Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help on collected in July & total cash collected for the second one. Schedule of Cash Payments for a Service Company SafeMark Financial Inc.

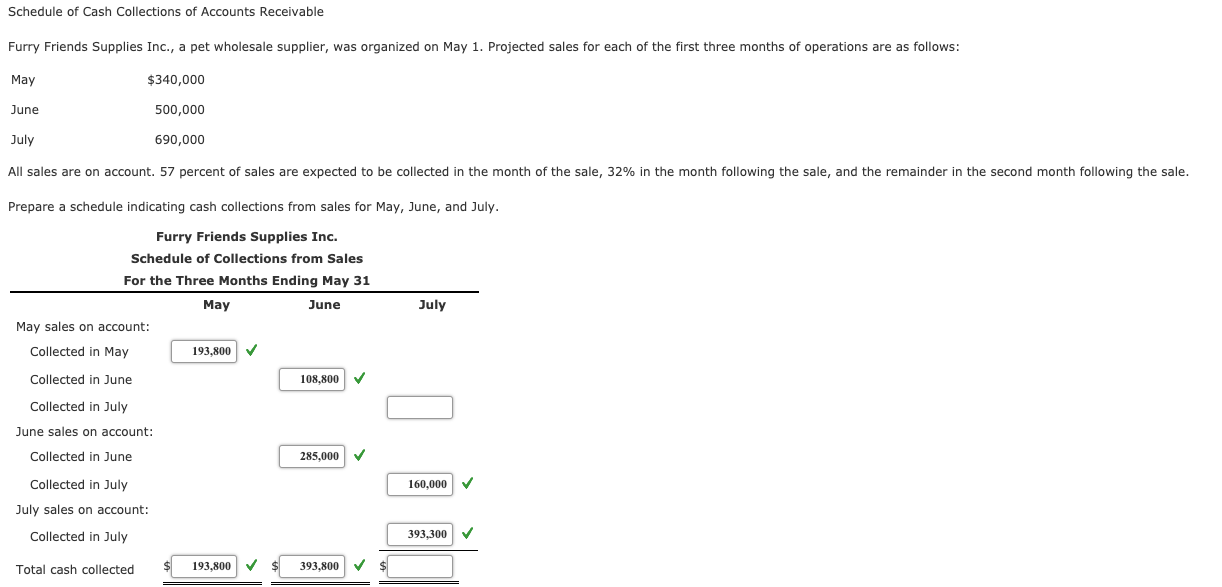

need help on collected in July & total cash collected for the second one.

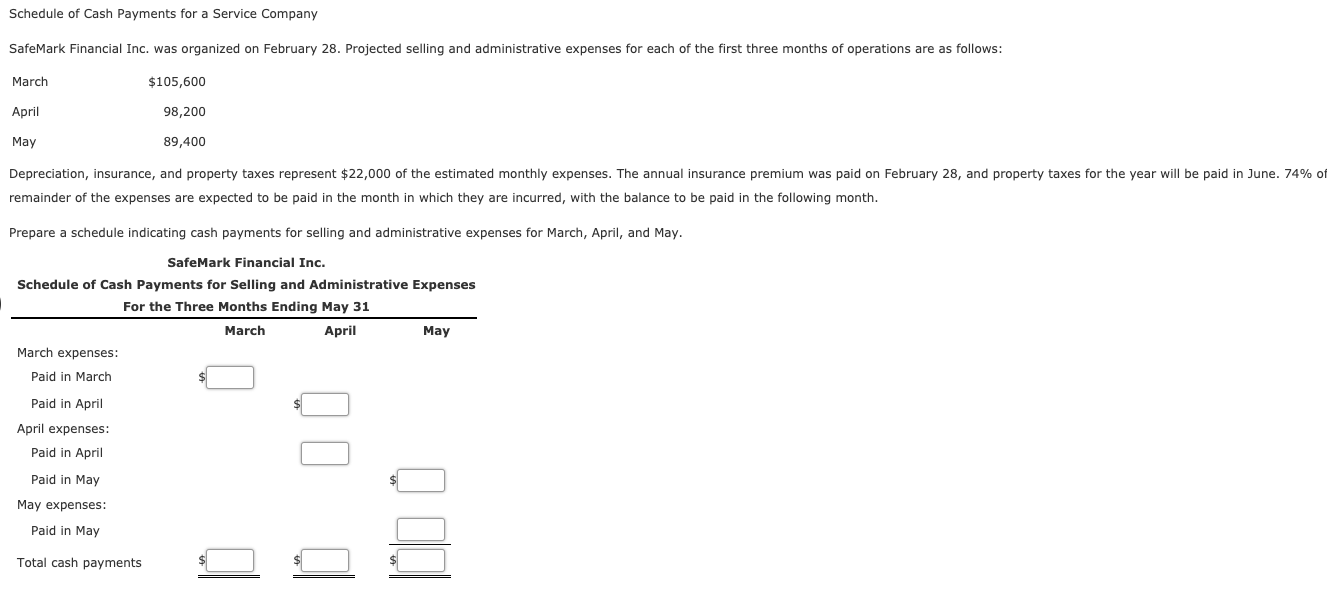

Schedule of Cash Payments for a Service Company SafeMark Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $105,600 April 98,200 May 89,400 Depreciation, insurance, and property taxes represent $22,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 74% of remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. SafeMark Financial Inc. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March April May March expenses: Paid in March Paid in April April expenses: Paid in April Paid in May May expenses: Paid in May Total cash payments Schedule of Cash Collections of Accounts Receivable Furry Friends Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May $340,000 June 500,000 July 690,000 All sales are on account. 57 percent of sales are expected to be collected in the month of the sale, 32% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for May, June, and July. Furry Friends Supplies Inc. Schedule of Collections from Sales For the Three Months Ending May 31 May June May sales on account: Collected in May 193,800 July Collected in June 108.800 Collected in July June sales on account: Collected in June 285,000 160,000 Collected in July July sales on account: Collected in July 393,300 Total cash collected 193,800 393.800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started