Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help on the following problem, I have been struggling all day would be greatly appreciate if I can get some assistance. All information has

need help on the following problem, I have been struggling all day would be greatly appreciate if I can get some assistance. All information has been given. Answer both parts of the same problem.

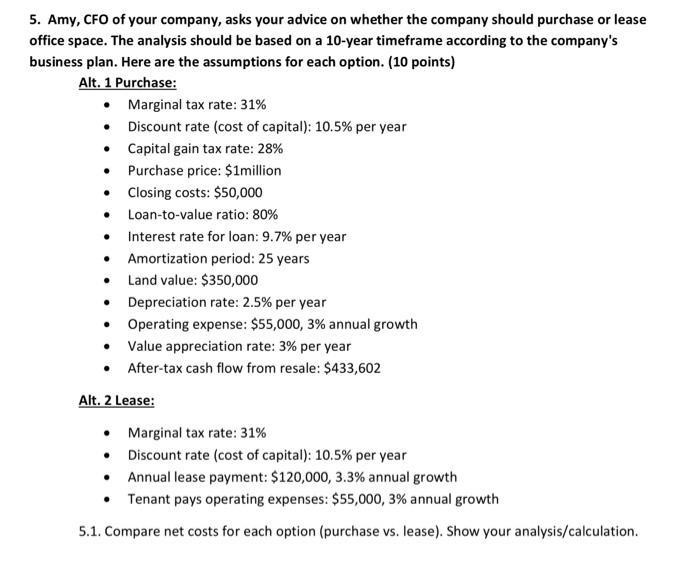

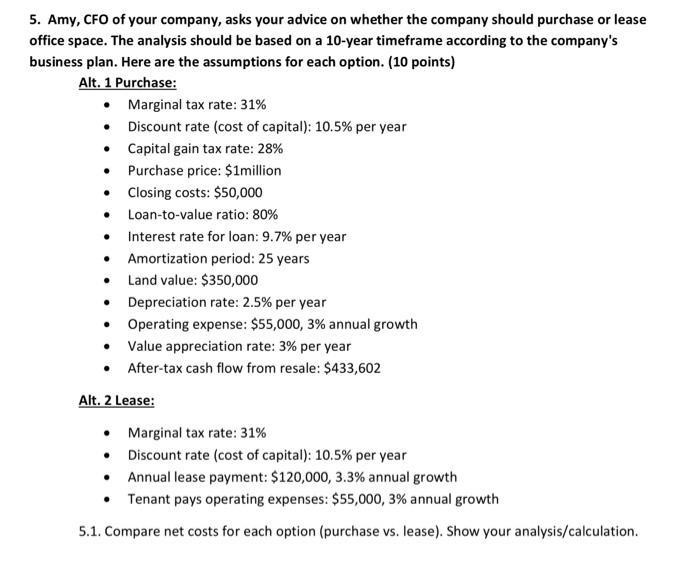

5. Amy, CFO of your company, asks your advice on whether the company should purchase or lease office space. The analysis should be based on a 10-year timeframe according to the company's business plan. Here are the assumptions for each option. (10 points) Alt. 1 Purchase: Marginal tax rate: 31% Discount rate (cost of capital): 10.5% per year Capital gain tax rate: 28% Purchase price: $1million Closing costs: $50,000 Loan-to-value ratio: 80% Interest rate for loan: 9.7% per year Amortization period: 25 years Land value: $350,000 Depreciation rate: 2.5% per year Operating expense: $55,000, 3% annual growth Value appreciation rate: 3% per year After-tax cash flow from resale: $433,602 . Alt. 2 Lease: Marginal tax rate: 31% Discount rate (cost of capital): 10.5% per year Annual lease payment: $120,000, 3.3% annual growth Tenant pays operating expenses: $55,000, 3% annual growth 5.1. Compare net costs for each option (purchase vs. lease). Show your analysis/calculation. 5.2. Besides the financial analysis above (6.1), what would you recommend the CFO and your FM department to consider? 5. Amy, CFO of your company, asks your advice on whether the company should purchase or lease office space. The analysis should be based on a 10-year timeframe according to the company's business plan. Here are the assumptions for each option. (10 points) Alt. 1 Purchase: Marginal tax rate: 31% Discount rate (cost of capital): 10.5% per year Capital gain tax rate: 28% Purchase price: $1million Closing costs: $50,000 Loan-to-value ratio: 80% Interest rate for loan: 9.7% per year Amortization period: 25 years Land value: $350,000 Depreciation rate: 2.5% per year Operating expense: $55,000, 3% annual growth Value appreciation rate: 3% per year After-tax cash flow from resale: $433,602 . Alt. 2 Lease: Marginal tax rate: 31% Discount rate (cost of capital): 10.5% per year Annual lease payment: $120,000, 3.3% annual growth Tenant pays operating expenses: $55,000, 3% annual growth 5.1. Compare net costs for each option (purchase vs. lease). Show your analysis/calculation. 5.2. Besides the financial analysis above (6.1), what would you recommend the CFO and your FM department to consider

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started