Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help on part G 1. One important property of a special floater (when coupon rate = discount rate) is that its Macaulay duration is

need help on part G

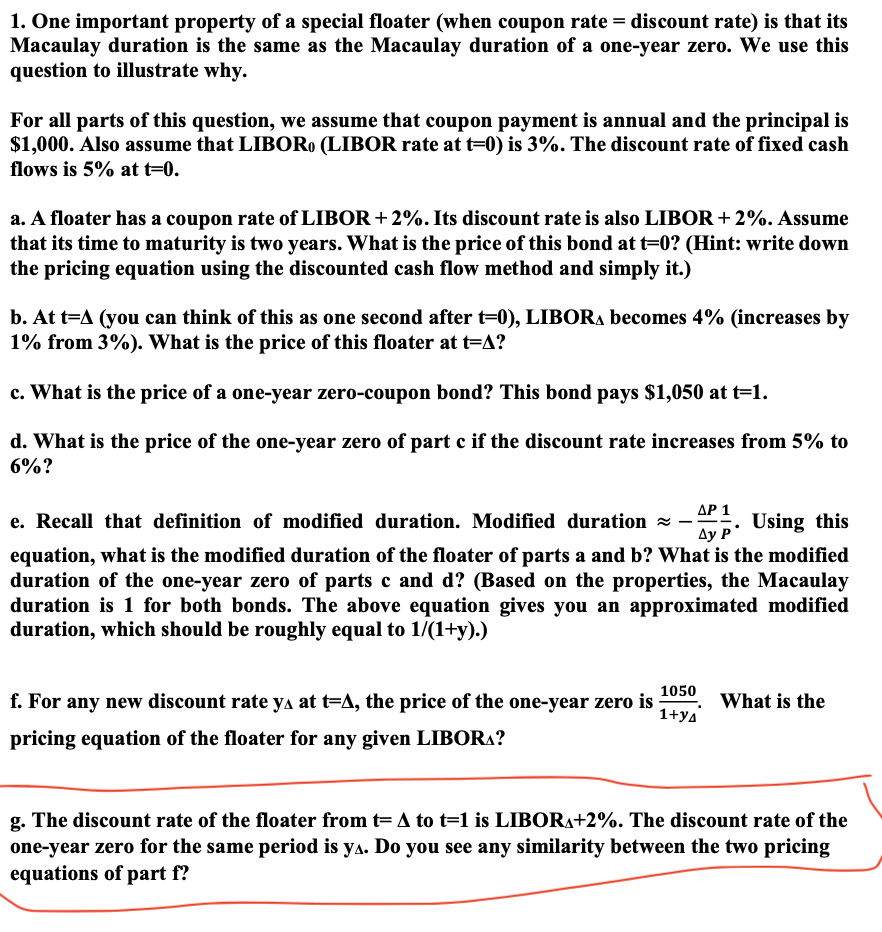

1. One important property of a special floater (when coupon rate = discount rate) is that its Macaulay duration is the same as the Macaulay duration of a one-year zero. We use this question to illustrate why. For all parts of this question, we assume that coupon payment is annual and the principal is $1,000. Also assume that LIBOR, (LIBOR rate at t=0) is 3%. The discount rate of fixed cash flows is 5% at t=0. a. A floater has a coupon rate of LIBOR +2%. Its discount rate is also LIBOR + 2%. Assume that its time to maturity is two years. What is the price of this bond at t=0? (Hint: write down the pricing equation using the discounted cash flow method and simply it.) b. At t=A (you can think of this as one second after t=0), LIBORA becomes 4% (increases by 1% from 3%). What is the price of this floater at t=A? c. What is the price of a one-year zero-coupon bond? This bond pays $1,050 at t=1. d. What is the price of the one-year zero of part c if the discount rate increases from 5% to 6%? e. Recall that definition of modified duration. Modified duration 2 -2Using this equation, what is the modified duration of the floater of parts a and b? What is the modified duration of the one-year zero of parts c and d? (Based on the properties, the Macaulay duration is 1 for both bonds. The above equation gives you an approximated modified duration, which should be roughly equal to 1/(1+y).) f. For any new discount rate ya at t=A, the price of the one-year zero is 1050. What is the pricing equation of the floater for any given LIBORA? 1+YA g. The discount rate of the floater from t=A to t=1 is LIBOR +2%. The discount rate of the one-year zero for the same period is ya. Do you see any similarity between the two pricing equations of part f? 1. One important property of a special floater (when coupon rate = discount rate) is that its Macaulay duration is the same as the Macaulay duration of a one-year zero. We use this question to illustrate why. For all parts of this question, we assume that coupon payment is annual and the principal is $1,000. Also assume that LIBOR, (LIBOR rate at t=0) is 3%. The discount rate of fixed cash flows is 5% at t=0. a. A floater has a coupon rate of LIBOR +2%. Its discount rate is also LIBOR + 2%. Assume that its time to maturity is two years. What is the price of this bond at t=0? (Hint: write down the pricing equation using the discounted cash flow method and simply it.) b. At t=A (you can think of this as one second after t=0), LIBORA becomes 4% (increases by 1% from 3%). What is the price of this floater at t=A? c. What is the price of a one-year zero-coupon bond? This bond pays $1,050 at t=1. d. What is the price of the one-year zero of part c if the discount rate increases from 5% to 6%? e. Recall that definition of modified duration. Modified duration 2 -2Using this equation, what is the modified duration of the floater of parts a and b? What is the modified duration of the one-year zero of parts c and d? (Based on the properties, the Macaulay duration is 1 for both bonds. The above equation gives you an approximated modified duration, which should be roughly equal to 1/(1+y).) f. For any new discount rate ya at t=A, the price of the one-year zero is 1050. What is the pricing equation of the floater for any given LIBORA? 1+YA g. The discount rate of the floater from t=A to t=1 is LIBOR +2%. The discount rate of the one-year zero for the same period is ya. Do you see any similarity between the two pricing equations of part fStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started