Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help on 5 through 8 includes the amount Comprehensive Problem Instructions Due Thursday, September 10 This assignment can either be worked by hand on

need help on 5 through 8

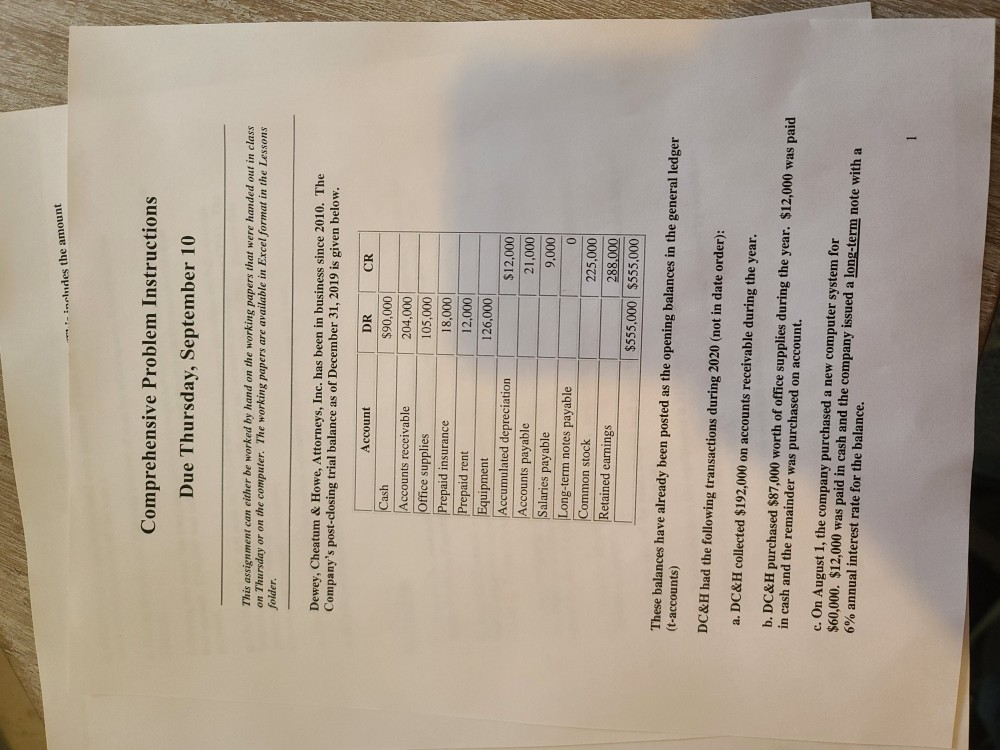

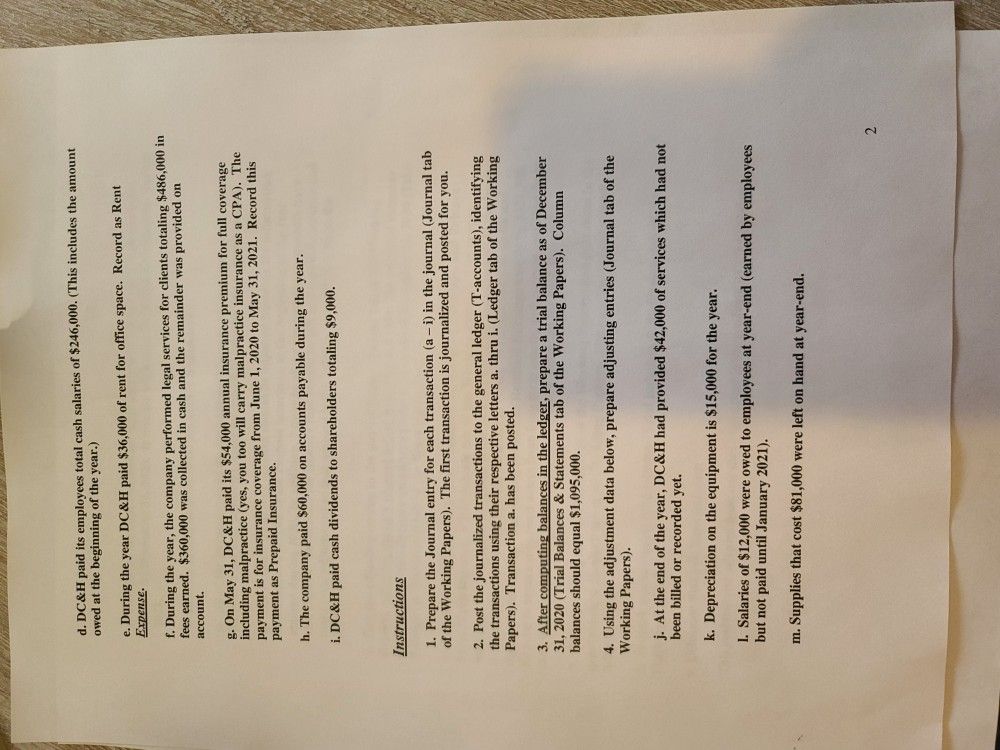

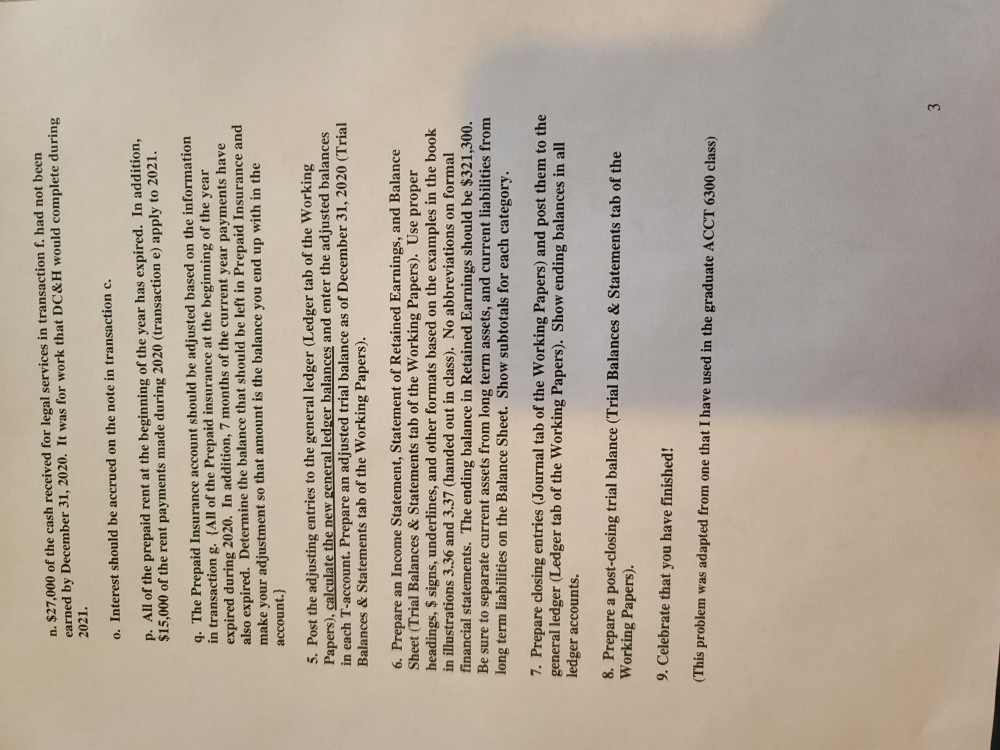

includes the amount Comprehensive Problem Instructions Due Thursday, September 10 This assignment can either be worked by hand on the working papers that were handed our in class on Thursday or on the computer. The working papers are available in Excel format in the Lessons folder. Dewey, Cheatum & Howe, Attorneys, Inc. has been in business since 2010. The Company's post-closing trial balance as of December 31, 2019 is given below. Account Cash Accounts receivable Office supplies Prepaid insurance Prepaid rent Equipment Accumulated depreciation Accounts payable Salaries payable Long-term notes payable Common stock Retained earnings DR CR $90,000 204,000 105,000 18,000 12.000 126,000 $12,000 21,000 9,000 0 225,000 288,000 $555,000 $555,000 These balances have already been posted as the opening balances in the general ledger (t-accounts) DC&H had the following transactions during 2020 (not in date order): a. DC&H collected $192,000 on accounts receivable during the year. b. DC&H purchased $87,000 worth of office supplies during the year. $12,000 was paid in cash and the remainder was purchased on account. c. On August 1, the company purchased a new computer system for $60,000. $12,000 was paid in cash and the company issued a long-term note with a 6% annual interest rate for balance. d. DC&H paid its employees total cash salaries of $246,000. (This includes the amount owed at the beginning of the year.) e. During the year DC&H paid $36,000 of rent for office space. Record as