Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help solving e) and f) as well as the filling out the table using the info posted below the markup rate is 160% original

need help solving e) and f) as well as the filling out the table using the info posted below

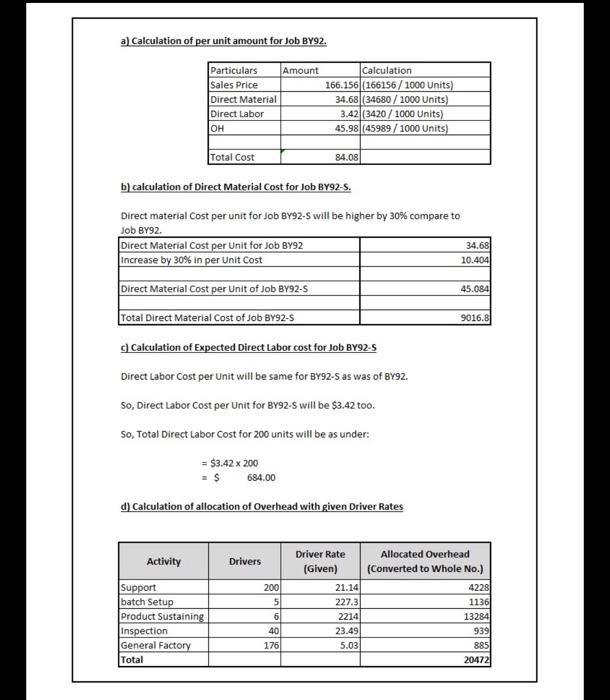

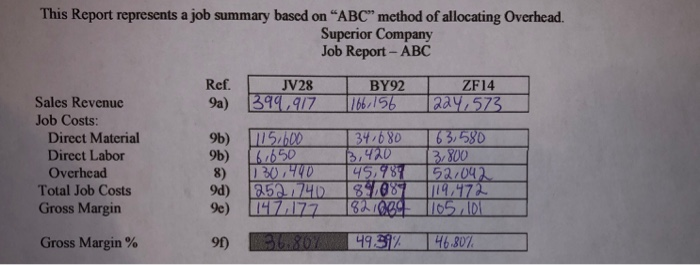

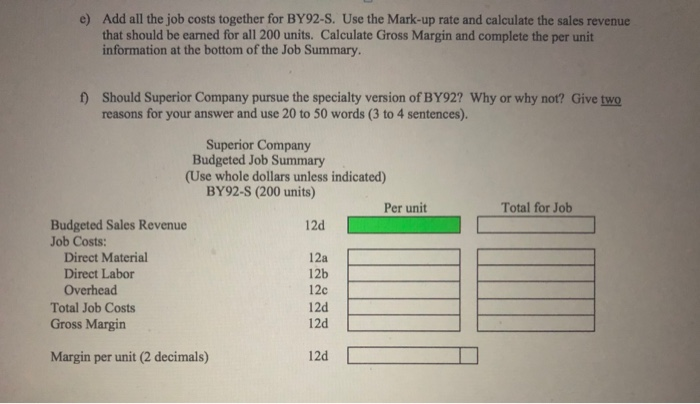

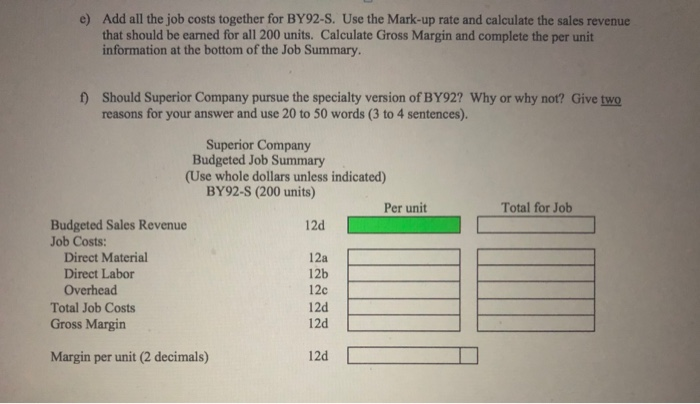

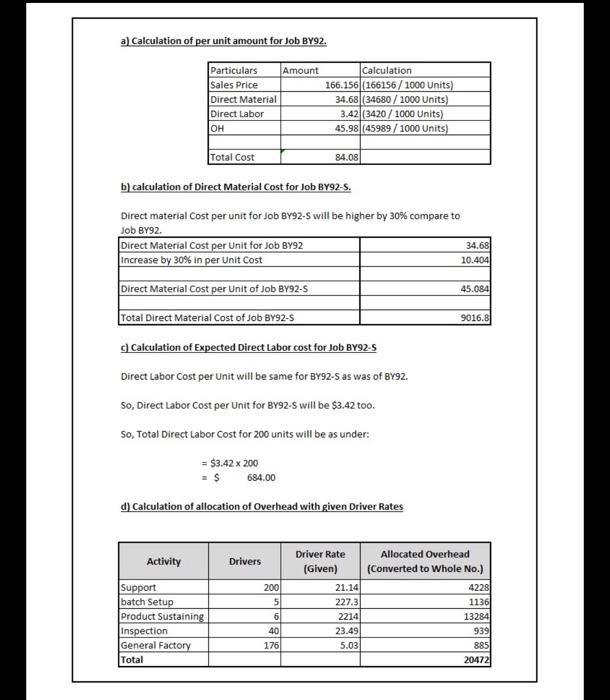

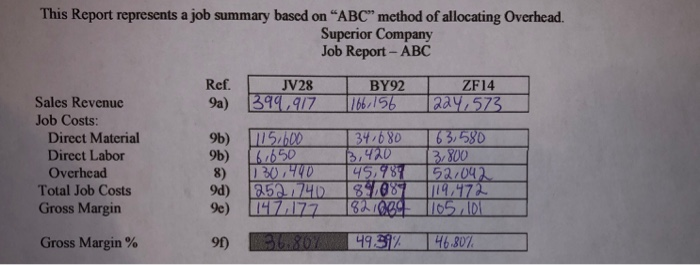

e) Add all the job costs together for BY92-S. Use the Mark-up rate and calculate the sales revenue that should be earned for all 200 units. Calculate Gross Margin and complete the per unit information at the bottom of the Job Summary f) Should Superior Company pursue the specialty version of BY92? Why or why not? Give two reasons for your answer and use 20 to 50 words (3 to 4 sentences). Total for Job Superior Company Budgeted Job Summary (Use whole dollars unless indicated) BY92-S (200 units) Per unit Budgeted Sales Revenue 12d Job Costs: Direct Material 12a Direct Labor 12b Overhead 12c Total Job Costs 120 Gross Margin 12d Margin per unit (2 decimals) 120 a) Calculation of per unit amount for Job BY92. Particulars Amount Sales Price Direct Material Direct Labor OH Calculation 166.156|(166156 / 1000 Units) 34.68|(34680 / 1000 Units) 3.42|(3420 / 1000 Units) 45.98|(45989/1000 Units) Total Cost 84.08 b) calculation of Direct Material Cost for Job BY92-S. Direct material Cost per unit for Job By92-S will be higher by 30% compare to Job BY92. Direct Material Cost per Unit for Job BY92 Increase by 30% in per Unit Cost Direct Material Cost per Unit of Job BY92-S Total Direct Material Cost of Job BY92-5 34.68 10.404 45.084 9016.8 c) Calculation of Expected Direct Labor cost for Job BY92-S Direct Labor Cost per Unit will be same for By92-S as was of BY92. So, Direct Labor Cost per Unit for BY92-S will be $3.42 too. So, Total Direct Labor Cost for 200 units will be as under: = $3.42 x 200 = $ 684.00 d) Calculation of allocation of Overhead with given Driver Rates Activity Drivers 200 5 6 Support batch Setup Product Sustaining Inspection General Factory Total Driver Rate (Given) 21.14 227.3 2214 23.49 5.03 Allocated Overhead (Converted to Whole No.) 4228 1136 13284 939 885 20472 40 176 This Report represents a job summary based on "ABC" method of allocating Overhead. Superior Company Job Report - ABC Ref. 9a) JV28 399,917 BY92 1166.156 ZF14 [224, 573 Sales Revenue Job Costs: Direct Material Direct Labor Overhead