Answered step by step

Verified Expert Solution

Question

1 Approved Answer

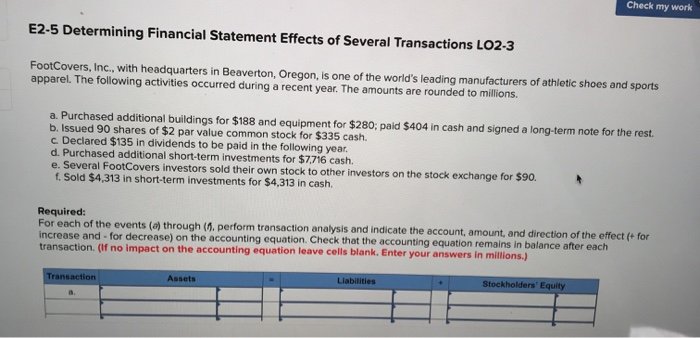

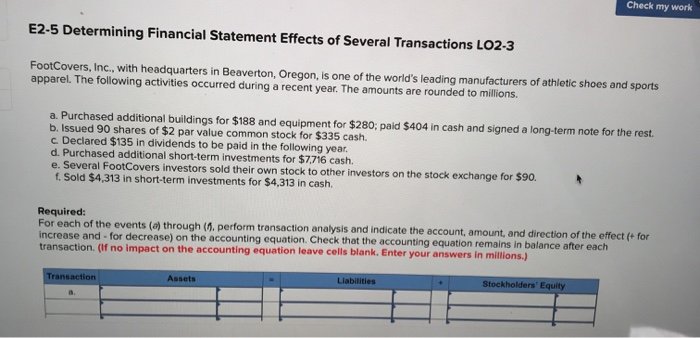

need help on this homework problem Check my work E2-5 Determining Financial Statement Effects of Several Transactions LO2-3 FootCovers, Inc., with headquarters in Beaverton, Oregon,

