need help

please i need help with correct answer asap

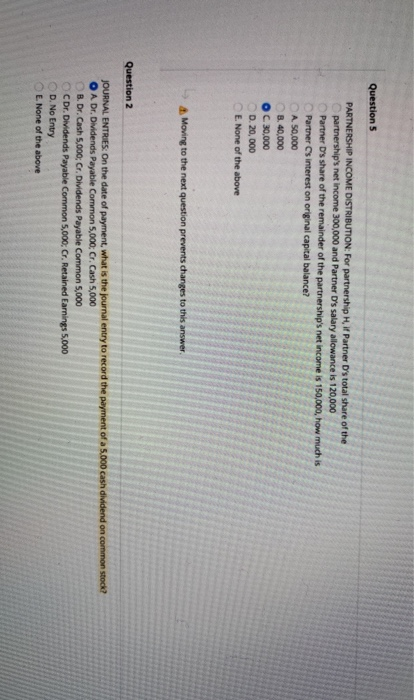

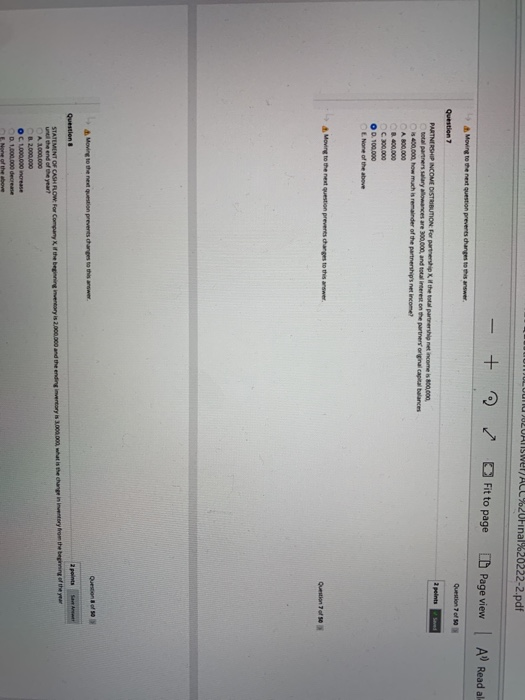

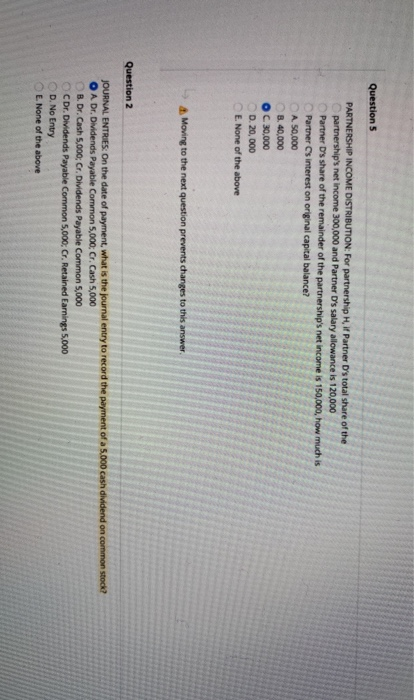

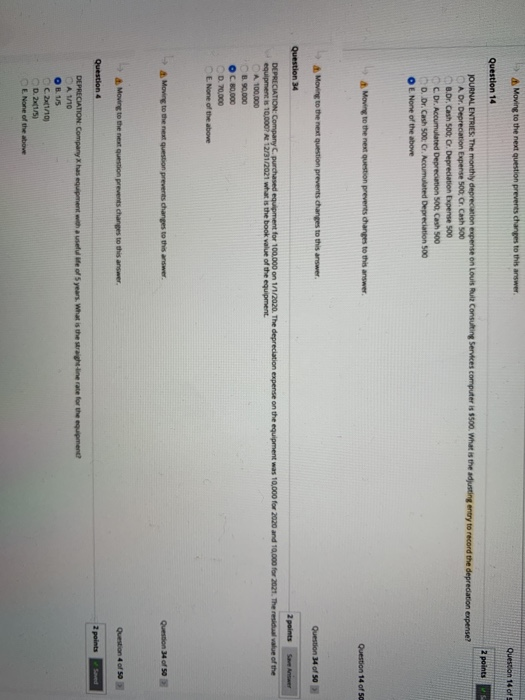

Question 5 PARTNERSHIP INCOME DISTRIBUTION: For partnership Hif Partner D's total share of the partnership's net income 300,000 and Partner D's salary allowance is 120,000 Partner D's share of the remainder of the partnership's net income is 150,000, how much is Partner Cs interest on original capital balance? A. 50,000 B. 40,000 OC 30,000 D. 20,000 E. None of the above Moving to the next question prevents changes to this answer Question 2 JOURNAL ENTRIES: On the date of payment, what is the journal entry to record the payment of a 5.000 cash dividend on common stock? O A Dr. Dividends Payable Common 5,000; Cr. Cash 5,000 B. Dr. Cash 5,000; Cr. Dividends Payable Common 5,000 Dr. Dividends Payable Common 5,000, Cr, Retained Earnings 5.000 D.No Entry E. None of the above Moving to the next question prevents changes to this answer Question 14 of E Question 14 2 points JOURNAL ENTRIES: The monthly depreciation expense on Louis Ruiz Consulting Services computer is 1500. What is the adjusting entry to record the depreciation expense? A Dr. Deprecation Expense 500 r. Cash 500 B.Dr. Cash 500: Or. Depreciation Expense 500 Dr. Accumulated Depreciation on Cash 500 D. Dr. Cash 500 Cr Accumulated Depreciation 500 E. None of the above Moving to the next question prevents changes to this answer Question 14 of 5 Moving to the next question prevents changes to this answer Question 34 of 50 Question 34 2 points DEPRECIATION: Company C. purchased equipment for 100.000 on 1/1/2020. The depreciation expense on the equipment was 10,000 for 2020 and 10,000 for 2021. The residual value of the equipment is 10,000? At 12/31/2021 what is the book value of the equipment A 100,000 B. 90.000 C. 80,000 D. 70.000 E. None of the above Moving to the next question prevents changes to this answer Question 34 of 50 Moving to the next question prevents changes to this answer Question of so Question 4 2 points Saved DEPRECIATION Company has equipment with ause we of years. What is the straight line rate for the equipment A110 OB 1/5 OC. 21/10) D. 21/51 E. None of the above eye view A Moving to the next question prevents charges to this Question of so Question 12 JOURNAL ENTRIES Company is so res of 10 per le confor 15 per hart Wathurney O A Dr. Cash 