Answered step by step

Verified Expert Solution

Question

1 Approved Answer

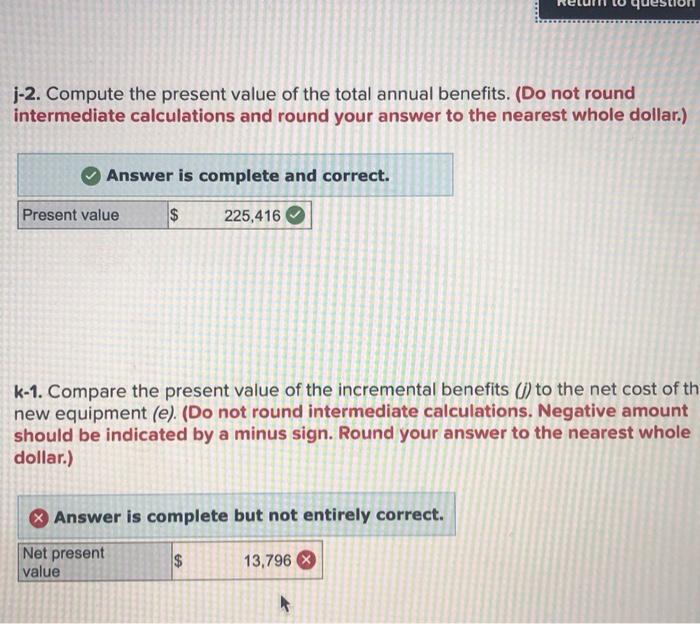

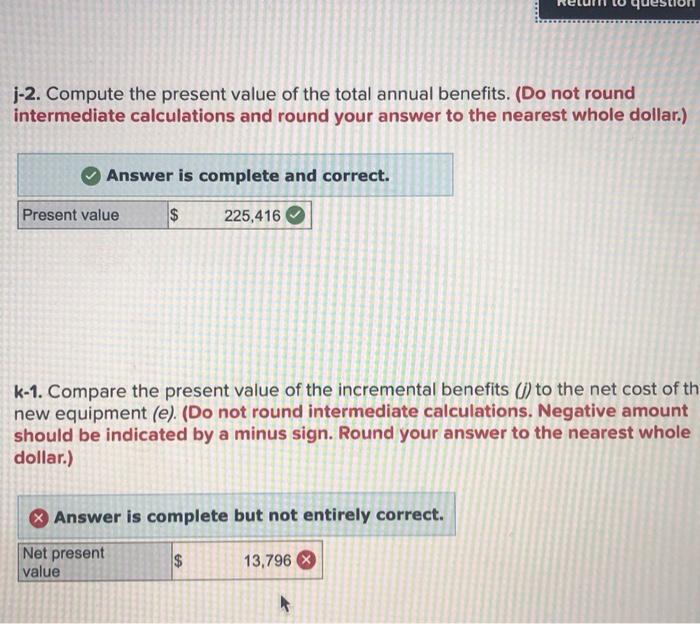

need help solving for k-1 ques j-2. Compute the present value of the total annual benefits. (Do not round intermediate calculations and round your answer

