Answered step by step

Verified Expert Solution

Question

1 Approved Answer

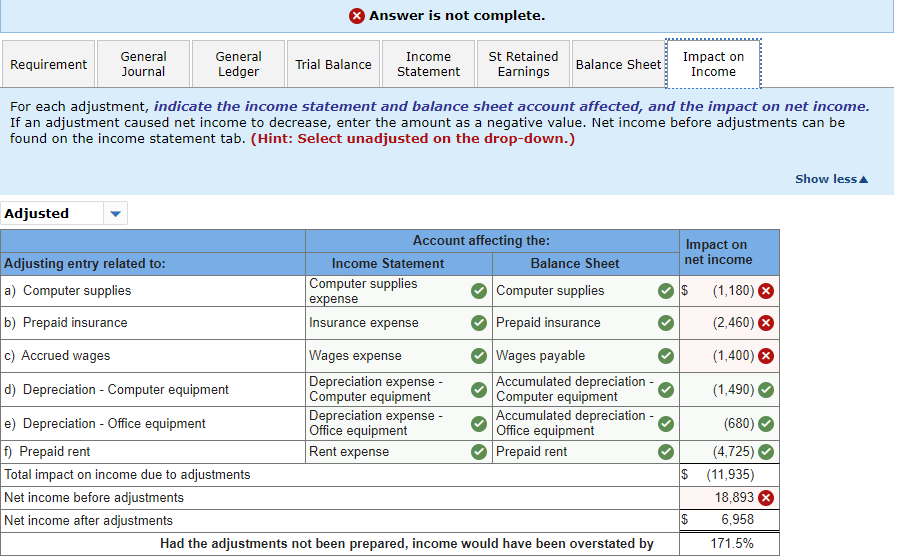

Need help on the Red X's shown here on the Impact on income and any other answer is not complete Answer is not complete. Requirement

Need help on the Red X's shown here on the "Impact on income" and any other "answer is not complete

