Answered step by step

Verified Expert Solution

Question

1 Approved Answer

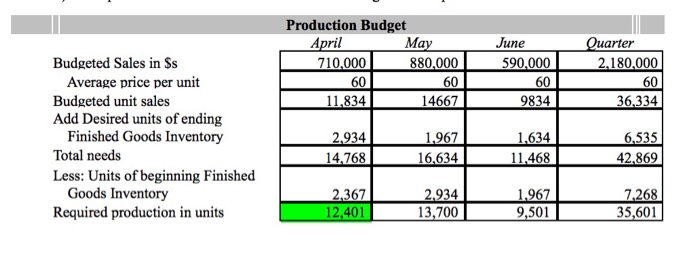

need help solving 12 a) and b) using the info below units for production question 12, the highlighted answer shown is correct the question is

need help solving 12 a) and b) using the info below

units for production

question 12, the highlighted answer shown is correct

the question is there

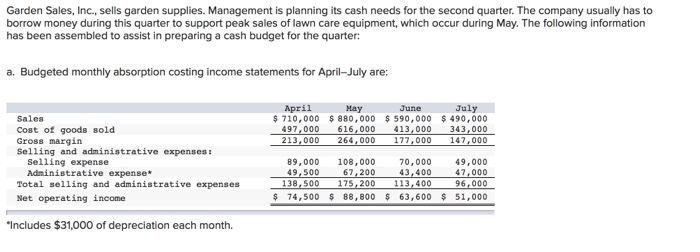

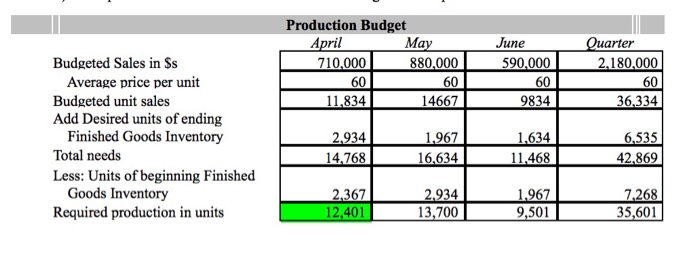

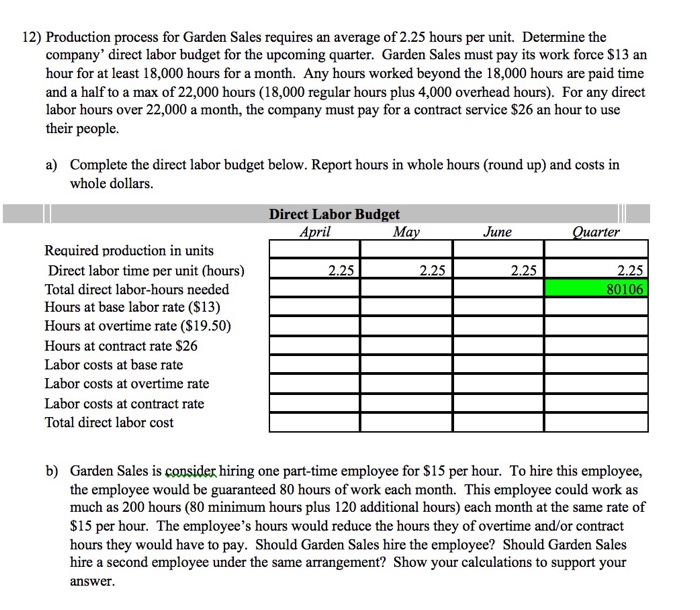

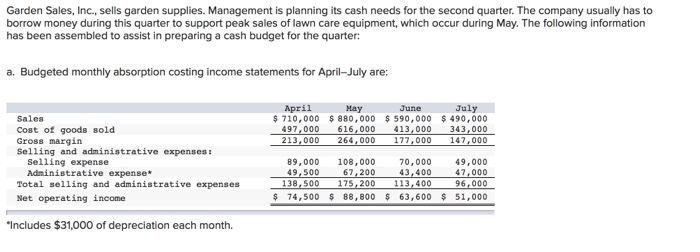

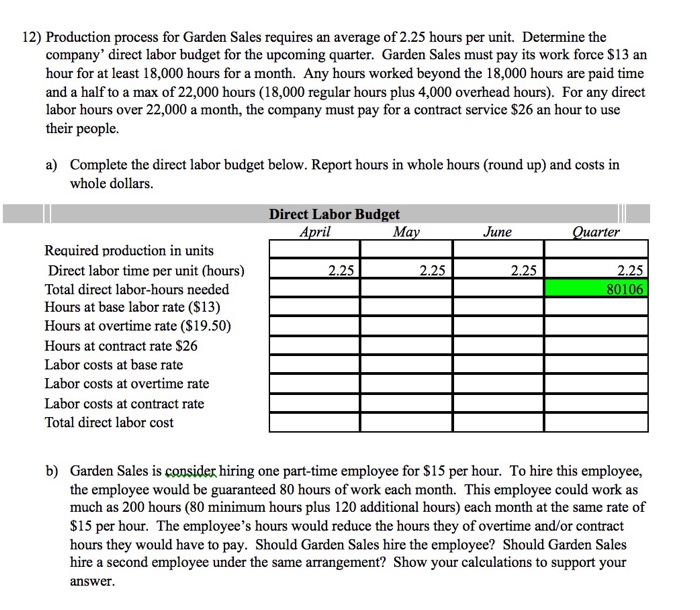

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: a. Budgeted monthly absorption costing income statements for April-July are: April May June July $ 710,000 $ 880,000 $ 590,000 $ 490,000 497,000 616,000 413,000 343,000 213,000 264,000 177,000 147,000 Sales Cost of goods sold Gross margin Selling and administrative expenses : Selling expense Administrative expense* Total selling and administrative expenses Net operating income 89,000 108,000 70,000 49,000 49,500 67,200 43,400 47,000 138,500 175,200 113,400 96,000 $ 74,500 $ 88,800 $ 63,600 $ 51,000 *Includes $31,000 of depreciation each month. Production Budget April May 710,000 880,000 60 60 11.834 14667 June 590,000 60 9834 Quarter 2,180,000 60 36,334 Budgeted Sales in $s Average price per unit Budgeted unit sales Add Desired units of ending Finished Goods Inventory Total needs Less: Units of beginning Finished Goods Inventory Required production in units 2.934 14.768 1,967 16,634 1,634 11,468 6,535 42.869 1.967 2.367 12,401 