need help interpreting data , how it was collected and how to use it to find spot price and arbitrage

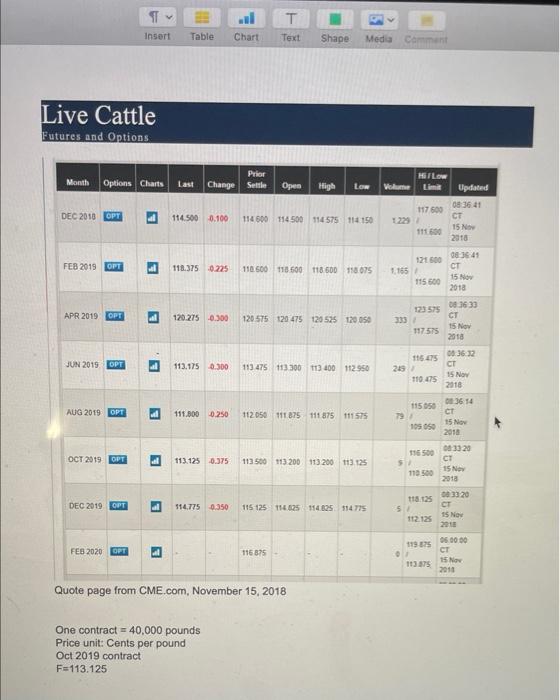

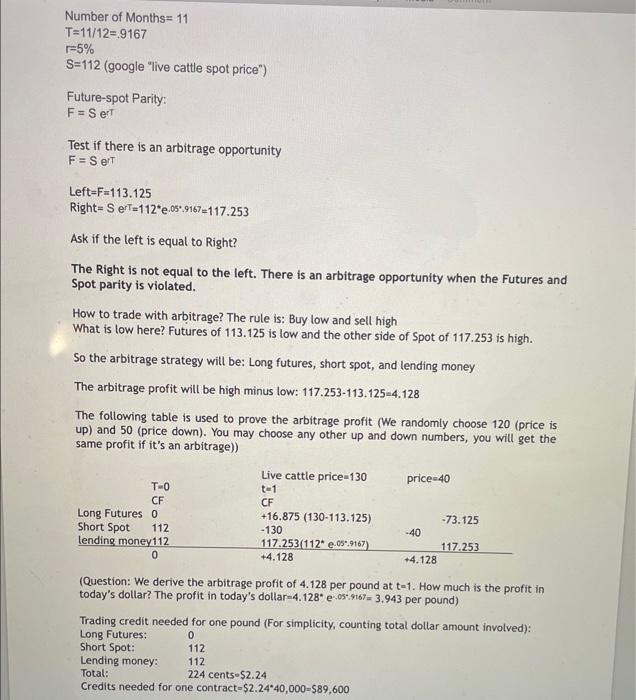

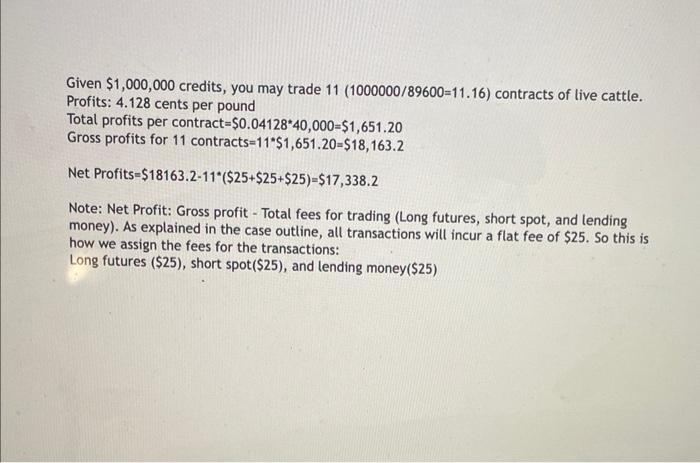

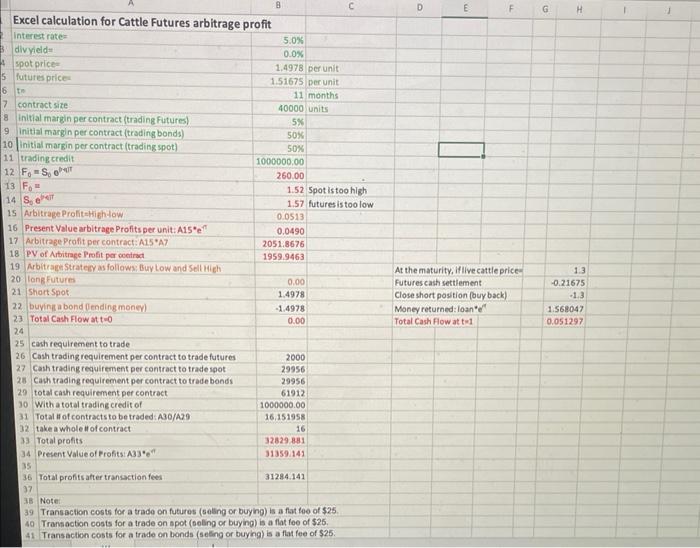

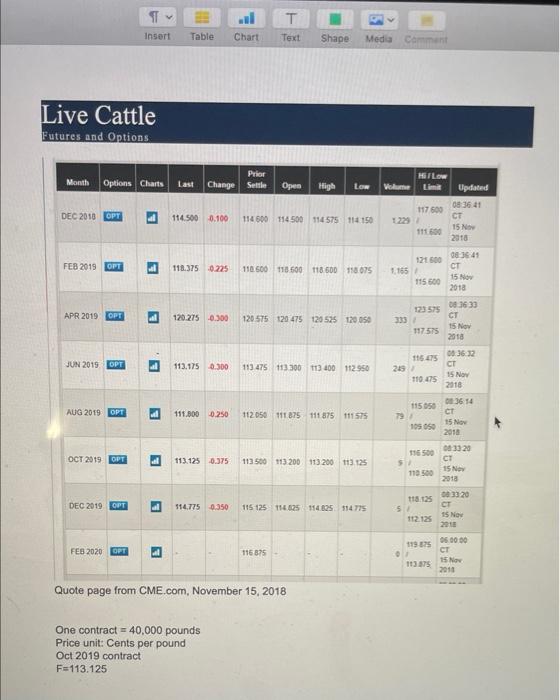

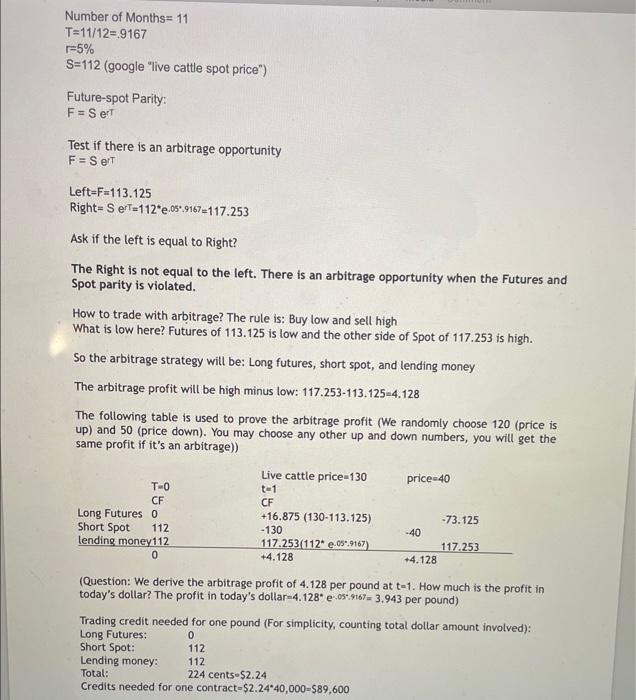

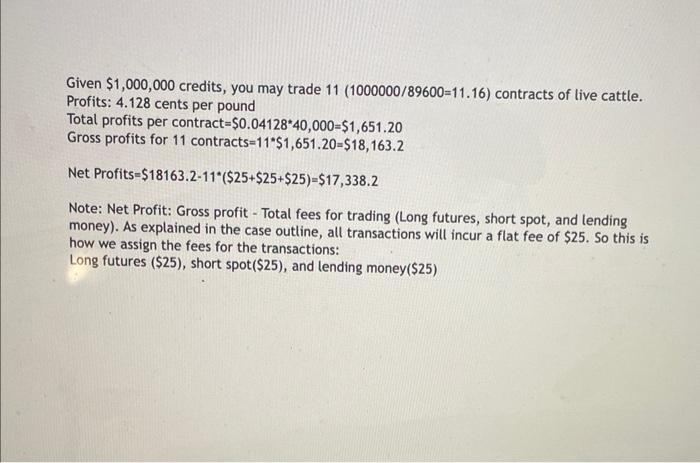

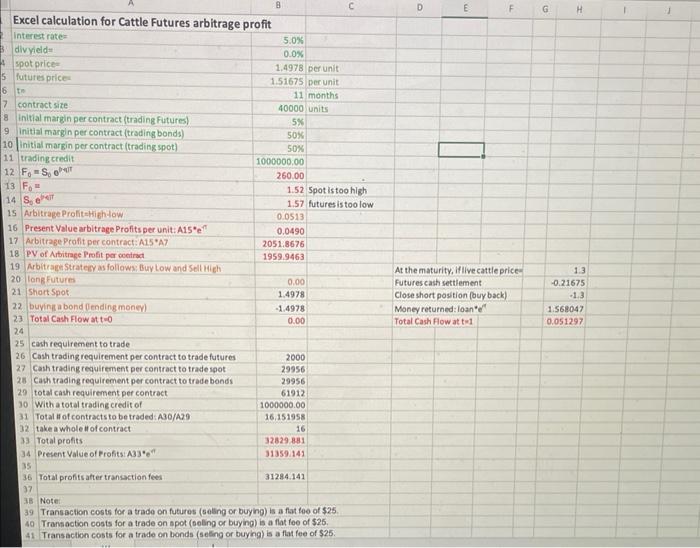

Quote page from CME.com, November 15,2018 One contract =40,000 pounds Price unit: Cents per pound Oct 2019 contract F=113.125 T=11/12=.9167r=5%S=112(google"livecattlespotprice") Future-spot Parity: F=Ser Test if there is an arbitrage opportunity F=Sert Left F=113.125 Right =SSrT=112e.05:9167=117.253 Ask if the left is equal to Right? The Right is not equal to the left. There is an arbitrage opportunity when the Futures and Spot parity is violated. How to trade with arbitrage? The rule is: Buy low and sell high What is low here? Futures of 113.125 is low and the other side of Spot of 117.253 is high. So the arbitrage strategy will be: Long futures, short spot, and lending money The arbitrage profit will be high minus low: 117.253113.125=4.128 The following table is used to prove the arbitrage profit (We randomly choose 120 (price is up) and 50 (price down). You may choose any other up and down numbers, you will get the same profit if it's an arbitrage)) (Question: We derive the arbitrage profit of 4.128 per pound at t=1. How much is the