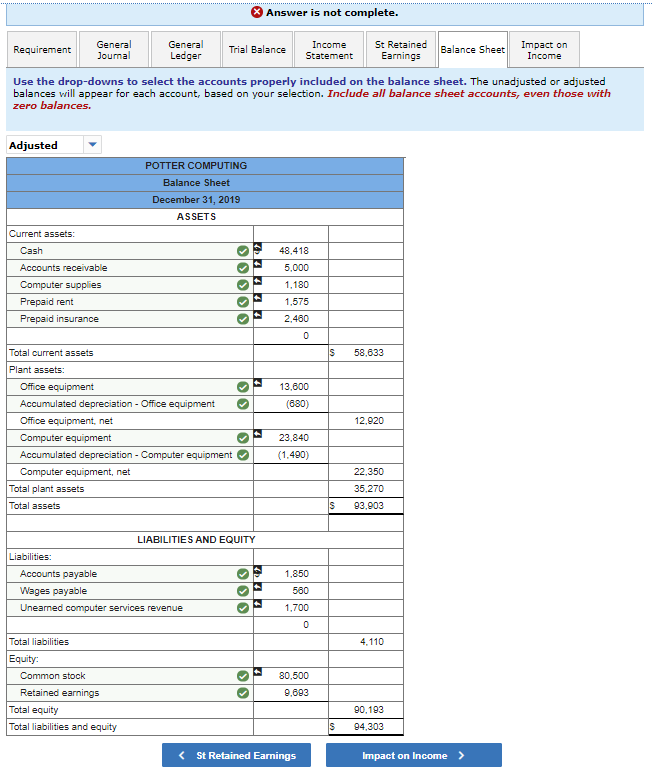

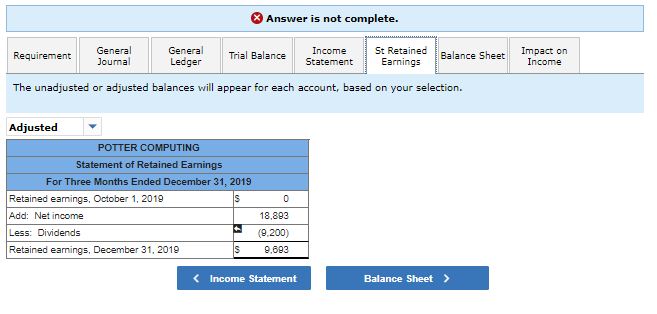

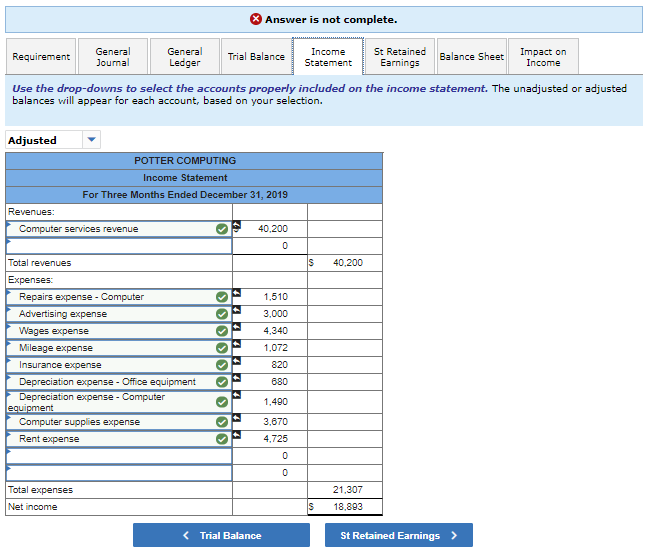

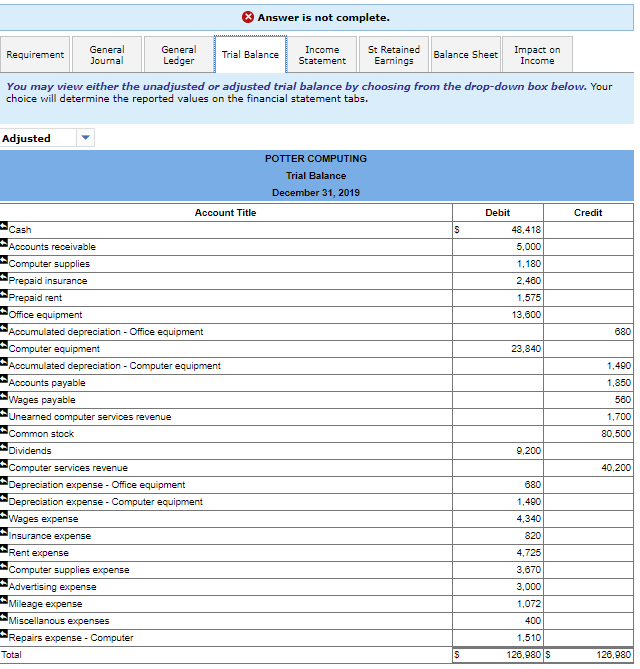

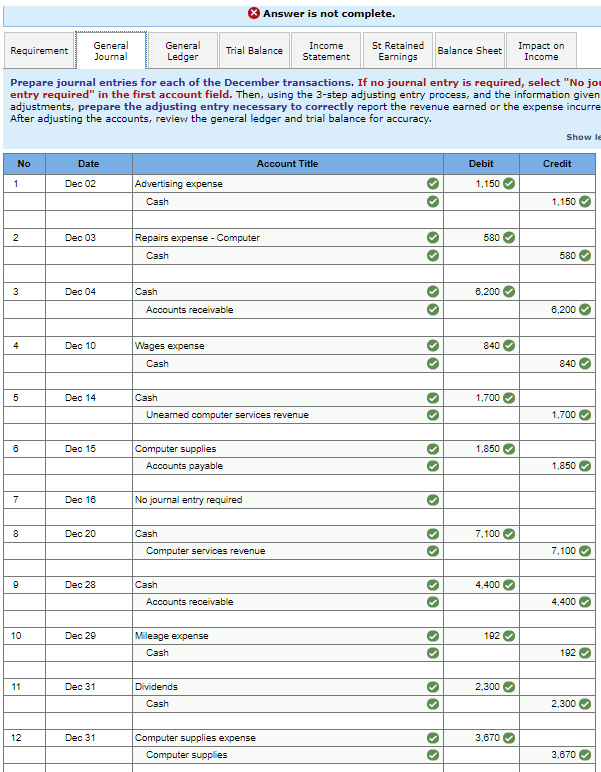

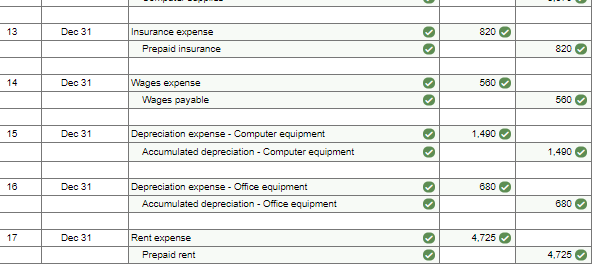

Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on Income For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the drop-down.) Show less Impact on net income $ (1,180) (2,460) (1,400) Adjusted Account affecting the: Adjusting entry related to: Income Statement Balance Sheet Computer supplies a) Computer supplies Computer supplies expense b) Prepaid insurance Insurance expense Prepaid insurance c) Accrued wages Wages expense Wages payable Depreciation expense - Accumulated depreciation - d) Depreciation - Computer equipment Computer equipment Computer equipment Depreciation expense Accumulated depreciation - e) Depreciation - Office equipment Office equipment Office equipment f) Prepaid rent Rent expense Prepaid rent Total impact on income due to adjustments Net income before adjustments Net income after adjustments Had the adjustments not been prepared, income would have been overstated by (1,490) (680) $ (4,725) (11,935) 18,893 X 6,958 171.5% $ Answer is not complete. General General Income Requirement Impact on Trial Balance St Retained Balance Sheet Journal Ledger Statement Earnings Income Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted or adjusted balances will appear for each account, based on your selection. Include all balance sheet accounts, even those with zero balances. Adjusted POTTER COMPUTING Balance Sheet December 31, 2019 ASSETS 48,418 5,000 Current assets: Cash Accounts receivable Computer supplies Prepaid rent Prepaid insurance Ooooo 1,180 1,575 2.460 Total current assets IS 58,633 13,600 (680) Plant assets Office equipment Accumulated depreciation - Office equipment Office equipment.net Computer equipment Accumulated depreciation - Computer equipment Computer equipment, net Total plant assets Total assets 00 OO 12,920 23.840 (1.490) 22,350 35,270 93.903 IS LIABILITIES AND EQUITY 1.850 Liabilities: Accounts payable Wages payable Unearned computer services revenue OOO 580 1,700 0 4,110 Total liabilities Equity: 80.500 9.693 Common stock Retained earnings Total equity Total liabilities and equity 90.193 94,303 S Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on Income The unadjusted or adjusted balances will appear for each account, based on your selection. Adjusted POTTER COMPUTING Statement of Retained Earnings For Three Months Ended December 31, 2019 Retained earnings, October 1, 2019 IS Add: Net income Less: Dividends Retained earnings, December 31, 2019 IS 0 18,893 (9.200) 9,693 Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on Income Use the drop-downs to select the accounts properly included on the income statement. The unadjusted or adjusted balances will appear for each account, based on your selection. Adjusted POTTER COMPUTING Income Statement