2.934 13,700 7.268 35,601 9,501 12) Production process for Garden Sales requires an average of 2.25 hours per unit. Determine the company' direct labor budget for the upcoming quarter. Garden Sales must pay its work force $13 an hour for at least 18,000 hours for a month. Any hours worked beyond the 18,000 hours are paid time and a half to a max of 22,000 hours (18,000 regular hours plus 4,000 overhead hours). For any direct labor hours over 22,000 a month, the company must pay for a contract service $26 an hour to use their people. a) Complete the direct labor budget below. Report hours in whole hours (round up) and costs in whole dollars. Direct Labor Budget April May June Quarter 2.25 2.25 2.25 2.25 80106 Required production in units Direct labor time per unit (hours) Total direct labor-hours needed Hours at base labor rate ($13) Hours at overtime rate ($19.50) Hours at contract rate $26 Labor costs at base rate Labor costs at overtime rate Labor costs at contract rate Total direct labor cost b) Garden Sales is consider hiring one part-time employee for $15 per hour. To hire this employee, the employee would be guaranteed 80 hours of work each month. This employee could work as much as 200 hours (80 minimum hours plus 120 additional hours) each month at the same rate of $15 per hour. The employee's hours would reduce the hours they of overtime and/or contract hours they would have to pay. Should Garden Sales hire the employee? Should Garden Sales hire a second employee under the same arrangement? Show your calculations to support your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started