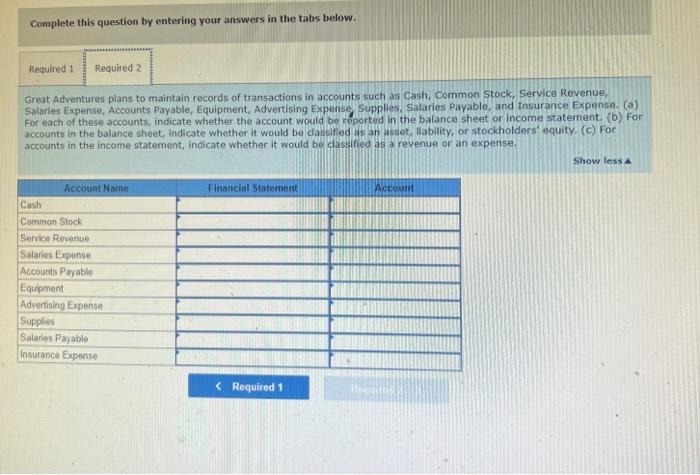

RWP1-1 Great Adventures Tony Matheson plans to graduate from college in May 2024 after spending four years earnirig a degree in sports and recreation management. Since beginning T. ball at age five, be's been actively involved in sports and enjoys the oundoors. Each summer growing up. he and his father would spend two weeks at a fatherison outdoor camp These fond memories are part of the reason he chose his majoc. He wants to remain involved in these outdoor activities and provide others with the same adventures he was able to share with his dad. He decides to start an outdoor adventure company. However. he's not sure he has the bus mess background necessary to do this This is where Suzie Ramos can help. Suze also plans to graduate in May 2024 with a major in business, Suzie and Tony first met their sophomore year and have been friends ever since, as they share a strong interest in sports and outdoor activities. They decide to name their company Great Adventures. They will provide clinics for a variety of outdoor activities such as kayaking. mountain biking, rock climbing. wildemess survival techniques, orienteeting, backpacking, and other adventure sports. Required: 1. Tony and Suzie are concerned about personal liability from custnem who are injured during outdoor adventure activities. Which of the three basic forms of business organization do you recommend for Great Advertures (iole proprietorship. partnership, of corporation)? 2. Great Adventures plans to maintain records of transactions in accounts such as Cash, Common Stock. Service Revenue, Salaries Expense, Accounts Payable, Equipment. Advertising Expense, Supplies, Salaries Payable and Insurance Expense (a) For each of these. accounts, indicate whether the account would be feported in the balince sheet on income statement (b) For accounts in the balance sheet. indicate whether it would be classified as an asset, liability, or stockthold ens fquizy (c) For accounts in the income statement. incicate whether it would be classified as a revenue or an expense Complete this question by entering your answers in the tabs below. Tony and suzie are concerned about personal liability from customers who are injured during outdoor adventura activities. Which of the three basic forms of business organization do you recommend for Great Adventures (sole proprietoratip. partnerthip, pr corporation)? Complete this question by entering your answers in the tabs below. Great Adventures plans to maintain records of transactions in accounts such as Cash, Common Stock, Service Revenue, Salaries Expense, Accounts Payable, Equipment, Advertising Expense, Supplies, Salaries Payable, and tnsurance Expense. (a) For each of these accounts, indicate whether the account would be reported in the balance sheet or income statement. (b) For accounts in the balance sheet, indicate whether it would be classified as an asset, liability, or stockholders' equity. (c) For accounts in the income statement, indicate whether it would be classified as a revenue or an expense