For Three Months Ended December 31, 2019 Revenues: Computer services revenue 40.200 s 40.200 1,510 Total revenues Expenses Repairs expense - Computer Advertising expense Wages expense Mileage expense Insurance expense Depreciation expense - Office equipment Depreciation expense - Computer equipment Computer supplies expense Rent expense 3,000 4,340 1,072 820 @lolololololololo 680 1,490 3.670 4,725 0 0 Total expenses 21,307 18,893 Net Income IS Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on Income You may view either the unadjusted or adjusted trial balance by choosing from the drop-down box below. Your choice will determine the reported values on the financial statement tabs. Adjusted POTTER COMPUTING Trial Balance December 31, 2019 Credit S Debit 48,418 5,000 1,180 2,480 1,575 13,600 680 23,840 1,400 1.850 580 1,700 Account Title Cash * Accounts receivable Computer supplies Prepaid insurance Prepaid rent Office equipment Accumulated depreciation - Office equipment Computer equipment Accumulated depreciation - Computer equipment Accounts payable Wages payable Unearned computer services revenue Common stock Dividends Computer services revenue Depreciation expense - Office equipment Depreciation expense - Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellanous expenses Repairs expense - Computer Total 80,500 9.200 40,200 680 1,490 4,340 820 4,725 3,670 3,000 1,072 400 1,510 126,9805 S 126,980 Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Impact on Income Prepare journal entries for each of the December transactions. If no journal entry is required, select "No jo entry required" in the first account field. Then, using the 3-step adjusting entry process, and the information given adjustments, prepare the adjusting entry necessary to correctly report the revenue earned or the expense incurre After adjusting the accounts, review the general ledger and trial balance for accuracy. Show le No Date Account Title Debit Credit 1 Dec 02 1,150 Advertising expense Cash 1,150 2 Dec 03 Repairs expense - Computer 580 Olo Cash 580 3 Dec 04 6.200 Cash Accounts receivable 8.200 4 Dec 10 840 Wages expense Cash 00 840 5 Dec 14 1,700 Cash Unearned computer services revenue 1,700 6 Dec 15 1,850 Computer supplies Accounts payable O 1.850 7 Dec 18 No journal entry required 8 Dec 20 Cash 7.100 Computer services revenue 7.100 00 00 9 Dec 28 4,400 Cash Accounts receivable 4.400 10 Dec 29 192 Mileage expense Cash >> 192 11 Dec 31 Dividends 2.300 Cash O 2.300 12 Dec 31 3.670 Computer supplies expense Computer supplies so 3.670 13 Dec 31 820 Insurance expense Prepaid insurance ols 820 14 Dec 31 580 Wages expense Wages payable Oo 580 > 15 Dec 31 1,490 Depreciation expense - Computer equipment Accumulated depreciation - Computer equipment Olo 1,490 16 Dec 31 680 Depreciation expense - Office equipment Accumulated depreciation - Office equipment Olo 680 17 Dec 31 Rent expense 4.725 O Prepaid rent 4.725

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started