Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help plz with accounting for these 6 questions Absorption Costing Income Statement On October 31, the end of the first month of operations, Maryville

need help plz with accounting for these 6 questions

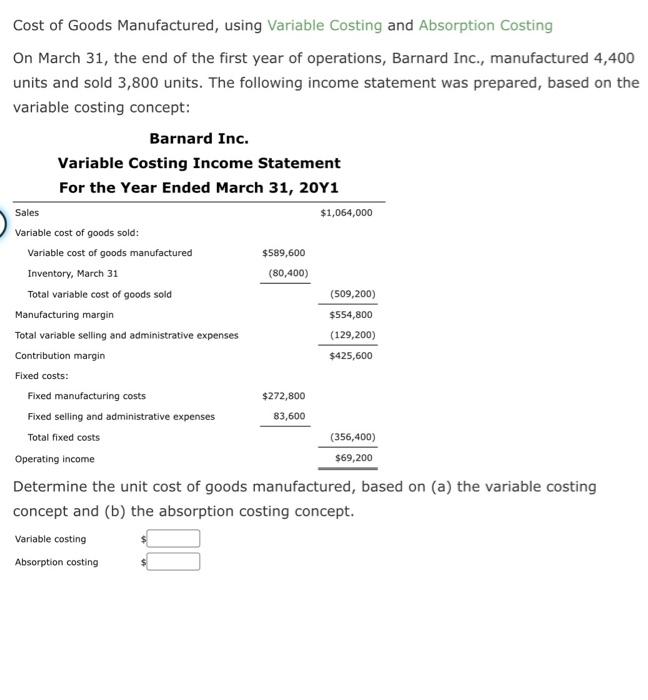

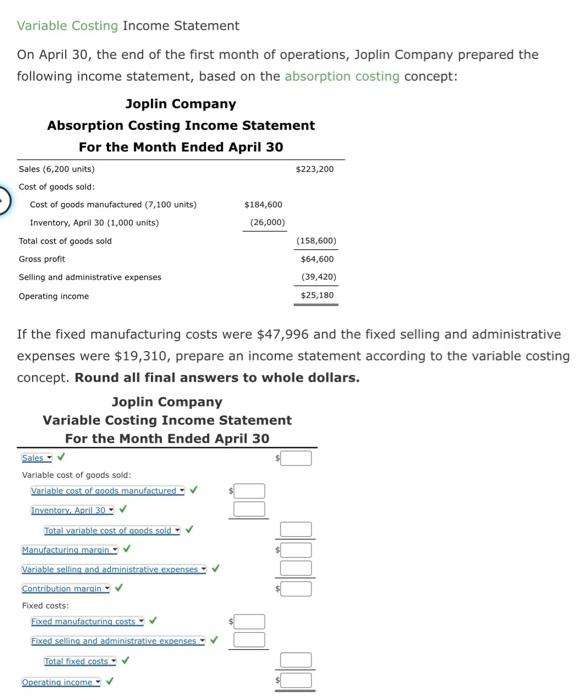

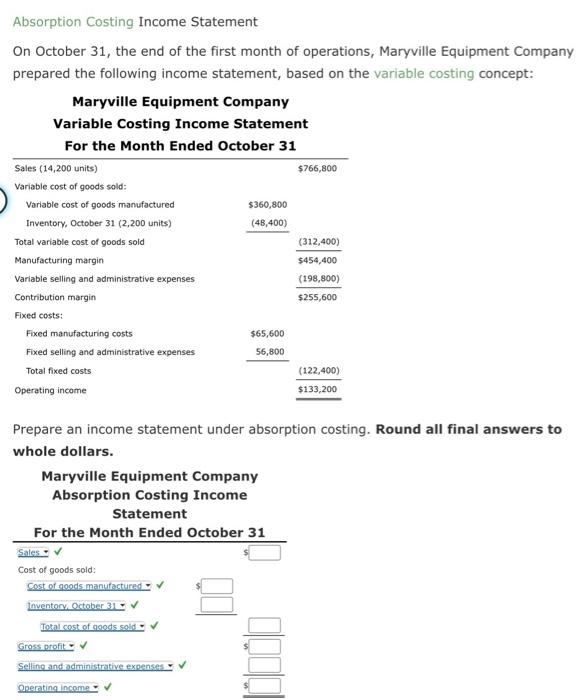

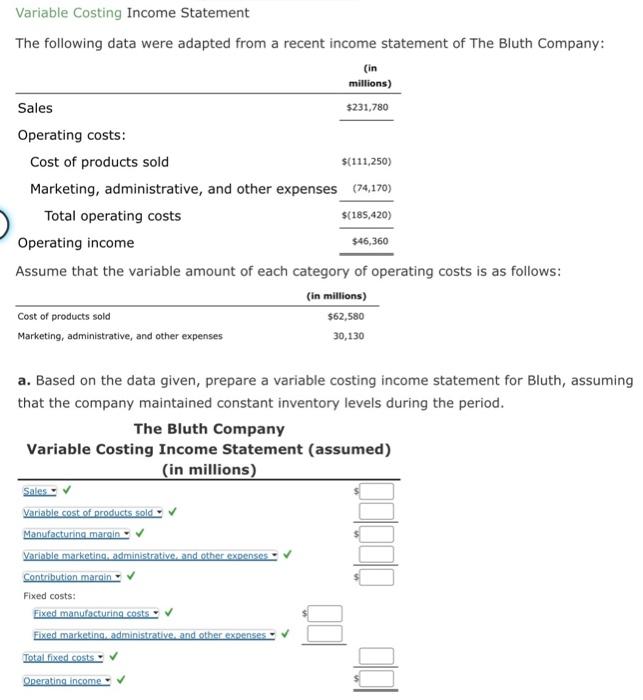

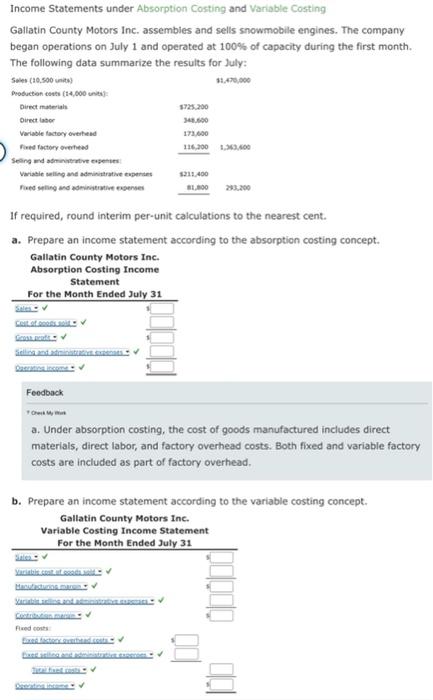

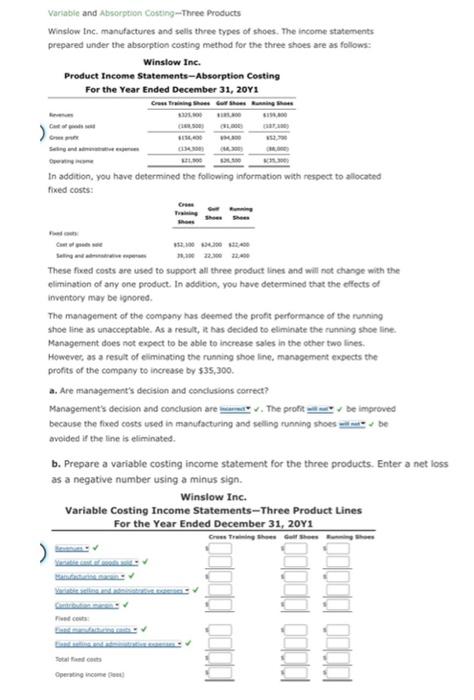

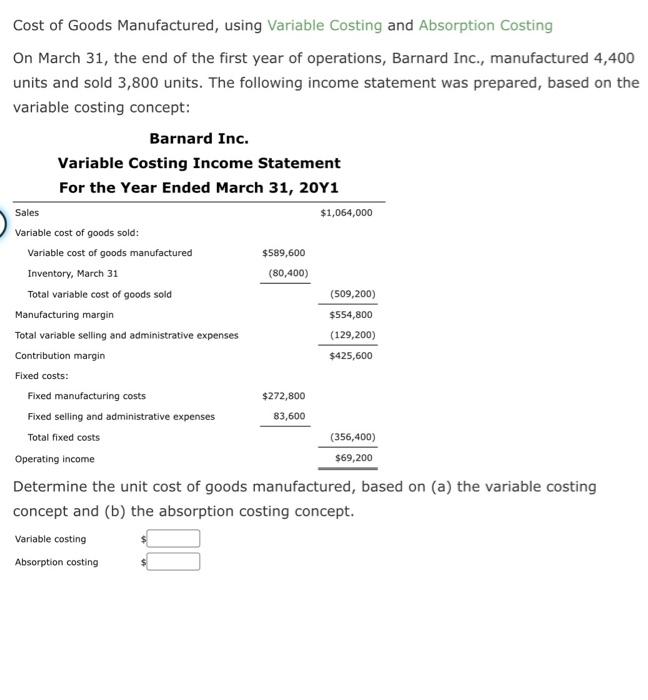

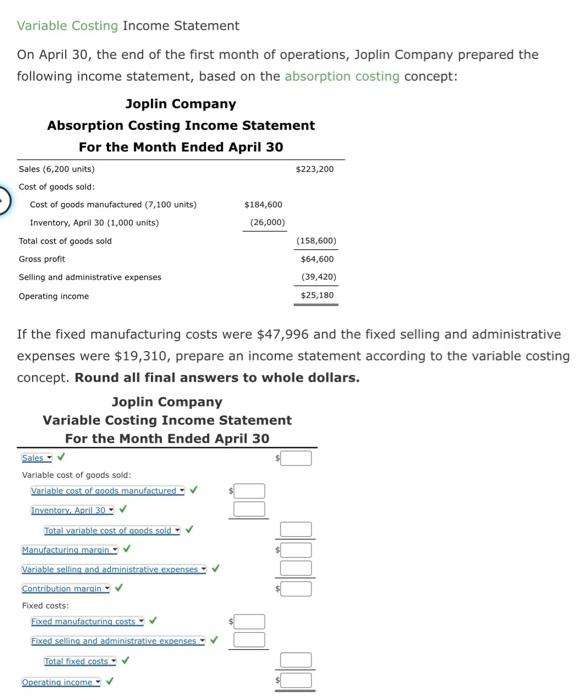

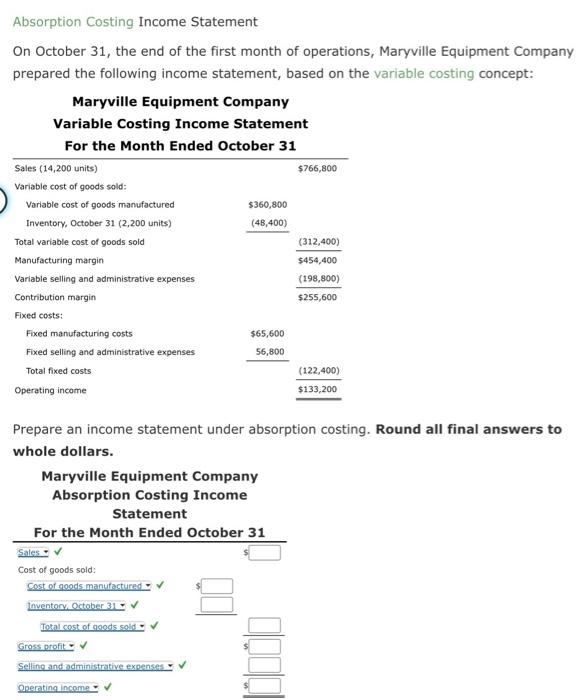

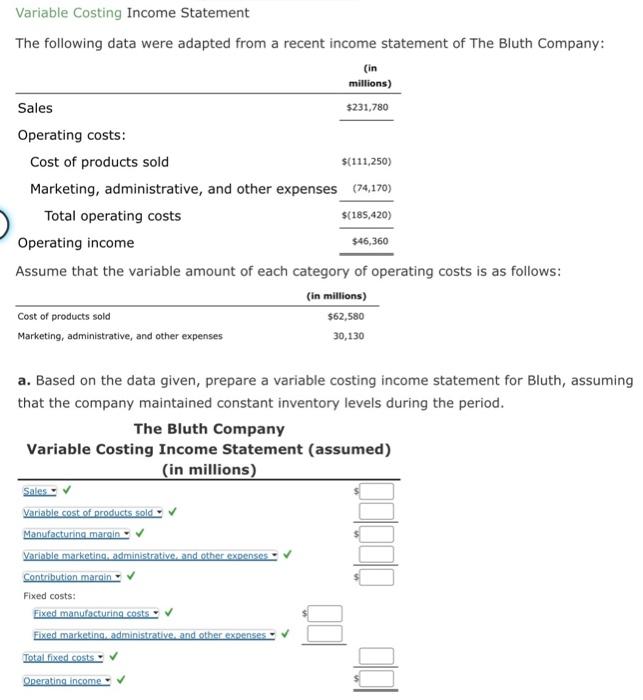

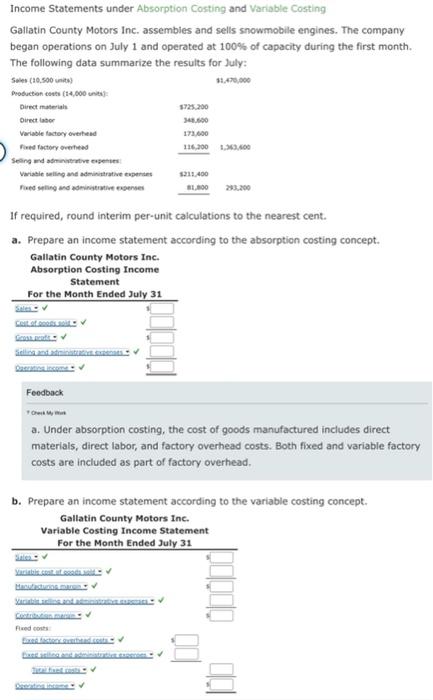

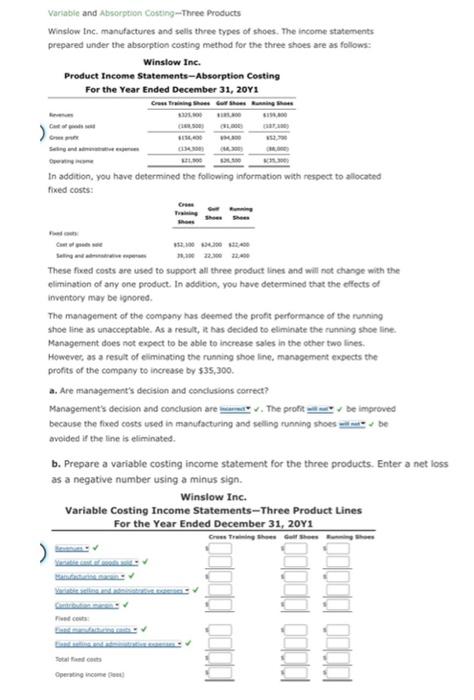

Absorption Costing Income Statement On October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing. Round all final answers to whole dollars. Income Statements under Absorption Costing and Variable Costing Gallatin County Motors Inc. assembies and sells snowmobile engines. The company began operations on July 1 and operated at 100% of capacity during the first month. The following data summarize the results for July: If required, round interim per-unit calculations to the nearest cent. a. Prepare an income statement according to the absorption costing concept. Feodback a. Under absorption costing, the cost