need help please and thank you

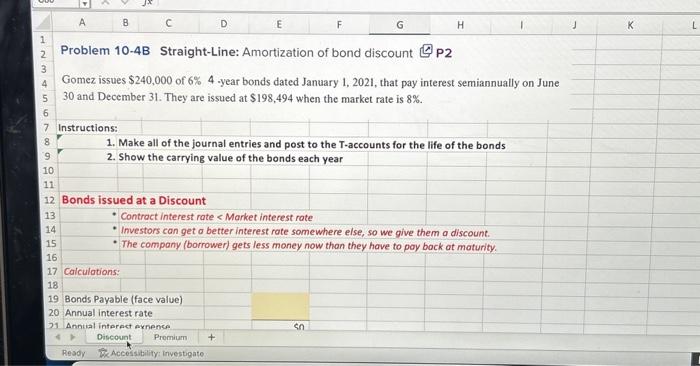

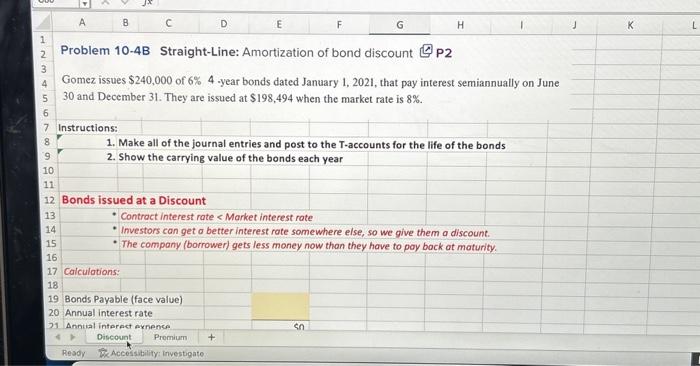

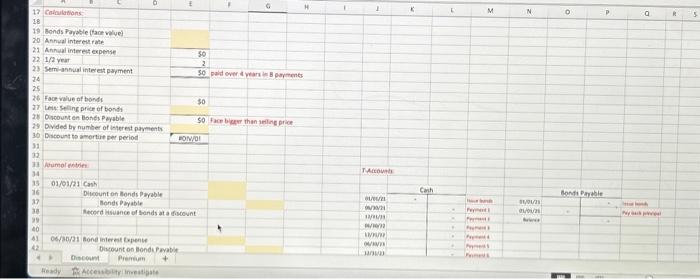

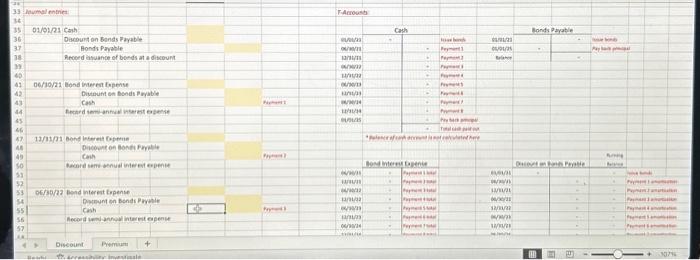

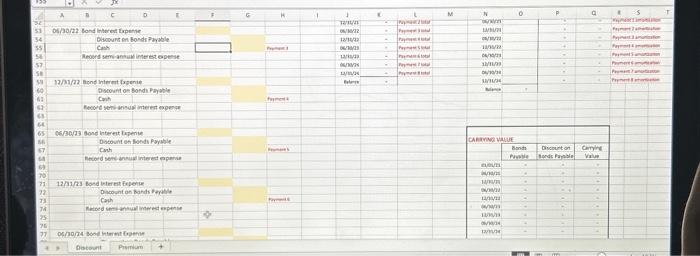

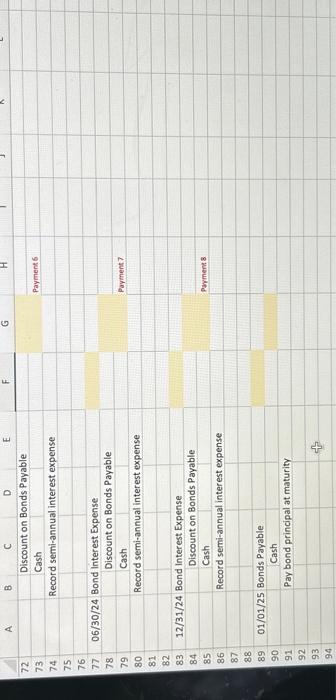

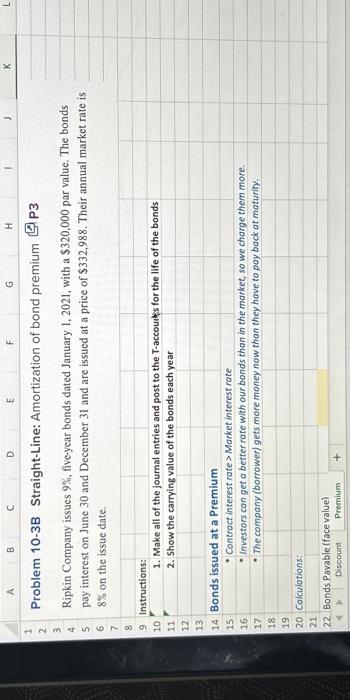

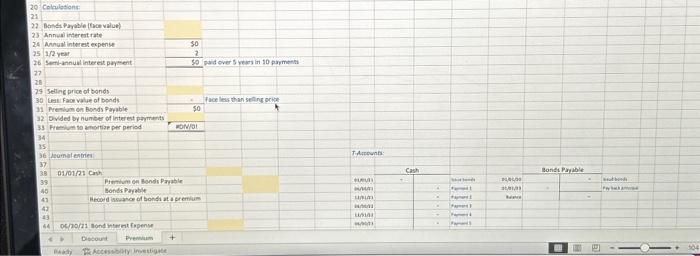

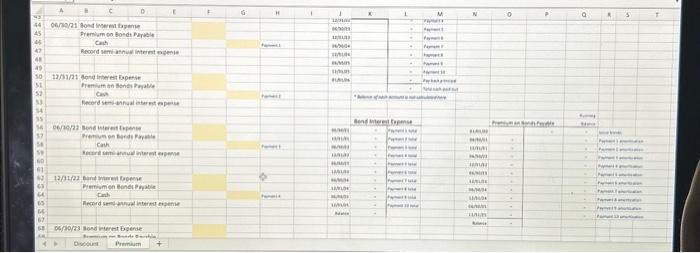

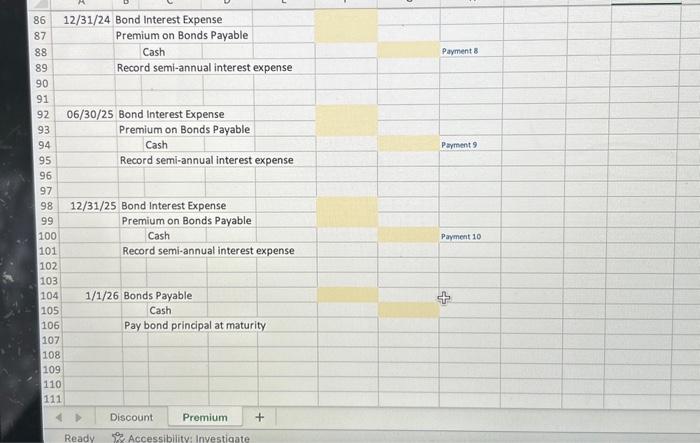

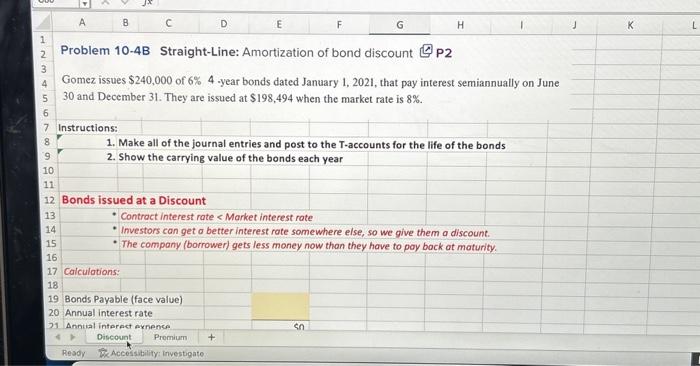

Problem 10-4B Straight-Line: Amortization of bond discount P2 Gomez issues $240,000 of 6%4-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31 . They are issued at $198,494 when the market rate is 8%. Instructions: 1. Make all of the journal entries and post to the T-accounts for the life of the bonds 2. Show the carrying value of the bonds each year Bonds issued at a Discount 13 - Contract interest rate Market interest rate - Investors can get a better rate with our bonds than in the market, so we charge them more. - The company (borrower) gets more money now than they have to pay back at maturity. Calculations: 22 Bonds Pavable (face value) 203 Colauletions: 2. Annual intereitrate 24 Arnual interest expense 25 1/2 year 26 Sem-annual intereit paywent. \begin{tabular}{|r|} \hline$0 \\ 2 \\ \hline 50 \end{tabular} 27 28 28 79 Selling price of bends: 30. Lean Face value of bonds 11 Prembum on Bonds payable 32 0.ided by number of inter est payminito 33. Frimiom to amortiap per period. 