Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help please... this is my last chance to upload question please help me with 5 questions please QUESTION 6 1. Questions 6-8 are related

need help please...

this is my last chance to upload question please help me with 5 questions please

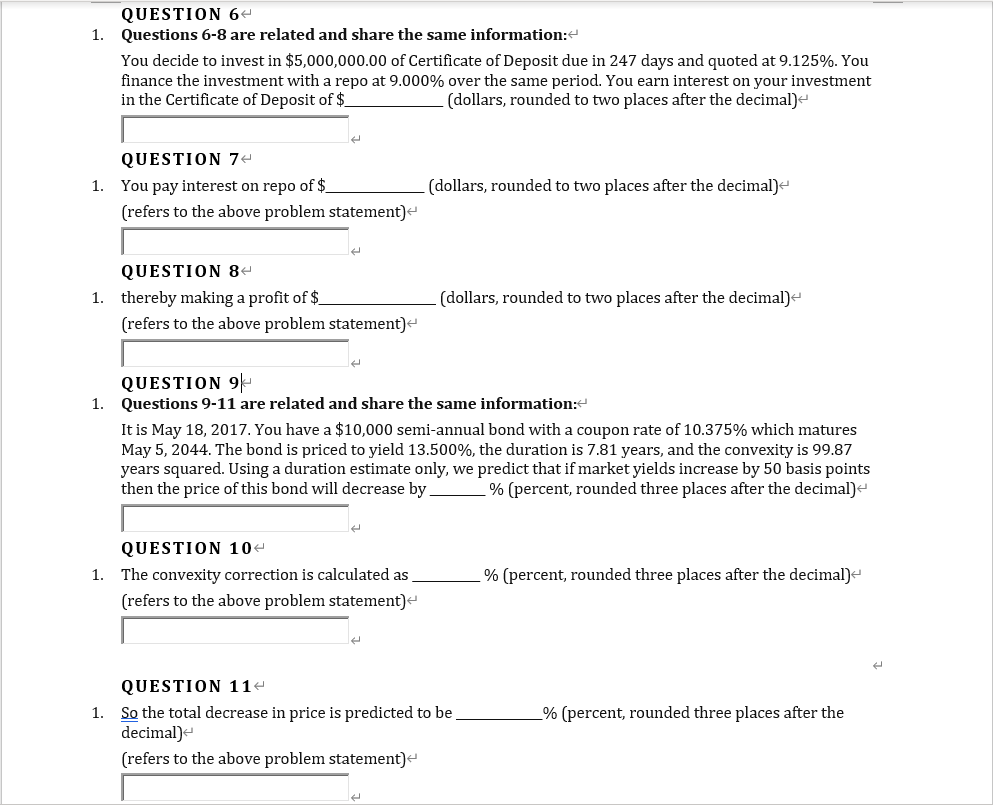

QUESTION 6 1. Questions 6-8 are related and share the same information: You decide to invest in $5,000,000.00 of Certificate of Deposit due in 247 days and quoted at 9.125%. You finance the investment with a repo at 9.000% over the same period. You earn interest on your investment in the Certificate of Deposit of $_ (dollars, rounded to two places after the decimal) QUESTION 7 1. You pay interest on repo of $ (refers to the above problem statement) (dollars, rounded to two places after the decimal) QUESTION 8 1. thereby making a profit of $ (refers to the above problem statement) (dollars, rounded to two places after the decimal) QUESTION 9 1. Questions 9-11 are related and share the same information: It is May 18, 2017. You have a $10,000 semi-annual bond with a coupon rate of 10.375% which matures May 5, 2044. The bond is priced to yield 13.500%, the duration is 7.81 years, and the convexity is 99.87 years squared. Using a duration estimate only, we predict that if market yields increase by 50 basis points then the price of this bond will decrease by % (percent, rounded three places after the decimal) QUESTION 10- 1. The convexity correction is calculated as (refers to the above problem statement) % (percent, rounded three places after the decimal) QUESTION 114 1. So the total decrease in price is predicted to be decimal) (refers to the above problem statement) % (percent, rounded three places after the QUESTION 6 1. Questions 6-8 are related and share the same information: You decide to invest in $5,000,000.00 of Certificate of Deposit due in 247 days and quoted at 9.125%. You finance the investment with a repo at 9.000% over the same period. You earn interest on your investment in the Certificate of Deposit of $_ (dollars, rounded to two places after the decimal) QUESTION 7 1. You pay interest on repo of $ (refers to the above problem statement) (dollars, rounded to two places after the decimal) QUESTION 8 1. thereby making a profit of $ (refers to the above problem statement) (dollars, rounded to two places after the decimal) QUESTION 9 1. Questions 9-11 are related and share the same information: It is May 18, 2017. You have a $10,000 semi-annual bond with a coupon rate of 10.375% which matures May 5, 2044. The bond is priced to yield 13.500%, the duration is 7.81 years, and the convexity is 99.87 years squared. Using a duration estimate only, we predict that if market yields increase by 50 basis points then the price of this bond will decrease by % (percent, rounded three places after the decimal) QUESTION 10- 1. The convexity correction is calculated as (refers to the above problem statement) % (percent, rounded three places after the decimal) QUESTION 114 1. So the total decrease in price is predicted to be decimal) (refers to the above problem statement) % (percent, rounded three places after theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started