Answered step by step

Verified Expert Solution

Question

1 Approved Answer

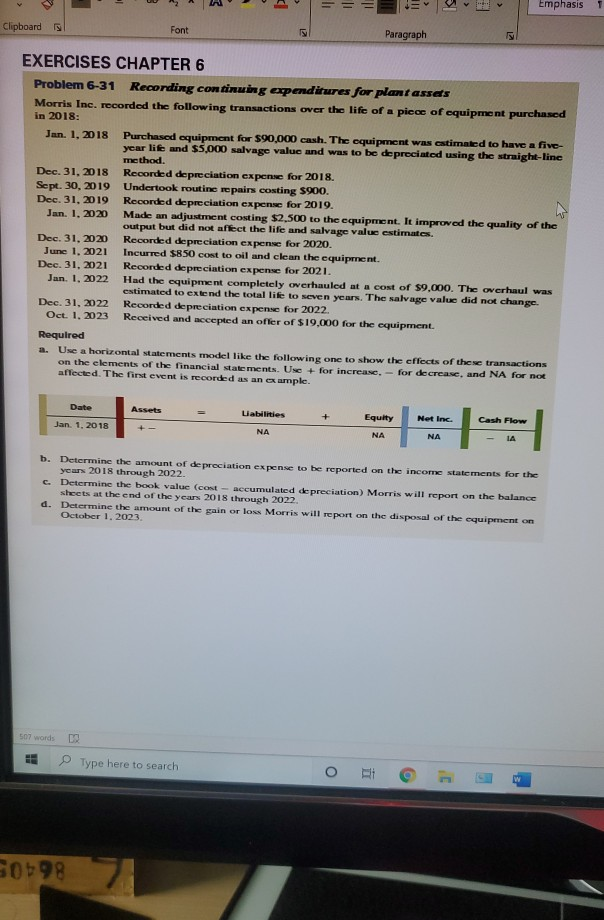

Need help, I think this is all wrong not sure. Emphasis Clipboard Font Paragraph EXERCISES CHAPTER 6 Problem 6-31 Recording continuing expenditures for plant assets

Need help, I think this is all wrong not sure.

