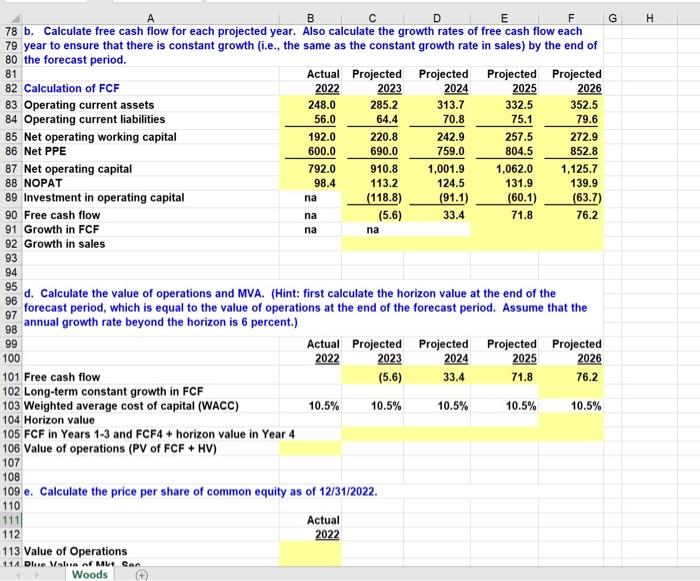

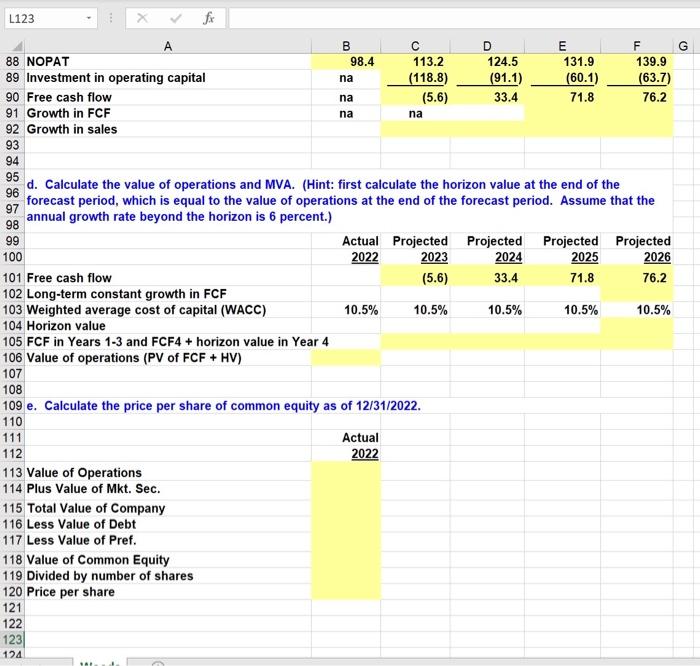

need help solving blank yellow, i was able to forecast everything else just got stuck with growth fcf and everything else! also if you can explain how to solve the blank will very much help me a ton!