of goods manufactured includes direct materials, direct labor, and factory overhead costs. Both fixed and variable factory costs are included as part of factory overhead. b. Prepare an income statement according to the variable costing concept. Varlable and Absorpticn Costing - Three Products Winsiow tnc. manufactures and selis three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as follows: Winslow Inc. Product Income Statements-Absorption Costing For the Year Ended December 31. 20Y1 In addition, you have determined the following information with respect to allocated foxed costs: These fixed costs are used to support all three product lines and will not change with the elimination of any one product. In addition, you have determined that the effocts of inventory may be ipnored. The management of the company has detmed the profit performance of the runhing shoe line as unacceptable. As a result, it has declded to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a resut of eliminating the running shoe line, management expects the profits of the company to increase by $35,300. a. Are management's dedision and conclusions correct? because the fixed costs used in manufacturing and seding running shoes =1 be aveided if the line is eliminated. b. Prepare a variable costing income statement for the three products. Enter a net loss as a negative number using a minus sign. Cost of Goods Manufactured, using Variable Costing and Absorption Costing On March 31, the end of the first year of operations, Barnard Inc., manufactured 4,400 units and sold 3,800 units. The following income statement was prepared, based on the variable costing concept: vetermne tne unt cost or gooas manuracturea, Dasea on (a) the variable costing concept and (b) the absorption costing concept. Variable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: If the fixed manufacturing costs were $47,996 and the fixed selling and administrative expenses were $19,310, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Variable Costing Income Statement The following data were adapted from a recent income statement of The Bluth Company: Assume that the variable amount of each category of operating costs is as follows: a. Based on the data given, prepare a variable costing income statement for Bluth, assuming that the company maintained constant inventory levels during the period

Absorption Costing Income Statement On October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing. Round all final answers to whole dollars. Income Statements under Absorption Costing and Variable Costing Gallatin County Motors Inc. assembies and sells snowmobile engines. The company began operations on July 1 and operated at 100% of capacity during the first