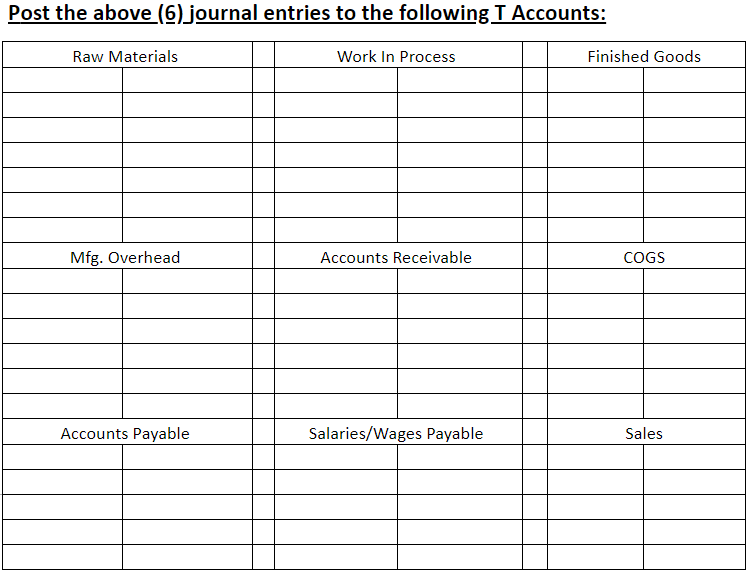

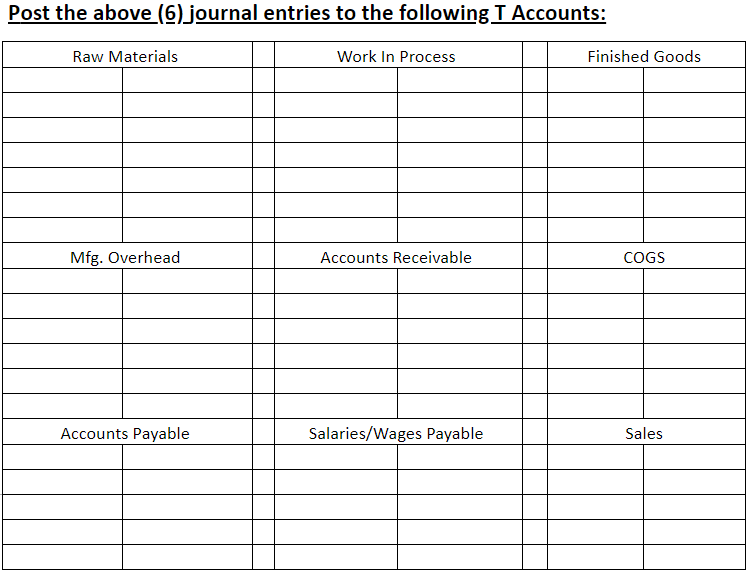

Need Help Making T Accounts using Infor Bellow:

