Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help plz with accounting for these 5 questions Estimated Income Statements, using Absorption and Varrable Costing Prior to the first month of operations ending

need help plz with accounting for these 5 questions

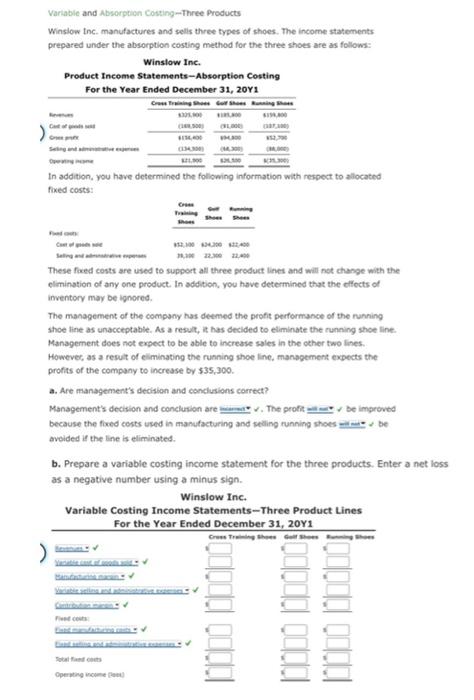

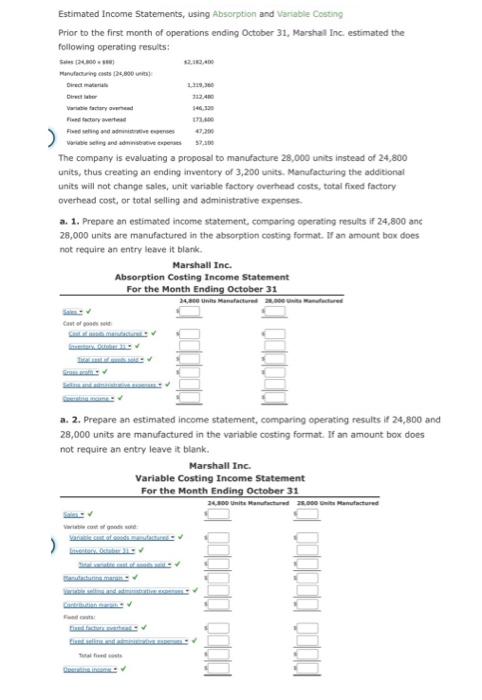

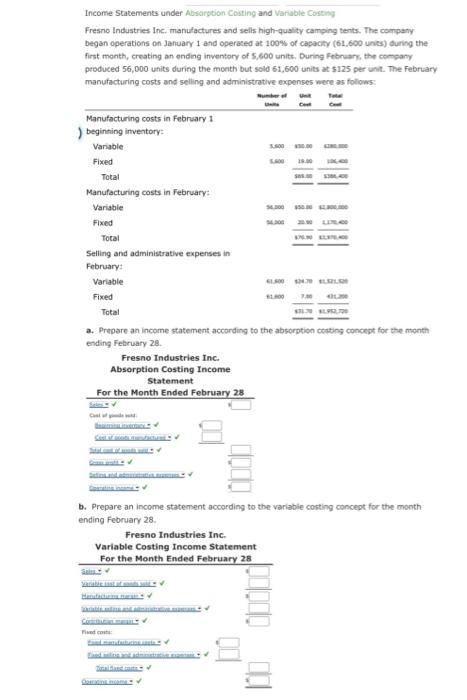

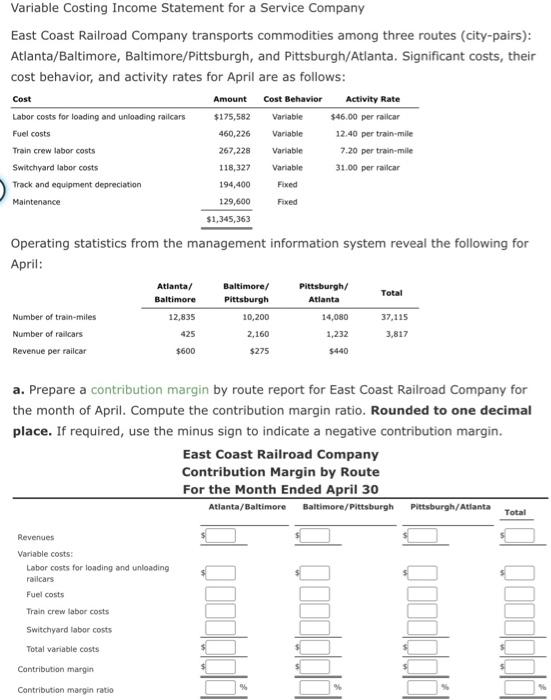

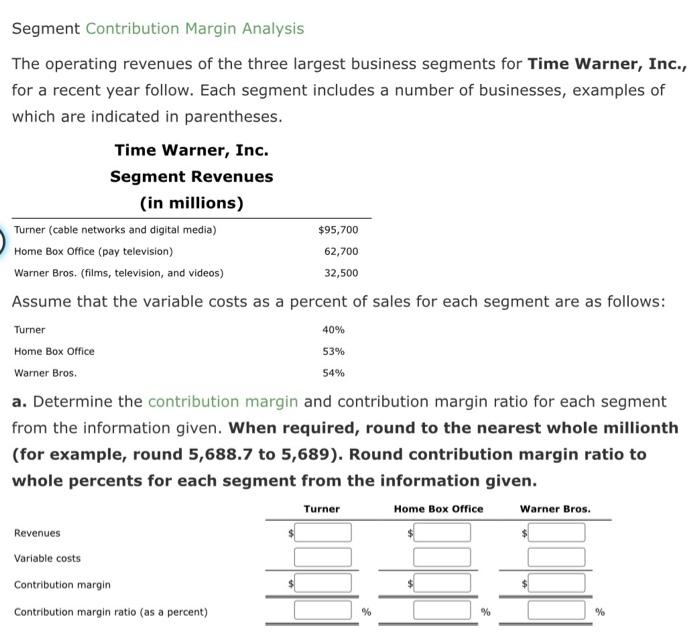

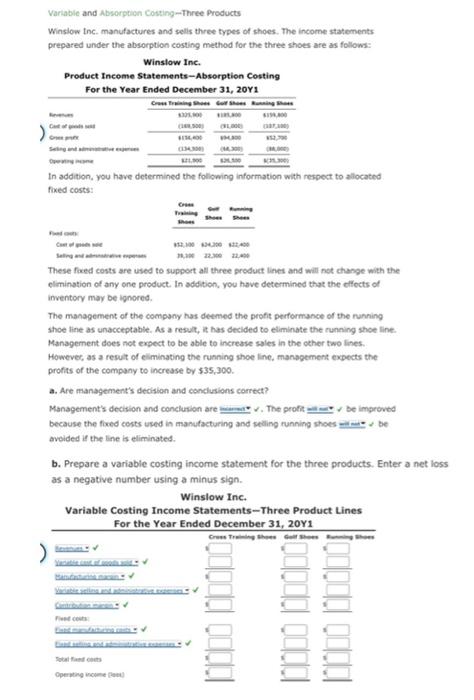

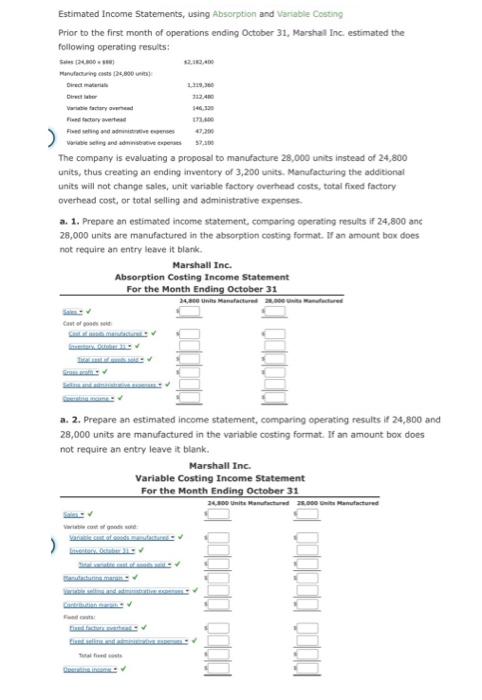

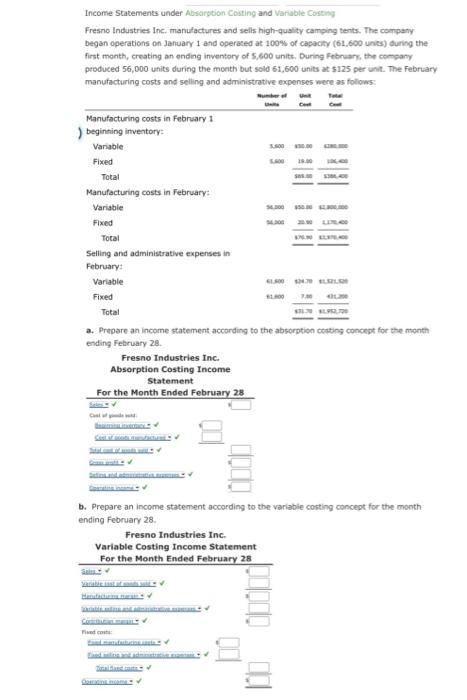

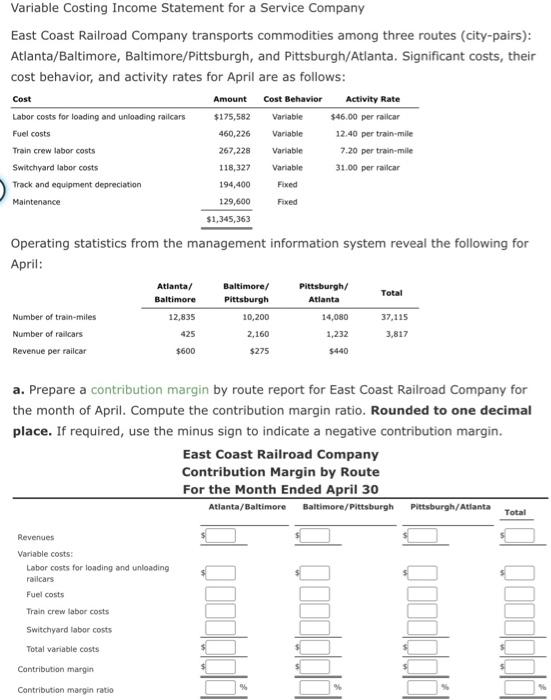

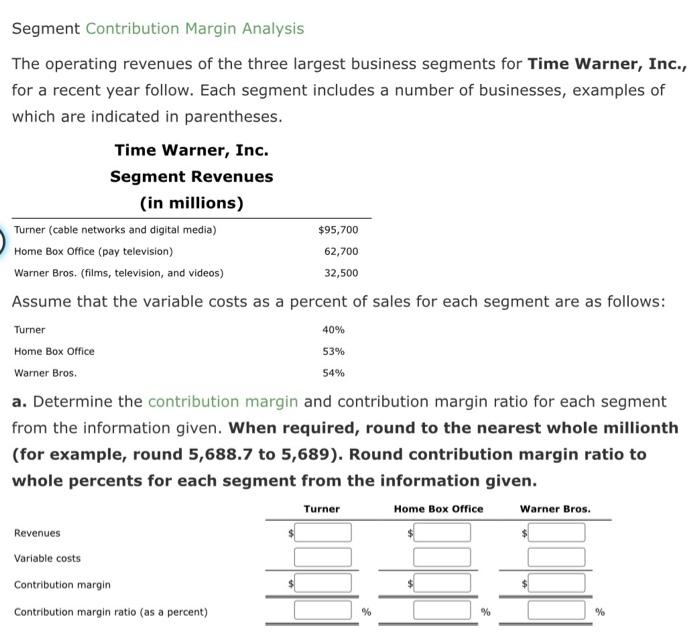

Estimated Income Statements, using Absorption and Varrable Costing Prior to the first month of operations ending October 31, Marshal Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 28,000 units instead of 24,800 units, thus creating an ending imventory of 3,200 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total foced factory. overhead cost, or total selling and administrative expenses. a. 1. Prepare an estimated income statement, combaring operating results if 24,800 ane 28,000 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank. a. 2. Prepare an estimated income statement, comparing operating results if 24,800 and 28,000 units are manufactured in the variable costing format. If an amount box does not require an entry leave it blank. Income Statements under Absorytion Costing and Variable Costing Fresne Industries Inc. manufactures and selis high-quality camping tents. The company began operations on January 1 and operaced at 100% of capacity (61,600 units) ouring the first month, creating an ending inventory of 5,600 units. During Frbnarm, the company produced 56,000 units during the month but sold 61,600 units at $125 per unit. The febraary manufacturing costs and seling and administrative expenses were as follows: a. Prepare an income statement according to the absorption couting concept for the month ending February 28. b. Prepare an income statement according to the variable costing concept for the month ending February 28. Varlable and Absorpticn Costing - Three Products Winsiow tnc. manufactures and selis three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as follows: Winslow Inc. Product Income Statements-Absorption Costing For the Year Ended December 31. 