Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on Required 1, 2, 3, and 4 Exercise 8-19 (Algo) Perpetual FIFO adjusted to periodic LIFO; LIFO reserve [LO8-1, 8-4, 8-6] To more

Need help on Required 1, 2, 3, and 4

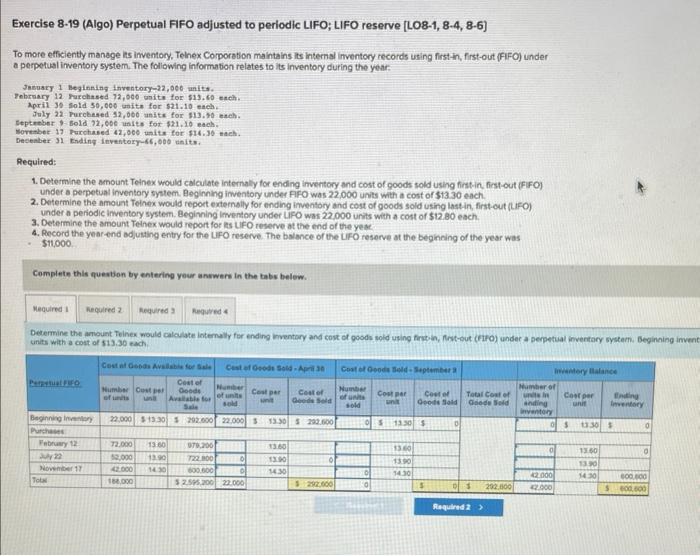

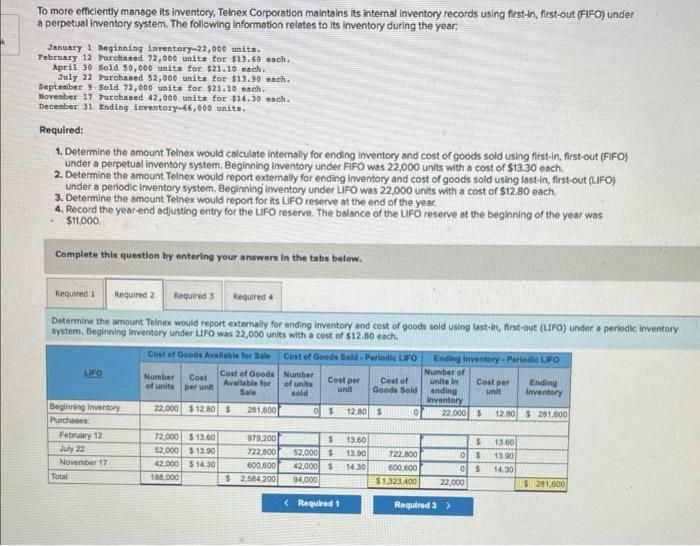

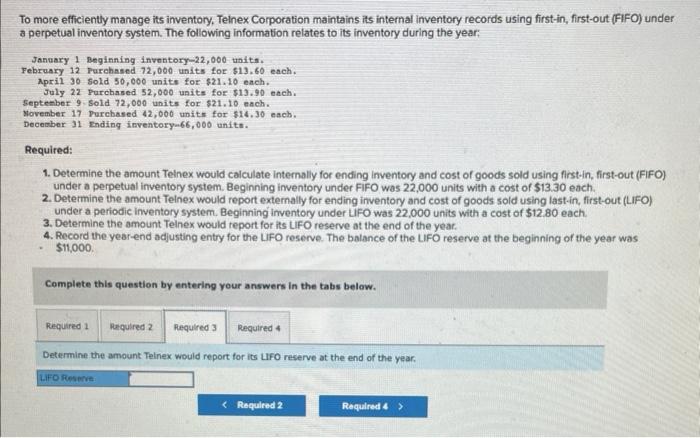

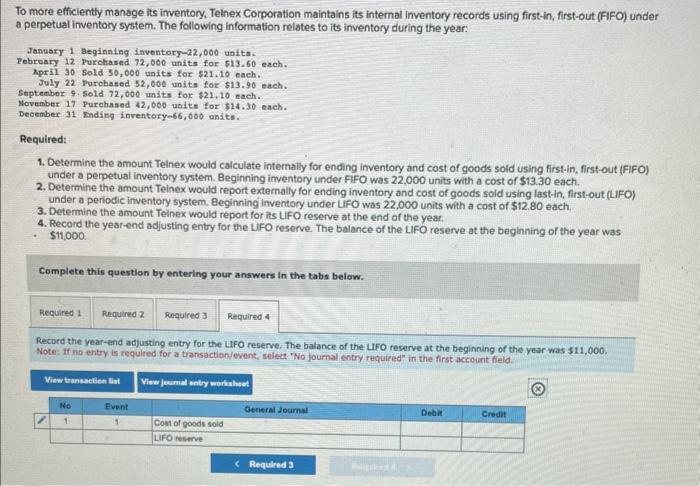

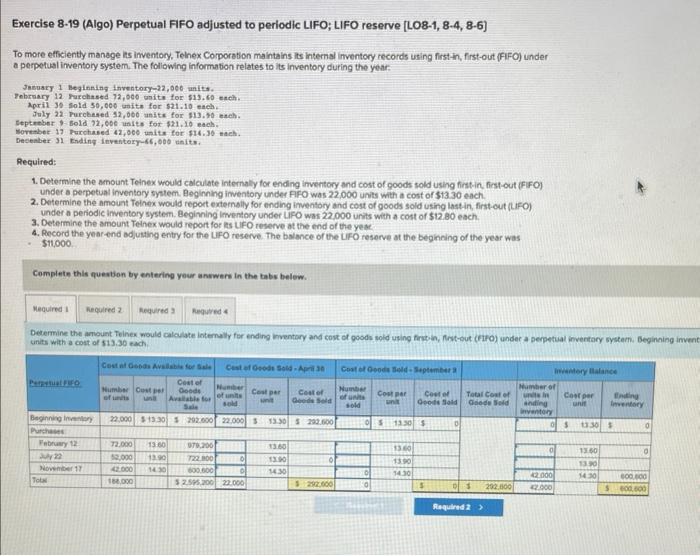

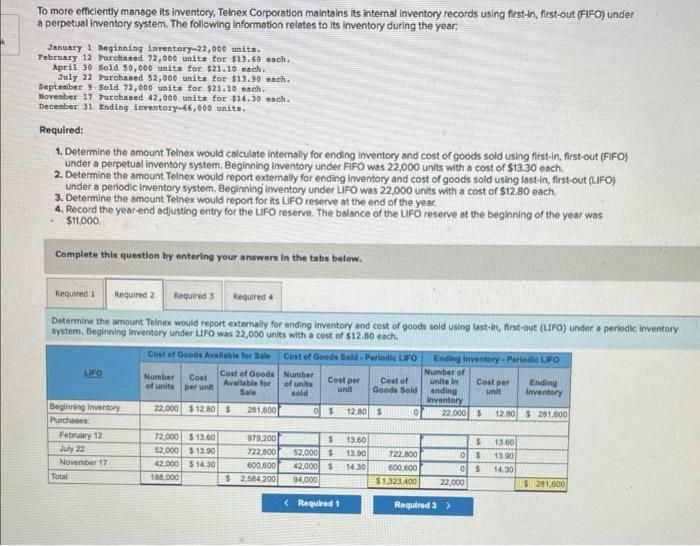

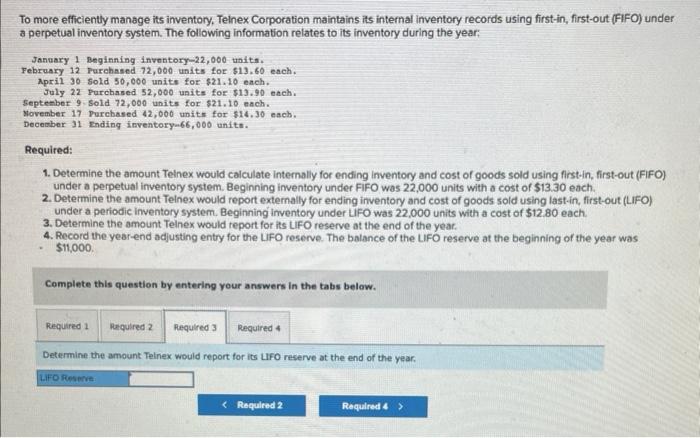

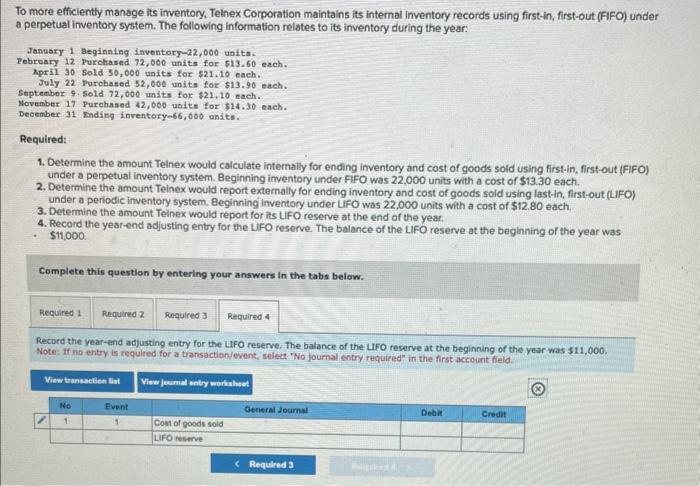

Exercise 8-19 (Algo) Perpetual FIFO adjusted to periodic LIFO; LIFO reserve [LO8-1, 8-4, 8-6] To more efficiently manege its imventory, Telnex Corporation maintains its internal imventory records using first-in, first-out (FFFO) under a perpetual inventory system. The following information relates to its inventory during the year: Jesuary 1 Beginning Inventory-22, 006 units. Fehrnary 12 Tarehased 72,500 units for 513,60 eneh. Aprit 30 sold 50,000 unita for 521.10 each. July 22 . Purckesed 12,060 anits for 113.70 eseh. Septreber 1 - Bold 72 , 00e units for $21,10 each. Sorember 17 Purchased 42,000 uaits for $14.30 =aeh. Decenber 31 trding inventery-66, 000 tinits. Required: 1. Determine the amount Teinex would calculate internaliy for ending invertory and cost of goods sold using firstin, first-out (FFF) under a perpetual inventary sytem. Beginning imventory under fFFO was 22,000 units with a cost of $13.30 each. 2. Determine the amount Teinex would report externally for ending imventory and cost of goods sold using last in, first-out (L.FF) under a periodic imventary system. Beginning imventory under LifO was 22.000 units with a cott of $12.80 each. 3. Determine the amount Teinex would report for is uFO teserve at the end of the yeac. 4. Record the yoar-end adjutting entry for the UFO reserve. The balance of the UFO reserve at the beginning of the year was - $11,000 Complete this question by entering yeur anwwers in the tabs belew. To more efficiently mansge its inventory, Telnex Corporation maintains its internal inventory records using first-in, first-out (FIFO) under a perpetual