need help solving for k-1

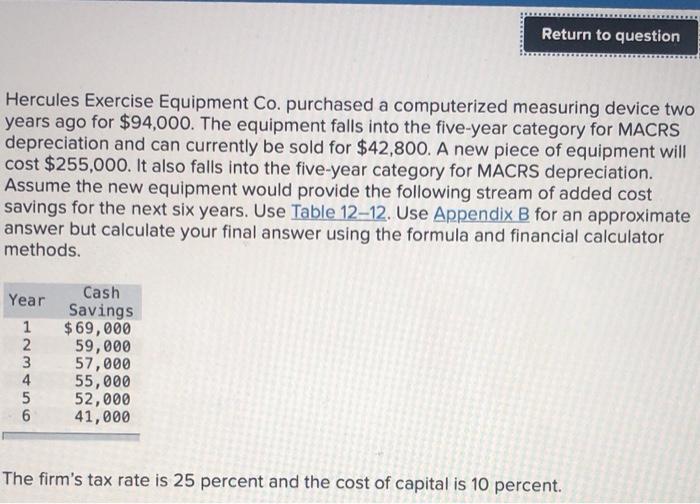

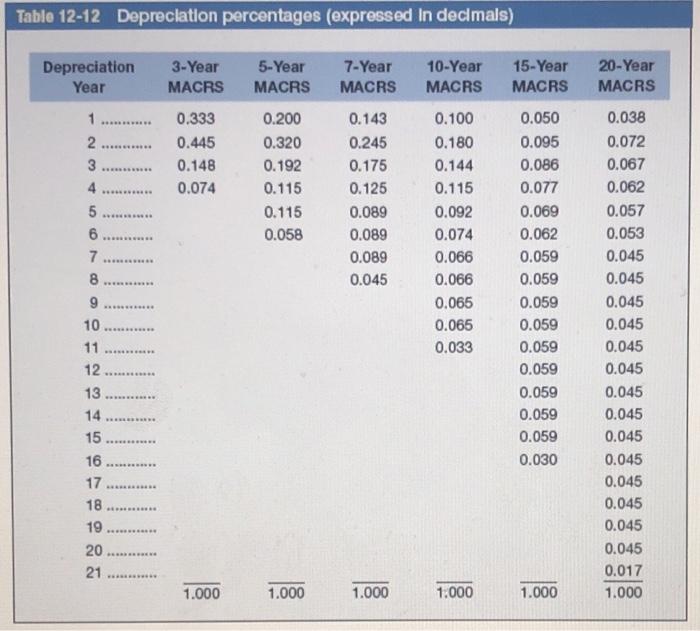

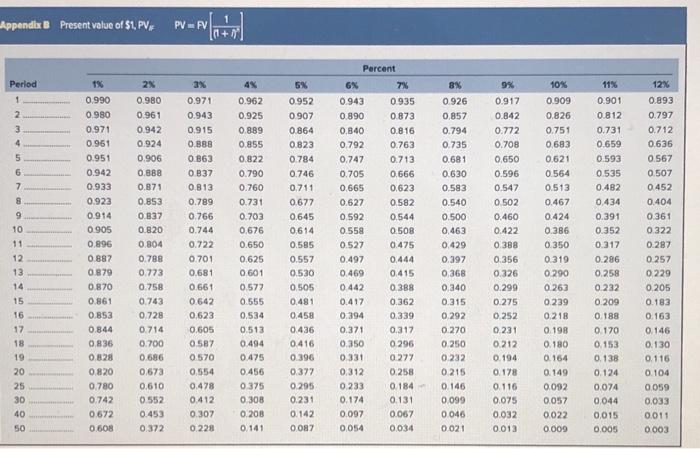

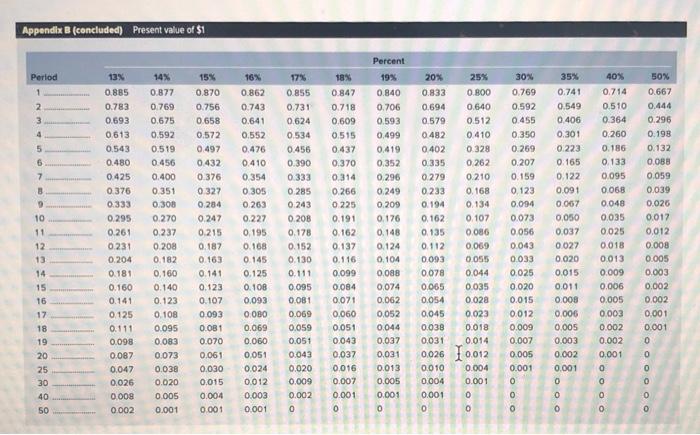

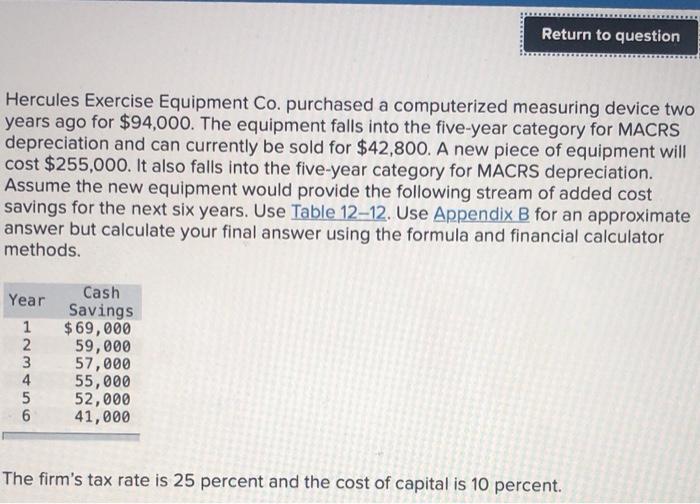

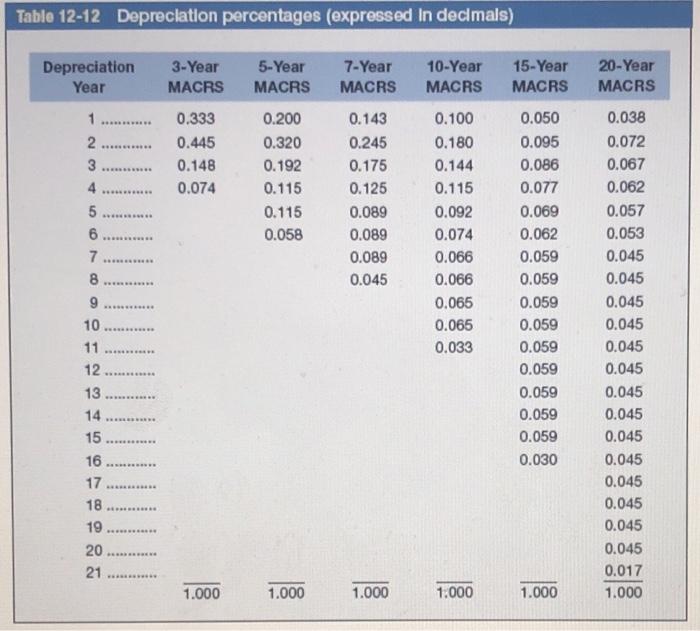

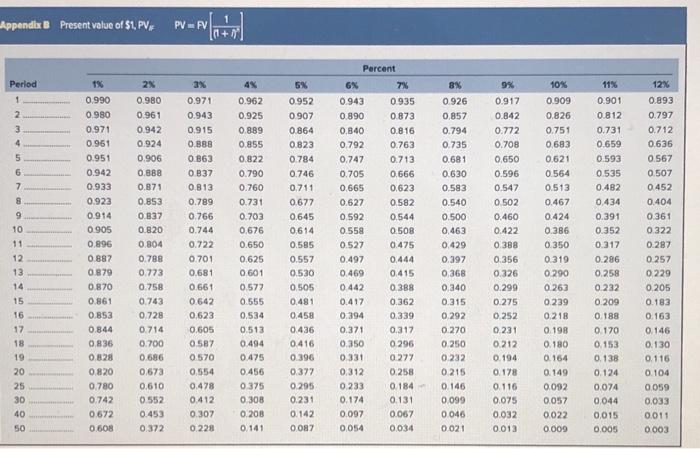

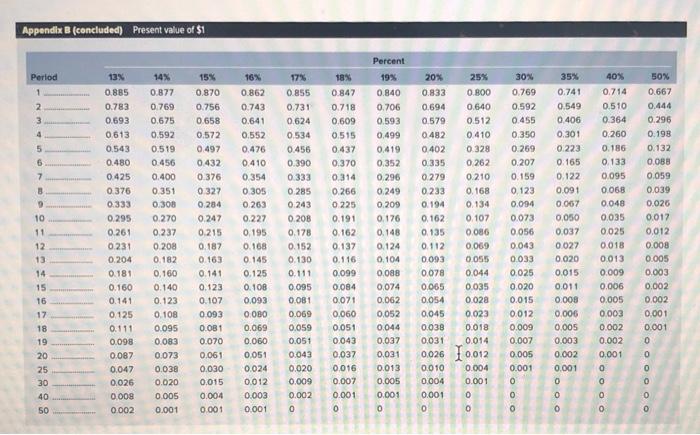

ques j-2. Compute the present value of the total annual benefits. (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Answer is complete and correct. Present value $ 225,416 K-1. Compare the present value of the incremental benefits (1) to the net cost of th new equipment (e). (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round your answer to the nearest whole dollar.) Answer is complete but not entirely correct. Net present $ 13,796 value Return to question Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $94,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $42,800. A new piece of equipment will cost $255,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 12-12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year Cash Savings 1 $69,000 259,000 3 57,000 4 55,000 5 52,000 6 41,000 The firm's tax rate is 25 percent and the cost of capital is 10 percent. Table 12-12 Depreciation percentages (expressed In decimals) Depreciation Year 3-Year MACRS 5-Year MACRS 7-Year MACRS 10-Year MACRS 15-Year MACRS 20-Year MACRS 1 ........ 2 .......... 