Answered step by step

Verified Expert Solution

Question

1 Approved Answer

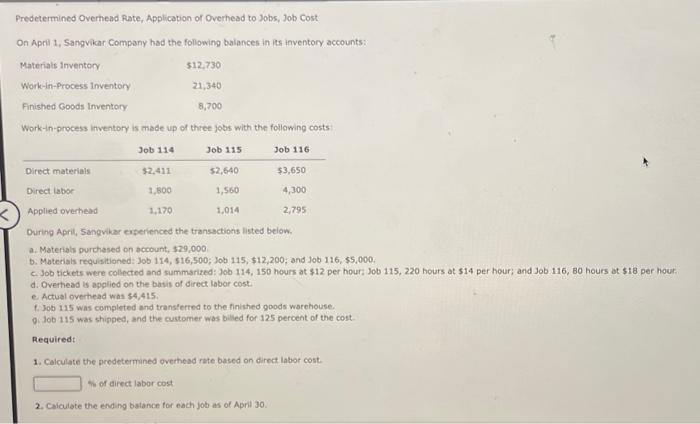

need help please Predetermined Overhead Rate, Application of Overhead to Jobs, Job Cost On Apra 1, Sangvikar Company had the following balances in its inventory

need help please

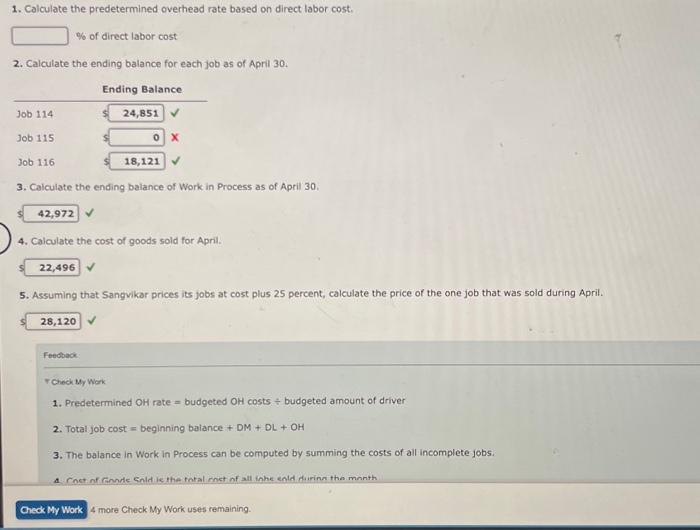

Predetermined Overhead Rate, Application of Overhead to Jobs, Job Cost On Apra 1, Sangvikar Company had the following balances in its inventory accounts: Work-in-process inventory is made up of three jobs with the following costs During April, Sangvikar erperlenced the transactions listed below. a. Materials purchased on account, 329,000 . b. Materials requisitioned: Job 114,$16,500; Job 115,$12,200; and 100116,$5,000. c. Job sickets were collected and summsrized: Job 114, 150 hours at $12 per hour: Job 115,220 hours at $14 per hour; and Job 116 , B0 hours at $18 per hour: d. Overthead is applied on the basis of direct labor cost. e. Actual overhead was $4,415. 1. Job 115 was completed and transterred to the finished goods warehouse. g. Job 115 was shipped, and the customer was billed for 125 percent of the cost. Requiredt: 1. Calculate the predetermined overhead rate based on direct labor cost. of direct labor cost 2. Caiculate the ending batance for each job as of April 30. 1. Calculate the predetermined overhead rate based on direct labor cost. % of direct labor cost 2. Calculate the ending balance for each job as of April 30. 3. Calculate the ending balance of Work in Process as of April 30. 4. Calculate the cost of goods sold for April. 5. Assuming that Sangvikar prices its jobs at cost plus 25 percent, calculate the price of the one job that Feedora. r Chech M, Work 1. Predetermined OH rate = budgeted OH costs budgeted amount of driver 2. Total job cost = beginning balance +DM+DL+OH 3. The balance in Work in Process can be computed by summing the costs of all incomplete jobs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started