Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help plz with accounting for these 6 questions plz Entries for Factory Costs and Jobs Completed Colleglate Publishing Inc. began printing operations on March

need help plz with accounting for these 6 questions plz

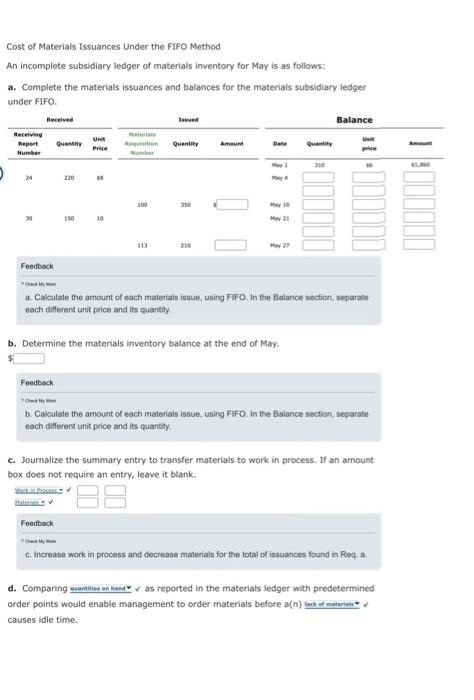

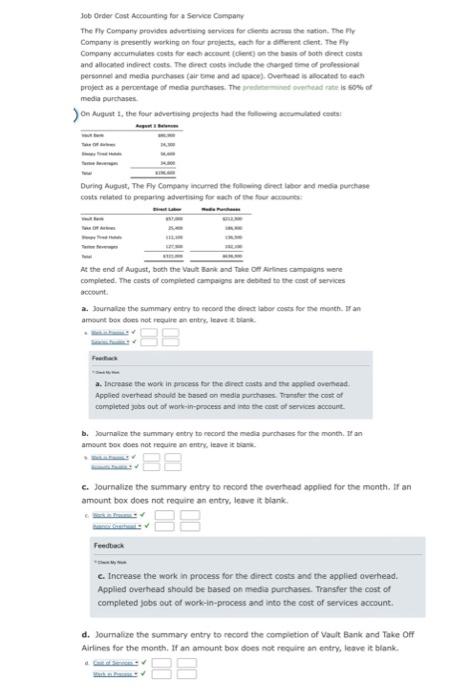

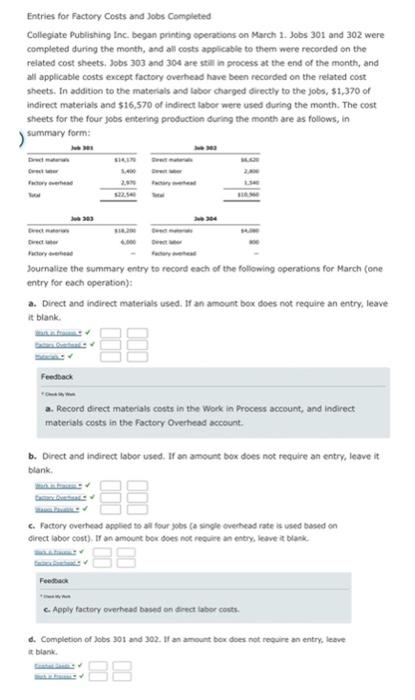

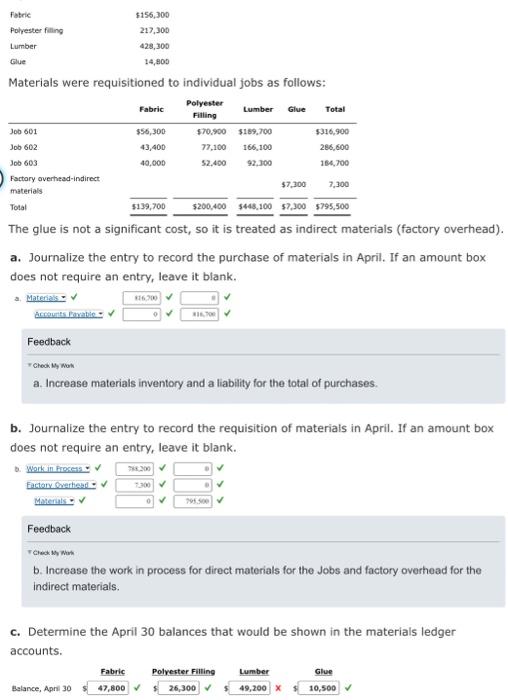

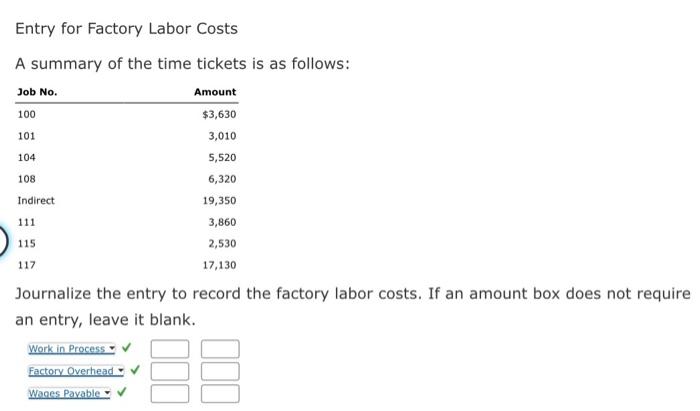

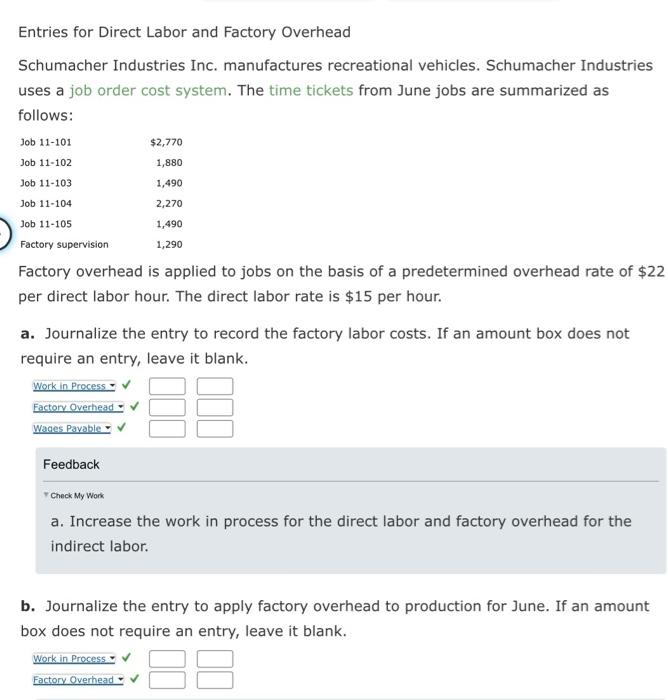

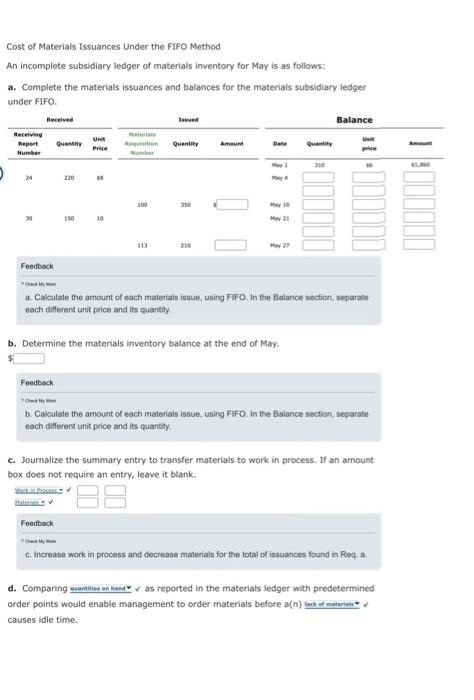

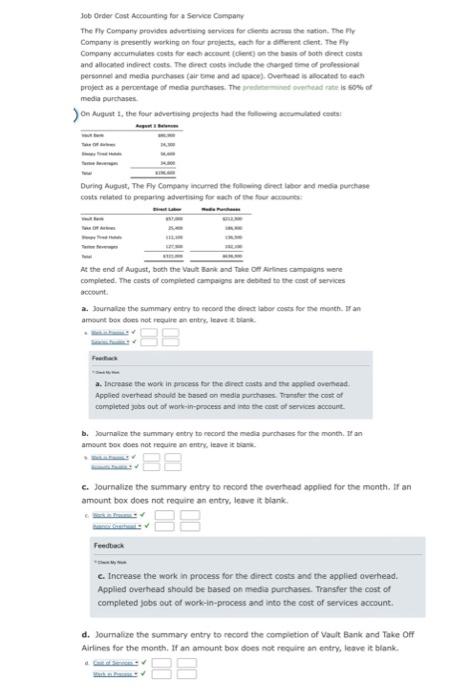

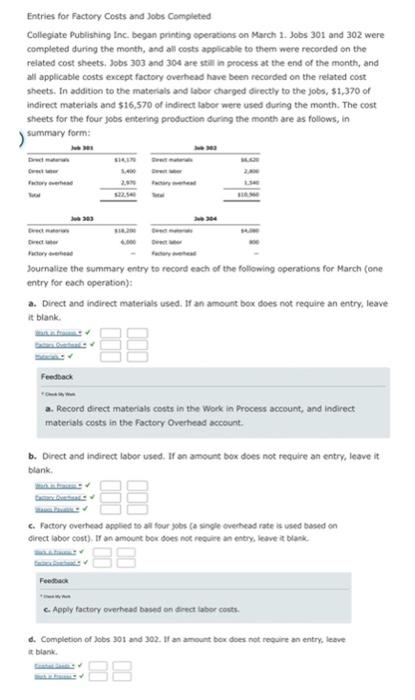

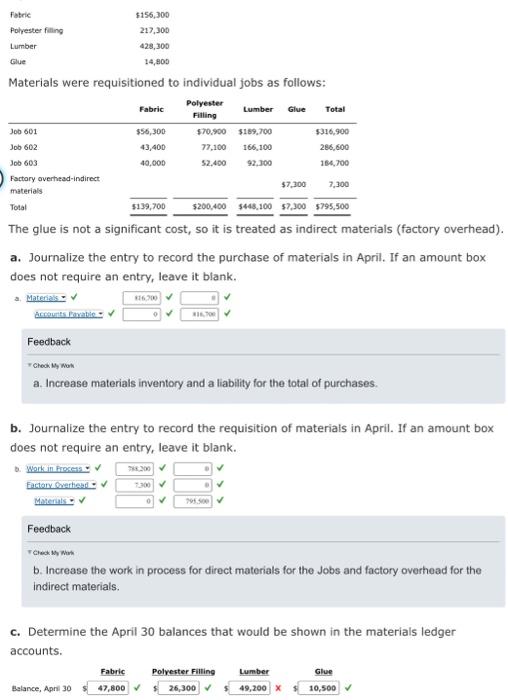

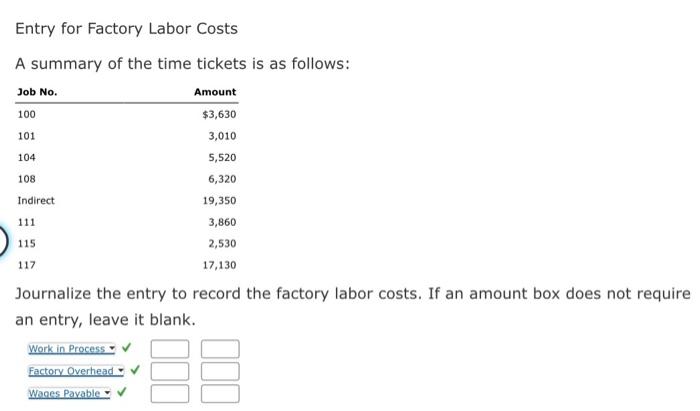

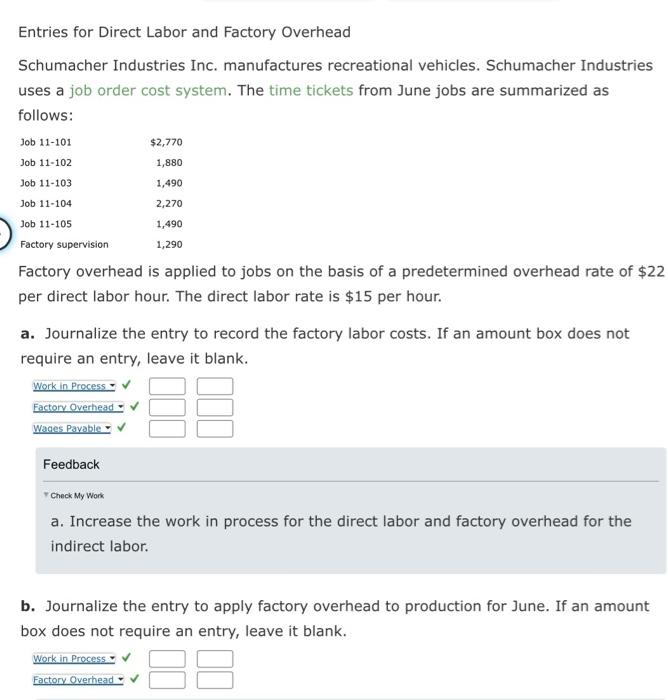

Entries for Factory Costs and Jobs Completed Colleglate Publishing Inc. began printing operations on March 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them wore recorded on the reiated cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $1,370 of indirect materials and $16,$70 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in I summary form: Journalize the summary entry to record each of the following operations for March (one entry for each operation): a. Direct and indirect materials used. If an amount box does not require an entry, leave it biank. Feedeack a. Record direct materials costs in the Work in Process account, and indirect materials costs in the Foctory Overhead account. b. Direct