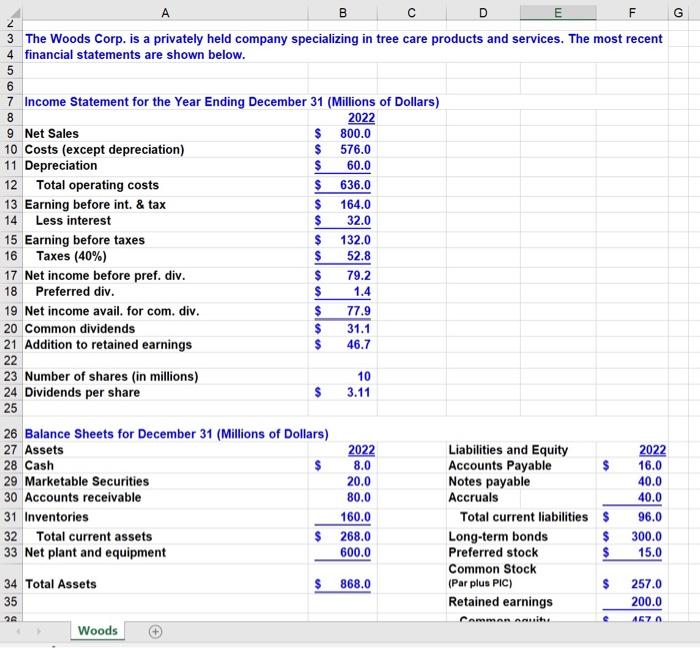

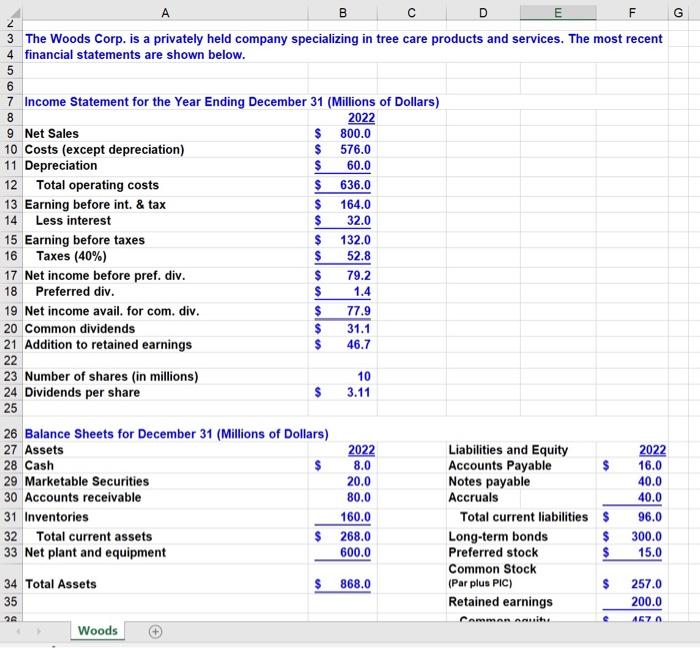

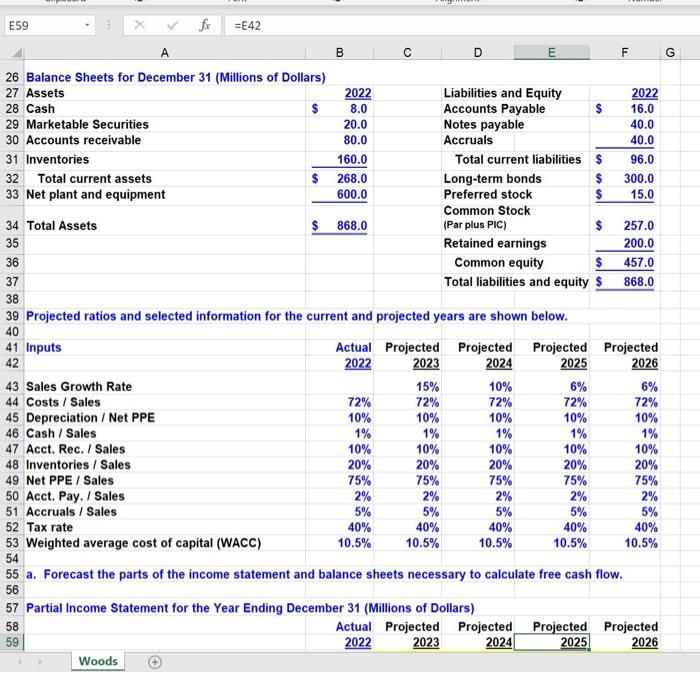

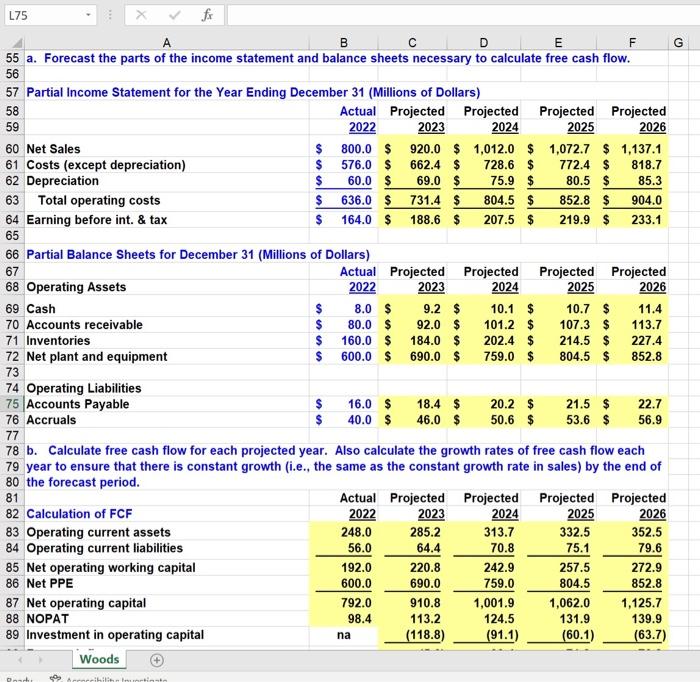

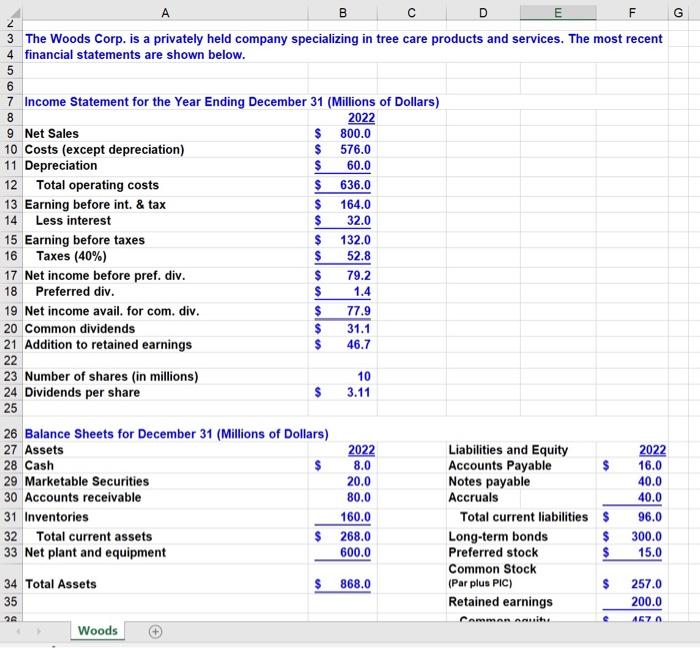

3 The Woods Corp. is a privately held company specializing in tree care products and services. The most recent 4 financial statements are shown below. Projected ratios and selected information for the current and projected years are shown below. 56 57 Partial Income Statement for the Year Ending December 31 (Millions of Dollars) \begin{tabular}{l|l} \hline 58 \\ 59 \end{tabular} 55 a. Forecast the parts of the income statement and balance sheets necessary to calculate free cash flow. 57 Partial Income Statement for the Year Ending December 31 (Millions of Dollars) 79 year to ensure that there is constant growth (i.e., the same as the constant growth rate in sales) by the end of 80 the forecast period. \begin{tabular}{ll} 81 & \\ 82 & Calculation of FCF \\ 84 & Operating current assets \\ \hline \end{tabular} 85 Net operating working capital 86 Net PPE 87 Net operating capital 88 NOPAT 89 Investment in operating capital b. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure that there is constant growth (i.e., the same as the constant growth rate in sales) by the end of the foracast nerind d. Calculate the value of operations and MVA. (Hint: first calculate the horizon value at the end of the forecast period, which is equal to the value of operations at the end of the forecast period. Assume that the annual growth rate beyond the horizon is 6 percent.) e. Calculate the price per share of common equity as of 12/31/2022. d. Calculate the value of operations and MVA. (Hint: first calculate the horizon value at the end of the forecast period, which is equal to the value of operations at the end of the forecast period. Assume that the annual growth rate beyond the horizon is 6 percent.) 