Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help solving for all information Following are the accounts for Dakota Corporation. Both ordinary journal entries and adjusting journal entries have been posted for

Need help solving for all information

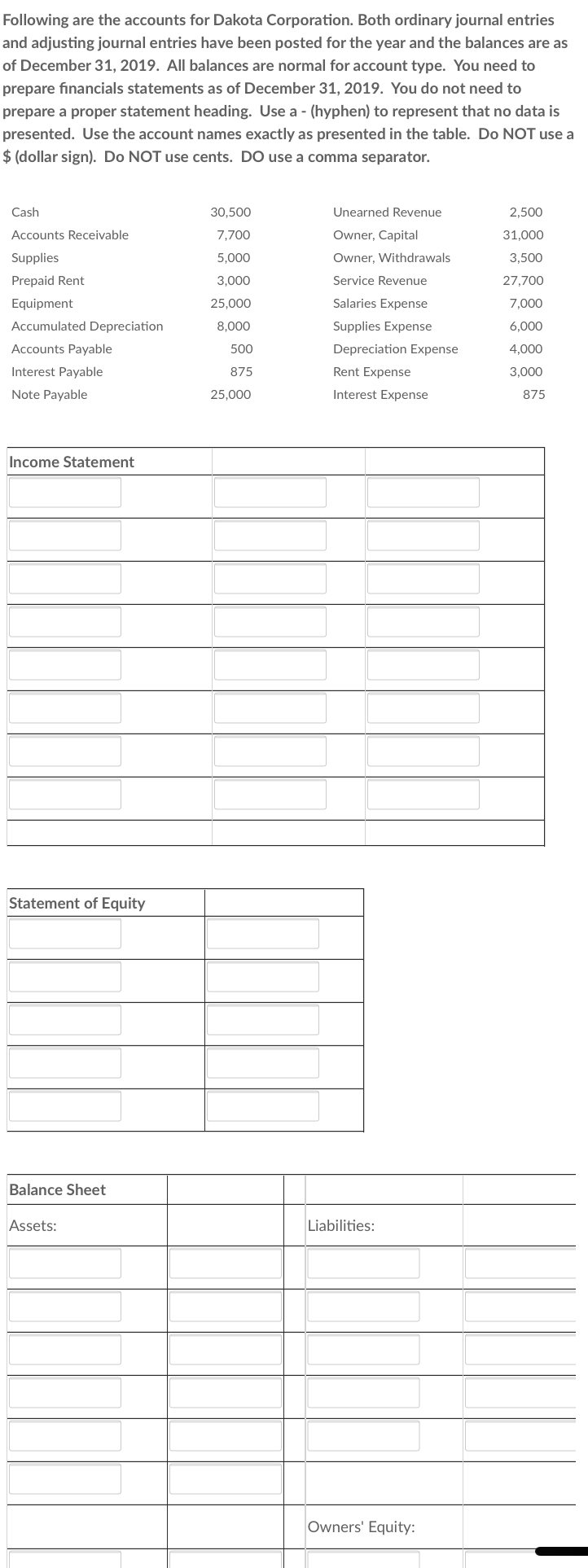

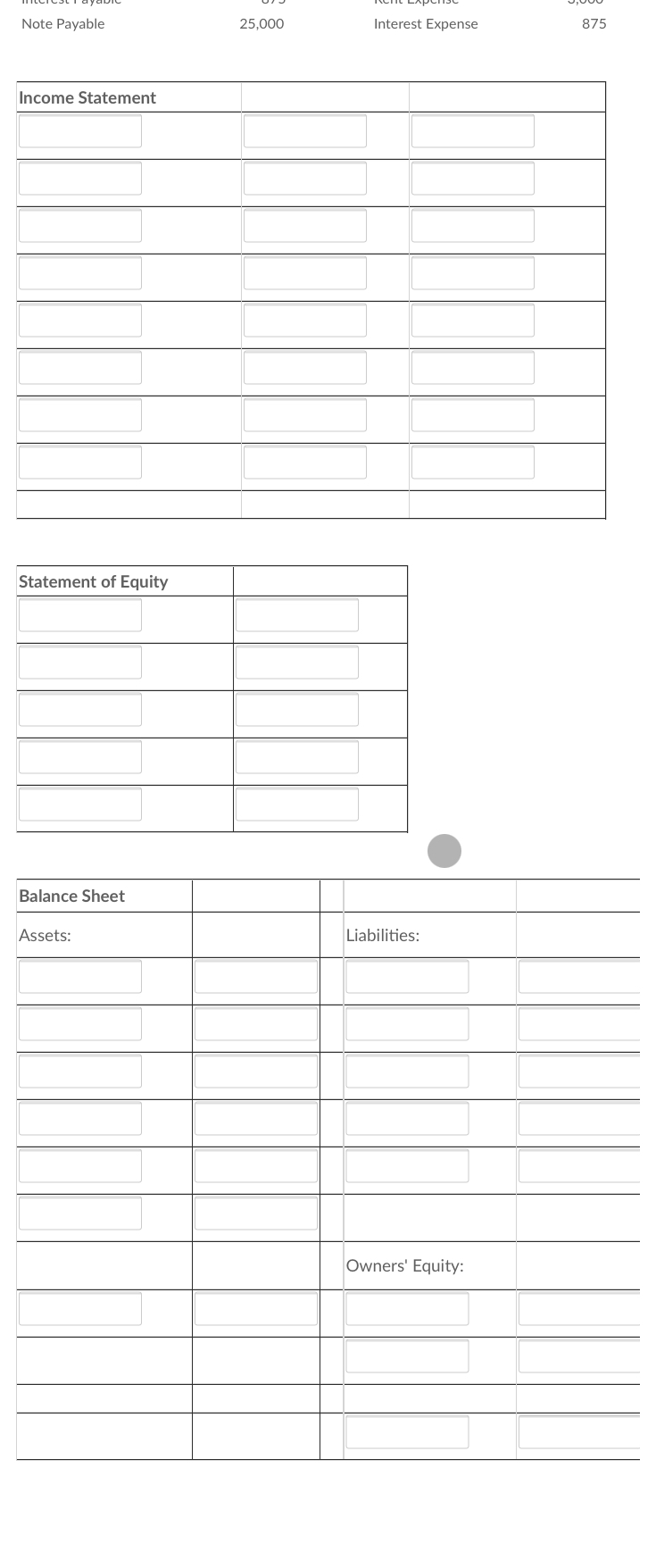

Following are the accounts for Dakota Corporation. Both ordinary journal entries and adjusting journal entries have been posted for the year and the balances are as of December 31, 2019. All balances are normal for account type. You need to prepare financials statements as of December 31, 2019. You do not need to prepare a proper statement heading. Use a - (hyphen) to represent that no data is presented. Use the account names exactly as presented in the table. Do NOT use a $(dollar sign). Do NOT use cents. DO use a comma separator. Cash 30,500 2,500 7,700 Unearned Revenue Owner, Capital Owner, Withdrawals 31,000 5,000 3,500 Service Revenue 27,700 Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Interest Payable Note Payable 3,000 25,000 8,000 7,000 6,000 500 Salaries Expense Supplies Expense Depreciation Expense Rent Expense Interest Expense 4,000 875 3,000 875 25,000 Income Statement Statement of Equity Balance Sheet Assets: Liabilities: Owners' Equity: Note Payable 25,000 25,000 Interest Expense 875 Income Statement Statement of Equity Balance Sheet Assets: Liabilities: Owners' EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started