Answered step by step

Verified Expert Solution

Question

1 Approved Answer

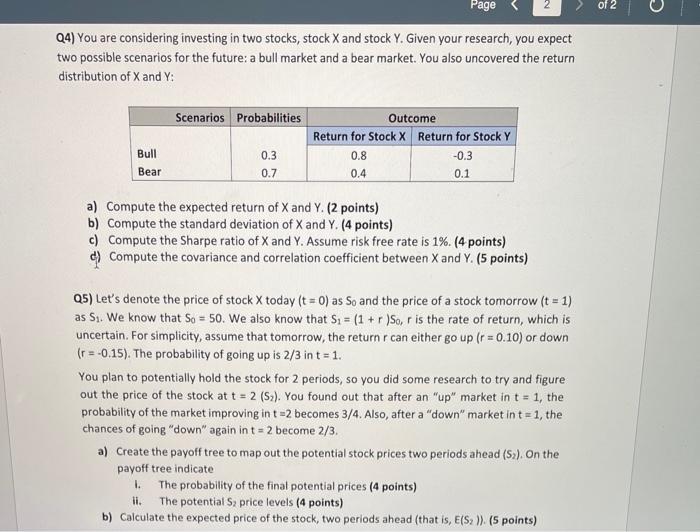

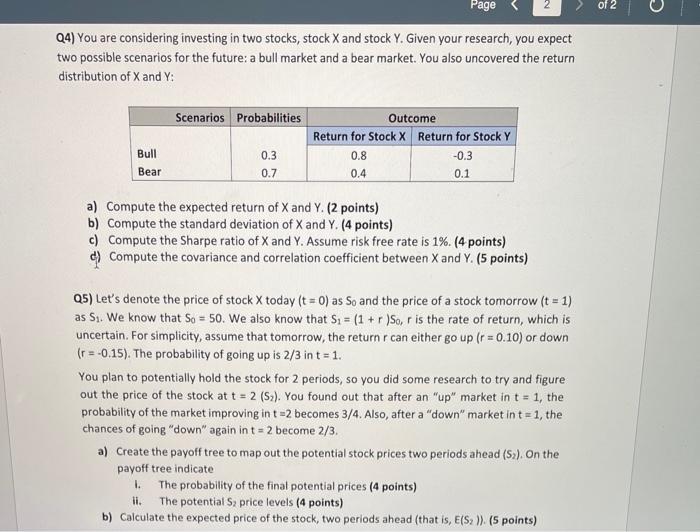

need help on 4&5 Page of 2 Q4) You are considering investing in two stocks, stock X and stock Y. Given your research, you expect

need help on 4&5

Page of 2 Q4) You are considering investing in two stocks, stock X and stock Y. Given your research, you expect two possible scenarios for the future: a bull market and a bear market. You also uncovered the return distribution of X and Y: Scenarios Probabilities Outcome Return for Stock X Return for Stock Y 0.8 -0.3 0.4 0.1 Bull Bear 0.3 0.7 a) Compute the expected return of X and Y. (2 points) b) Compute the standard deviation of X and Y. (4 points) c) Compute the Sharpe ratio of X and Y. Assume risk free rate is 1%. (4 points) 4) Compute the covariance and correlation coefficient between X and Y. (5 points) Q5) Let's denote the price of stock X today (t =0) as So and the price of a stock tomorrow (t = 1) as S. We know that so = 50. We also know that S = (1 + r)So, r is the rate of return, which is uncertain. For simplicity, assume that tomorrow, the return r can either go up (r = 0.10) or down (r = -0.15). The probability of going up is 2/3 in t = 1. You plan to potentially hold the stock for 2 periods, so you did some research to try and figure out the price of the stock at t = 2 (S.). You found out that after an "up" market in t = 1, the probability of the market improving int=2 becomes 3/4. Also, after a "down" market in t = 1, the chances of going "down" again in t = 2 become 2/3. a) Create the payoff tree to map out the potential stock prices two periods ahead (S.). On the payoff tree indicate 1. The probability of the final potential prices (4 points) The potential price levels (4 points) b) Calculate the expected price of the stock, two periods ahead (that is, E(S. >>. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started