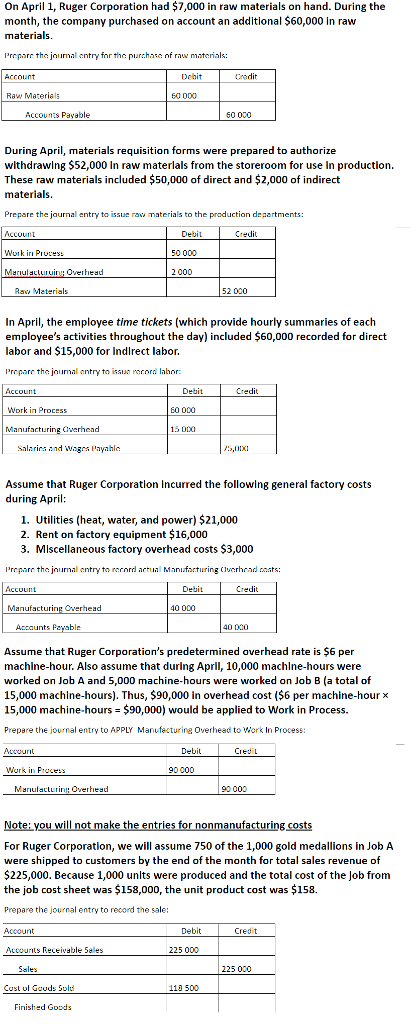

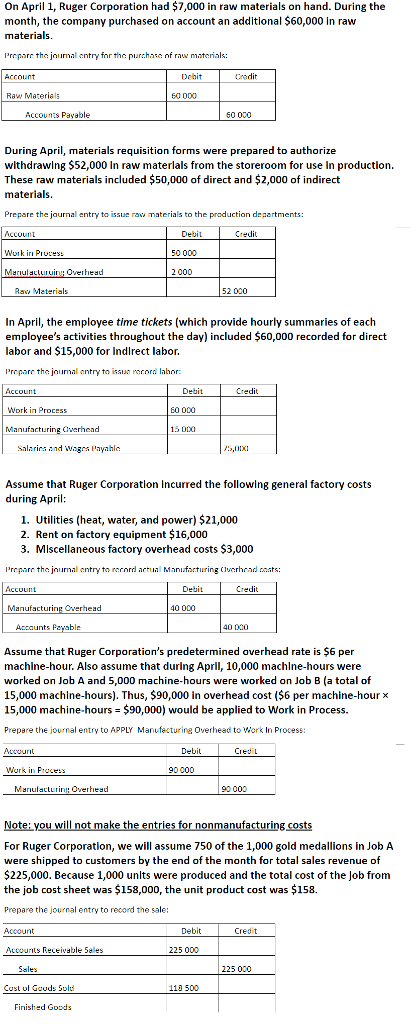

On April 1, Ruger Corporation had $7,000 in raw materials on hand. During the month, the company purchased on account an additional $60,000 in raw materials. Propar the jaurnal antry for the piurchas nfraw materials: Dehit Dredit Raw Materials 60 ODO Accounts Pavable 50 000 During April, materials requisition forms were prepared to authorize wlthdrawlng $52,000 In raw materlals from the storeroom for use In production. These raw materials included $50,000 of direct and $2,000 of indirect materials. Prepare the jaurnal entry to issue ra materials to the praduction deaartments: Debit 50 000 2000 Credit Overhead Raw Meterials 52 000 In April, the employee time tickets (which provide hourly summaries of each employee's activities throughout the day) included $60,000 recorded for direct labor and $15,000 for Indlrect labor. Prepare the journal entry to issu rocora lahor Debit Credit Work in Process 60 000 Manufacturing Cwerhead 15 000 arand Wages Payahle Assume that Ruger Corporatlon Incurred the following general factory costs during April 1. Utilities (heat, water, and power) $21,000 2. Rent on factory equipment $16,000 3. Miscellaneous factory overhead costs $3,000 Propar the journal antry to rocordca Manifarturing erhrd cats: Account Manufactu Debit Credit Cerhead 40 000 40 020 Assume that Ruger Corporation's predetermined overhead rate is $6 per machlne-hour. Also assume that during Aprll, 10,000 machlne-hours were worked on Job A and 5,000 machine-hours were worked on Job B (a total of 15,000 machine-hours). Thus, $90,000 in overhead cost ($6 per machine-hour x 15,000 machine-hours $90,000) would be applied to Work in Process. Prepare the journal entry to APPLY Manufacturing Overhead to Work In Process: Debit Work in Pracess Manulacturing Overhead 90000 Note:you will not make the entries for nonmanufacturing costs For Ruger Corporation, we will assume 750 of the 1,000 gold medallions in Job A were shipped to customers by the end of the month for total sales revenue of $225,000. Because 1,000 unlts were produced and the total cost of the Job from the job cost sheet was $158,000, the unit product cost was $158. Prepare the journal entry to record the sale: Account Accounits Receivable 5ales Debit 225 000 Sales 225 000 Cost ul Goods Solt 113 500 Finished Goods