Answered step by step

Verified Expert Solution

Question

1 Approved Answer

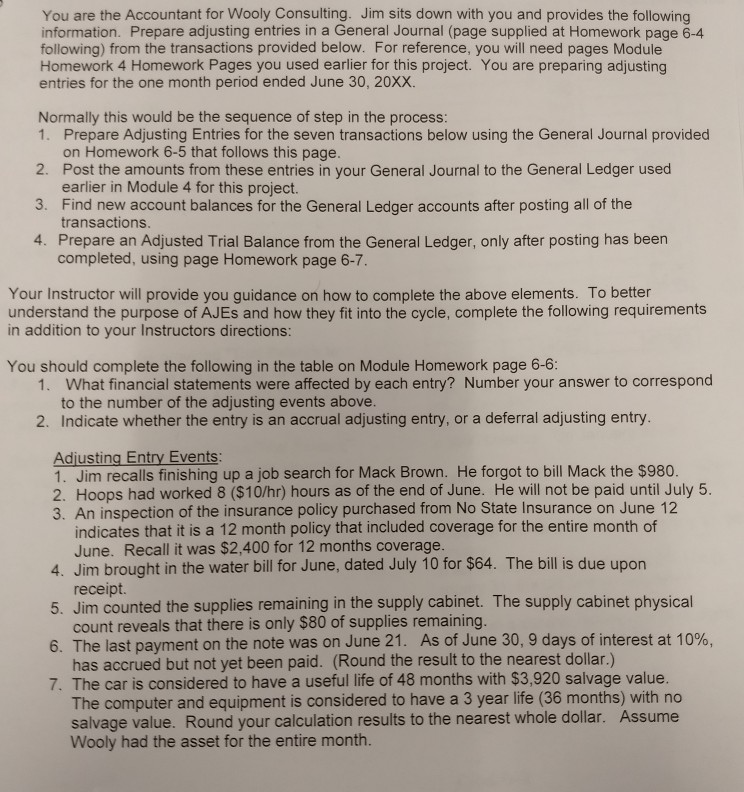

need help making the adjusted journal entry from steps 1-7 at the bottom. You are the Accountant for Wooly Consulting. Jim sits down with you

need help making the adjusted journal entry from steps 1-7 at the bottom.

You are the Accountant for Wooly Consulting. Jim sits down with you and provides the following information. Prepare adjusting entries in a General Journal (page supplied at Homework page 6-4 following) from the transactions provided below. For reference, you will need pages Module Homework 4 Homework Pages you used earlier for this project. You are preparing adjusting entries for the one month period ended June 30, 20XX Normally this would be the sequence of step in the process 2. 3. 4. Prepare Adjusting Entries for the seven transactions below using the General Journal provided on Homework 6-5 that follows this page. Post the amounts from these entries in your General Journal to the General Ledger used earlier in Module 4 for this project. Find new account balances for the General Ledger accounts after posting all of the transactions Prepare an Adjusted Trial Balance from the General Ledger, only after posting has been completed, using page Homework page 6-7 Your Instructor will provide you guidance on how to complete the above elements. To better understand the purpose of AJEs and how they fit into the cycle, complete the following requirements in addition to your Instructors directions: You should complete the following in the table on Module Homework page 6-6 What financial statements were affected by each entry? Number your answer to correspond to the number of the adjusting events above 1. 2. Indicate whether the entry is an accrual adjusting entry, or a deferral adjusting entry Adjusting Entry Events Jim recalls finishing up a job search for Mack Brown. He forgot to bill Mack the $980. 2. Hoops had worked 8 ($10/hr) hours as of the end of June. He will not be paid until July 5 3. An inspection of the insurance policy purchased from No State Insurance on June 12 indicates that it is a 12 month policy that included coverage for the entire month of June. Recall it was $2,400 for 12 months coverage 4. Jim brought in the water bill for June, dated July 10 for $64. The bill is due upon 5. Jim counted the supplies remaining in the supply cabinet. The supply cabinet physical 6. The last payment on the note was on June 21, As of June 30, 9 days of interest at 10% 7. The car is considered to have a useful life of 48 months with $3,920 salvage value receipt count reveals that there is only $80 of supplies remaining has accrued but not yet been paid. (Round the result to the nearest dollar.) The computer and equipment is considered to have a 3 year life (36 months) with no salvage value. Round your calculation results to the nearest whole dollar. Assume Wooly had the asset for the entire monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started