Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on both #2 & #3 2. Melanie's mother is changing jobs and offered to sell an office building and used office furniture to

Need help on both #2 & #3

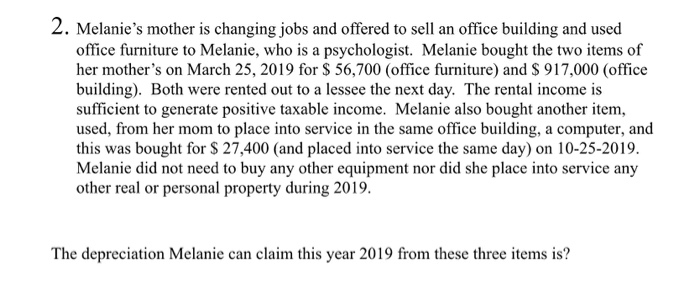

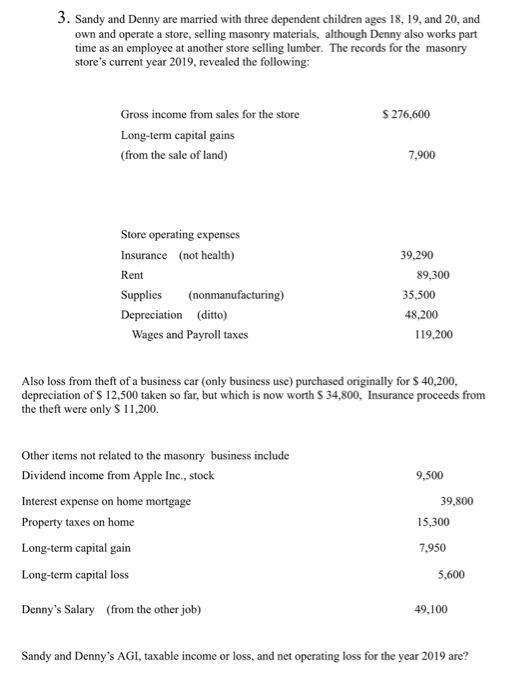

2. Melanie's mother is changing jobs and offered to sell an office building and used office furniture to Melanie, who is a psychologist. Melanie bought the two items of her mother's on March 25, 2019 for $ 56,700 (office furniture) and $ 917,000 (office building). Both were rented out to a lessee the next day. The rental income is sufficient to generate positive taxable income. Melanie also bought another item, used, from her mom to place into service in the same office building, a computer, and this was bought for $ 27,400 (and placed into service the same day) on 10-25-2019. Melanie did not need to buy any other equipment nor did she place into service any other real or personal property during 2019. The depreciation Melanie can claim this year 2019 from these three items is? 3. Sandy and Denny are married with three dependent children ages 18, 19, and 20, and own and operate a store, selling masonry materials, although Denny also works part time as an employee at another store selling lumber. The records for the masonry store's current year 2019, revealed the following: $ 276,600 Gross income from sales for the store Long-term capital gains (from the sale of land) 7,900 Store operating expenses Insurance (not health) Rent Supplies (nonmanufacturing) Depreciation (ditto) Wages and Payroll taxes 39,290 89,300 35,500 48.200 119,200 Also loss from theft of a business car (only business use) purchased originally for $ 40,200, depreciation of $ 12,500 taken so far, but which is now worth $ 34,800, Insurance proceeds from the theft were only $11,200. Other items not related to the masonry business include Dividend income from Apple Inc., stock 9,500 Interest expense on home mortgage Property taxes on home 39,800 15,300 Long-term capital gain 7,950 Long-term capital loss 5,600 Denny's Salary from the other job) 49,100 Sandy and Denny's AGI, taxable income or loss, and net operating loss for the year 2019 are? 2. Melanie's mother is changing jobs and offered to sell an office building and used office furniture to Melanie, who is a psychologist. Melanie bought the two items of her mother's on March 25, 2019 for $ 56,700 (office furniture) and $ 917,000 (office building). Both were rented out to a lessee the next day. The rental income is sufficient to generate positive taxable income. Melanie also bought another item, used, from her mom to place into service in the same office building, a computer, and this was bought for $ 27,400 (and placed into service the same day) on 10-25-2019. Melanie did not need to buy any other equipment nor did she place into service any other real or personal property during 2019. The depreciation Melanie can claim this year 2019 from these three items is? 3. Sandy and Denny are married with three dependent children ages 18, 19, and 20, and own and operate a store, selling masonry materials, although Denny also works part time as an employee at another store selling lumber. The records for the masonry store's current year 2019, revealed the following: $ 276,600 Gross income from sales for the store Long-term capital gains (from the sale of land) 7,900 Store operating expenses Insurance (not health) Rent Supplies (nonmanufacturing) Depreciation (ditto) Wages and Payroll taxes 39,290 89,300 35,500 48.200 119,200 Also loss from theft of a business car (only business use) purchased originally for $ 40,200, depreciation of $ 12,500 taken so far, but which is now worth $ 34,800, Insurance proceeds from the theft were only $11,200. Other items not related to the masonry business include Dividend income from Apple Inc., stock 9,500 Interest expense on home mortgage Property taxes on home 39,800 15,300 Long-term capital gain 7,950 Long-term capital loss 5,600 Denny's Salary from the other job) 49,100 Sandy and Denny's AGI, taxable income or loss, and net operating loss for the year 2019 are Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started