Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help how to get answer Homework: Homework 2: Ch 4 Save Score: 0.33 of 1 pt 5 of 10 (10 complete) HW Score: 93.33%,

need help how to get answer

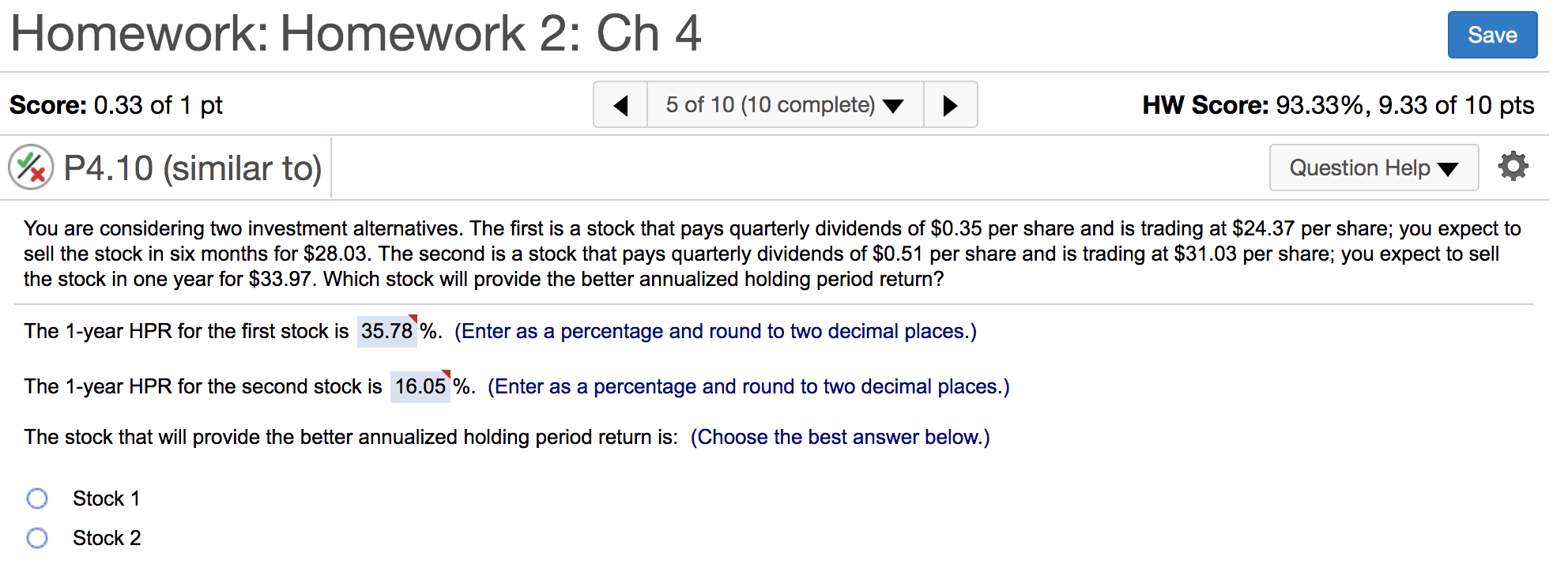

Homework: Homework 2: Ch 4 Save Score: 0.33 of 1 pt 5 of 10 (10 complete) HW Score: 93.33%, 9.33 of 10 pts %x P4.10 (similar to) Question Help o You are considering two investment alternatives. The first is a stock that pays quarterly dividends of $0.35 per share and is trading at $24.37 per share; you expect to sell the stock in six months for $28.03. The second is a stock that pays quarterly dividends of $0.51 per share and is trading at $31.03 per share; you expect to sell the stock in one year for $33.97. Which stock will provide the better annualized holding period return? The 1-year HPR for the first stock is 35.78 %. (Enter as a percentage and round to two decimal places.) The 1-year HPR for the second stock is 16.05%. (Enter as a percentage and round to two decimal places.) The stock that will provide the better annualized holding period return is: (Choose the best answer below.) Stock 1 Stock 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started