Question

Need help making a decision analysis for the localization alternative. Your analysis should focus on a decision analysis for the localization alternative. The US sourcing

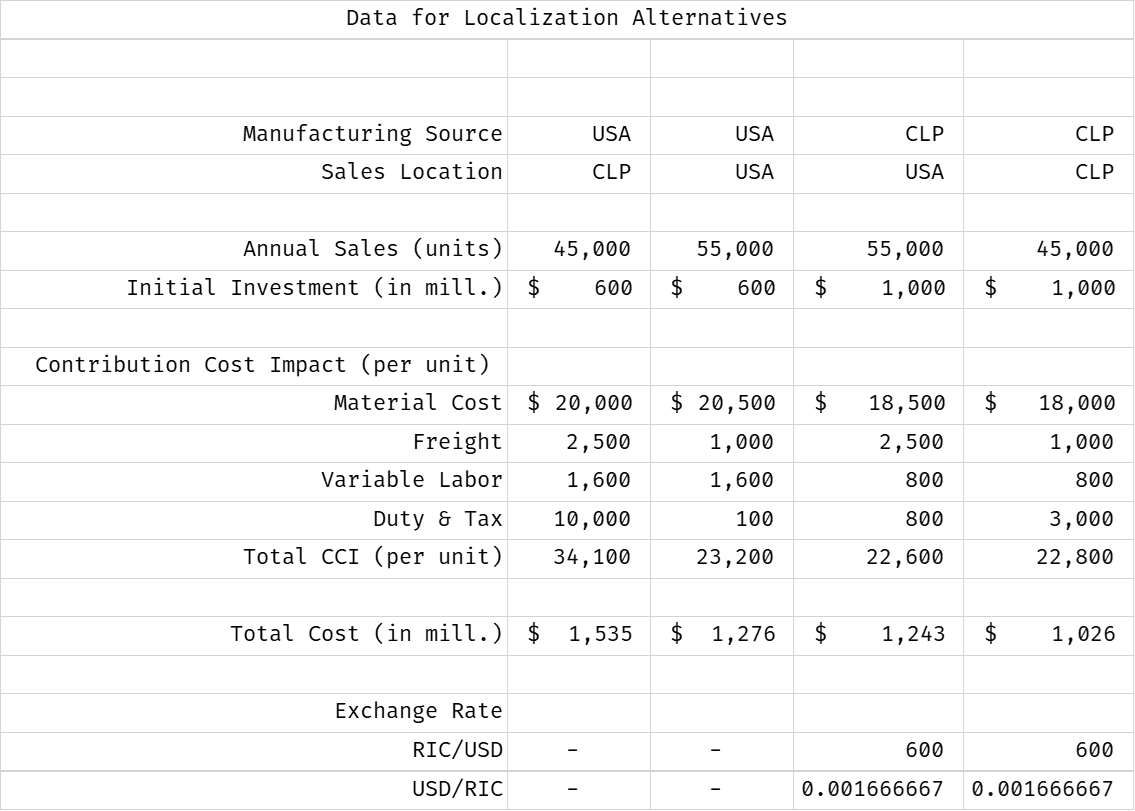

Need help making a decision analysis for the localization alternative. Your analysis should focus on a decision analysis for the localization alternative. The US sourcing location is in our present Business Plan. Provide an incremental view to our business plan shown in millions (USD).

2. The localization alternative will have no impact on our sale revenue, so all the data I have sent over is cost related. There is no need to include revenue in the incremental decision analysis.

3. Given the tight timing on this project, assume a one-period analysis for this study for simplicity (i.e., calculate the profit impact for one-year). At a later date, with better data and an aligned cost of capital, we will analyze the entire fve-year product cycle.

4. Ryan, from the Corporate Economics team, suggested we study a three-point range for the exchange rate (500:1, 600:1, and 700:1).

Data for Localization Alternatives USA USA CLP CLP Manufacturing Source Sales Location CLP USA USA CLP 45,000 55,000 Annual Sales (units) Initial Investment (in mill.) $ 55,000 1,000 45,000 1,000 600 600 $ $ 20,500 $ 18,500 $ 18,000 2,500 1,000 Contribution Cost Impact (per unit) Material cost $ 20,000 Freight 2,500 Variable Labor 1,600 Duty & Tax 10,000 Total CCI (per unit) 34,100 1,000 1,600 800 800 100 800 3,000 22,800 23,200 22,600 Total Cost (in mill.) $ 1,535 $ 1,276 1,243 $ 1,026 Exchange Rate RIC/USD USD/RIC 600 600 0.001666667 0.001666667 Data for Localization Alternatives USA USA CLP CLP Manufacturing Source Sales Location CLP USA USA CLP 45,000 55,000 Annual Sales (units) Initial Investment (in mill.) $ 55,000 1,000 45,000 1,000 600 600 $ $ 20,500 $ 18,500 $ 18,000 2,500 1,000 Contribution Cost Impact (per unit) Material cost $ 20,000 Freight 2,500 Variable Labor 1,600 Duty & Tax 10,000 Total CCI (per unit) 34,100 1,000 1,600 800 800 100 800 3,000 22,800 23,200 22,600 Total Cost (in mill.) $ 1,535 $ 1,276 1,243 $ 1,026 Exchange Rate RIC/USD USD/RIC 600 600 0.001666667 0.001666667

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started