Question

Need help on question 5,6,7 please QUESTION 7 State the key non-economic reason for the success of the film. The value in the 2021 can

Need help on question 5,6,7 please

QUESTION 7

State the key non-economic reason for the success of the film.

The value in the 2021 can be calculated by using the PW formula

PW = Amount / (1+Interest Rate)^Duration

1) The initial cost of the liner in 1912 was $7500000

We will have to calculate the FW of that in terms of 1997 and 2021

Titanic Liner 1997 Cost 7500000 * (1.038 ^ 85) = 7500000 * 23.8109 = 178581436.44

2021 Cost 7500000 * (1.038 ^ 109) = 437091938.09

The cost of the liner has seen a huge increase in 2021 because of compounding effect.

Titanic Movie 2021 Cost 200000000 * (1.038 ^ 24) = 489515536.21

2) The first year revenue was $70632

70632 * (1.038 ^ 85) = 1681808.54

This is quite lower than the first year revenue of $1843201268 of the film.

3) The annual revenue was $2000000.

Its value after 85 years or in 1997 2000000 * (1.038 ^ 85) = 47621716.39

We need to calculate the equivalent value of this annual revenue in 2021.

47621716.39 * (F/A,3.8%,24) = 47621716.39 * 38.094149500812

= 1814108783.46

4) PW of the revenue in 1912

2000000 * (P/A,3.8%,24) = 2000000 * 15.564020621714

= 31128041.24

FW of this amount in 2021

31128041.24 * (1.038 ^ 109) = 1814108783.46

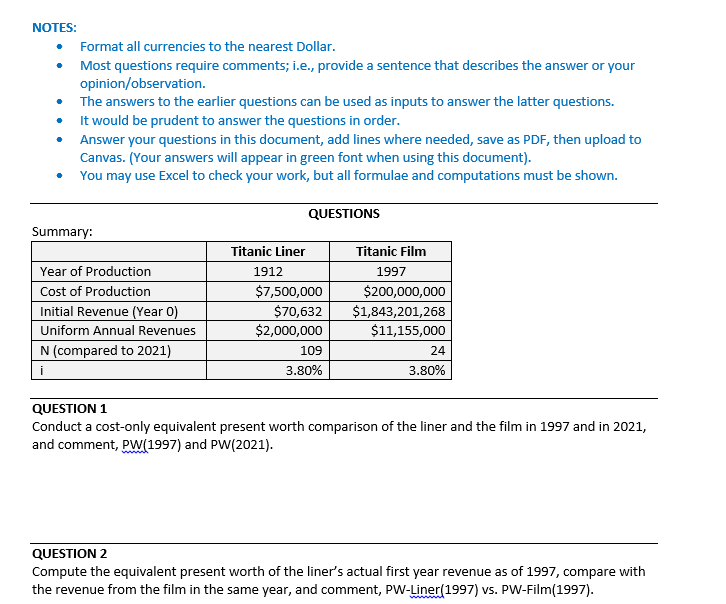

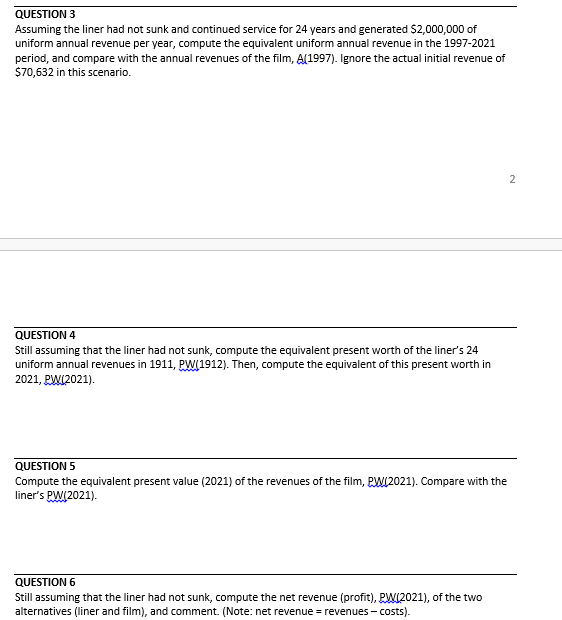

Objective Perform a time-value comparative economic analysis of the Titanic liner and the Titanic film based on the following information. Provide comments and observations as appropriate. Background The RMS Titanic ocean liner was constructed in 1912 in Ireland and operated by the White Star Line. In its maiden voyage the Titanic struck an iceberg and sank in the Atlantic Ocean. 1,517 lives were lost, and 705 passengers survived. The cost of building the Titanic in 1912 was $7,500,000 and the revenues from the ticket sales for the maiden voyage was $70,632. Titanic was expected to generate $2,000,000 of revenues each year as of 1912. The Titanic disaster fascinates the public to this day, perhaps more than any other disaster. The film Titanic was produced by James Cameron and released in 1997; a romantic and disaster story about the Titanic liner. The film achieved critical and commercial success and won 11 Oscars. In 1997 the cost of production of the film was $200,000,000, and the worldwide ticket and DVD sales were reported to be $1,843,201,268. The uniform annual revenues after the first year have been $11,155,000/year. Assumptions The average inflation/interest rate from 1912 through 2021 is a constant 3.8%. . Consider the scenario that the Titanic liner had survived the mishap and continued service for an additional 24 years (i.e., equal economic lives for both alternatives). In this case, the uniform annual revenues would have been $2,000,000/year for 24 years (disregard the initial $70,632 ticket sales).|| Consider 2021 as the last year in this study. Insurance premiums and payouts are not considered in this study. Answer the questions in the following pages and show all work. NOTES: Format all currencies to the nearest Dollar. Most questions require comments; i.e., provide a sentence that describes the answer or your opinion/observation. The answers to the earlier questions can be used as inputs to answer the latter questions. It would be prudent to answer the questions in order. Answer your questions in this document, add lines where needed, save as PDF, then upload to Canvas. (Your answers will appear in green font when using this document). You may use Excel to check your work, but all formulae and computations must be shown. QUESTIONS Summary: Year of Production Cost of Production Initial Revenue (Year 0) Uniform Annual Revenues N (compared to 2021) i Titanic Liner 1912 $7,500,000 $70,632 $2,000,000 109 3.80% Titanic Film 1997 $200,000,000 $1,843,201,268 $11,155,000 24 3.80% QUESTION 1 Conduct a cost-only equivalent present worth comparison of the liner and the film in 1997 and in 2021, and comment, PW (1997) and PW(2021). QUESTION 2 Compute the equivalent present worth of the liner's actual first year revenue as of 1997, compare with the revenue from the film in the same year, and comment, PW-Liner(1997) vs. PW-Film(1997). QUESTION 3 Assuming the liner had not sunk and continued service for 24 years and generated $2,000,000 of uniform annual revenue per year, compute the equivalent uniform annual revenue in the 1997-2021 period, and compare with the annual revenues of the film, A(1997). Ignore the actual initial revenue of $70,632 in this scenario. 