Total Job Costs Gross Margin 9b) 15,600 9b) 16,650 130,440 [2521740 34,680 13,420 45,987 88,081 63,580 3.800 52.042 119,472 105 1821004 Gross Margin % 98) 36.807 49.92 46.807 e) Add all the job costs together for BY92-S. Use the Mark-up rate and calculate the sales revenue that should be earned for all 200 units. Calculate Gross Margin and complete the per unit information at the bottom of the Job Summary f) Should Superior Company pursue the specialty version of BY92? Why or why not? Give two reasons for your answer and use 20 to 50 words (3 to 4 sentences). Total for Job Superior Company Budgeted Job Summary (Use whole dollars unless indicated) BY92-S (200 units) Per unit Budgeted Sales Revenue 12d Job Costs: Direct Material 12a Direct Labor 12b Overhead 12c Total Job Costs 120 Gross Margin 12d Margin per unit (2 decimals) 120 a) Calculation of per unit amount for Job BY92. Particulars Amount Sales Price Direct Material Direct Labor OH Calculation 166.156|(166156 / 1000 Units) 34.68|(34680 / 1000 Units) 3.42|(3420 / 1000 Units) 45.98|(45989/1000 Units) Total Cost 84.08 b) calculation of Direct Material Cost for Job BY92-S. Direct material Cost per unit for Job By92-S will be higher by 30% compare to Job BY92. Direct Material Cost per Unit for Job BY92 Increase by 30% in per Unit Cost Direct Material Cost per Unit of Job BY92-S Total Direct Material Cost of Job BY92-5 34.68 10.404 45.084 9016.8 c) Calculation of Expected Direct Labor cost for Job BY92-S Direct Labor Cost per Unit will be same for By92-S as was of BY92. So, Direct Labor Cost per Unit for BY92-S will be $3.42 too. So, Total Direct Labor Cost for 200 units will be as under: = $3.42 x 200 = $ 684.00 d) Calculation of allocation of Overhead with given Driver Rates Activity Drivers 200 5 6 Support batch Setup Product Sustaining Inspection General Factory Total Driver Rate (Given) 21.14 227.3 2214 23.49 5.03 Allocated Overhead (Converted to Whole No.) 4228 1136 13284 939 885 20472 40 176 This Report represents a job summary based on "ABC" method of allocating Overhead. Superior Company Job Report - ABC Ref. 9a) JV28 399,917 BY92 1166.156 ZF14 [224, 573 Sales Revenue Job Costs: Direct Material Direct Labor Overhead Total Job Costs Gross Margin 9b) 15,600 9b) 16,650 130,440 [2521740 34,680 13,420 45,987 88,081 63,580 3.800 52.042 119,472 105 1821004 Gross Margin % 98) 36.807 49.92 46.807 the markup rate is 160%

original abc cost report to compare if superior should purse the specialty product

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started