20Y1 In addition, you have determined the following information with respect to allocated foxed costs: These fixed costs are used to support all three product lines and will not change with the elimination of any one product. In addition, you have determined that the effocts of inventory may be ipnored. The management of the company has detmed the profit performance of the runhing shoe line as unacceptable. As a result, it has declded to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a resut of eliminating the running shoe line, management expects the profits of the company to increase by $35,300. a. Are management's dedision and conclusions correct? because the fixed costs used in manufacturing and seding running shoes =1 be aveided if the line is eliminated. b. Prepare a variable costing income statement for the three products. Enter a net loss as a negative number using a minus sign. Variable Costing Income Statement for a Service Company East Coast Railroad Company transports commodities among three routes (city-pairs): Atlanta/Baltimore, Baltimore/Pittsburgh, and Pittsburgh/Atlanta. Significant costs, their cost behavior, and activity rates for April are as follows: Operating statistics from the management information system reveal the following for April: a. Prepare a contribution margin by route report for East Coast Railroad Company for the month of April. Compute the contribution margin ratio. Rounded to one decimal place. If required, use the minus sign to indicate a negative contribution margin. Segment Contribution Margin Analysis The operating revenues of the three largest business segments for Time Warner, Inc., for a recent year follow. Each segment includes a number of businesses, examples of which are indicated in parentheses. Time Warner, Inc. Segment Revenues (in millions) Assume that the variable costs as a percent of sales for each segment