Rent Expense. f. During the year, the company performed legal services for clients totaling $486,000 in fees earned. $360,000 was collected in cash and the remainder was provided on account g. On May 31, DC&H paid its $54,000 annual insurance premium for full coverage including malpractice (yes, you too will carry malpractice insurance as a CPA). The payment is for insurance coverage from June 1, 2020 to May 31, 2021. Record this payment as Prepaid Insurance. h. The company paid $60,000 on accounts payable during the year. i. DC&H paid cash dividends to shareholders totaling $9,000. Instructions 1. Prepare the Journal entry for each transaction (a - i) in the journal (Journal tab of the Working Papers). The first transaction is journalized and posted for you. 2. Post the journalized transactions to the general ledger (T-accounts), identifying the transactions using their respective letters a. thru i. (Ledger tab of the Working Papers). Transaction a. has been posted. 3. After computing balances in the ledger, prepare a trial balance as of December 31, 2020 (Trial Balances & Statements tab of the Working Papers). Column balances should equal $1,095,000. 4. Using the adjustment data below, prepare adjusting entries (Journal tab of the Working Papers). j. At the end of the year, DC&H had provided $42,000 of services which had not been billed or recorded yet. k. Depreciation on the equipment is $15,000 for the year. 1. Salaries of $12,000 were owed to employees at year-end (earned by employees but not paid until January 2021). m. Supplies that cost $81,000 were left on hand at year-end. 2 n. $27,000 of the cash received for legal services in transaction f. had not been earned by December 31, 2020. It was for work that DC&H would complete during 2021. o. Interest should be accrued on the note in transaction c. p. All of the prepaid rent at the beginning of the year has expired. In addition, $15,000 of the rent payments made during 2020 (transaction e) apply to 2021. 