Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help plz with accounting for the following questions Payroll Entries Widmer Company had gross wages of $274,000 during the week ended June 17 .

need help plz with accounting for the following questions

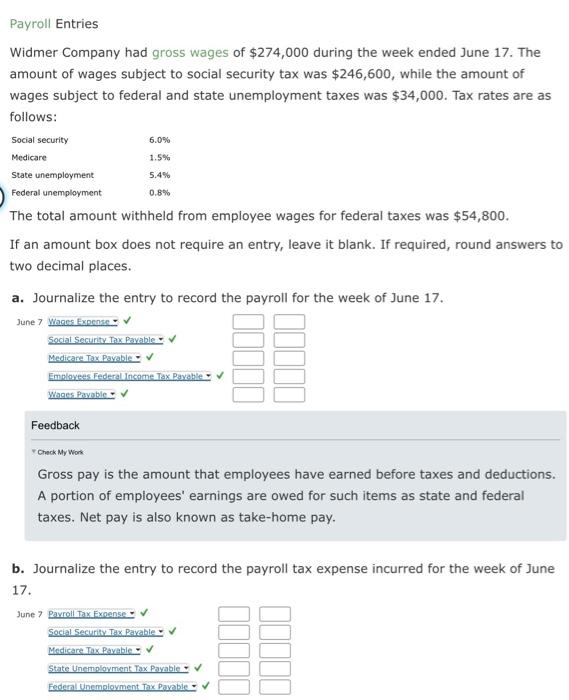

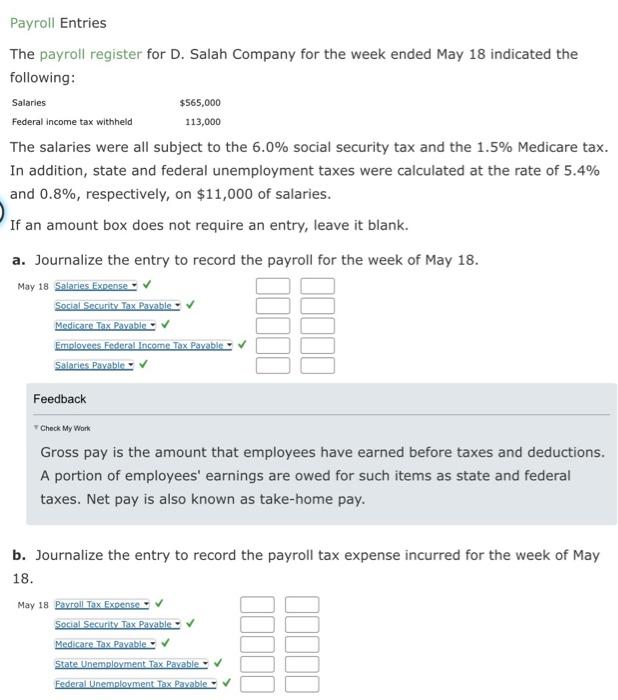

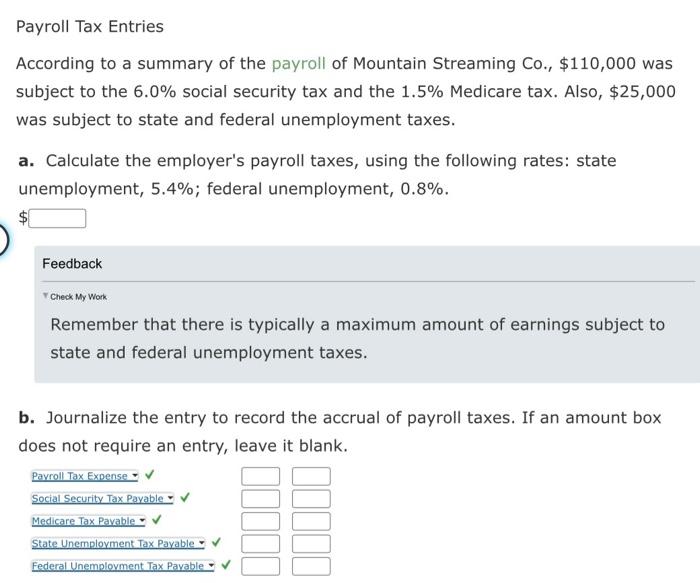

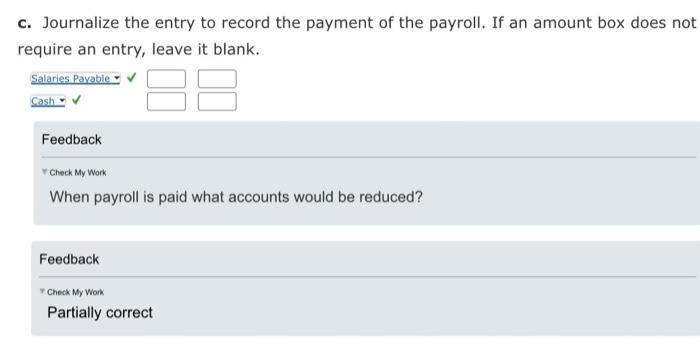

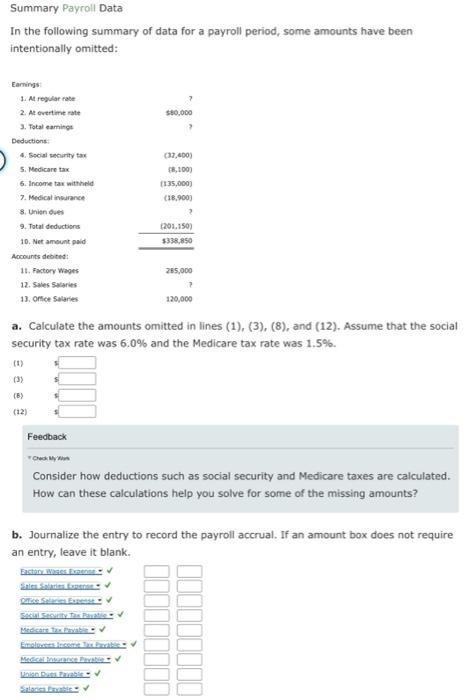

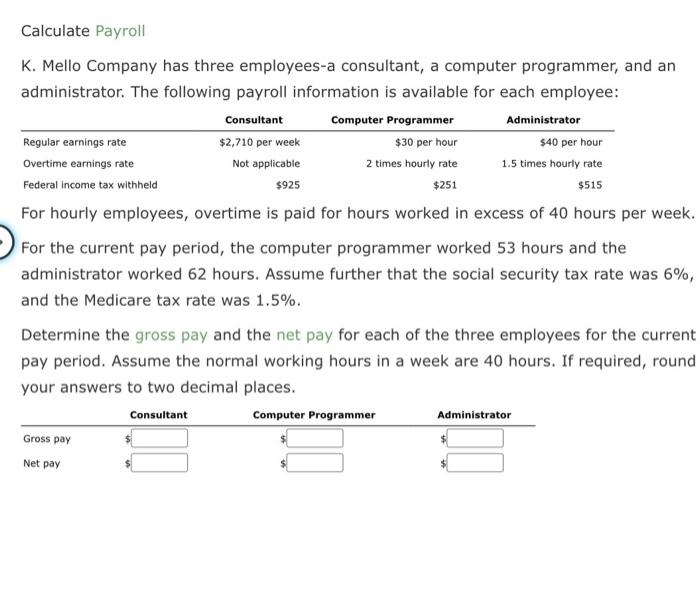

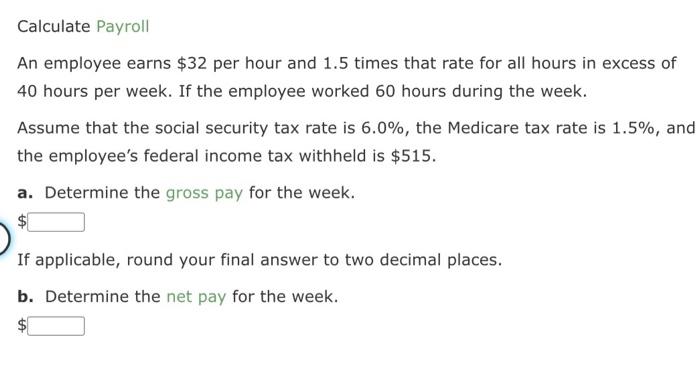

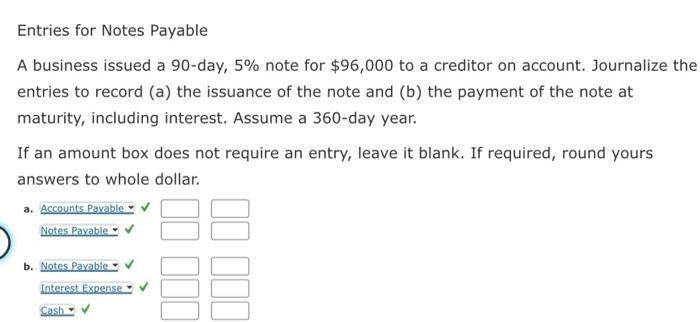

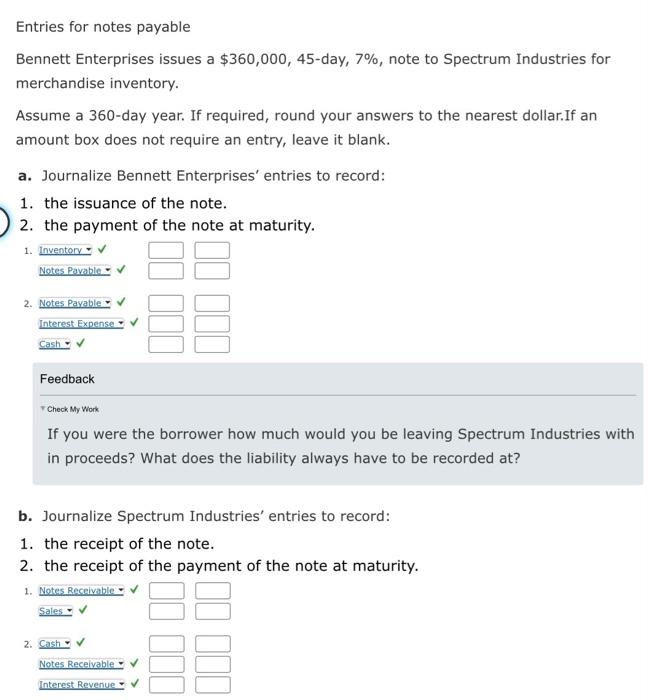

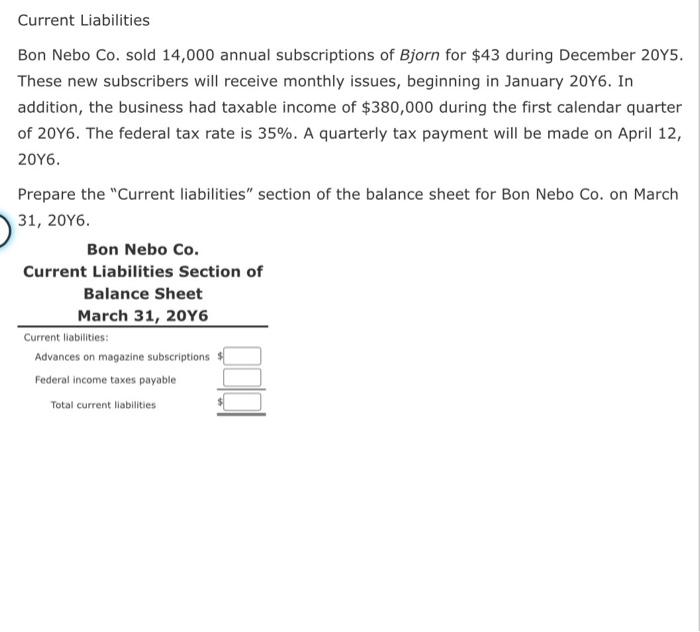

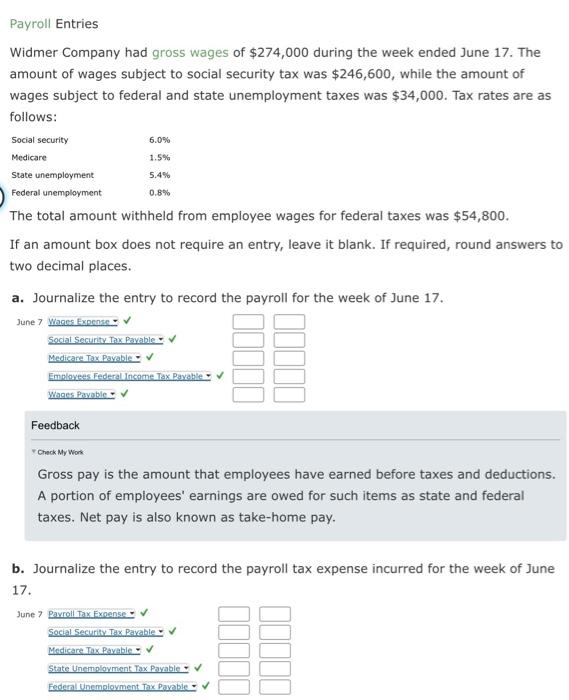

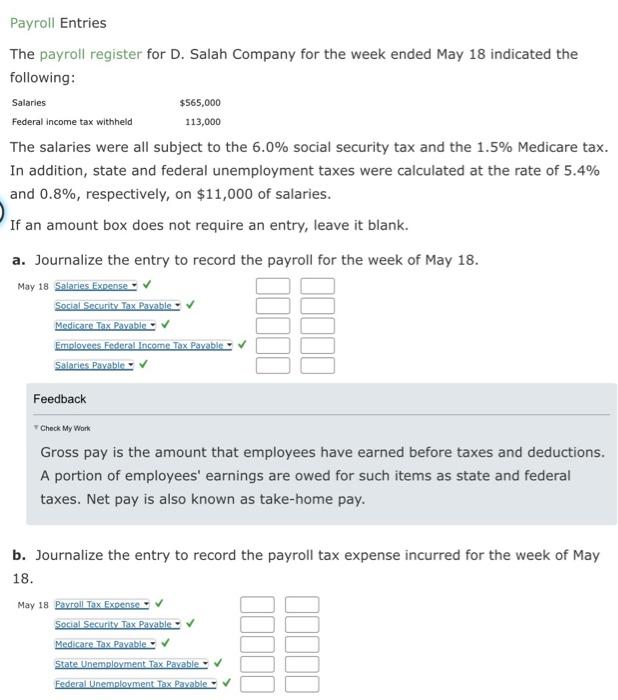

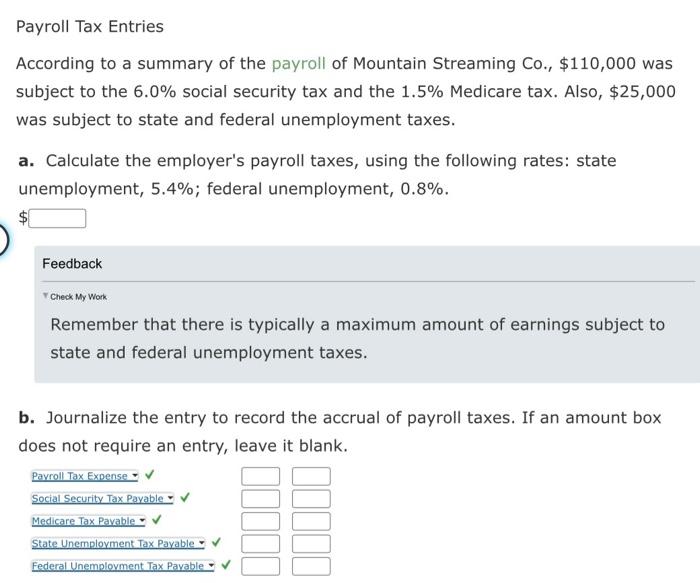

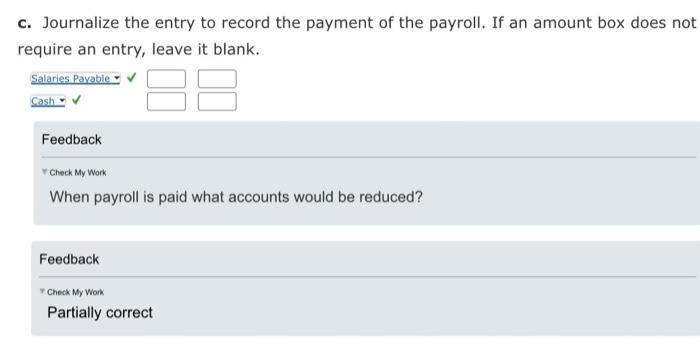

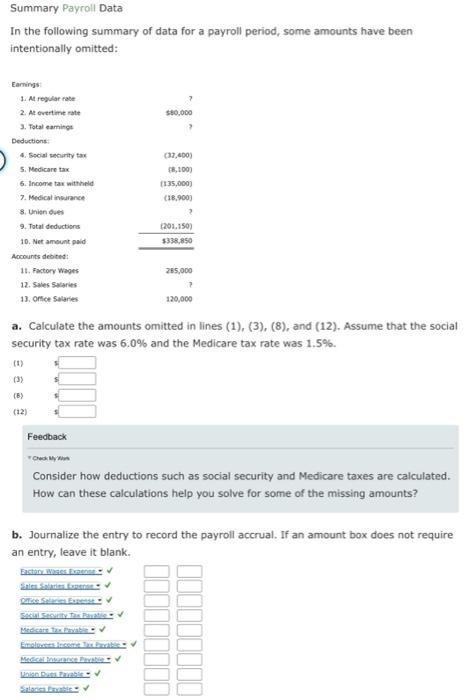

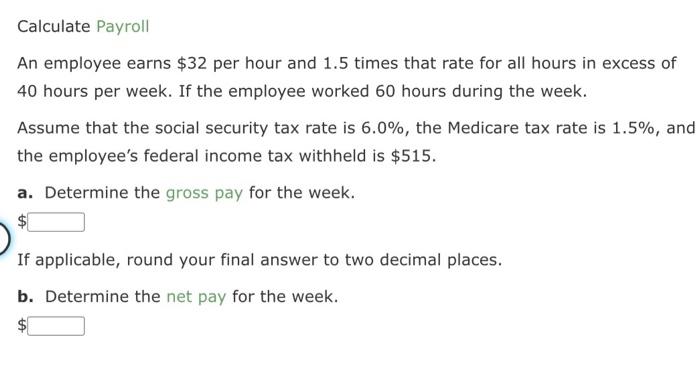

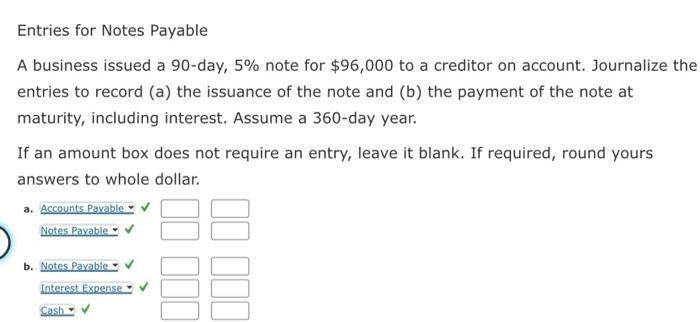

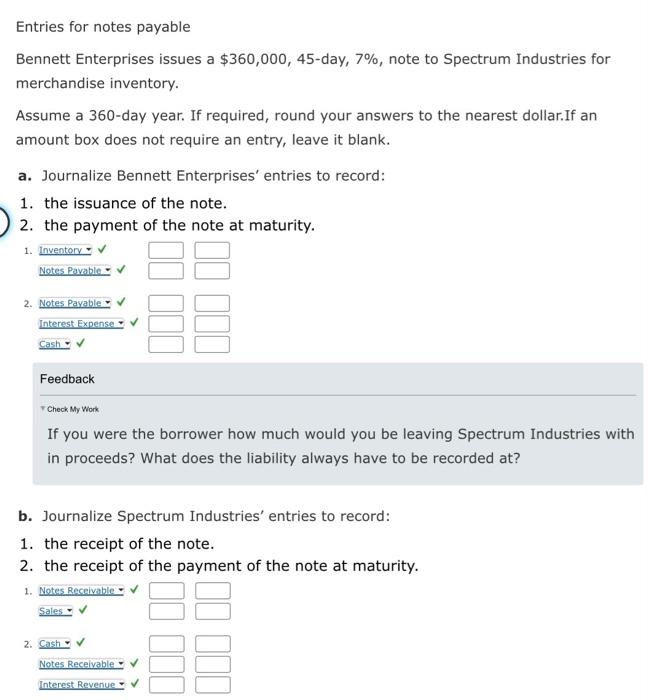

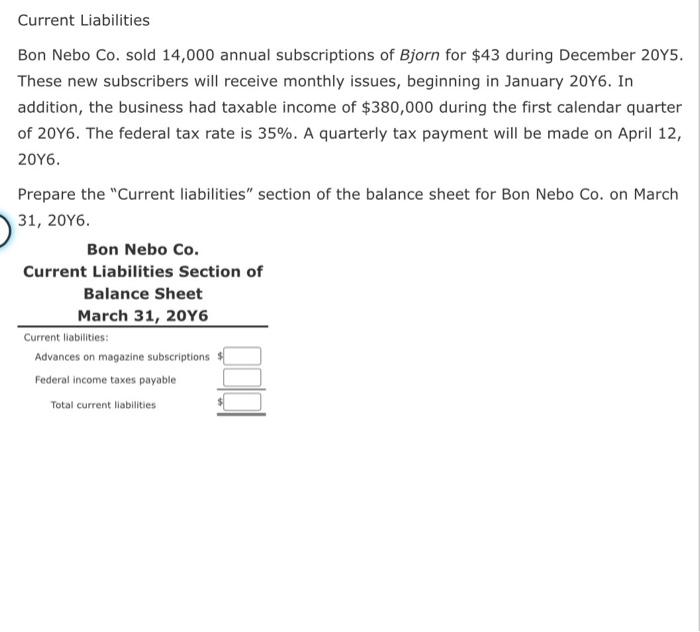

Payroll Entries Widmer Company had gross wages of $274,000 during the week ended June 17 . The amount of wages subject to social security tax was $246,600, while the amount of wages subject to federal and state unemployment taxes was $34,000. Tax rates are as follows: The total amount withheld from employee wages for federal taxes was $54,800. If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places. a. Journalize the entry to record the payroll