Answered step by step

Verified Expert Solution

Question

1 Approved Answer

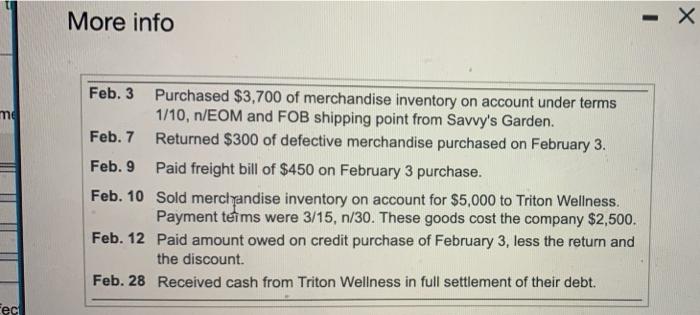

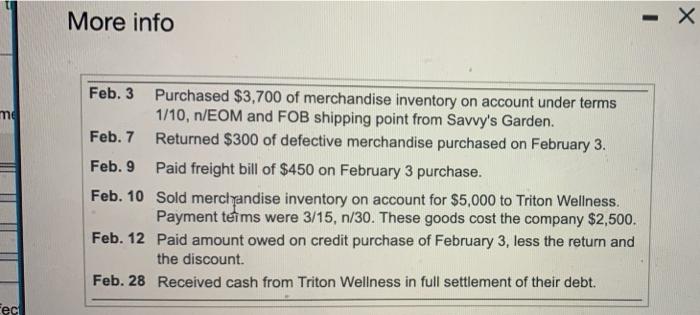

need help!!! me Fec More info Feb. 3 Purchased $3,700 of merchandise inventory on account under terms 1/10, n/EOM and FOB shipping point from Savvy's

need help!!!