are as follows: a. Determine the contribution margin and contribution margin ratio for each segment from the information given. When required, round to the nearest whole millionth (for example, round 5,688.7 to 5,689 ). Round contribution margin ratio to whole percents for each segment from the information given. Estimated Income Statements, using Absorption and Varrable Costing Prior to the first month of operations ending October 31, Marshal Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 28,000 units instead of 24,800 units, thus creating an ending imventory of 3,200 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total foced factory. overhead cost, or total selling and administrative expenses. a. 1. Prepare an estimated income statement, combaring operating results if 24,800 ane 28,000 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank. a. 2. Prepare an estimated income statement, comparing operating results if 24,800 and 28,000 units are manufactured in the variable costing format. If an amount box does not require an entry leave it blank. Income Statements under Absorytion Costing and Variable Costing Fresne Industries Inc. manufactures and selis high-quality camping tents. The company began operations on January 1 and operaced at 100% of capacity (61,600 units) ouring the first month, creating an ending inventory of 5,600 units. During Frbnarm, the company produced 56,000 units during the month but sold 61,600 units at $125 per unit. The febraary manufacturing costs and seling and administrative expenses were as follows: a. Prepare an income statement according to the absorption couting concept for the month ending February 28. b. Prepare an income statement according to the variable costing concept for the month ending February 28. Varlable and Absorpticn Costing - Three Products Winsiow tnc. manufactures and selis three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as follows: Winslow Inc. Product Income Statements-Absorption Costing For the Year Ended December 31. 