Answered step by step

Verified Expert Solution

Question

1 Approved Answer

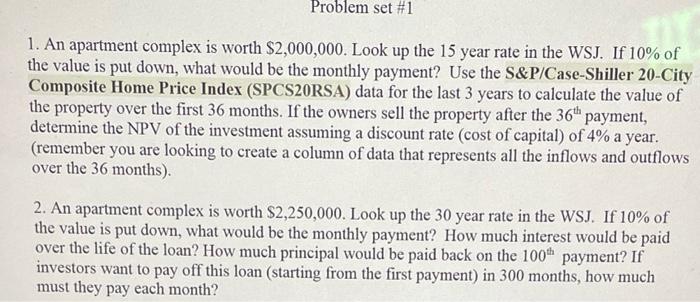

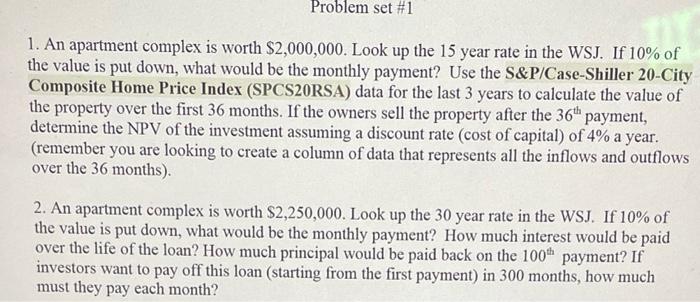

need help on these if possible asap !! Problem set #1 1. An apartment complex is worth $2,000,000. Look up the 15 year rate in

need help on these if possible asap !!

Problem set #1 1. An apartment complex is worth $2,000,000. Look up the 15 year rate in the WSJ. If 10% of the value is put down, what would be the monthly payment? Use the S&P/Case-Shiller 20-City Composite Home Price Index (SPCSORSA) data for the last 3 years to calculate the value of the property over the first 36 months. If the owners sell the property after the 36" payment, determine the NPV of the investment assuming a discount rate (cost of capital) of 4% a year. (remember you are looking to create a column of data that represents all the inflows and outflows over the 36 months). 2. An apartment complex is worth $2,250,000. Look up the 30 year rate in the WSJ. If 10% of the value is put down, what would be the monthly payment? How much interest would be paid over the life of the loan? How much principal would be paid back on the 100 payment? If investors want to pay off this loan (starting from the first payment) in 300 months, how much must they pay each month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started