need help

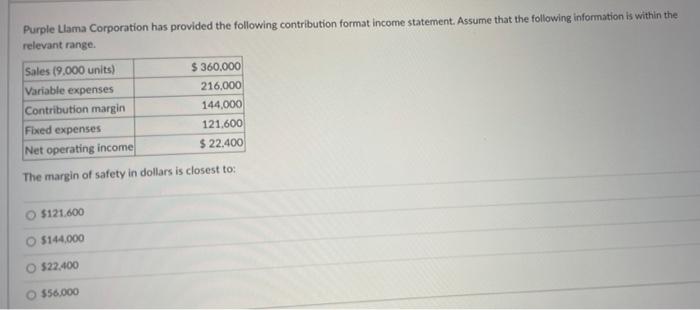

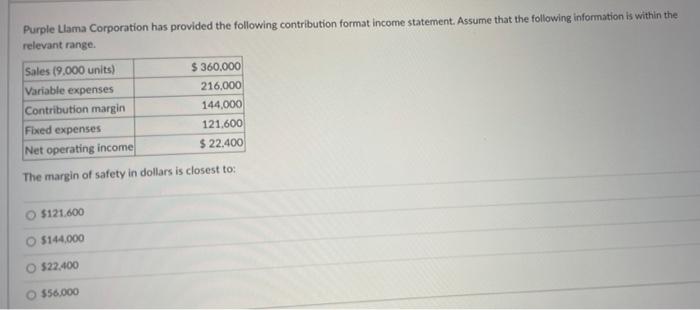

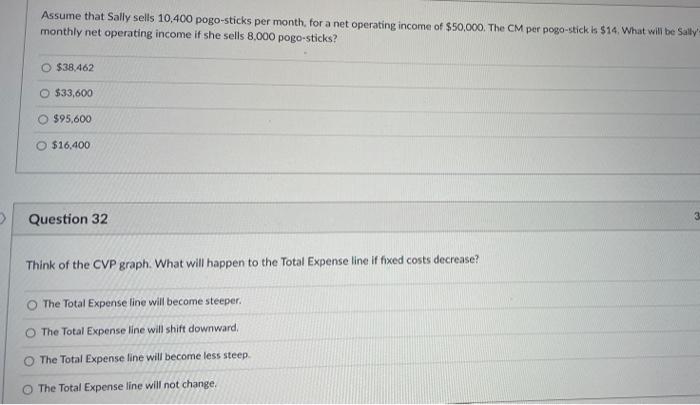

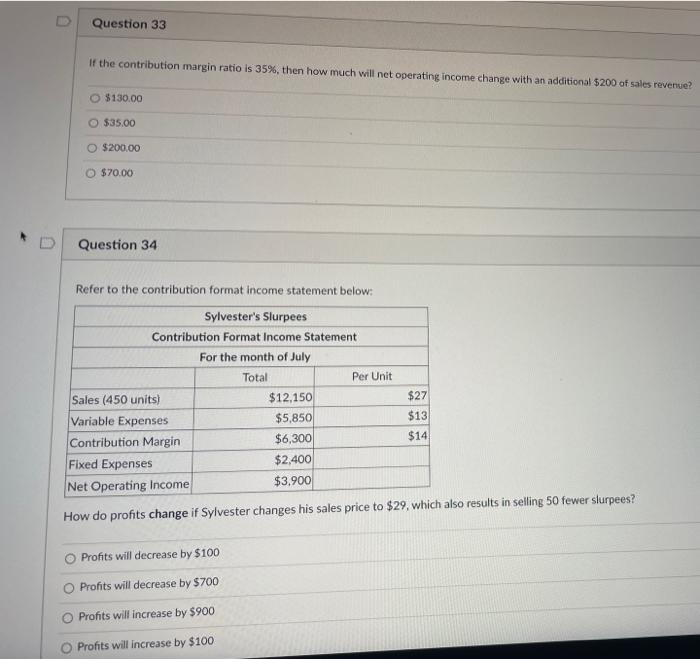

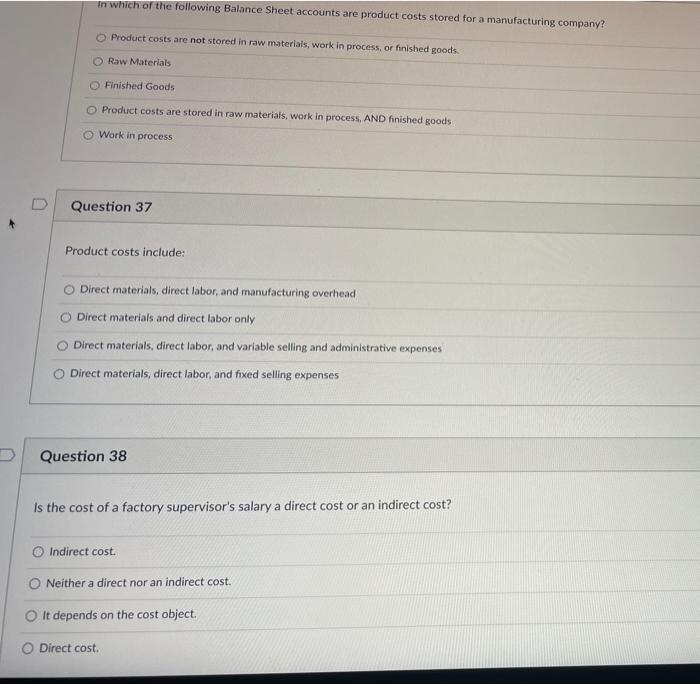

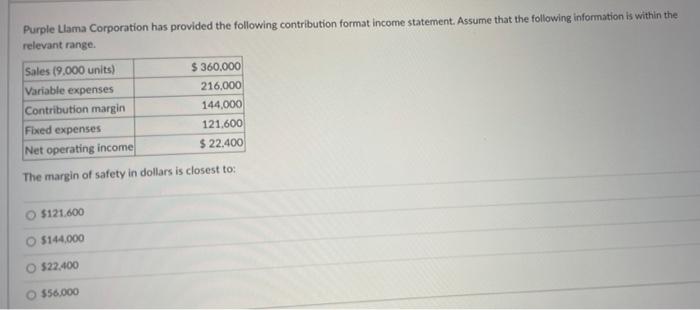

Purple Llama Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (9.000 units) Variable expenses Contribution margin Fixed expenses Net operating income $360,000 216,000 144.000 121.600 $22.400 The margin of safety in dollars is closest to: $121.600 5144.000 O $22.400 $56.000 Assume that Sally sells 10,400 pogo-sticks per month, for a net operating income of $50,000. The CM per pogo-stick is $14. What will be Sally- monthly net operating income if she sells 8.000 pogo-sticks? O $38,462 O $33,600 $95,600 $16,400 3 Question 32 Think of the CVP graph. What will happen to the Total Expense line if fixed costs decrease? The Total Expense line will become steeper. The Total Expense line will shift downward, The Total Expense line will become less steep The Total Expense line will not change. Question 33 If the contribution margin ratio is 35%, then how much will net operating income change with an additional $200 of sales revenue? $130.00 $35.00 $200.00 O $70.00 Question 34 Refer to the contribution format income statement below: Sylvester's Slurpees Contribution Format Income Statement For the month of July Total Per Unit Sales (450 units) $12.150 Variable Expenses $5,850 Contribution Margin $6,300 Fixed Expenses $2,400 Net Operating Income $3,900 $27 $13 $14 How do profits change if Sylvester changes his sales price to $29, which also results in selling 50 fewer slurpees? Profits will decrease by $100 Profits will decrease by $700 O Profits will increase by $900 Profits will increase by $100 in which of the following Balance Sheet accounts are product costs stored for a manufacturing company? Product costs are not stored in raw materials, work in process, or finished goods Raw Materials Finished Goods Product costs are stored in raw materials, work in process. AND finished goods Work in process Question 37 Product costs include: Direct materials, direct labor, and manufacturing overhead Direct materials and direct labor only Direct materials, direct labor, and variable selling and administrative expenses Direct materials, direct labor, and fixed selling expenses Question 38 Is the cost of a factory supervisor's salary a direct cost or an indirect cost? Indirect cost. Neither a direct nor an indirect cost. It depends on the cost object. Direct cost