20Y1 In addition, you have determined the following information with respect to allocated foxed costs: These fixed costs are used to support all three product lines and will not change with the elimination of any one product. In addition, you have determined that the effocts of inventory may be ipnored. The management of the company has detmed the profit performance of the runhing shoe line as unacceptable. As a result, it has declded to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a resut of eliminating the running shoe line, management expects the profits of the company to increase by $35,300. a. Are management's dedision and conclusions correct? because the fixed costs used in manufacturing and seding running shoes =1 be aveided if the line is eliminated. b. Prepare a variable costing income statement for the three products. Enter a net loss as a negative number using a minus sign. Variable Costing Income Statement for a Service Company East Coast Railroad Company transports commodities among three routes (city-pairs): Atlanta/Baltimore, Baltimore/Pittsburgh, and Pittsburgh/Atlanta. Significant costs, their cost behavior, and activity rates for April are as follows: Operating statistics from the management information system reveal the following for April: a. Prepare a contribution margin by route report for East Coast Railroad Company for the month of April. Compute the contribution margin ratio. Rounded to one decimal place. If required, use the minus sign to indicate a negative contribution margin. Segment Contribution Margin Analysis The operating revenues of the three largest business segments for Time Warner, Inc., for a recent year follow. Each segment includes a number of businesses, examples of which are indicated in parentheses. Time Warner, Inc. Segment Revenues (in millions) Assume that the variable costs as a percent of sales for each segment are as follows: a. Determine the contribution margin and contribution margin ratio for each segment from the information given. When required, round to the nearest whole millionth (for example, round 5,688.7 to 5,689 ). Round contribution margin ratio to whole percents for each segment from the information given

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started