Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help plz with these 5 questions for accounting Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Assuming

need help plz with these 5 questions for accounting

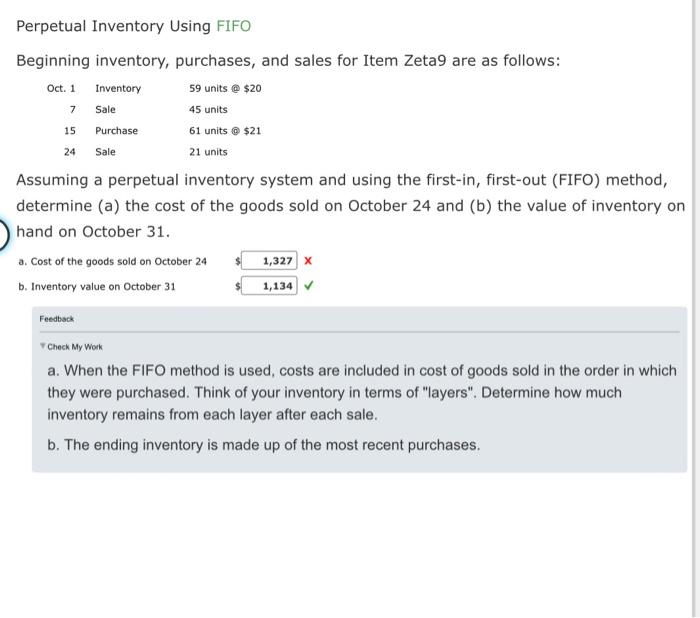

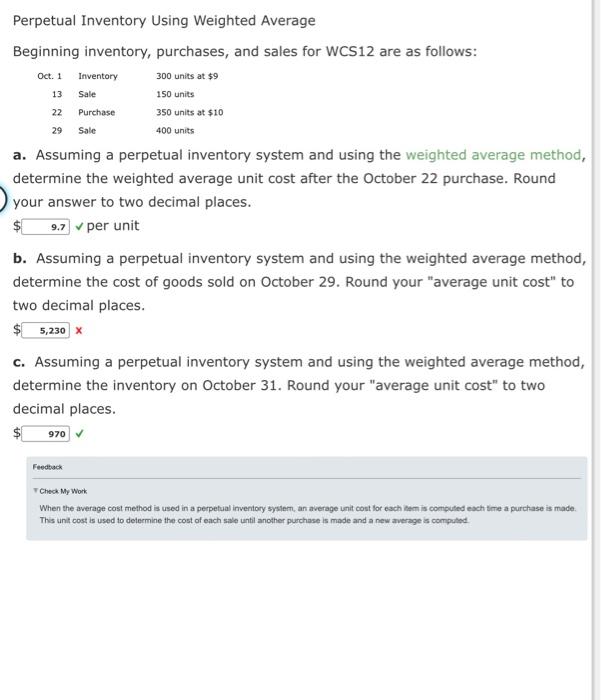

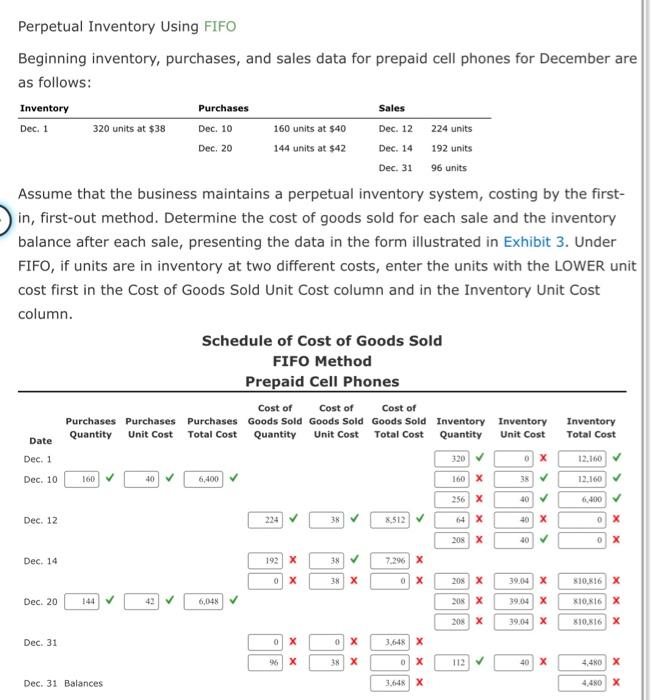

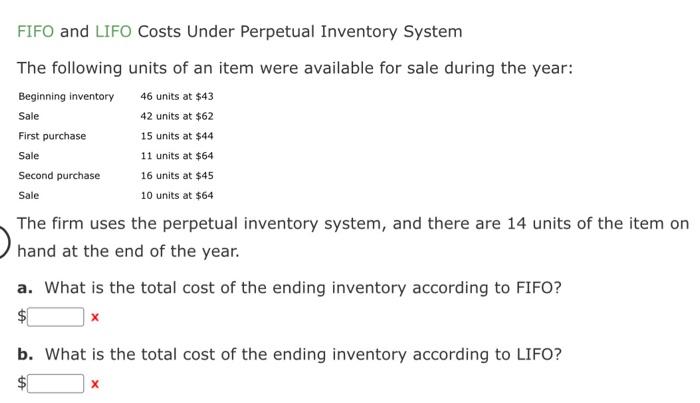

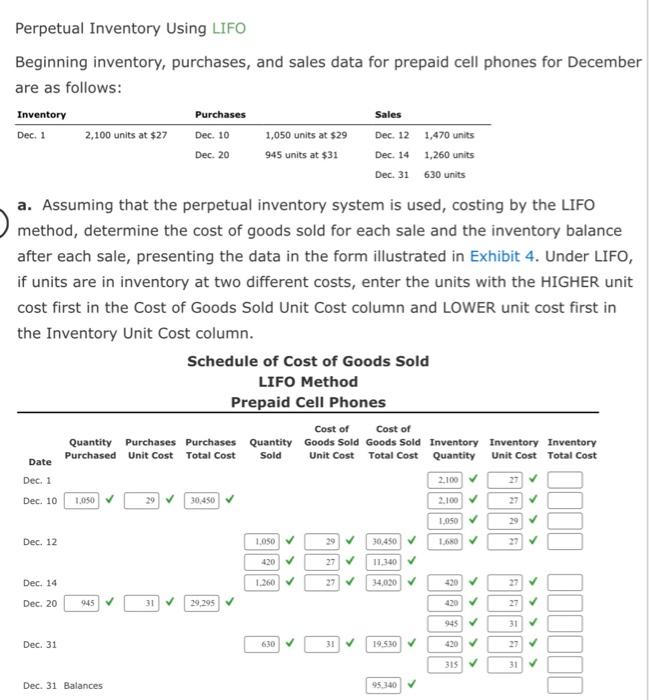

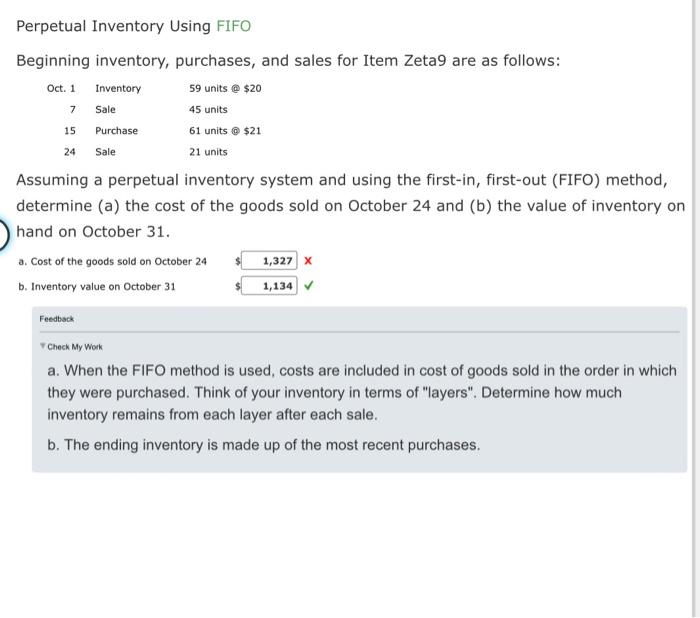

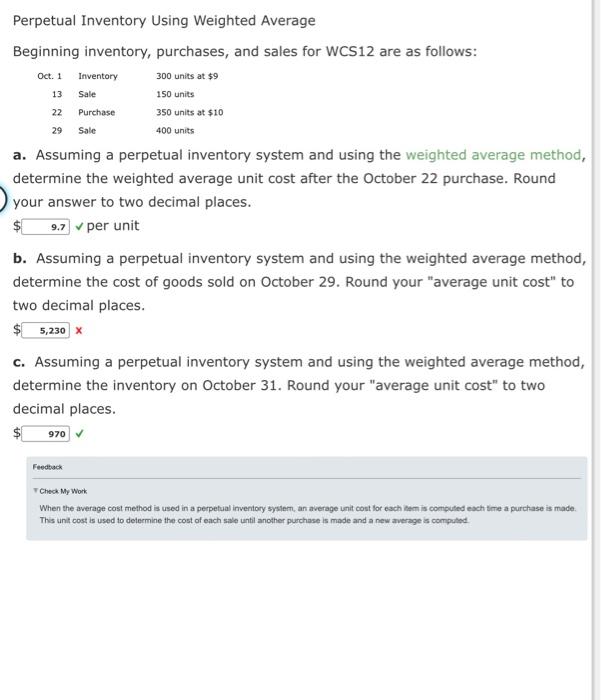

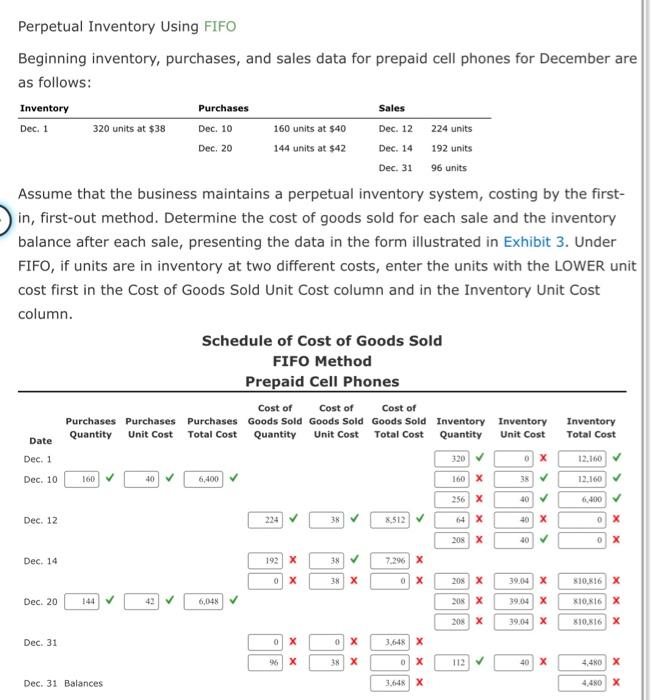

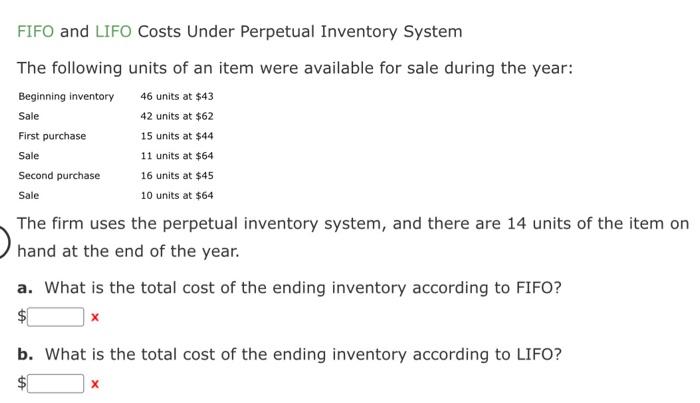

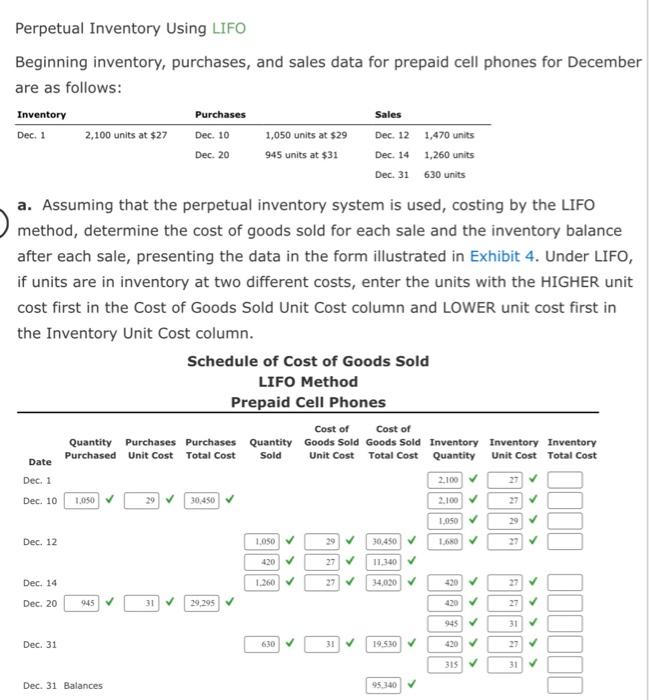

Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of the goods sold on October 24 and (b) the value of inventory on hand on October 31. a. When the FIFO method is used, costs are included in cost of goods sold in the order in which they were purchased. Think of your inventory in terms of "layers". Determine how much inventory remains from each layer after each sale. b. The ending inventory is made up of the most recent purchases. Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for WCS12 are as follows: a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of goods sold on October 29. Round your "average unit cost" to two decimal places. $ c. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31 . Round your "average unit cost" to two decimal places. $ T Check My Work When the average cost method is used in a perpetual inveriory syslem, an average unit cost lor each item is compuled each time a purchase is made. This unit cost is used to determine the cost of each sale until another purchase is made and a new arverage is compuled. Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: Assume that the business maintains a perpetual inventory system, costing by the firstin, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: The firm uses the perpetual inventory system, and there are 14 units of the item on hand at the end of the year. a. What is the total cost of the ending inventory according to FIFO? x b. What is the total cost of the ending inventory according to LIFO? x Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of the goods sold on October 24 and (b) the value of inventory on hand on October 31. a. When the FIFO method is used, costs are included in cost of goods sold in the order in which they were purchased. Think of your inventory in terms of "layers". Determine how much inventory remains from each layer after each sale. b. The ending inventory is made up of the most recent purchases. Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for WCS12 are as follows: a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of goods sold on October 29. Round your "average unit cost" to two decimal places. $ c. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31 . Round your "average unit cost" to two decimal places. $ T Check My Work When the average cost method is used in a perpetual inveriory syslem, an average unit cost lor each item is compuled each time a purchase is made. This unit cost is used to determine the cost of each sale until another purchase is made and a new arverage is compuled. Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: Assume that the business maintains a perpetual inventory system, costing by the firstin, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: The firm uses the perpetual inventory system, and there are 14 units of the item on hand at the end of the year. a. What is the total cost of the ending inventory according to FIFO? x b. What is the total cost of the ending inventory according to LIFO? x Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started