Answered step by step

Verified Expert Solution

Question

1 Approved Answer

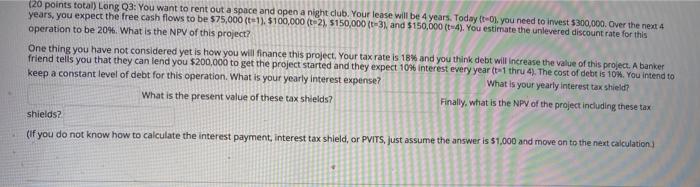

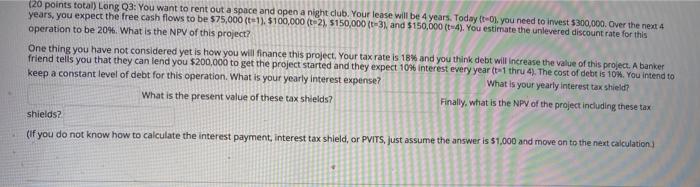

Need Help Please (20 points total) Long 03: You want to rent out a space and open a night dub. Your lease will be 4

Need Help Please

(20 points total) Long 03: You want to rent out a space and open a night dub. Your lease will be 4 years. Today to you need to invest $300,000. Over the next 4 years, you expect the free cash flows to be $75,000 (t-1). $100.000 (L-21, 5150,000 (-3), and $150,000 (t4). You estimate the unlevered discount rate for this operation to be 20%. What is the NPV of this project? One thing you have not considered yet is how you will finance this project. Your tax rate is 18% and you think debt will increase the value of this project. A banker friend tells you that they can lend you $200,000 to get the project started and they expect 10% interest every year (-1 thru 4). The cost of debt is 10. You intend to keep a constant level of debt for this operation. What is your yearly interest expense? What is your yearly interest tax shield? What is the present value of these tax shields? Finally, what is the NPV of the project including these tax shields? (If you do not know how to calculate the interest payment, interest tax shield, or PVITS. Just assume the answer is $1,000 and move on to the next calculation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started