Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help solving requirement 3. I have included all of my correct answers to help solve. Requirement 1. Calculate the following ratios for 2021 and

Need help solving requirement 3. I have included all of my correct answers to help solve.

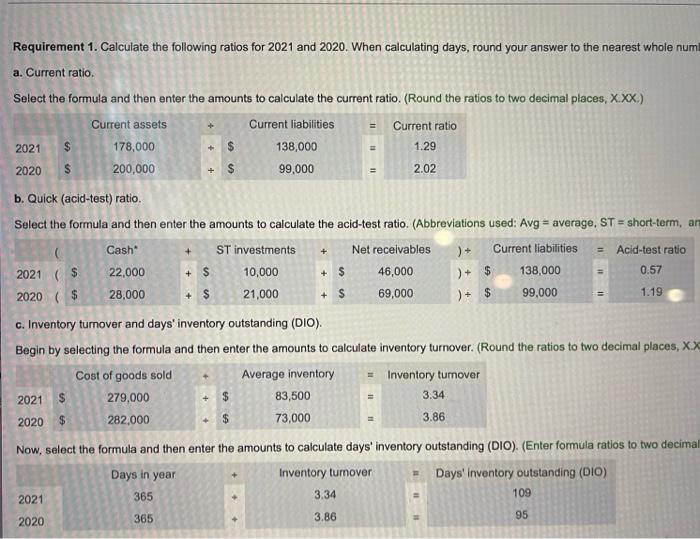

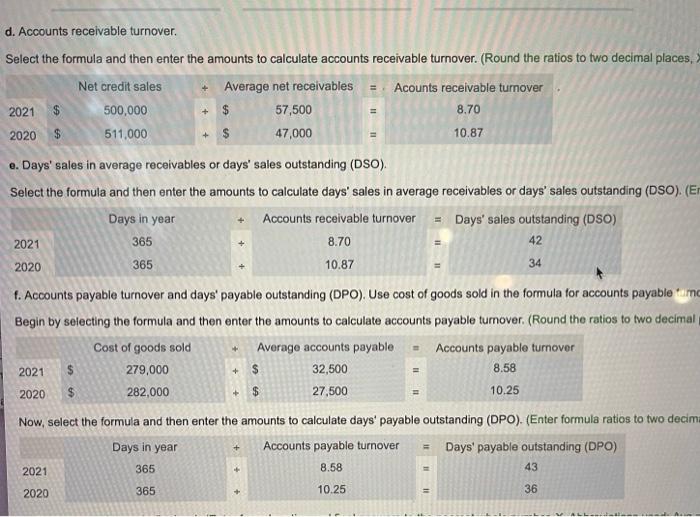

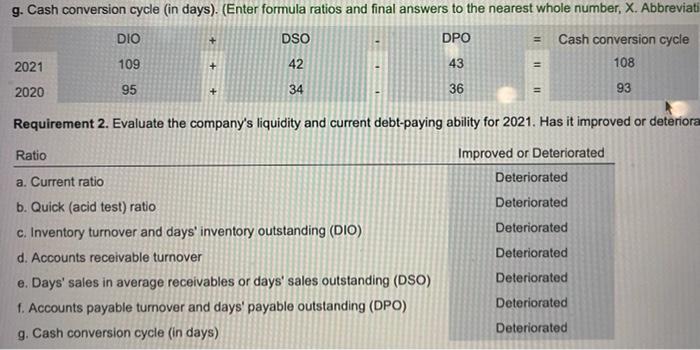

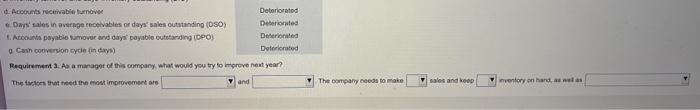

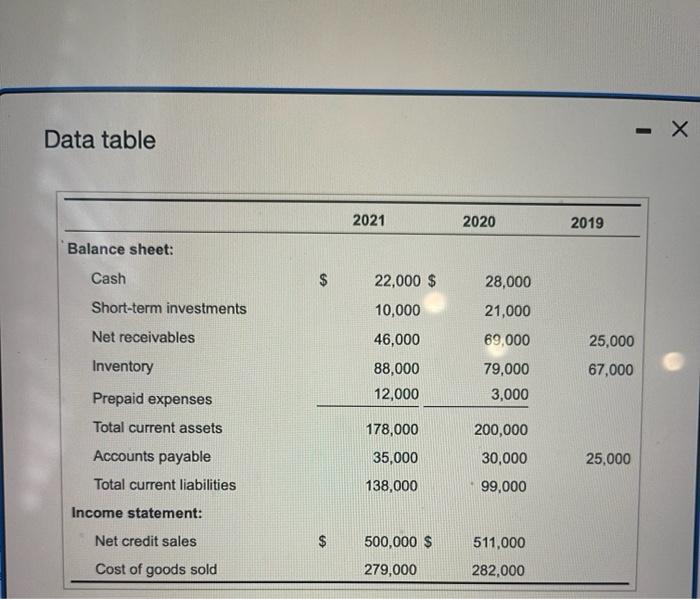

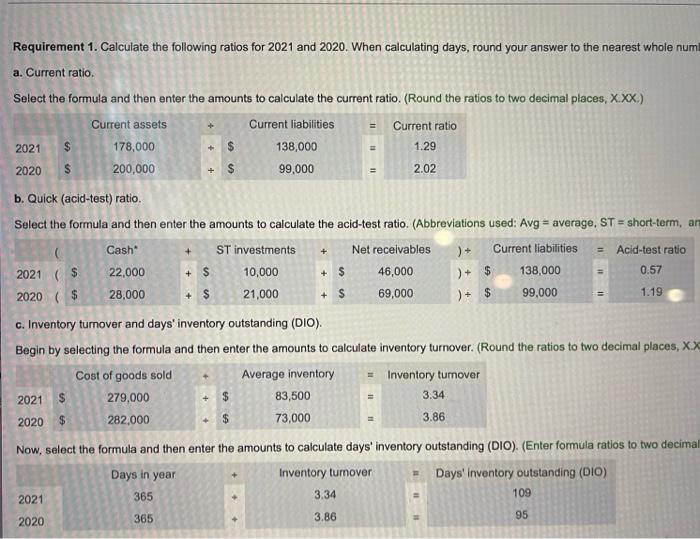

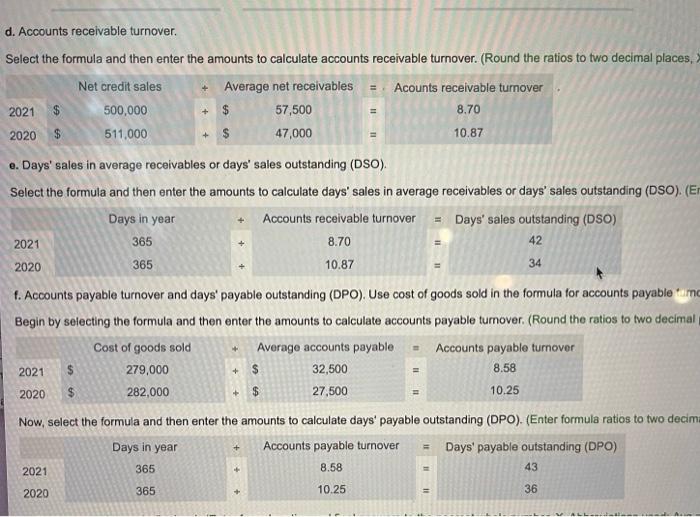

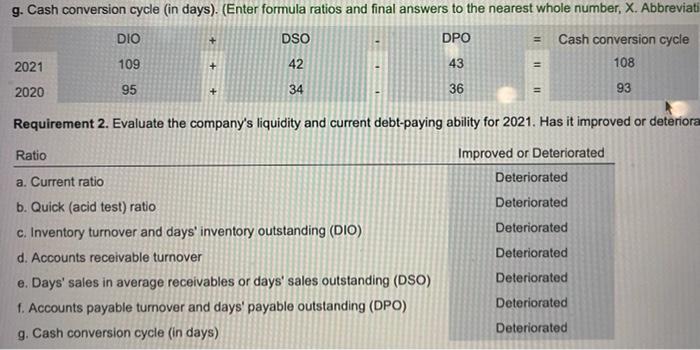

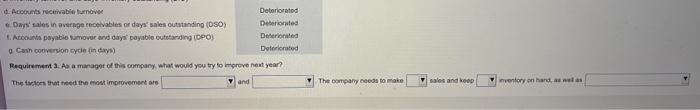

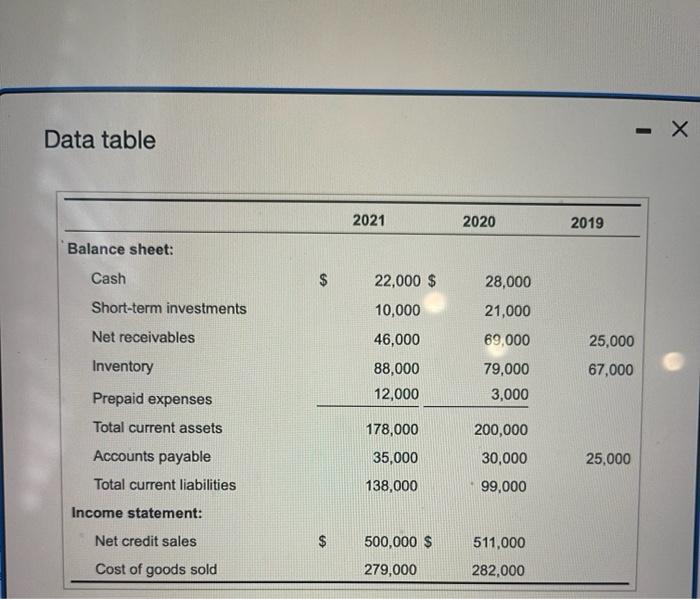

Requirement 1. Calculate the following ratios for 2021 and 2020. When calculating days, round your answer to the nearest whole num a. Current ratio. Select the formula and then enter the amounts to calculate the current ratio. (Round the ratios to two decimal places, X.XX.) Current assets Current liabilities 138,000 99,000 2021 $ 2020 $ 2021 ( $ 2020 ($ 2021 2020 178,000 200,000 b. Quick (acid-test) ratio. Select the formula and then enter the amounts to calculate the acid-test ratio. (Abbreviations used: Avg = average, ST = short-term, an $ $ 2021 2020 Cash 22,000 28,000 $ Cost of goods sold 279,000 282,000 + ST investments + S 10,000 + $ 21,000 Days in year 365 365 $ = c. Inventory turnover and days' inventory outstanding (DIO). Begin by selecting the formula and then enter the amounts to calculate inventory turnover. (Round the ratios to two decimal places, X.Xx Average inventory = Inventory turnover 83,500 73,000 = Current ratio 1.29 2.02 3.34 3.86 Net receivables + +$ 46,000 + $ 69,000 = Current liabilities )+ )+ $ )+ $ 3.34 3.86 Now, select the formula and then enter the amounts to calculate days' inventory outstanding (DIO). (Enter formula ratios to two decimall Inventory turnover Days' inventory outstanding (DIO) = 138,000 99,000 = Acid-test ratio 0.57 1.19 109 95 d. Accounts receivable turnover. Select the formula and then enter the amounts to calculate accounts receivable turnover. (Round the ratios to two decimal places, > Net credit sales 500,000 511,000 2021 $ 2020 $ 2021 2020 + Average net receivables = Acounts receivable turnover 8.70 10.87 e. Days' sales in average receivables or days' sales outstanding (DSO). Select the formula and then enter the amounts to calculate days' sales in average receivables or days' sales outstanding (DSO). (Er Accounts receivable turnover = Days' sales outstanding (DSO) Days in year 365 42 8.70 10.87 365 34 2021 $ 2020 $ f. Accounts payable turnover and days' payable outstanding (DPO). Use cost of goods sold in the formula for accounts payable amo Begin by selecting the formula and then enter the amounts to calculate accounts payable turnover. (Round the ratios to two decimal + Average accounts payable. Cost of goods sold 279,000 32,500 282,000 27,500 2021 2020 + 57,500 47,000 + 11 $ $ Accounts payable turnover 8.58 10.25 Now, select the formula and then enter the amounts to calculate days' payable outstanding (DPO). (Enter formula ratios to two decima Days in year Accounts payable turnover = Days' payable outstanding (DPO) 365 8.58 365 10.25 43 36 g. Cash conversion cycle (in