for the week of June 17. Jun Feedback F Check My Work Gross pay is the amount that employees have earned before taxes and deductions. A portion of employees' earnings are owed for such items as state and federal taxes. Net pay is also known as take-home pay. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. Payroll Entries The payroll register for D. Salah Company for the week ended May 18 indicated the following: The salaries were all subject to the 6.0% social security tax and the 1.5% Medicare tax. In addition, state and federal unemployment taxes were calculated at the rate of 5.4% and 0.8%, respectively, on $11,000 of salaries. If an amount box does not require an entry, leave it blank. a. Journalize the entry to record the payroll for the week of May 18. Mar Feedback F Check My Work: Gross pay is the amount that employees have earned before taxes and deductions. A portion of employees' earnings are owed for such items as state and federal taxes. Net pay is also known as take-home pay. b. Journalize the entry to record the payroll tax expense incurred for the week of May 18. Payroll Tax Entries According to a summary of the payroll of Mountain Streaming Co., $110,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $25,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.8%. $ Feedback Theck My Work Remember that there is typically a maximum amount of earnings subject to state and federal unemployment taxes. b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank. c. Journalize the entry to record the payment of the payroll. If an amount box does not require an entry, leave it blank. Feedback v Check My Work When payroll is paid what accounts would be reduced? Feedback \% check My Work Partially correct Summary Payroll Data In the following summary of data for a payroll period, some amounts have been intentionally omitted: a. Calculate the amounts omitted in lines (1), (3), (8), and (12). Assume that the social security tax rate was 6.0% and the Medicare tax rate was 1.5%. (1) 1 (3) 1 (B) s (12) 1 Feedback wand ay ines Consider how deductions such as social security and Medicare taxes are calculated. How can these calculations help you solve for some of the missing amounts? b. Journalize the entry to record the payroll accrual. If an amount box does not require an entry, leave it blank. Calculate Payroll K. Mello Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: For hourly employees, overtime is paid for hours worked in excess of 40 hours per week. For the current pay period, the computer programmer worked 53 hours and the administrator worked 62 hours. Assume further that the social security tax rate was 6%, and the Medicare tax rate was 1.5%. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places. Calculate Payroll An employee earns $32 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 60 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $515. a. Determine the gross pay for the week. If applicable, round your final answer to two decimal