profit in today's dollar? The profit in today's dollar =4.128 e e.05: 967=3.943 per pound) Trading credit needed for one pound (For simplicity, counting total dollar amount involved): Long Futures: 0 Short Spot: 112 Lendingmoney:Total:112224centse$2.24 Total: Credits needed for one contract =$2.24 cents $2.24 Given $1,000,000 credits, you may trade 11(1000000/89600=11.16) contracts of live cattle. Profits: 4.128 cents per pound Total profits per contract =$0.0412840,000=$1,651.20 Gross profits for 11 contracts =11$1,651.20=$18,163.2 Net Profits =$18163.211($25+$25+$25)=$17,338.2 Note: Net Profit: Gross profit - Total fees for trading (Long futures, short spot, and lending money). As explained in the case outline, all transactions will incur a flat fee of $25. So this is how we assign the fees for the transactions: Long futures ($25), short spot(\$25), and lending money(\$25) Transaction costs for a trade on bonds (seding or buying) is a nat ree of $20 : Quote page from CME.com, November 15,2018 One contract =40,000 pounds Price unit: Cents per pound Oct 2019 contract F=113.125 T=11/12=.9167r=5%S=112(google"livecattlespotprice") Future-spot Parity: F=Ser Test if there is an arbitrage opportunity F=Sert Left F=113.125 Right =SSrT=112e.05:9167=117.253 Ask if the left is equal to Right? The Right is not equal to the left. There is an arbitrage opportunity when the Futures and Spot parity is violated. How to trade with arbitrage? The rule is: Buy low and sell high What is