0.333 0.445 0.148 0.074 3 0.200 0.320 0.192 0.115 0.115 0.058 ***** 3 4 5 6 7 8 9 10 11 12 0.143 0.245 0.175 0.125 0.089 0.089 0.089 0.045 0.100 0.180 0.144 0.115 0.092 0.074 0.066 0.066 0.065 0.065 0.033 0.050 0.095 0.086 0.077 0.069 0.062 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.030 *** 0.038 0.072 0.067 0.062 0.057 0.053 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.017 1.000 13 ............ 14 ... 15 ........ 16 ........ 17 18 19 20 21 1.000 1.000 1.000 1.000 1.000 Appendix B Present value of $1, PV, PVFV 8 Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 1% 0.990 0.980 0.971 0.951 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.882 0.879 0870 0.861 0.853 0.844 0.836 0828 0.820 0.780 0.742 0.672 0,608 2x 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0673 0.610 0.552 0.453 0.372 3x 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0,676 0.650 0.625 0.601 0.572 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0,614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0087 Percent 6% 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.666 0665 0.623 0.627 0.582 0 592 0.544 0.558 0.508 0.527 0.475 0.497 0.444 0.469 0.415 0.442 0.388 0.417 0.362 0.394 0,339 0.371 0.317 0.350 0.296 0.331 0.277 0.312 0.258 0.233 0.184 0.174 0.131 0,097 0.067 0054 0.034 0.926 0,857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0,463 0.429 0.397 0,368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0,460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.012 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0,015 0.005 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0229 0,205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 15 16 17 18 19 20 25 30 40 50 0.011 0.003 Appendix B (concluded) Present value of $1 1 Period 1 16% 0.862 0.743 2 3 