places. b. Determine the net pay for the week. Entries for Notes Payable A business issued a 90 -day, 5% note for $96,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360-day year. If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar. Entries for notes payable Bennett Enterprises issues a $360,000,45-day, 7%, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round your answers to the nearest dollar.If an amount box does not require an entry, leave it blank. a. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. Feedback F Check My Work If you were the borrower how much would you be leaving Spectrum Industries with in proceeds? What does the liability always have to be recorded at? b. Journalize Spectrum Industries' entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity. Current Liabilities Bon Nebo Co. sold 14,000 annual subscriptions of Bjorn for $43 during December 20 Y5. These new subscribers will receive monthly issues, beginning in January 20Y6. In addition, the business had taxable income of $380,000 during the first calendar quarter of 20 Y6. The federal tax rate is 35%. A quarterly tax payment will be made on April 12 , 20Y6 Prepare the "Current liabilities" section of the balance sheet for Bon Nebo Co. on March Payroll Entries Widmer Company had gross wages of $274,000 during the week ended June 17 . The amount of wages subject to social security tax was $246,600, while the amount of wages subject to federal and state unemployment taxes was $34,000. Tax rates are as follows: The total amount withheld from employee wages for federal taxes was $54,800. If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places. a. Journalize the entry to record the payroll for the week of June 17. Jun Feedback F Check My Work Gross pay is the amount that employees have earned before taxes and deductions. A portion of employees' earnings are owed for such items as state and federal taxes. Net pay is also known as take-home pay. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. Payroll Entries The payroll register for D. Salah Company for the week ended May 18 indicated the following: The salaries were all subject to the 6.0% social security tax and the 1.5% Medicare tax. In addition, state and federal unemployment taxes were calculated at the rate of 5.4% and 0.8%, respectively, on $11,000 of salaries. If an amount box does not require an entry, leave it blank. a. Journalize the entry to record the payroll for the week of May 18. Mar Feedback F Check My Work: Gross pay is the amount that employees have earned before taxes and deductions. A portion of employees' earnings are owed for such items as state and federal taxes. Net pay is also known as take-home pay. b. Journalize the entry to record the payroll tax expense incurred for the week of May 18. Payroll Tax Entries According to a summary of the payroll of Mountain Streaming Co., $110,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $25,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.8%. $ Feedback