Question

need help on all five PLEASE Part I. AUDITING FINANCIAL STATEMENT IS RISK BASED EVIDENITAL REASONING [ 50 pts] Examine and use the following table

need help on all five PLEASE

Part I. AUDITING FINANCIAL STATEMENT IS RISK BASED EVIDENITAL REASONING [ 50 pts]

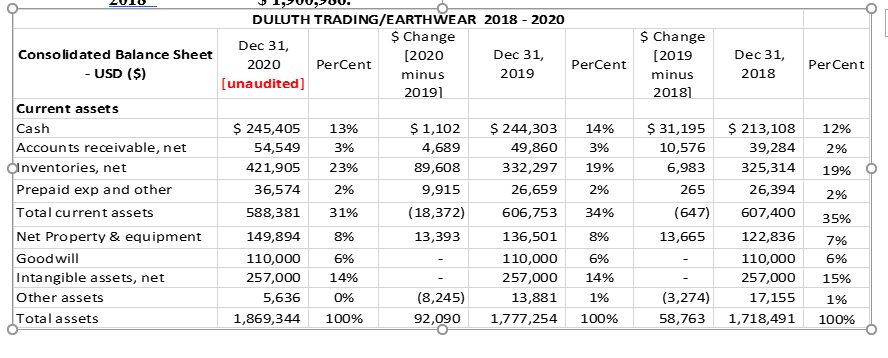

Examine and use the following table for all parts of exam where financial statement information is useful.

Assumptions are in blue text. During 2019 Duluth Trading merged with EarthWear to form DTE Inc. It is January 25, 2021 and you are part of the audit team examining the unaudited 2020 data. Assume any knowledge you acquired by studying EarthWear carries over to the merged company.

The consolidated total revenues for DTE Inc. is as follows:

2020 [unaudited]: $ 2,032,154

2019 $ 2,015,026

2018 $ 1,900,986.

| Part I. AUDITING FINANCIAL STATEMENT IS RISK BASED EVIDENITAL REASONING [ 50 pts] The manager of your audit team has identified two of DTEs asset accounts as requiring additional audit analysis: Cash and Accounts Receivable. The following questions relate to these two accounts. 1. List one accounting pronouncement and two auditing pronouncements that you should consider when auditing DTEs Cash and Accounts Receivable accounts:

2. What would be your dollar recommendation for Materiality and Tolerable Misstatement [TM] for these 2 accounts? Show any calculations you use and provide reasoning as to why your recommendations would be appropriate:

3. For each account, list two examples of misstatement, one an unintentional and the other an intentional misstatement. For example, if you were examining sales, an unintentional misstatement might be a pricing miscalculation and intentional error might be creating fictional sale.

4. For each account, state the complete Assertion that you believe is of most audit interest and explain WHY it is of most audit interest. For example, for sales, the Assertion might be: Completeness: The sales account balance includes all sales transactions for 2019: a. Cash [assertion plus your reasoning]: b. Trade Accounts Receivable [assertion plus your reasoning]: 5. During audit planning, the auditor will conduct IR Assessment. Given your knowledge of EarthWear, provide one example of an IR that may be audit important for DTE Inc for each of the following categories:

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started