Answered step by step

Verified Expert Solution

Question

1 Approved Answer

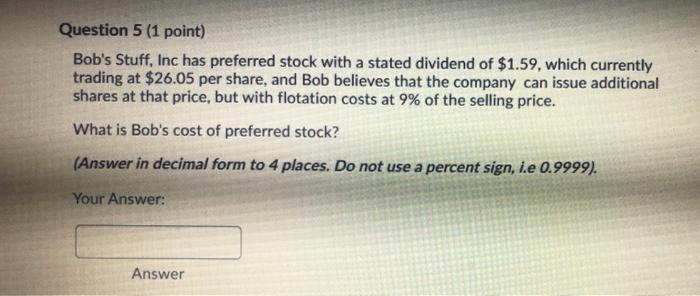

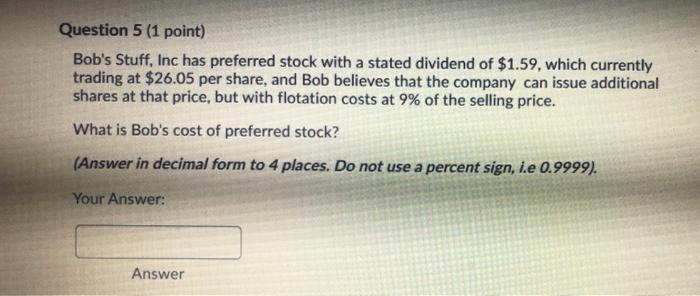

need help on 5 and 6 Question 5 (1 point) Bob's Stuff, Inc has preferred stock with a stated dividend of $1.59, which currently trading

need help on 5 and 6

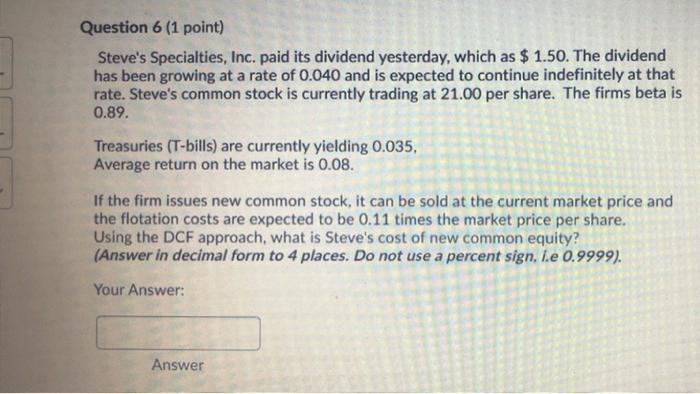

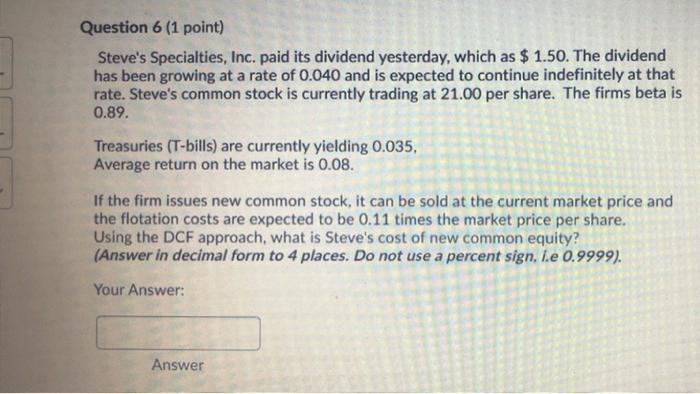

Question 5 (1 point) Bob's Stuff, Inc has preferred stock with a stated dividend of $1.59, which currently trading at $26.05 per share, and Bob believes that the company can issue additional shares at that price, but with flotation costs at 9% of the selling price. What is Bob's cost of preferred stock? (Answer in decimal form to 4 places. Do not use a percent sign, i.e 0.9999). Your Answer: Answer Question 6 (1 point) Steve's Specialties, Inc. paid its dividend yesterday, which as $ 1.50. The dividend has been growing at a rate of 0.040 and is expected to continue indefinitely at that rate. Steve's common stock is currently trading at 21.00 per share. The firms beta is 0.89. Treasuries (T-bills) are currently yielding 0.035, Average return on the market is 0.08. If the firm issues new common stock, it can be sold at the current market price and the flotation costs are expected to be 0.11 times the market price per share. Using the DCF approach, what is Steve's cost of new common equity? (Answer in decimal form to 4 places. Do not use a percent sign. I.e 0.9999). Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started