need help solving, please refrain from using excel need to see work:(

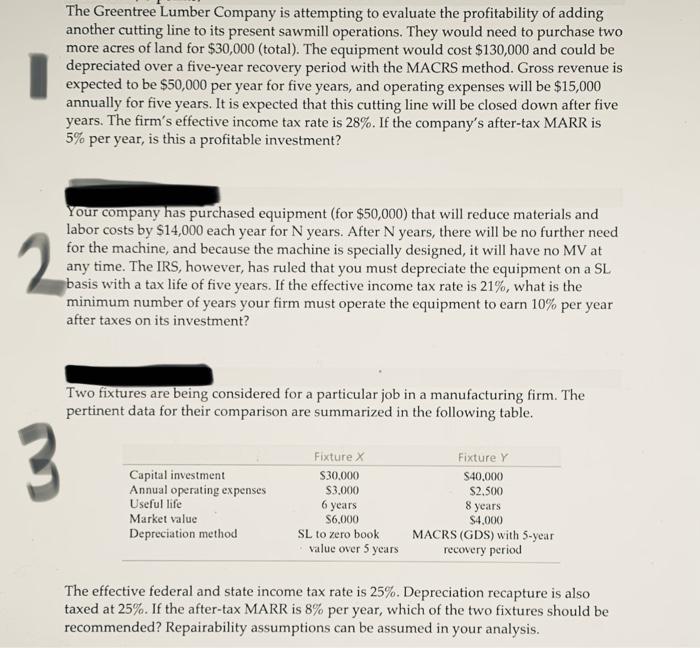

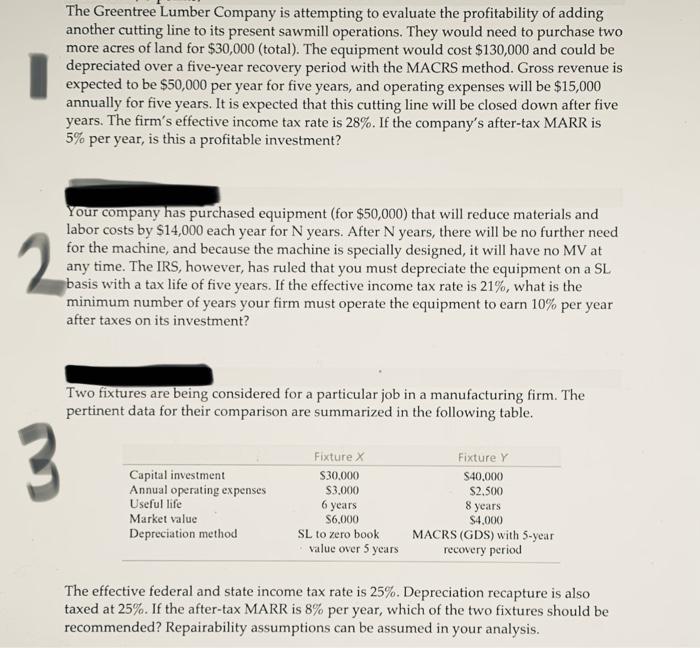

The Greentree Lumber Company is attempting to evaluate the profitability of adding another cutting line to its present sawmill operations. They would need to purchase two more acres of land for $30,000 (total). The equipment would cost $130,000 and could be depreciated over a five-year recovery period with the MACRS method. Gross revenue is expected to be $50,000 per year for five years, and operating expenses will be $15,000 annually for five years. It is expected that this cutting line will be closed down after five years. The firm's effective income tax rate is 28%. If the company's after-tax MARR is 5% per year, is this a profitable investment? 2 Your company has purchased equipment (for $50,000) that will reduce materials and labor costs by $14,000 each year for N years. After N years, there will be no further need for the machine, and because the machine is specially designed, it will have no MV at any time. The IRS, however, has ruled that you must depreciate the equipment on a SL basis with a tax life of five years. If the effective income tax rate is 21%, what is the minimum number of years your firm must operate the equipment to earn 10% per year after taxes on its investment? Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. 3 Capital investment Annual operating expenses Useful life Market value Depreciation method Fixture $30,000 $3.000 6 years 56.000 SL to zero book value over 5 years Fixture Y $40.000 $2.500 8 years $4.000 MACRS (GDS) with 5-year recovery period The effective federal and state income tax rate is 25%. Depreciation recapture is also taxed at 25%. If the after-tax MARR is 8% per year, which of the two fixtures should be recommended? Repairability assumptions can be assumed in your analysis. The Greentree Lumber Company is attempting to evaluate the profitability of adding another cutting line to its present sawmill operations. They would need to purchase two more acres of land for $30,000 (total). The equipment would cost $130,000 and could be depreciated over a five-year recovery period with the MACRS method. Gross revenue is expected to be $50,000 per year for five years, and operating expenses will be $15,000 annually for five years. It is expected that this cutting line will be closed down after five years. The firm's effective income tax rate is 28%. If the company's after-tax MARR is 5% per year, is this a profitable investment? 2 Your company has purchased equipment (for $50,000) that will reduce materials and labor costs by $14,000 each year for N years. After N years, there will be no further need for the machine, and because the machine is specially designed, it will have no MV at any time. The IRS, however, has ruled that you must depreciate the equipment on a SL basis with a tax life of five years. If the effective income tax rate is 21%, what is the minimum number of years your firm must operate the equipment to earn 10% per year after taxes on its investment? Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. 3 Capital investment Annual operating expenses Useful life Market value Depreciation method Fixture $30,000 $3.000 6 years 56.000 SL to zero book value over 5 years Fixture Y $40.000 $2.500 8 years $4.000 MACRS (GDS) with 5-year recovery period The effective federal and state income tax rate is 25%. Depreciation recapture is also taxed at 25%. If the after-tax MARR is 8% per year, which of the two fixtures should be recommended? Repairability assumptions can be assumed in your analysis