Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on the following finiace, The problem builds off of each other. answers all steps. All informaion is given. mush show work. Will upvote

Need help on the following finiace, The problem builds off of each other. answers all steps. All informaion is given. mush show work. Will upvote correct answers. Have been struggling all day.

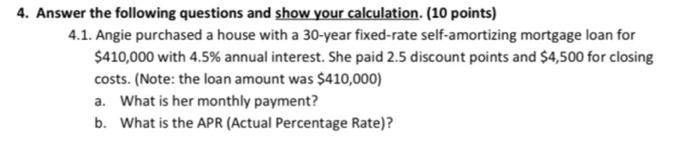

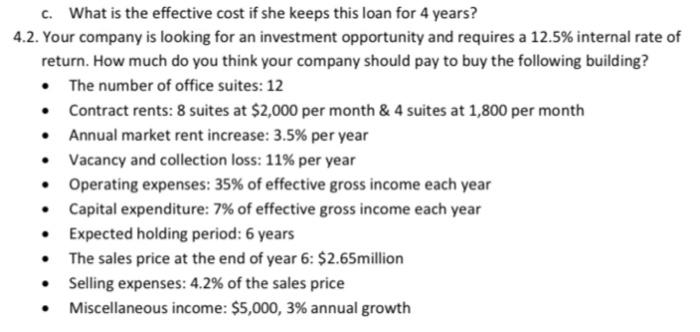

4. Answer the following questions and show your calculation. (10 points) 4.1. Angie purchased a house with a 30-year fixed-rate self-amortizing mortgage loan for $410,000 with 4.5% annual interest. She paid 2.5 discount points and $4,500 for closing costs. (Note: the loan amount was $410,000) a. What is her monthly payment? b. What is the APR (Actual Percentage Rate)? . c. What is the effective cost if she keeps this loan for 4 years? 4.2. Your company is looking for an investment opportunity and requires a 12.5% internal rate of return. How much do you think your company should pay to buy the following building? The number of office suites: 12 Contract rents: 8 suites at $2,000 per month & 4 suites at 1,800 per month Annual market rent increase: 3.5% per year Vacancy and collection loss: 11% per year Operating expenses: 35% of effective gross income each year Capital expenditure: 7% of effective gross income each year Expected holding period: 6 years The sales price at the end of year 6: $2.65million Selling expenses: 4.2% of the sales price Miscellaneous income: $5,000, 3% annual growth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started