low here? Futures of 113.125 is low and the other side of Spot of 117.253 is high. So the arbitrage strategy will be: Long futures, short spot, and lending money The arbitrage profit will be high minus low: 117.253113.125=4.128 The following table is used to prove the arbitrage profit (We randomly choose 120 (price is up) and 50 (price down). You may choose any other up and down numbers, you will get the same profit if it's an arbitrage)) (Question: We derive the arbitrage profit of 4.128 per pound at t=1. How much is the profit in today's dollar? The profit in today's dollar =4.128 e e.05: 967=3.943 per pound) Trading credit needed for one pound (For simplicity, counting total dollar amount involved): Long Futures: 0 Short Spot: 112 Lendingmoney:Total:112224centse$2.24 Total: Credits needed for one contract =$2.24 cents $2.24 Given $1,000,000 credits, you may trade 11(1000000/89600=11.16) contracts of live cattle. Profits: 4.128 cents per pound Total profits per contract =$0.0412840,000=$1,651.20 Gross profits for 11 contracts =11$1,651.20=$18,163.2 Net Profits =$18163.211($25+$25+$25)=$17,338.2 Note: Net Profit: Gross profit - Total fees for trading (Long futures, short spot, and lending money). As explained in the case outline, all transactions will incur a flat fee of $25. So this is how we assign the fees for the transactions: Long futures ($25), short spot(\$25), and lending money(\$25) Transaction costs for a trade on bonds (seding or buying) is a nat ree of $20