4500 r. Common Stock 3000 Paid in Calines of P100 Dr. Common Stock Dr. Paldin Capital in wes of Preach Dr. Cash 4500. Common Pain Clince of 100 D. Dr. Common Stock Dr. Padin Caprice of Swed Cash 4500 None of the above Moving to the next gestion prevents restos . Moving to the next question prevents changes to the Question 13 STATEMENT OF CASH ROW. In the office A Operating YO Question 2 points PARTNERSHIP INCOME DISTRIBUTION. For partnership to partners salary lowances are 100,000, total rest on the partner orginal capital balance is 400,000, and the remainder of the partnershipset Income is 200.000, how much is the total partnership net income? O A 900.000 B. 800,000 C. 300,000 D. 100.000 CE None of the above Moving to the next question prevents changes to this answer Question of so Question 10 2 points PARTNERSHIP INCOME DISTRIBUTION:For partnership, the remainder of the partnerships net income is 150,000 and there are three partners among whom the remainder is divided equally how much is each partner's share of the reminder? O AS,000 B. 40.000 C. 30.000 D. 20.000 E. None of the above Moving to the next question prevents changes to this answer Question 10 of 50 Question 11 2 points PARTNERSHP INCOME DISTRIBUTION for partnership the remainder of the partnerships net income is 120.000 and there are three partners among whom the remainder is vided equally how much is each partners share of the reminder? A 50,000 O 8.40,000 30.000 D. 20.000 None the above UANSWER ALL%20Final%20222-2.pdf - + Fit to page ID Page view | A Read al Moving to the next question prevents changes to this answer Question of ins Sed Question 7 PARTNERSHIP INCOME DISTRIBUTION. For ship it the total partnership net income is 800,000 o partners salary ances are 300,000, and total interest on the partners original capablanc 400,000 how much is remainder of the partnership net income? A 800,000 8.400.000 300,000 OD 100.000 None of the above Moving to the next question prevents changes to this rower Question 70 Questions A Moving to the next question prevents changes to this we Questions STATEMENT OF CASH ROW For Company if the beginning intory is 2.000.000 and the ending invertory is 1.000.00, what is the change from the beginning of the ye until the end of the year! A 1.000.000 B 2.000.000 C.1.000.000 increase D. 1.000.000 decrease None of the above

need help

need help

please i need help with correct answer asap

please i need help with correct answer asap