9. The Prepaid Insurance account should be adjusted based on the information in transaction g. {All of the Prepaid insurance at the beginning of the year expired during 2020. In addition, 7 months of the current year payments have also expired. Determine the balance that should be left in Prepaid Insurance and make your adjustment so that amount is the balance you end up with in the account.) 5. Post the adjusting entries to the general ledger (Ledger tab of the Working Papers), calculate the new general ledger balances and enter the adjusted balances in each T-account. Prepare an adjusted trial balance as of December 31, 2020 (Trial Balances & Statements tab of the Working Papers). 6. Prepare an Income Statement, Statement of Retained Earnings, and Balance Sheet (Trial Balances & Statements tab of the Working Papers). Use proper headings, $ signs, underlines, and other formats based on the examples in the book in illustrations 3.36 and 3.37 (handed out in class). No abbreviations on formal financial statements. The ending balance in Retained Earnings should be $321,300. Be sure to separate current assets from long term assets, and current liabilities from long term liabilities on the Balance Sheet. Show subtotals for each category. 7. Prepare closing entries (Journal tab of the Working Papers) and post them to the general ledger (Ledger tab of the Working Papers). Show ending balances in all ledger accounts. 8. Prepare a post-closing trial balance (Trial Balances & Statements tab of the Working Papers). 9. Celebrate that you have finished! (This problem was adapted from one that I have used in the graduate ACCT 6300 class) 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started