Answered step by step

Verified Expert Solution

Question

1 Approved Answer

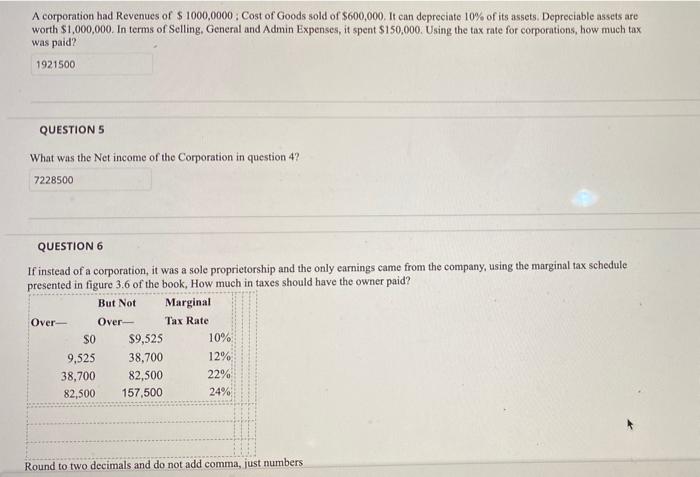

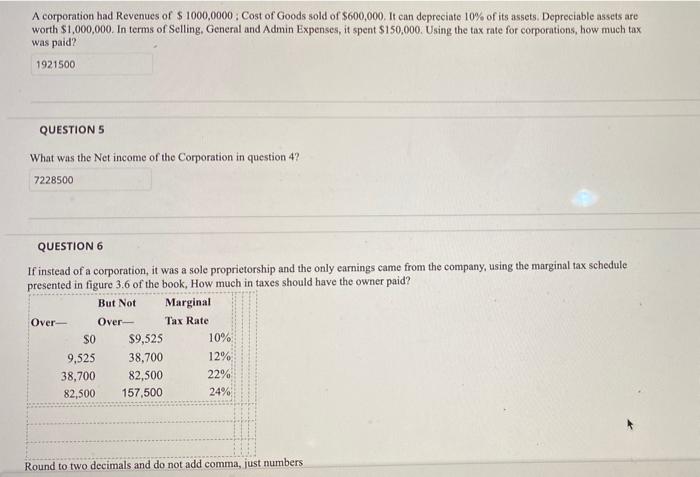

need help on question 6 please A corporation had Revenues of $ 1000,0000: Cost of Goods sold of $600,000. It can deprecinto 10% of its

need help on question 6 please

A corporation had Revenues of $ 1000,0000: Cost of Goods sold of $600,000. It can deprecinto 10% of its assets. Depreciable assets are worth $1,000,000. In terms of Selling, General and Admin Expenses, it spent $150,000. Using the tax rate for corporations, how much tax was paid? 1921500 QUESTIONS What was the Net income of the Corporation in question 4? 7228500 QUESTION 6 If instead of a corporation, it was a sole proprietorship and the only earnings came from the company, using the marginal tax schedule presented in figure 3.6 of the book, How much in taxes should have the owner paid? But Not Marginal Over- Over Tax Rate SO $9,525 10% 9,525 38,700 12% 38,700 82,500 22% 82,500 157,500 24% Round to two decimals and do not add comma, just numbers A corporation had Revenues of $ 1000,0000: Cost of Goods sold of $600,000. It can deprecinto 10% of its assets. Depreciable assets are worth $1,000,000. In terms of Selling, General and Admin Expenses, it spent $150,000. Using the tax rate for corporations, how much tax was paid? 1921500 QUESTIONS What was the Net income of the Corporation in question 4? 7228500 QUESTION 6 If instead of a corporation, it was a sole proprietorship and the only earnings came from the company, using the marginal tax schedule presented in figure 3.6 of the book, How much in taxes should have the owner paid? But Not Marginal Over- Over Tax Rate SO $9,525 10% 9,525 38,700 12% 38,700 82,500 22% 82,500 157,500 24% Round to two decimals and do not add comma, just numbers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started