Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The case of transaction exposure is described as follows. Choose the correct answer in the parenthesis in the description of the case. The choice is

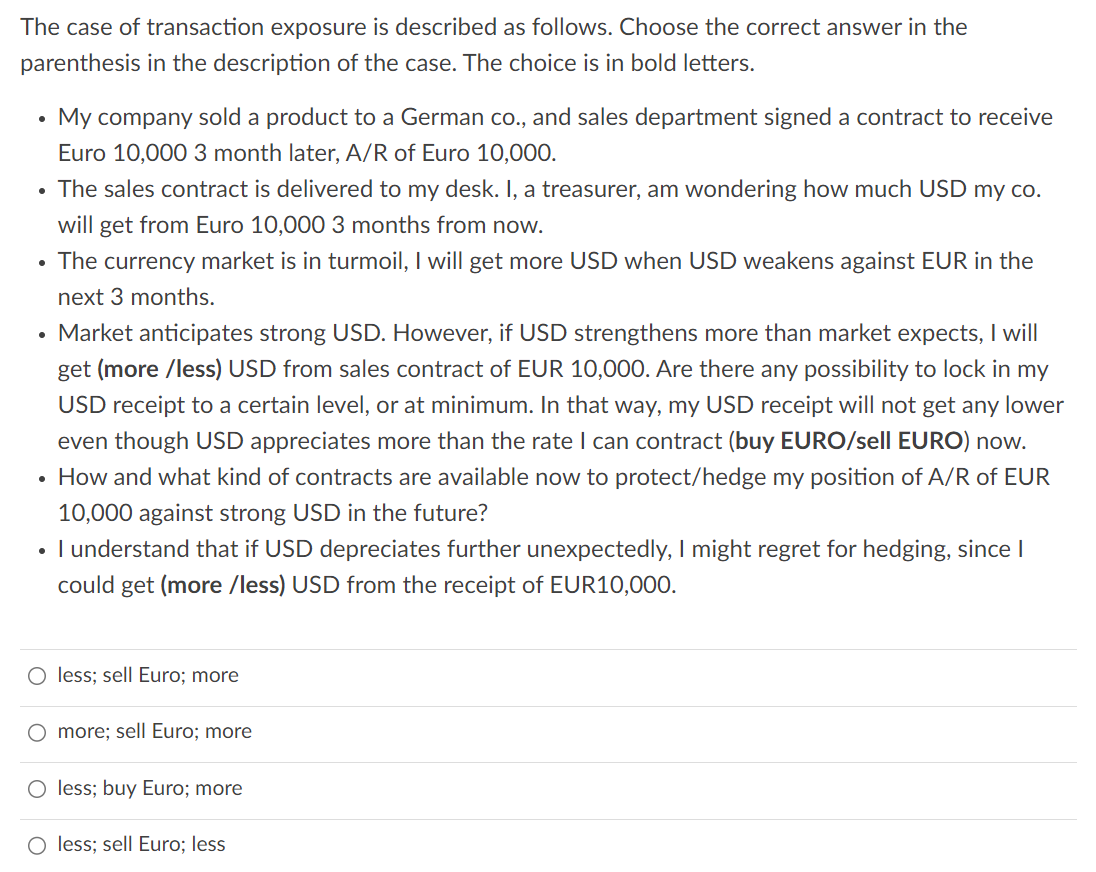

The case of transaction exposure is described as follows. Choose the correct answer in the parenthesis in the description of the case. The choice is in bold letters. - My company sold a product to a German co., and sales department signed a contract to receive Euro 10,000 3 month later, A/R of Euro 10,000. - The sales contract is delivered to my desk. I, a treasurer, am wondering how much USD my co. will get from Euro 10,000 3 months from now. - The currency market is in turmoil, I will get more USD when USD weakens against EUR in the next 3 months. - Market anticipates strong USD. However, if USD strengthens more than market expects, I will get (more /less) USD from sales contract of EUR 10,000. Are there any possibility to lock in my USD receipt to a certain level, or at minimum. In that way, my USD receipt will not get any lower even though USD appreciates more than the rate I can contract (buy EURO/sell EURO) now. - How and what kind of contracts are available now to protect/hedge my position of A/R of EUR 10,000 against strong USD in the future? - I understand that if USD depreciates further unexpectedly, I might regret for hedging, since I could get (more /less) USD from the receipt of EUR10,000. less; sell Euro; more more; sell Euro; more less; buy Euro; more less; sell Euro; less

The case of transaction exposure is described as follows. Choose the correct answer in the parenthesis in the description of the case. The choice is in bold letters. - My company sold a product to a German co., and sales department signed a contract to receive Euro 10,000 3 month later, A/R of Euro 10,000. - The sales contract is delivered to my desk. I, a treasurer, am wondering how much USD my co. will get from Euro 10,000 3 months from now. - The currency market is in turmoil, I will get more USD when USD weakens against EUR in the next 3 months. - Market anticipates strong USD. However, if USD strengthens more than market expects, I will get (more /less) USD from sales contract of EUR 10,000. Are there any possibility to lock in my USD receipt to a certain level, or at minimum. In that way, my USD receipt will not get any lower even though USD appreciates more than the rate I can contract (buy EURO/sell EURO) now. - How and what kind of contracts are available now to protect/hedge my position of A/R of EUR 10,000 against strong USD in the future? - I understand that if USD depreciates further unexpectedly, I might regret for hedging, since I could get (more /less) USD from the receipt of EUR10,000. less; sell Euro; more more; sell Euro; more less; buy Euro; more less; sell Euro; less Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started