Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help solving After Recapitalization part. Thanks! 7. As a way of illustrating the usefulness of the M&M theory and consolidating your grasp of the

Need help solving After Recapitalization part. Thanks!

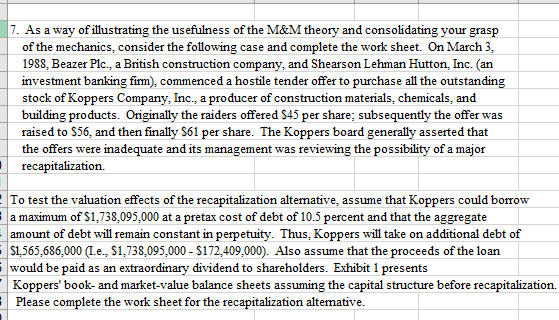

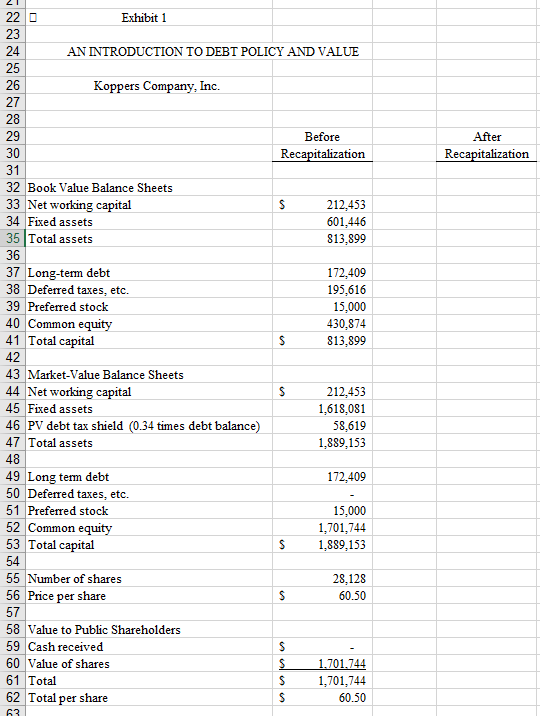

7. As a way of illustrating the usefulness of the M&M theory and consolidating your grasp of the mechanics, consider the following case and complete the work sheet. On March 3, 1988, Beazer Plc., a British construction company, and Shears on Lehman Hutton, Inc. (an investment banking firm), commenced a hostile tender offer to purchase all the outstanding stock of Koppers Company, Inc., a producer of construction materials, chemicals, and building products. Originally the raiders offered $45 per share; subsequently the offer was raised to $56, and then finally $61 per share. The Koppers board generally asserted that the offers were inadequate and its management was reviewing the possibility of a major recapitalization To test the valuation effects of the recapitalization altemative, assume that Koppers could borrow a maximum of $1,738,095,000 at a pretax cost of debt of 10.5 percent and that the aggregate amount of debt will remain constant in perpetuity. Thus, Koppers will take on additional debt of $1,565,686,000 (Le, $1,738,095,000 - S172,409,000). Also assume that the proceeds of the loan would be paid as an extraordinary dividend to shareholders. Exhibit 1 presents Koppers' book- and market-value balance sheets assuming the capital structure before recapitalization. Please complete the work sheet for the recapitalization altemative 22 Exhibit 1 23 24 AN INTRODUCTION TO DEBT POLICY AND VALUE 25 26 Koppers Company, Inc 27 28 29 After Before 30 Recapitalization Recapitalization 31 32 Book Value Balance Sheets 33 Net working capital 34 Fixed assets 212,453 601,446 35 Total assets 813,899 36 37 Long-term debt 38 Deferred taxes, etc. 172,409 195,616 15,000 430,874 813,899 39 Preferred stock 40 Common equity 41 Total capital S 42 43 Market-Value Balance Sheets 44 Net working capital 45 Fixed assets S 212,453 1,618,081 46 PV debt tax shield (0.34 times debt balance) 47 Total assets 58,619 1,889,153 48 49 Long tem debt 50 Deferred taxes, etc 51 Preferred stock 52 Common equity 53 Total capital 172,409 15,000 1,701,744 S 1,889,153 54 55 Number of shares 56 Price per share 28,128 S 60.50 57 58 Value to Public Shareholders 59 Cash received 60 Value of shares 61 Total 62 Total per share 1,701,744 1,701,744 S S 60.50 63 7. As a way of illustrating the usefulness of the M&M theory and consolidating your grasp of the mechanics, consider the following case and complete the work sheet. On March 3, 1988, Beazer Plc., a British construction company, and Shears on Lehman Hutton, Inc. (an investment banking firm), commenced a hostile tender offer to purchase all the outstanding stock of Koppers Company, Inc., a producer of construction materials, chemicals, and building products. Originally the raiders offered $45 per share; subsequently the offer was raised to $56, and then finally $61 per share. The Koppers board generally asserted that the offers were inadequate and its management was reviewing the possibility of a major recapitalization To test the valuation effects of the recapitalization altemative, assume that Koppers could borrow a maximum of $1,738,095,000 at a pretax cost of debt of 10.5 percent and that the aggregate amount of debt will remain constant in perpetuity. Thus, Koppers will take on additional debt of $1,565,686,000 (Le, $1,738,095,000 - S172,409,000). Also assume that the proceeds of the loan would be paid as an extraordinary dividend to shareholders. Exhibit 1 presents Koppers' book- and market-value balance sheets assuming the capital structure before recapitalization. Please complete the work sheet for the recapitalization altemative 22 Exhibit 1 23 24 AN INTRODUCTION TO DEBT POLICY AND VALUE 25 26 Koppers Company, Inc 27 28 29 After Before 30 Recapitalization Recapitalization 31 32 Book Value Balance Sheets 33 Net working capital 34 Fixed assets 212,453 601,446 35 Total assets 813,899 36 37 Long-term debt 38 Deferred taxes, etc. 172,409 195,616 15,000 430,874 813,899 39 Preferred stock 40 Common equity 41 Total capital S 42 43 Market-Value Balance Sheets 44 Net working capital 45 Fixed assets S 212,453 1,618,081 46 PV debt tax shield (0.34 times debt balance) 47 Total assets 58,619 1,889,153 48 49 Long tem debt 50 Deferred taxes, etc 51 Preferred stock 52 Common equity 53 Total capital 172,409 15,000 1,701,744 S 1,889,153 54 55 Number of shares 56 Price per share 28,128 S 60.50 57 58 Value to Public Shareholders 59 Cash received 60 Value of shares 61 Total 62 Total per share 1,701,744 1,701,744 S S 60.50 63Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started