2 QUESTION 4 Still assuming that the liner had not sunk, compute the equivalent present worth of the liner's 24 uniform annual revenues in 1911, PW(1912). Then, compute the equivalent of this present worth in 2021, PW12021). QUESTION 5 Compute the equivalent present value (2021) of the revenues of the film, PW12021). Compare with the liner's PW12021). QUESTION 6 Still assuming that the liner had not sunk, compute the net revenue (profit), PW12021), of the two alternatives (liner and film), and comment. (Note: net revenue = revenues - costs). Objective Perform a time-value comparative economic analysis of the Titanic liner and the Titanic film based on the following information. Provide comments and observations as appropriate. Background The RMS Titanic ocean liner was constructed in 1912 in Ireland and operated by the White Star Line. In its maiden voyage the Titanic struck an iceberg and sank in the Atlantic Ocean. 1,517 lives were lost, and 705 passengers survived. The cost of building the Titanic in 1912 was $7,500,000 and the revenues from the ticket sales for the maiden voyage was $70,632. Titanic was expected to generate $2,000,000 of revenues each year as of 1912. The Titanic disaster fascinates the public to this day, perhaps more than any other disaster. The film Titanic was produced by James Cameron and released in 1997; a romantic and disaster story about the Titanic liner. The film achieved critical and commercial success and won 11 Oscars. In 1997 the cost of production of the film was $200,000,000, and the worldwide ticket and DVD sales were reported to be $1,843,201,268. The uniform annual revenues after the first year have been $11,155,000/year. Assumptions The average inflation/interest rate from 1912 through 2021 is a constant 3.8%. . Consider the scenario that the Titanic liner had survived the mishap and continued service for an additional 24 years (i.e., equal economic lives for both alternatives). In this case, the uniform annual revenues would have been $2,000,000/year for 24 years (disregard the initial $70,632 ticket sales).|| Consider 2021 as the last year in this study. Insurance premiums and payouts are not considered in this study. Answer the questions in the following pages and show all work. NOTES: Format all currencies to the nearest Dollar. Most questions require comments; i.e., provide a sentence that describes the answer or your opinion/observation. The answers to the earlier questions can be used as inputs to answer the latter questions. It would be prudent to answer the questions in order. Answer your questions in this document, add lines where needed, save as PDF, then upload to Canvas. (Your answers will appear in green font when using this document). You may use Excel to check your work, but all formulae and computations must be shown. QUESTIONS Summary: Year of Production Cost of Production Initial Revenue (Year 0) Uniform Annual Revenues N (compared to 2021) i Titanic Liner 1912 $7,500,000 $70,632 $2,000,000 109 3.80% Titanic Film 1997 $200,000,000 $1,843,201,268 $11,155,000 24 3.80% QUESTION 1 Conduct a cost-only equivalent present worth comparison of the liner and the film in 1997 and in 2021, and comment, PW (1997) and PW(2021). QUESTION 2 Compute the equivalent present worth of the liner's actual first year revenue as of 1997, compare with the revenue from the film in the same year, and comment, PW-Liner(1997) vs. PW-Film(1997). QUESTION 3 Assuming the liner had not sunk and continued service for 24 years and generated $2,000,000 of uniform annual revenue per year, compute the equivalent uniform annual revenue in the 1997-2021 period, and compare with the annual revenues of the film, A(1997). Ignore the actual initial revenue of $70,632 in this scenario. 2 QUESTION 4 Still assuming that the liner had not sunk, compute the equivalent present worth of the liner's 24 uniform annual revenues in 1911, PW(1912). Then, compute the equivalent of this present worth in 2021, PW12021). QUESTION 5 Compute the equivalent present value (2021) of the revenues of the film, PW12021). Compare with the liner's PW12021). QUESTION 6 Still assuming that the liner had not sunk, compute the net revenue (profit), PW12021), of the two alternatives (liner and film), and comment. (Note: net revenue = revenues - costs)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started