iiventory system. The following information relates to its inventory during the year: January 1 Deginining inventory-22, 000 unite. Pebruary 12 Turchinted 12,000 uaite for 513,60 each. Apri1 30 Bold 50,000 unite for 621.10 oech. July 22 Purobased 52,000 units for $13.90 each. September 9 . Sold 72,000 waits for $21,10 eneh. Navenber 17 Purchased 42,000-units for \$14.30 nnch. Decenber 31 Fnding inventory-66,000 units. Required: 1. Determine the amount Telnex would calculate intemally for ending inventory and cost of goods sold using first-in, first-out (FiFO) under a perpetual inventory system, Beginning inventory under Fifo was 22,000 units with a cost of 513.30 each. 2. Determine the amount Teinex would report externally for ending irventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. Beginning inventory under LIFO was 22,000 units with a cost of $12.80 each. 3. Determine the amount Telnex would report for its LlFO reserve at the end of the yeac. 4. Record the year-end adjusting entry for the Lifo reserve. The baiance of the LFOO reserve at the beginning of the year was - $11,000 Complete this question by entering your answers in the tabs below. Determine the amount Teinex would report externally for ending inventory and cost of gaods sold using last-in, first-out (LIFo) under a periodic inventory system. Beginning inventory under LFFO was 22,000 units with a cost of $12.100 each. To more efficiently manage its inventory, Teinex Corporation maintains its internal inventory records using first-in, first-out (FIFO) under a perpetual inventory system. The following information relates to its inventory during the year: Januaxy \& Beginning inventory-22,000 tiaita. February 12 Purehased 72,000 units for $13.60 each. April 30 sold 50,000 units for $21.10 each. July 22 Parchased 52,000 units for $13.90 each. September 9 . Sold 72,000 units for $21,10 ench. November 17 Purchased 42,000 units for $14,30 each. December 31 Ending inventory 66,000 unite. Required: 1. Determine the amount Teinex would calculate internally for ending inventory and cost of goods sold using first-in, first-out (FiFO) under a perpetual inventory system. Beginning