Need help on question 3 and why. Please and thank you.

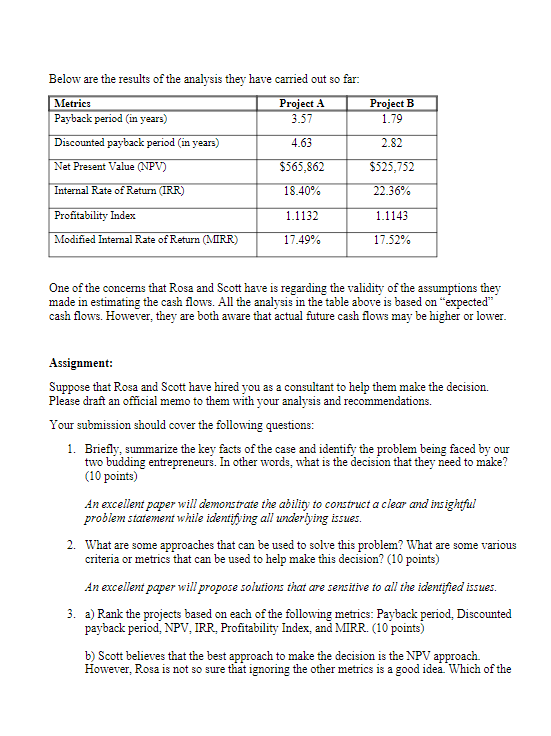

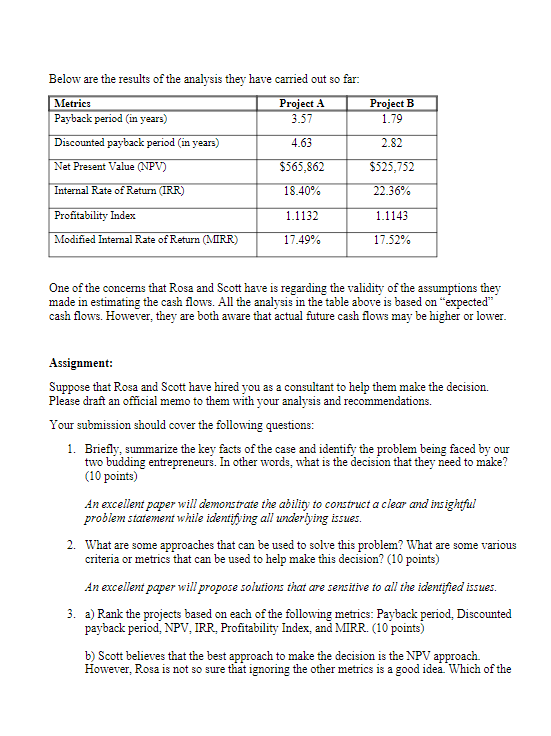

Project B 1.79 Below are the results of the analysis they have carried out so far: Metrics Project A Payback period in years) 3.57 Discounted payback period (in years) 4.63 Net Present Value (NPV) $565,862 Internal Rate of Return (IRR) 18.40% 2.82 $525,752 22.36% Profitability Index 1.1132 1.1143 Modified Internal Rate of Return (MIRR) 17.49% 17.52% One of the concerns that Rosa and Scott have is regarding the validity of the assumptions they made in estimating the cash flows. All the analysis in the table above is based on expected" cash flows. However, they are both aware that actual future cash flows may be higher or lower. Assignment: Suppose that Rosa and Scott have hired you as a consultant to help them make the decision. Please draft an official memo to them with your analysis and recommendations. Your submission should cover the following questions: 1. Briefly, summarize the key facts of the case and identify the problem being faced by our two budding entrepreneurs. In other words, what is the decision that they need to make? (10 points) An excellent paper will demonstrate the ability to construct a clear and insightful problem statement while identifying all underlying issues. 2. What are some approaches that can be used to solve this problem? What are some various criteria or metrics that can be used to help make this decision? (10 points) An excellent paper will propose solutions that are sensitive to all the identified issues. 3. a) Rank the projects based on each of the following metrics: Payback period. Discounted payback period. NPV, IRR. Profitability Index, and MIRR. (10 points) b) Scott believes that the best approach to make the decision is the NPV approach However, Rosa is not so sure that ignoring the other metrics is a good idea. Which of the approaches or metrics would you propose? In other words, would you prefer one or more of these approaches over the others? Explain why. (20 points) An excellent paper will include an evaluation of solutions containing thorough and insightful explanations, feasibility of solutions, and impacts of solutions. 4. a) Which of these projects would you recommend? Explain why. (10 points) b) Briefly state the limitations of the approach you used in making this decision, and outline what further analysis you would recommend. (20 points) An excellent paper will provide concise yet thorough action-oriented recommendations using appropriate subject matter justifications related to the problem while addressing limitations of the solution and outlining recommended future analysis. Note: Please keep your responses brief and to the point. Your answers must be typed up in double space, Times New Roman 12 font, with 1-inch margins, and uploaded into the DAL dropbox as a Word or pdf file. I expect your submission to be between three to five pages in length Please note that the work you submit must be your own. Please name your file as follows: FirstName. LastName. Fin390-section Number, for example, "Jane Smith Fin390-50.docx. The assignment will be scored out of 100 points. 