need help making a 10 column worksheet

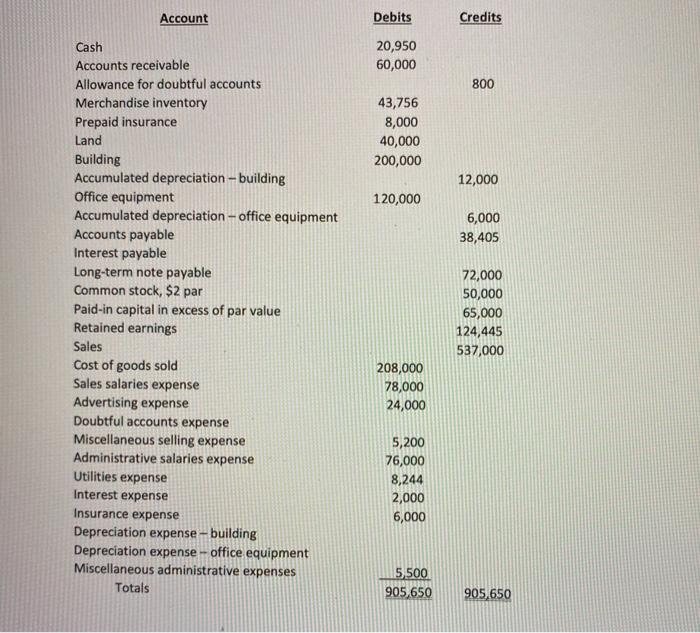

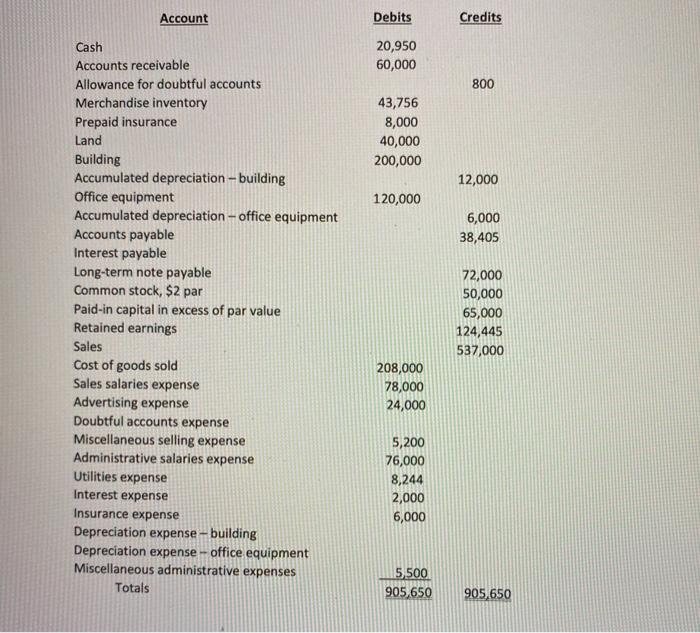

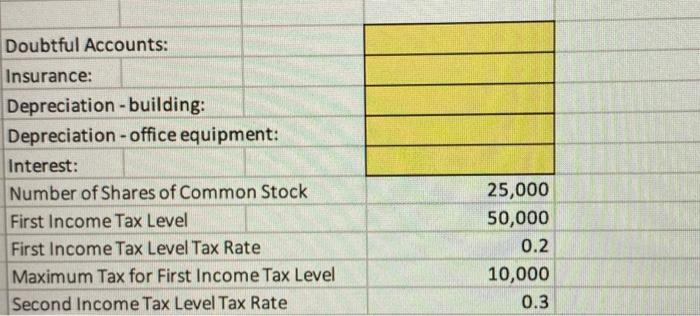

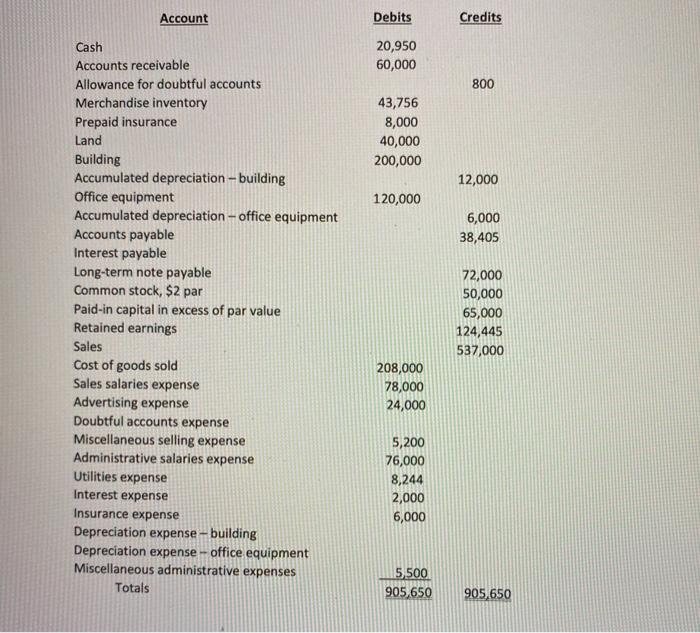

Account Debits Credits 20,950 60,000 800 43,756 8,000 40,000 200,000 12,000 120,000 6,000 38,405 Cash Accounts receivable Allowance for doubtful accounts Merchandise inventory Prepaid insurance Land Building Accumulated depreciation - building Office equipment Accumulated depreciation - office equipment Accounts payable Interest payable Long-term note payable Common stock, $2 par Paid-in capital in excess of par value Retained earnings Sales Cost of goods sold Sales salaries expense Advertising expense Doubtful accounts expense Miscellaneous selling expense Administrative salaries expense Utilities expense Interest expense Insurance expense Depreciation expense-building Depreciation expense -- office equipment Miscellaneous administrative expenses Totals 72,000 50,000 65,000 124,445 537,000 208,000 78,000 24,000 5,200 76,000 8,244 2,000 6,000 5500 905,650 905,650 Doubtful Accounts: Insurance: Depreciation - building: Depreciation - office equipment: Interest: Number of Shares of Common Stock First Income Tax Level First Income Tax Level Tax Rate Maximum Tax for First Income Tax Level Second Income Tax Level Tax Rate 25,000 50,000 0.2 10,000 0.3 Account Debits Credits 20,950 60,000 800 43,756 8,000 40,000 200,000 12,000 120,000 6,000 38,405 Cash Accounts receivable Allowance for doubtful accounts Merchandise inventory Prepaid insurance Land Building Accumulated depreciation - building Office equipment Accumulated depreciation - office equipment Accounts payable Interest payable Long-term note payable Common stock, $2 par Paid-in capital in excess of par value Retained earnings Sales Cost of goods sold Sales salaries expense Advertising expense Doubtful accounts expense Miscellaneous selling expense Administrative salaries expense Utilities expense Interest expense Insurance expense Depreciation expense-building Depreciation expense -- office equipment Miscellaneous administrative expenses Totals 72,000 50,000 65,000 124,445 537,000 208,000 78,000 24,000 5,200 76,000 8,244 2,000 6,000 5500 905,650 905,650 Doubtful Accounts: Insurance: Depreciation - building: Depreciation - office equipment: Interest: Number of Shares of Common Stock First Income Tax Level First Income Tax Level Tax Rate Maximum Tax for First Income Tax Level Second Income Tax Level Tax Rate 25,000 50,000 0.2 10,000 0.3