inventory under FIFO was 22,000 units with a cost of $13.30 each. 2. Determine the amount Teinex would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. Beginning inventory under Lifo was 22,000 units with a cost of $12.80 each. 3. Determine the amount Teinex would report for its LIFO reserve at the end of the year. 4. Record the year-end adjusting entry for the LFO reserve. The balance of the LFFO reserve at the beginning of the year was - $11,000 Complete this question by entering your answers in the tabs below. Determine the amount Telnex would report for its Lifo reserve at the end of the year, To more efficiently manage its inventory, Teinex Corporation maintains its internal inventory records using first-in, first-out (FIFO) under a perpetual inventory system. The following information relates to its inventory during the year: Januaxy 1 Beginining inventory-22,000 units. Tebruary 12 Purchased 72,000 units for $13.60 each. April 30 5old 50,000 units for $21,10 each. July 22 rurchased 52,000 units for $13.90 each. Septeaber 9 . Sold 72,000 units for $21,10 each. Novenber 17 Purchased 42,000 units for $14,30 each. December 31 Ending inventory-66,000 units. Required: 1. Determine the amount Telnex would calculate internally for ending inventory and cost of goods sold using first-in, first-out (FIFO) under a perpetual inventory system. Beginning imventory under FIFO was 22,000 units with a cost of $13.30 each. 2. Determine the amount Telnex would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. Beginning inventory under LFO was 22,000 units with a cost of $12.80 each, 3. Determine the amount Teinex would report for its LIFO reserve at the end of the year. 4. Record the year-end adjusting entry for the LFO reserve. The balance of the LIFO reserve at the beginning of the year was - $11,000 Complete this question by entering your answers in the tabs below. Record the year-end adjusting entry for the Lifo reserve. The balance of the LIFO reserve at the beginning of the year was $11,000. Notes If no entry is required for a transacton/event, select. "No fournal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started