Theck My Work Remember that there is typically a maximum amount of earnings subject to state and federal unemployment taxes. b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank. c. Journalize the entry to record the payment of the payroll. If an amount box does not require an entry, leave it blank. Feedback v Check My Work When payroll is paid what accounts would be reduced? Feedback \% check My Work Partially correct Summary Payroll Data In the following summary of data for a payroll period, some amounts have been intentionally omitted: a. Calculate the amounts omitted in lines (1), (3), (8), and (12). Assume that the social security tax rate was 6.0% and the Medicare tax rate was 1.5%. (1) 1 (3) 1 (B) s (12) 1 Feedback wand ay ines Consider how deductions such as social security and Medicare taxes are calculated. How can these calculations help you solve for some of the missing amounts? b. Journalize the entry to record the payroll accrual. If an amount box does not require an entry, leave it blank. Calculate Payroll K. Mello Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: For hourly employees, overtime is paid for hours worked in excess of 40 hours per week. For the current pay period, the computer programmer worked 53 hours and the administrator worked 62 hours. Assume further that the social security tax rate was 6%, and the Medicare tax rate was 1.5%. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places. Calculate Payroll An employee earns $32 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 60 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $515. a. Determine the gross pay for the week. If applicable, round your final answer to two decimal places. b. Determine the net pay for the week. Entries for Notes Payable A business issued a 90 -day, 5% note for $96,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360-day year. If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar. Entries for notes payable Bennett Enterprises issues a $360,000,45-day, 7%, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round your answers to the nearest dollar.If an amount box does not require an entry, leave it blank. a. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. Feedback F Check My Work If you were the borrower how much would you be leaving Spectrum Industries with in proceeds? What does the liability always have to be recorded at? b. Journalize Spectrum Industries' entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity. Current Liabilities Bon Nebo Co. sold 14,000 annual subscriptions of Bjorn for $43 during December 20 Y5. These new subscribers will receive monthly issues, beginning in January 20Y6. In addition, the business had taxable income of $380,000 during the first calendar quarter of 20 Y6. The federal tax rate is 35%. A quarterly tax payment will be made on April 12 , 20Y6 Prepare the "Current liabilities" section of the balance sheet for Bon Nebo Co. on March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started