Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help please. Thanks 1. Events concerning the Ellen Company for 2015 are described below a. On September 1, 2015, a two-year comprehensive insurance policy

Need help please. Thanks

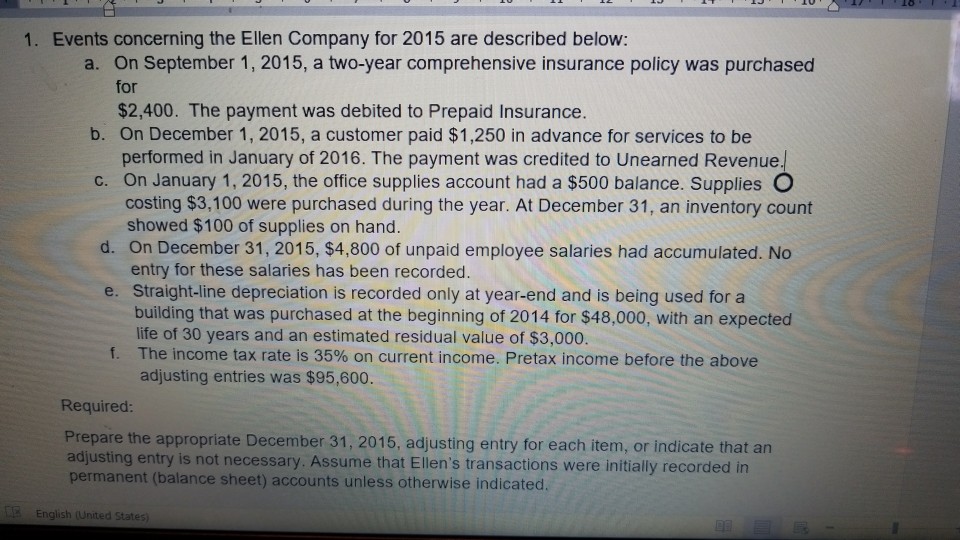

1. Events concerning the Ellen Company for 2015 are described below a. On September 1, 2015, a two-year comprehensive insurance policy was purchased for $2,400. The payment was debited to Prepaid Insurance. b. On December 1, 2015, a customer paid $1,250 in advance for services to be performed in January of 2016. The payment was credited to Unearned Revenue On January 1, 2015, the office supplies account had a $500 balance. Supplies O costing $3,100 were purchased during the year. At December 31, an inventory count c. showed $100 of supplies on hand d. On December 31, 2015, $4,800 of unpaid employee salaries had accumulated. No entry for these salaries has been recorded e. Straight-line depreciation is recorded only at year-end and is being used for a building that was purchased at the beginning of 2014 for $48,000, with an expected life of 30 years and an estimated residual value of $3,000. The income tax rate is 35% on current income. Pretax income before the above adjusting entries was $95,600. f. Required Prepare the appropriate December 31, 2015, adjusting entry for each item, or indicate that an adjusting entry is not necessary. Assume that Ellen's transactions were initially recorded in permanent (balance sheet) accounts unless otherwise indicated English (United StatesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started