3 The Woods Corp. is a privately held company specializing in tree care products and services. The most recent 4 financial statements are shown below. Projected ratios and selected information for the current and projected years are shown below. 56 57 Partial Income Statement for the Year Ending December 31 (Millions of Dollars) \begin{tabular}{l|l} \hline 58 \\ 59 \end{tabular} 55 a. Forecast the parts of the income statement and balance sheets necessary to calculate free cash flow. 57 Partial Income Statement for the Year Ending December 31 (Millions of Dollars) 79 year to ensure that there is constant growth (i.e., the same as the constant growth rate in sales) by the end of 80 the forecast period. \begin{tabular}{ll} 81 & \\ 82 & Calculation of FCF \\ 84 & Operating current assets \\ \hline \end{tabular} 85 Net operating working capital 86 Net PPE 87 Net operating capital 88 NOPAT 89 Investment in operating capital b. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure that there is constant growth (i.e., the same as the constant growth rate in sales) by the end of the foracast nerind d. Calculate the value of operations and MVA. (Hint: first calculate the horizon value at the end of the forecast period, which is equal to the value of operations at the end of the forecast period. Assume that the annual growth rate beyond the horizon is 6 percent.) e. Calculate the price per share of common equity as of 12/31/2022. d. Calculate the value of operations and MVA. (Hint: first calculate the horizon value at the end of the forecast period, which is equal to the value of operations at the end of the forecast period. Assume that the annual growth rate beyond the horizon is 6 percent.)