need help on this homework problem

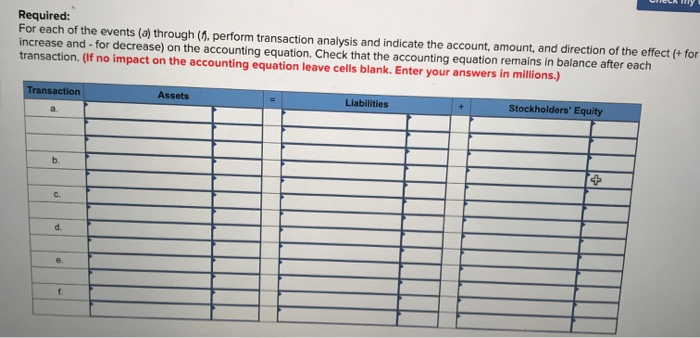

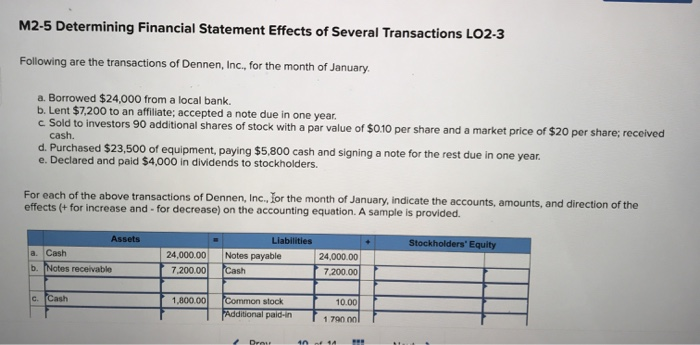

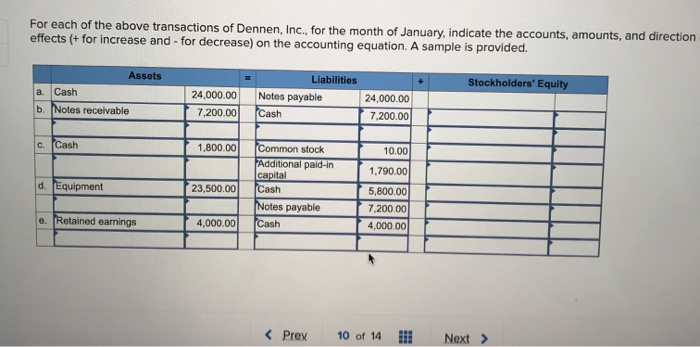

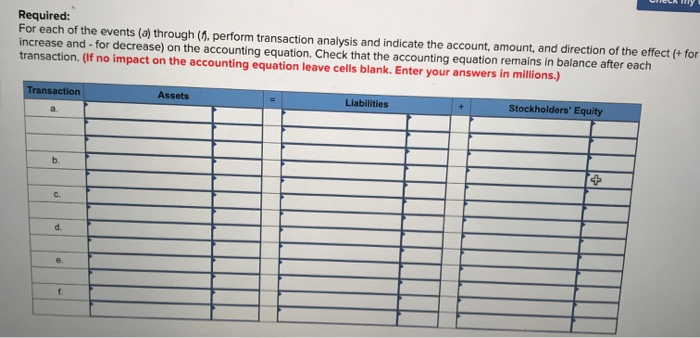

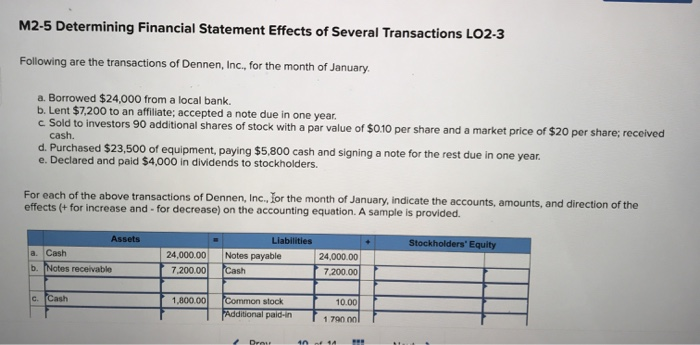

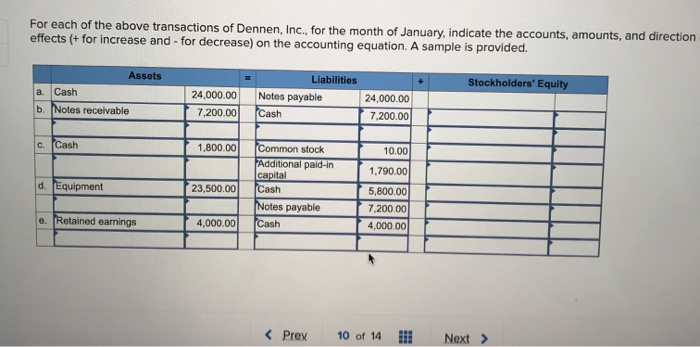

Check my work E2-5 Determining Financial Statement Effects of Several Transactions LO2-3 FootCovers, Inc., with headquarters in Beaverton, Oregon, is one of the world's leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions a. Purchased additional buildings for $188 and equipment for $280; paid $404 in cash and signed a long-term note for the rest. b. Issued 90 shares of $2 par value common stock for $335 cash. c. Declared $135 in dividends to be paid in the following year d. Purchased additional short-term investments for $7,716 cash. e. Several FootCovers investors sold their own stock to other investors on the stock exchange for $90. f. Sold $4,313 in short-term investments for $4,313 in cash. Required: For each of the events (a) through (6. perform transaction analysis and indicate the account, amount, and direction of the effect (+ for increase and- for decrease) on the accounting equation. Check that the accounting equation remains in balance after each transaction. (If no impact on the accounting equation leave cells blank. Enter your answers in millions.) Stockholders' Equity Liabilities Assets Transaction Required: For each of the events (a) through (. perform transaction analysis and indicate the account, amount, and direction of the effect (+ for increase and - for decrease) on the accounting equation. Check that the accounting equation remains in balance after each transaction. (If no impact on the accounting equation leave cells blank. Enter your answers in millions.) Transaction Assets Liabilities Stockholders' Equity a b c. d. f. M2-5 Determining Financial Statement Effects of Several Transactions LO2-3 Following are the transactions of Dennen, Inc., for the month of January a. Borrowed $24,000 from a local bank b. Lent $7,200 to an affiliate; accepted a note due in one year. c Sold to investors 90 additional shares of stock with a par value of $010 per share and a market price of $$20 per share; received cash. d. Purchased $23,500 of equipment, paying $5,800 cash and signing a note for the rest due in one year e. Declared and paid $4,000 in dividends to stockholders For each of the above transactions of Dennen, Inc, Ior the month of January, indicate the accounts, amounts, and direction of the effects (+ for increase and- for decrease) on the accounting equation. A sample is provided Assets Liabilities Stockholders' Equity Cash 24,000.00 Notes payable Cash 24,000.00 b. Notes receivable 7,200.00 7,200.00 c. Cash Common stock Additional paid-in 1,800.00 10.00 1 790 00 Dratr 40 For each of the above transactions of Dennen, Inc., for the month of January, indicate the accounts, amounts, and direction effects (+ for increase and for decrease) on the accounting equation. A sample is provided. Assets Liabilities Stockholders' Equity Cash a Notes payable 24,000.00 24,000.00 b. Notes receivable 7,200.00 Cash 7,200.00 C. Cash 1,800.00 Common stock Additional paid-in capital Cash Notes payable 10.00 1,790.00 d. Equipment 23,500.00 5,800.00 7,200.00 e. Retained earnings Cash 4,000.00 4,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started