and indirect labor vsed. If an amount box does not require an entry, leave it blank. c. Factory overhead apoled to all four yos (a sngle ovechesd rate is used based on direct labor cost), If an amoune bor boes noe reoulre an entry, leave it black. Feoseace c. Apply factory overtead based on direct labor costs. c. Completion of 7065301 and 302 . If an amount ber does not require an entry, lebve it blank. Entry for Factory Labor Costs A summary of the time tickets is as follows: Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Entries for Direct Labor and Factory Overhead Schumacher Industries Inc. manufactures recreational vehicles. Schumacher Industries uses a job order cost system. The time tickets from June jobs are summarized as follows: Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $22 per direct labor hour. The direct labor rate is $15 per hour. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Feedback r Check My Work a. Increase the work in process for the direct labor and factory overhead for the indirect labor. b. Journalize the entry to apply factory overhead to production for June. If an amount box does not require an entry, leave it blank. Materials were requisitioned to individual jobs as follows: The glue is not a significant cost, so it is treated as indirect materials (factory overhead). a. Journalize the entry to record the purchase of materials in April. If an amount box does not require an entry, leave it blank. Feedback screak wh wom a. Increase materials inventory and a liability for the total of purchases. b. Journalize the entry to record the requisition of materiais in April. If an amount box does not require an entry, leave it blank. Feedback b. Increase the work in process for direct materials for the Jobs and factory overhead for the indirect materials. c. Determine the April 30 balances that would be shown in the materials ledger accounts. Cost of Materials Issuances Under the FIFO Method An incomplete subsidiary ledger of materials inventory for May is as follows: a. Complete the materials issuances and balances for the materials subsidiary ledger under FIFO. Feedback a. Calculate the amount of each materials issue, using FIFO, In the Balance section, separate each ditferent unit price and its quantity. b. Determine the materials inventory balance at the end of May. Feedback romuren b. Casculate the amount of each materials issue, using FIFO. In the Balance section, separate each different unit price and its quantify c. Journalize the summary entry to transfer materials to work in process, If an amount box does not require an entry, leave it blank. Feedback c. Increase work in process and decrease materials for the total of issuances found in Req, a. d. Comparing as reported in the materials ledger with predetermined order points would enable management to order materials before a(n) causes idle time. Job Order Cost Accounting for a Sevice Company The fy Company provides advertising servioes for clients derses the sation. The Fr Company is presently wirking on four projects, each for a differest clent. The fity and allocaned indirect couts. The direct coits include the charged tese of prolessionat personnel and medis purchases (air cane and ad sace). Overtseae is allocated to each media purchases. During August, The fly Company imarred the folineing firect labor and mesa purchase costs reiated to preparang advertising for wach of the fov acrovits: At the end of Aupust, boch the Waut Iank and Take cef Arines campoigns were completed. The cists of complefed campaips are debied to the cont ef services vocownt. a. Jaurnalize the summary entery to record the divact labor costs for me monch. If an b. Journalize the summory entry to necord the nedla punchases for the month, It an amsune boi does not require an entro, iebve it bars. c. Journalize the summary entry to recoed the sverhead applied for the month. If an amount box does not reguire an entry, Ieave it blank. c. Fendoak c. Increase the work in process for the direct costs and the applied overhead. Applied overhead should be based on media purchases. Transfer the cost of completed jobs out of work-in-process and into the cont of services account. d. Journalize the summary entry to record the completion of Vault Bank and Take Off Airlines for the month, if an amount box does not reeuire an entry, leave it blank. a. id

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started