Answered step by step

Verified Expert Solution

Question

1 Approved Answer

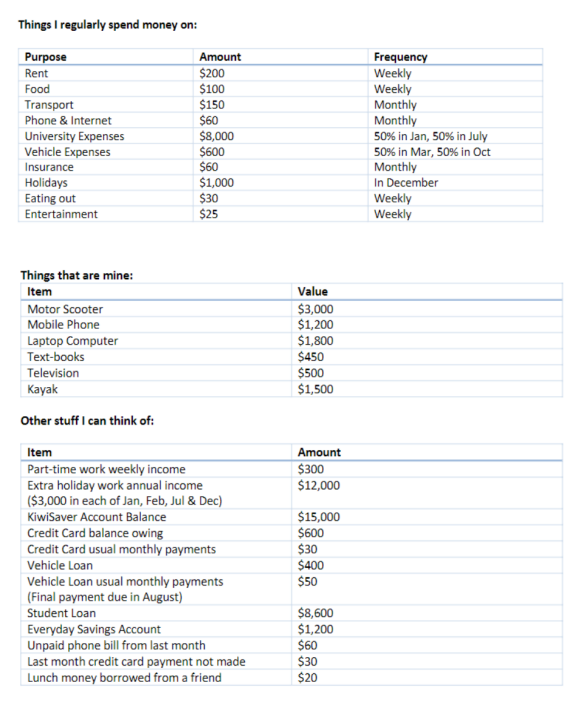

need help solving all questions Things I regularly spend money on: Purpose Rent Food Transport Phone & Internet University Expenses Vehicle Expenses Insurance Holidays Eating

need help solving all questions

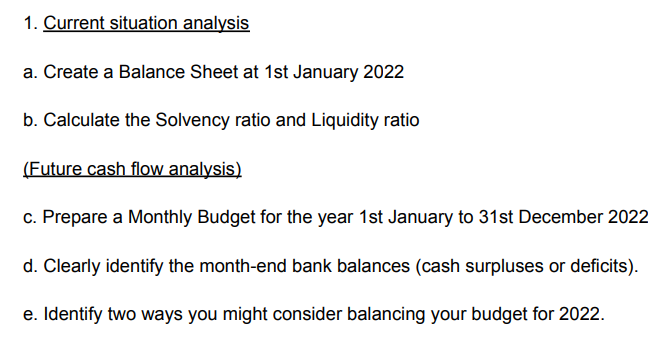

Things I regularly spend money on: Purpose Rent Food Transport Phone & Internet University Expenses Vehicle Expenses Insurance Holidays Eating out Entertainment Amount $200 $100 $150 $60 $8,000 Frequency Weekly Weekly Monthly Monthly 50% in Jan, 50% in July 50% in Mar, 50% in Oct Monthly In December Weekly Weekly $600 $60 $1,000 $30 $25 Things that are mine: Item Motor Scooter Mobile Phone Laptop Computer Text-books Television Kayak Value $3,000 $1,200 $1,800 $450 $500 $1,500 Other stuff I can think of: Amount $300 $12,000 Item Part-time work weekly income Extra holiday work annual income ($3,000 in each of Jan, Feb, Jul & Dec) KiwiSaver Account Balance Credit Card balance owing Credit Card usual monthly payments Vehicle Loan Vehicle Loan usual monthly payments (Final payment due in August) Student Loan Everyday Savings Account Unpaid phone bill from last month Last month credit card payment not made Lunch money borrowed from a friend $15,000 $600 $30 $400 $50 $8,600 $1,200 $60 $30 $20 1. Current situation analysis a. Create a Balance Sheet at 1st January 2022 b. Calculate the Solvency ratio and Liquidity ratio (Future cash flow analysis) c. Prepare a Monthly Budget for the year 1st January to 31st December 2022 d. Clearly identify the month-end bank balances (cash surpluses or deficits). e. Identify two ways you might consider balancing your budget for 2022. Things I regularly spend money on: Purpose Rent Food Transport Phone & Internet University Expenses Vehicle Expenses Insurance Holidays Eating out Entertainment Amount $200 $100 $150 $60 $8,000 Frequency Weekly Weekly Monthly Monthly 50% in Jan, 50% in July 50% in Mar, 50% in Oct Monthly In December Weekly Weekly $600 $60 $1,000 $30 $25 Things that are mine: Item Motor Scooter Mobile Phone Laptop Computer Text-books Television Kayak Value $3,000 $1,200 $1,800 $450 $500 $1,500 Other stuff I can think of: Amount $300 $12,000 Item Part-time work weekly income Extra holiday work annual income ($3,000 in each of Jan, Feb, Jul & Dec) KiwiSaver Account Balance Credit Card balance owing Credit Card usual monthly payments Vehicle Loan Vehicle Loan usual monthly payments (Final payment due in August) Student Loan Everyday Savings Account Unpaid phone bill from last month Last month credit card payment not made Lunch money borrowed from a friend $15,000 $600 $30 $400 $50 $8,600 $1,200 $60 $30 $20 1. Current situation analysis a. Create a Balance Sheet at 1st January 2022 b. Calculate the Solvency ratio and Liquidity ratio (Future cash flow analysis) c. Prepare a Monthly Budget for the year 1st January to 31st December 2022 d. Clearly identify the month-end bank balances (cash surpluses or deficits). e. Identify two ways you might consider balancing your budget for 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started