20 of these points will be based on presentation and clarity of writing (including correctness of grammar). The remaining 80 points are distributed across the 4 questions as indicated above. Project B 1.79 Below are the results of the analysis they have carried out so far: Metrics Project A Payback period in years) 3.57 Discounted payback period (in years) 4.63 Net Present Value (NPV) $565,862 Internal Rate of Return (IRR) 18.40% 2.82 $525,752 22.36% Profitability Index 1.1132 1.1143 Modified Internal Rate of Return (MIRR) 17.49% 17.52% One of the concerns that Rosa and Scott have is regarding the validity of the assumptions they made in estimating the cash flows. All the analysis in the table above is based on expected" cash flows. However, they are both aware that actual future cash flows may be higher or lower. Assignment: Suppose that Rosa and Scott have hired you as a consultant to help them make the decision. Please draft an official memo to them with your analysis and recommendations. Your submission should cover the following questions: 1. Briefly, summarize the key facts of the case and identify the problem being faced by our two budding entrepreneurs. In other words, what is the decision that they need to make? (10 points) An excellent paper will demonstrate the ability to construct a clear and insightful problem statement while identifying all underlying issues. 2. What are some approaches that can be used to solve this problem? What are some various criteria or metrics that can be used to help make this decision? (10 points) An excellent paper will propose solutions that are sensitive to all the identified issues. 3. a) Rank the projects based on each of the following metrics: Payback period. Discounted payback period. NPV, IRR. Profitability Index, and MIRR. (10 points) b) Scott believes that the best approach to make the decision is the NPV approach However, Rosa is not so sure that ignoring the other metrics is a good idea. Which of the approaches or metrics would you propose? In other words, would you prefer one or more of these approaches over the others? Explain why. (20 points) An excellent paper will include an evaluation of solutions containing thorough and insightful explanations, feasibility of solutions, and impacts of solutions. 4. a) Which of these projects would you recommend? Explain why. (10 points) b) Briefly state the limitations of the approach you used in making this decision, and outline what further analysis you would recommend. (20 points) An excellent paper will provide concise yet thorough action-oriented recommendations using appropriate subject matter justifications related to the problem while addressing limitations of the solution and outlining recommended future analysis. Note: Please keep your responses brief and to the point. Your answers must be typed up in double space, Times New Roman 12 font, with 1-inch margins, and uploaded into the DAL dropbox as a Word or pdf file. I expect your submission to be between three to five pages in length Please note that the work you submit must be your own. Please name your file as follows: FirstName. LastName. Fin390-section Number, for example, "Jane Smith Fin390-50.docx. The assignment will be scored out of 100 points. 20 of these points will be based on presentation and clarity of writing (including correctness of grammar). The remaining 80 points are distributed across the 4 questions as indicated above