days). (Enter formula ratios and final answers to the nearest whole number, X. Abbreviati DPO 43 36 2021 2020 DIO 109 95 DSO 42 34 Ratio a. Current ratio b. Quick (acid test) ratio c. Inventory turnover and days' inventory outstanding (DIO) d. Accounts receivable turnover = Cash conversion cycle 108 93 e. Days' sales in average receivables or days' sales outstanding (DSO) f. Accounts payable turnover and days' payable outstanding (DPO) g. Cash conversion cycle (in days) 11 Requirement 2. Evaluate the company's liquidity and current debt-paying ability for 2021. Has it improved or deteriora Improved or Deteriorated Deteriorated Deteriorated Deteriorated Deteriorated Deteriorated Deteriorated Deteriorated = d. Accounts receivable turnover Days' sales in average receivables or days' sales outstanding (OSO) 1. Accounts payable tumover and days payable outstanding (DPO) g Cash conversion cycle (in days) Requirement 3. As a manager of this company, what would you try to improve next year? The factors that need the most improvement are Deteriorated Deteriorated Deteriorated Deteriorated and The company needs to make sales and keep inventory on hand, as well as Data table Balance sheet: Cash Short-term investments Net receivables Inventory Prepaid expenses Total current assets Accounts payable Total current liabilities Income statement: Net credit sales Cost of goods sold $ 2021 22,000 $ 10,000 46,000 88,000 12,000 178,000 35,000 138,000 500,000 $ 279,000 2020 28,000 21,000 69,000 79,000 3,000 200,000 30,000 99,000 511,000 282,000 2019 25,000 67,000 25,000 - X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started