0.641 4 5 6 7 0.885 0.783 0.693 0613 0943 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.047 0.026 0008 0.002 14% 0.877 0.769 0.675 0.592 0519 0.456 0.400 0 351 0.308 0.270 0.237 0.208 0.182 0,160 0.140 0.123 0.108 0.095 0.083 0.073 0.038 0.020 0.005 0.001 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0,061 0.030 0.015 0.004 0.001 10 11 12 13 14 15 16 17 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0 195 0.168 0.145 0.125 . 0.093 0.069 0.060 0.051 0.024 0.012 0.003 0.001 17% 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0,043 0.020 0.009 0.002 0 0.847 0.718 0.609 0.515 0437 0.370 0.314 0.266 0225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.060 0.051 0.043 0,037 0.016 0.007 0.001 Percent 19% 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0,052 0.044 0.037 0.031 0.013 0.005 0.001 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 25% 0.800 0.640 0.512 0.410 0.328 0.262 0.210 0.168 0.134 0.107 0.086 0.069 0.055 0.044 0.035 0.028 0.023 0.018 0.014 30% 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 0.073 0.056 0.043 0.033 0.025 0.020 0.015 0.012 0.009 0.007 0.005 0.001 O 35% 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.091 0.067 0.050 0.037 0.027 0.020 0.015 0.011 0.008 0.006 0.005 0.003 0.002 0.001 40% 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0,035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0,001 0.667 0.444 0.296 0.198 0.132 0.0 0,059 0.039 0.026 0.017 0.012 0.008 0.005 0.003 0.002 0.002 0.001 0.001 18 19 20 o026 Ioo12 25 30 0.010 0.004 0.001 0 0.004 0.001 0 40 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started