34 36 Leomalevirie: 38 01/01/2 Caph: Prowion en Bonds Payahle Bonds Payable Bpodd iscuater of bondi at a cremium ocmo/z1 londwiwet fapenve C1 06/30/73 Bond Interest Eugenue Pay bond principal at maturity Problem 10-4B Straight-Line: Amortization of bond discount P2 Gomez issues $240,000 of 6%4-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31 . They are issued at $198,494 when the market rate is 8%. Instructions: 1. Make all of the journal entries and post to the T-accounts for the life of the bonds 2. Show the carrying value of the bonds each year Bonds issued at a Discount 13 - Contract interest rate Market interest rate - Investors can get a better rate with our bonds than in the market, so we charge them more. - The company (borrower) gets more money now than they have to pay back at maturity. Calculations: 22 Bonds Pavable (face value) 203 Colauletions: 2. Annual intereitrate 24 Arnual interest expense 25 1/2 year 26 Sem-annual intereit paywent. \begin{tabular}{|r|} \hline$0 \\ 2 \\ \hline 50 \end{tabular} 27 28 28 79 Selling price of bends: 30. Lean Face value of bonds 11 Prembum on Bonds payable 32 0.ided by number of inter est payminito 33. Frimiom to amortiap per period. 34 36 Leomalevirie: 38 01/01/2 Caph: Prowion en Bonds Payahle Bonds Payable Bpodd iscuater of bondi at a cremium ocmo/z1 londwiwet fapenve C1 06/30/73 Bond Interest Eugenue Pay bond principal at maturity