month. The following data summarize the results for July: If required, round interim per-unit calculations to the nearest cent. a. Prepare an income statement according to the absorption costing concept. Feodback a. Under absorption costing, the cost of goods manufactured includes direct materials, direct labor, and factory overhead costs. Both fixed and variable factory costs are included as part of factory overhead. b. Prepare an income statement according to the variable costing concept. Varlable and Absorpticn Costing - Three Products Winsiow tnc. manufactures and selis three types of shoes. The income statements prepared under the absorption costing method for the three shoes are as follows: Winslow Inc. Product Income Statements-Absorption Costing For the Year Ended December 31. 20Y1 In addition, you have determined the following information with respect to allocated foxed costs: These fixed costs are used to support all three product lines and will not change with the elimination of any one product. In addition, you have determined that the effocts of inventory may be ipnored. The management of the company has detmed the profit performance of the runhing shoe line as unacceptable. As a result, it has declded to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a resut of eliminating the running shoe line, management expects the profits of the company to increase by $35,300. a. Are management's dedision and conclusions correct? because the fixed costs used in manufacturing and seding running shoes =1 be aveided if the line is eliminated. b. Prepare a variable costing income statement for the three products. Enter a net loss as a negative number using a minus sign. Cost of Goods Manufactured, using Variable Costing and Absorption Costing On March 31, the end of the first year of operations, Barnard Inc., manufactured 4,400 units and sold 3,800 units. The following income statement was prepared, based on the variable costing concept: vetermne tne unt cost or gooas manuracturea, Dasea on (a) the variable costing concept and (b) the absorption costing concept. Variable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: If the fixed manufacturing costs were $47,996 and the fixed selling and administrative expenses were $19,310, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Variable Costing Income Statement The following data were adapted from a recent income statement of The Bluth Company: Assume that the variable amount of each category of operating costs is as follows: a. Based on the data given, prepare a variable costing income statement for Bluth, assuming that the company maintained constant inventory levels during the period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started