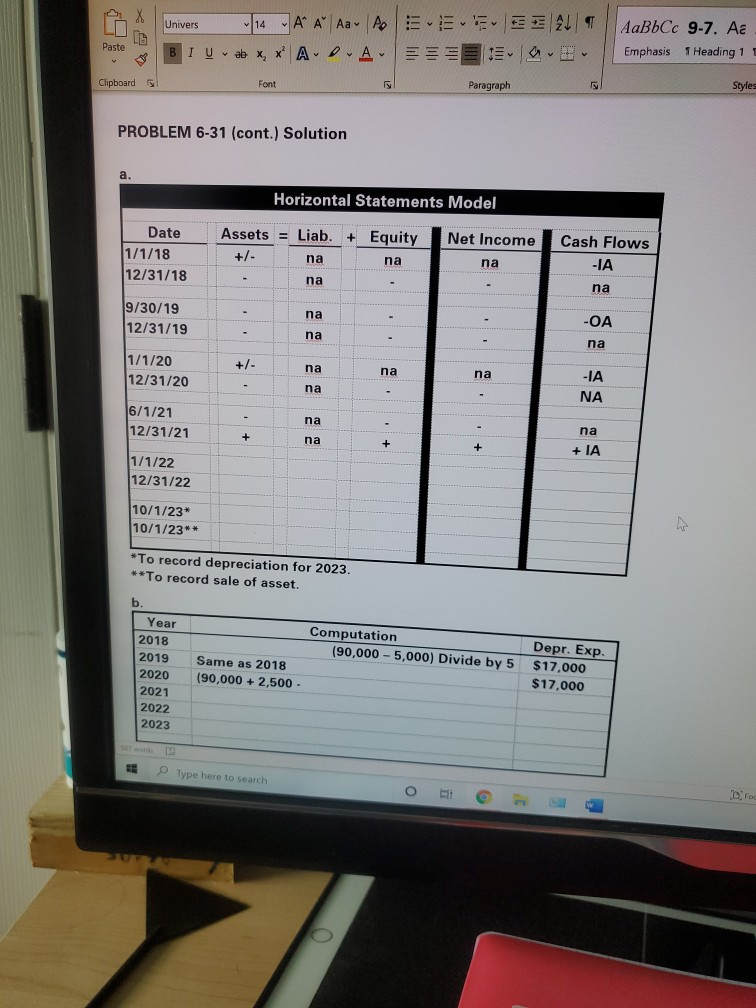

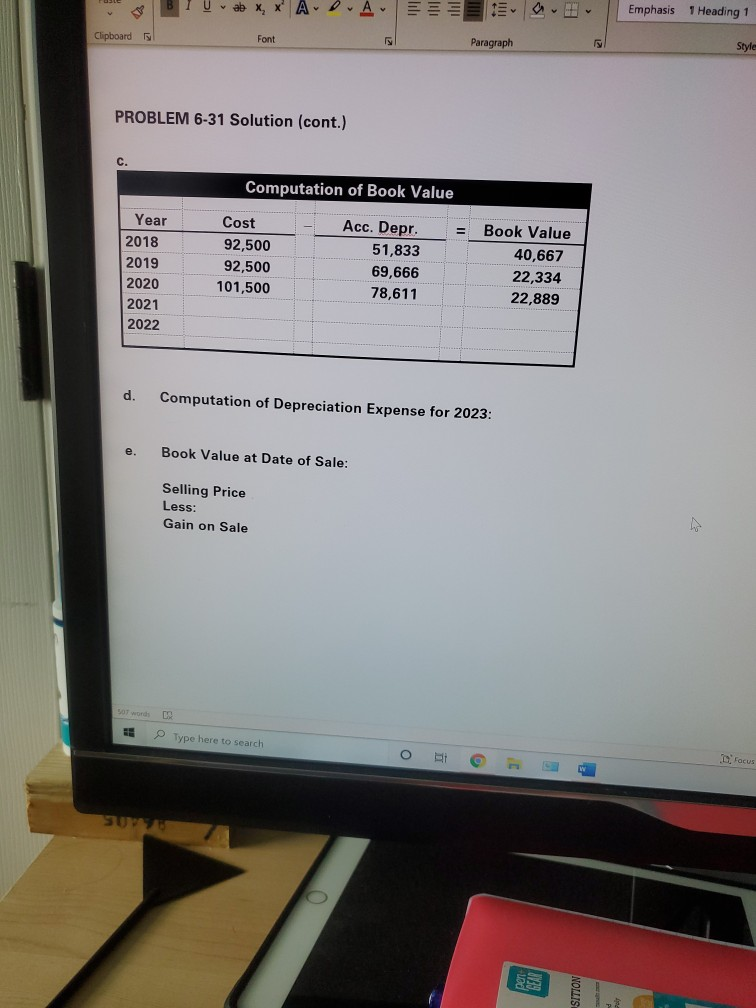

Emphasis Clipboard Font Paragraph EXERCISES CHAPTER 6 Problem 6-31 Recording continuing expenditures for plant assets Morris Inc. recorded the following transactions over the life of a picce of equipment purchased in 2018: Jan. 1. 2018 Purchased equipment for $90,000 cash. The equipment was estimated to have a five- year life and $5,000 salvage value and was to be depreciated using the straight-line method. Dec. 31, 2018 Recorded depreciation expense for 2018. Sept. 30, 2019 Undertook routine repairs costing $900. Dec 31, 2019 Recorded depreciation expense for 2019. Jan. 1. 2020 Made an adjustment costing $2.500 to the equipment. It improved the quality of the output but did not affect the life and salvage value estimates. Dec. 31. 2020 Recorded depreciation expense for 2020. June 1, 2021 Incurred $850 cost to oil and clean the equipment. Dec 31, 2021 Recorded depreciation expense for 2021. Jan. 1. 2022 Had the equipment completely overhauled at a cost of $9,000. The overhaul was estimated to extend the total like to seven years. The salvage value did not change. Dec. 31, 2022 Recorded depreciation expense for 2022 Oct. 1. 2023 Received and accepted an offer of $19,000 for the equipment. Required a. Use a horizontal statements model like the following one to show the effects of these transactions on the elements of the financial statements. Use for increase. - for decrease, and NA for not affected. The first event is recorded as an example. Date Assets Liabilities + Equity Net Inc. Jan. 1. 2018 Cash Flow NA NA NA IA b. Determine the amount of depreciation expense to be reported on the income statements for the yeurs 2018 through 2022 Determine the book value (cost - accumulated depreciation) Morris will report on the balance sheets at the end of the years 2018 through 2022 d. Determine the amount of the gain or loss Morris will report on the disposal of the equipment on October 1, 2023. 507 words 2 Type here to search o 3 S01987 La Univers 14 A A A A A BIUab x x ADA AaBbCc 9-7. Aa Emphasis 1 Heading 1 Paste Clipboard Font Paragraph Styles PROBLEM 6-31 (cont.) Solution a. Horizontal Statements Model Date 1/1/18 12/31/18 Assets = Liab. + Equity +/- Net Income na na na Cash Flows -IA na na 9/30/19 12/31/19 na -OA na na +/- 1/1/20 12/31/20 na na na - na -IA NA - 6/1/21 12/31/21 na + na + na + IA + 1/1/22 12/31/22 10/1/23* 10/1/23** *To record depreciation for 2023. **To record sale of asset. b. Year 2018 2019 2020 Computation (90,000 - 5,000) Divide by 5 Same as 2018 (90,000 + 2,500 Depr. Exp. $17.000 $17,000 2021 2022 2023 Type here to search O I foc ab X, X Emphasis 1 Heading 1 Clipboard Font Paragraph Style PROBLEM 6-31 Solution (cont.) C. Computation of Book Value Year 2018 2019 2020 2021 2022 Cost 92,500 92,500 101,500 Acc. Depr. 51,833 69,666 78,611 Book Value 40,667 22,334 22,889 d. Computation of Depreciation Expense for 2023: e. Book Value at Date of Sale: Selling Price Less: Gain on Sale SOT word Type here to search O Focus SUTOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started