire with $1 million in savings by the time he turns 65. He is currently 18 years old. How much will be need to save each year, assuming he can get a 10% annual return on his investments? The amount DeMarcus will need to save each year, PMT, is $. (Round to the nearest cent.) (Use your firarcial calculator or you may lose the Financial Tables in Appendix Cin computing your answer) Present Value. Juan would like to give his newly bom grandson a gift of $9,200 on his eighteenth birthday Juan can eam 8% annual interest on a certificate al deposit. How much must he deposit now in order to achieve his goal? In order to given his grandson $9,200 on his eighteenth birthday, Juneeds to deposit (Round to the newest cent) (Use your financial Calculator or you may use the Financial Tables in Apendixin computing your answer and round to the nearest cent) orred Present Value. Winners of the Georgia Lotto drawing are gven the choice of receiving the wrong amount divided ogumilyover 21 years or as a lump sum cash option amount. The cash option amount is determined by discounting the annual winning payment at 9% over 21 years. This week the lottery is worth $15 million to a single winner. What would the cash option payout be? The cash ophon payout would be sound to the meest cert) (Use your ac caulk or you may use the Financial Tables in sede in computing your answer and round to the nearest cent) Future Value of Annuity. Twine Jessica and Joshu, both 25, graduated from college and began working in the family restaurant business. The first year, Jessica began putting $2,000 per year in an individual retirement account and contributed to it for a total of 10 years. After 10 years she made no further contributions until she retired at age 65 Joshua did not start making contributions to his individual retirement account until he was 40, but he continued making contributions of $2,000 each year until he retired at age 65. Assuming that both Jessica and Joshu receive 11% interest per year, how much wil Jessica Pave at retirement? How much did she contribute in total? How much will Joshua have at retirement? How much did he contribute in total? At retirement, Jessica will have $ (Round to the nearest dola) (Use the Financial Tables in Apendix C in computing your answer or you may was the fic calculator)