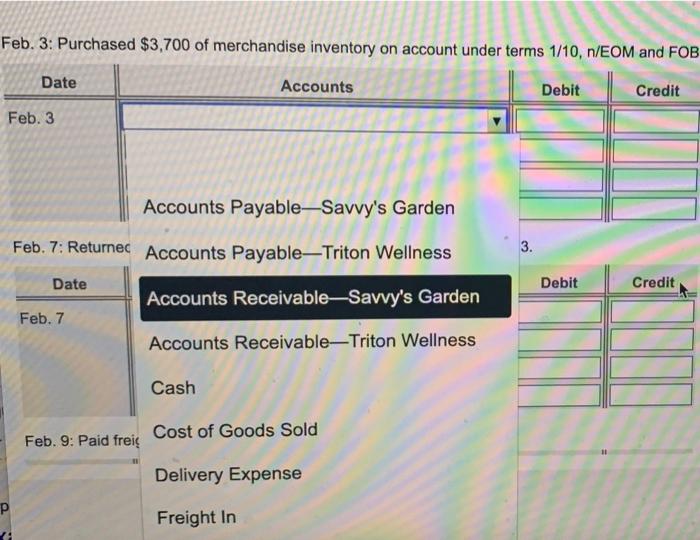

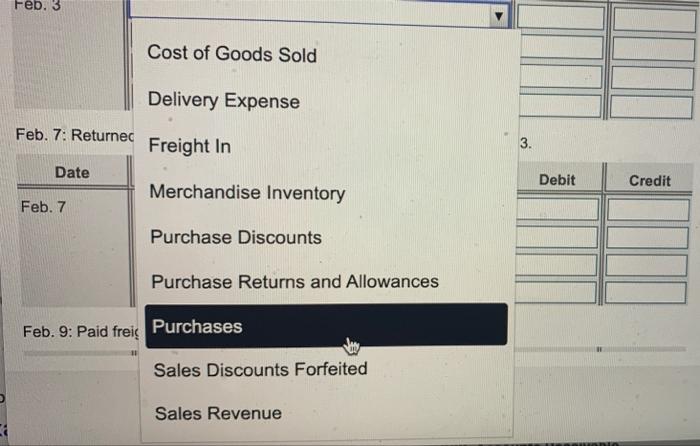

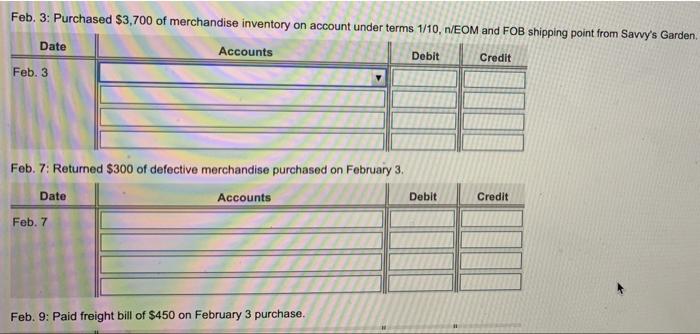

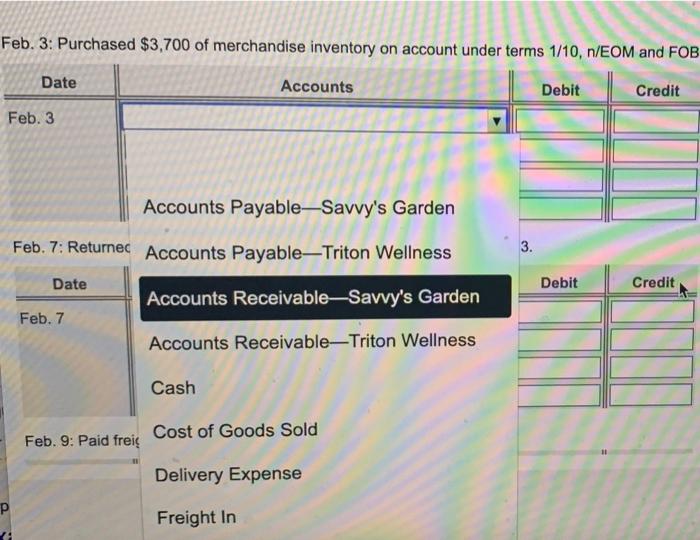

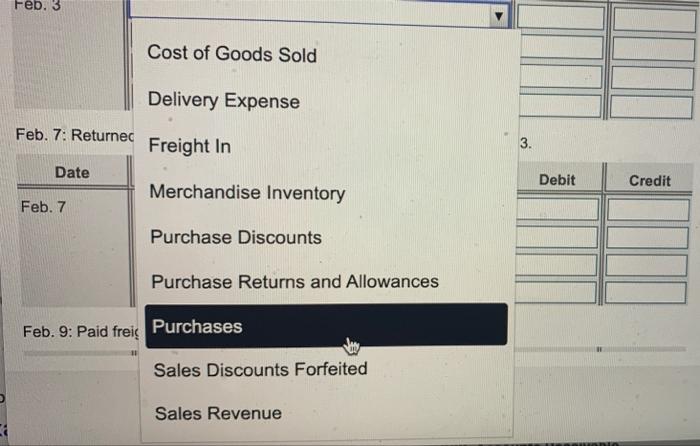

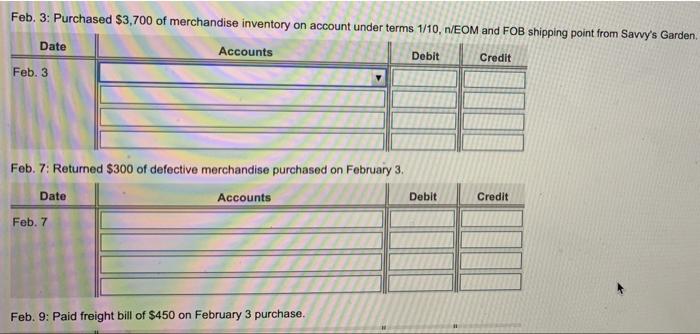

me Fec More info Feb. 3 Purchased $3,700 of merchandise inventory on account under terms 1/10, n/EOM and FOB shipping point from Savvy's Garden. Feb. 7 Returned $300 of defective merchandise purchased on February 3. Paid freight bill of $450 on February 3 purchase. Feb. 9 Feb. 10 Sold merchandise inventory on account for $5,000 to Triton Wellness. Payment terms were 3/15, n/30. These goods cost the company $2,500. Paid amount owed on credit purchase of February 3, less the return and the discount. Feb. 12 Feb. 28 Received cash from Triton Wellness in full settlement of their debt. - X Feb. 3: Purchased $3,700 of merchandise inventory on account under terms 1/10, n/EOM and FOB Date Accounts Debit Credit Feb. 3 Accounts Payable-Savvy's Garden Feb. 7: Returned Accounts Payable-Triton Wellness Date Credit Accounts Receivable-Savvy's Garden Feb. 7 Accounts Receivable-Triton Wellness Cash Cost of Goods Sold Feb. 9: Paid frei Delivery Expense Freight In P 3. Debit Feb. 3 Feb. 7: Returnec Date Feb. 7 Feb. 9: Paid freig Cost of Goods Sold Delivery Expense Freight In Merchandise Inventory Purchase Discounts Purchase Returns and Allowances Purchases Sales Discounts Forfeited Sales Revenue 3. Debit Credit Feb. 3: Purchased $3,700 of merchandise inventory on account under terms 1/10, n/EOM and FOB shipping point from Savvy's Garden. Date Accounts Debit Credit Feb. 3 Feb. 7: Returned $300 of defective merchandise purchased on February 3. Date Accounts Debit Credit Feb. 7 Feb. 9: Paid freight bill of $450 on February 3 purchase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started